PM Images

The High Income Securities Fund (NYSE:PCF) is, as the name implies, a closed-end fund that income-seeking investors can purchase in order to pursue their goals of generating a high level of income from the assets that are in their portfolios. The fund generally does a pretty good job of this, as its 11.07% current yield is in line with many of the best fixed-income closed-end funds in the market, including those ones that employ strategies that rely on leveraging junk bonds and similar assets. However, this fund does not rely on investing in high-risk securities, but rather it purchases shares of closed-end funds, business development companies, and other high-yielding investment management firms. This can give it a certain amount of diversification that might be lacking in an income-focused portfolio today, as well as provide some upside potential that could be lacking from a portfolio that is heavily invested in debt securities. As such, there could be some reasons to consider purchasing it today.

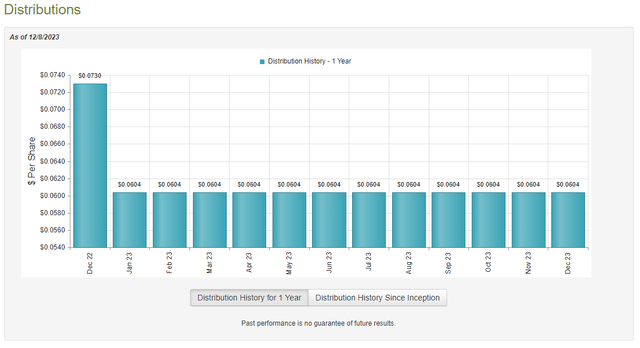

As regular readers are no doubt well aware, we last discussed the High Income Securities Fund in early October. At the time that article was published, I expressed some concerns about the sustainability of the fund’s distribution. Thus far, at least, it has been able to sustain it but the current payment is less than it was at this time last year:

CEF Connect

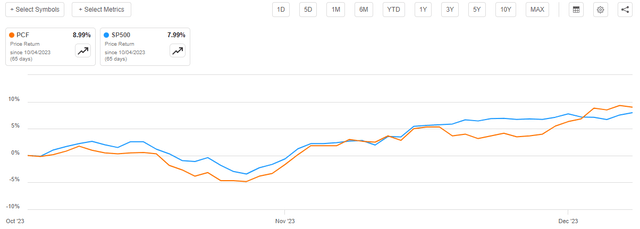

That may or may not be a concern, especially for someone who is considering purchasing the fund today since such an investor would not be negatively impacted by a distribution cut. The performance of the fund has been pretty reasonable over the past two months though, as its shares have appreciated by 8.99% since the date that my previous article was published. That is a better performance than the S&P 500 Index (SP500) managed to deliver over the same time period:

Seeking Alpha

When we add in the fund’s distributions that were paid out during the period, the fund’s outperformance relative to the index becomes even more stark. However, as I have pointed out in a few recent articles, there have been some cases recently of closed-end funds seeing greater share price appreciation than is justified by the performance of their portfolios. That does appear to be the case with this fund, as the fund’s net asset value has only appreciated by 3.22% since October 4 (the date that my prior article was published). That does not necessarily mean that the fund has become overpriced though, so this is something that we very much want to investigate.

Let us dig deeper into the High Income Securities Fund and see if a purchase could make sense today.

About The Fund

The website for the High Income Securities Fund can be found here, but it includes very limited information about the fund. In fact, this is probably the only fund that does not publish a fact sheet on the website, nor does it include any information about the fund’s performance. It does still have the fund’s financial statements and quarterly holdings reports that are required by Securities and Exchange Commission regulations. We will therefore be forced to rely on those documents as well as outside sources for our analysis. Unfortunately, some of this information is a few months old at this point, but at least the fund’s most recent financial report is relatively recent. This report corresponds to the full-year period that ended on August 31, 2023. It is therefore only four months old and is newer than the financial statements that have been provided by many other closed-end funds.

The fund’s annual report includes a description of its strategy, which will undoubtedly prove useful for any investors trying to obtain information about this fund. Here is what it states:

Generally, the fund invests in securities of discounted shares of income-oriented closed-end investment companies, business development companies and Special Purpose Acquisition Vehicles.

This strategy sounds pretty similar to the Saba Capital Income & Opportunities Fund (BRW), which also invests in closed-end funds and investment companies such as business development corporations. The Saba Capital Income & Opportunities Fund also invests in high-yield debt securities as well as private equity and debt investments that will not ordinarily be found in the High Income Securities Fund. As such, the two funds are not perfectly comparable, although the Saba Capital Income & Opportunities Fund is probably the closest peer in terms of strategy.

In fact, the High Income Securities Fund includes the Saba Capital Income & Opportunities Fund among its largest positions. The fund held 339,736 common shares of this peer as of August 31, 2023. This was one of the fund’s largest positions as of May 31, 2023, but curiously there is not a current list of the fund’s largest positions. The annual report does not include one, and the lists available on both Morningstar and CEF Connect’s websites are out of date. It appears that the Saba Capital Income & Opportunities Fund is one of the larger positions in terms of total value, however.

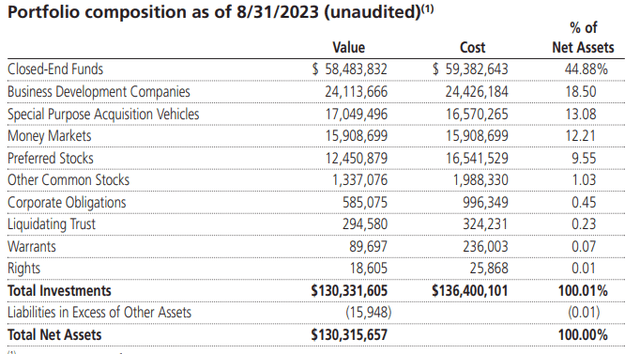

As just mentioned, the High Income Securities Fund invests primarily in closed-end funds, business development companies, and special purpose acquisition companies. However, closed-end funds are the most important of these for the fund’s portfolio, as these entities currently account for a larger portion of the fund’s total assets than any other type of company in the portfolio. As of August 31, 2023:

Fund Annual Report

This is not particularly surprising considering that closed-end funds are a somewhat more robust asset class than the others. There are only a very limited number of business development companies in operation today. For example, the VanEck BDC Income ETF (BIZD) only holds 26 companies, and three companies account for almost half of the portfolio: Ares Capital Corp. (ARCC), FS KKR Capital Corp. (FSK), and Blue Owl Capital Corp. (OWL). Thus, it is rather difficult to achieve a significant amount of diversification by investing in business development companies. However, there are a substantial number of closed-end funds trading in the market today and they employ a variety of strategies. For example, there are fixed-income funds, option-income funds, broad market equity funds, sector equity funds, and even funds employing long-short style strategies. Thus, it makes sense that the High Income Securities Fund would focus its efforts on these entities rather than on business development companies or special purpose acquisition companies.

It is surprising that 13.08% of this fund is invested in special-purpose acquisition companies. This is a type of entity that was incredibly popular during the heady period of time immediately following the pandemic, driven by 0% interest rates and an enormous amount of newly printed money sloshing around the economy. However, they have lost much of their appeal in today’s more expensive monetary environment. According to the Financial Times:

Meanwhile, some SPAC sponsors – who typically contribute 3 to 7 per cent of the listing proceeds upfront to cover underwriting and operating costs – have lost their entire investment because they haven’t been able to conclude a deal. Spacs typically have to be liquidated if they can’t complete a merger within 18-24 months, and when presented with a business combination, most Spac shareholders are now redeeming their shares to get their money back with interest. The average loss for Spac founders from liquidation has been around $9 million.

To make matters worse, sponsors incurred $750 million in losses last month alone, as they rushed to wind up Spacs before year-end, believing that a new 1 per cent federal excise tax on stock buybacks would apply to liquidations of US-domiciled Spacs starting in 2023. A whopping 85 Spacs were liquidated in December, only for the Department of Treasury to say at the very end of the month that the levy wouldn’t apply to liquidations after all. These sponsors acted in (understandable) haste and will now repent at leisure.

The sponsors of these entities are not the only individuals who lost money in them once the Federal Reserve started tightening monetary policy. According to the same Financial Times article:

For one thing, investors have suffered bone-crushing losses, as companies merging with Spacs (inelegantly known as a “de-Spac transaction”) have vastly underperformed the stock market. The AXS De-Spac ETF fell almost 75 per cent in 2022. Several companies have missed their forecasts, restated their financials and even gone bankrupt. SPACs have in some cases incubated a unicorn-to-penny stock lifecycle – with companies having to launch reverse splits to avoid delisting.

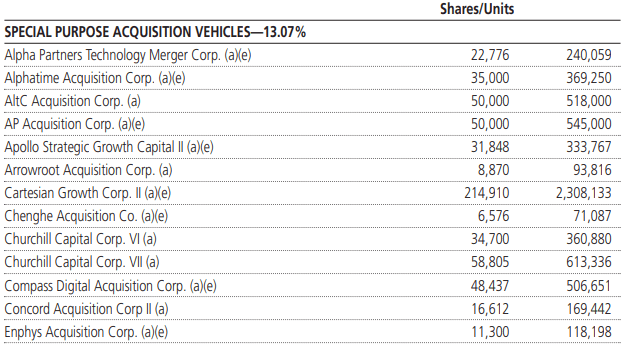

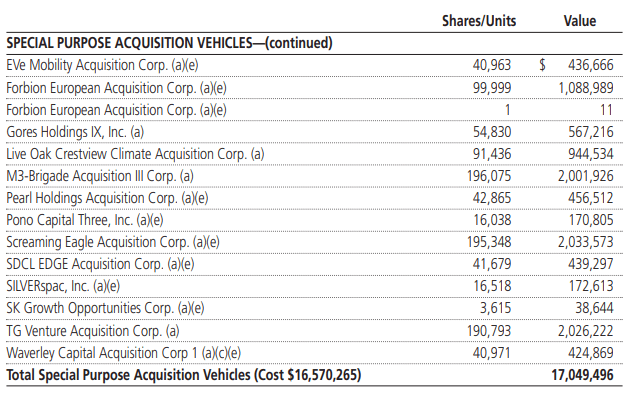

In short, there is a reason why we do not hear about special purpose acquisition companies very often in the financial media anymore. This is why the presence of these companies in the fund’s portfolio is rather surprising, as they do not possess particularly high yields and many of them deliver very poor performance. This does not necessarily mean that all of these companies are bad investments, as it ultimately depends on what exactly they purchase, but I would still prefer it if the fund was not holding these entities. Here are the special-purpose acquisition companies currently held by this fund:

Fund Annual Report

Fund Annual Report

Many of these appear to be looking for renewable energy or electric vehicle companies to buy. Companies in those sectors are also not as attractive as they were back in 2021 as we have been seeing inflation and high interest rates cause renewable energy projects to get cancelled over the past year. Basically, the companies building these projects are not able to make any money from the renewable energy projects. Electric vehicles are still generally considered to be a growth area, but the industry may struggle to find traction despite government incentives. After all, consumers who live outside of a big city or suburbs are still suffering from range anxiety and thus far there have not been nearly enough charging stations built to overcome this problem, let alone the fact that the electric grid in many areas cannot support the necessary infrastructure at this time. There is a reason why we have not been seeing rapid development of renewable energy or a surge of electric car start-ups over the past two or three years despite the government subsidies in this area.

Leverage

As regular readers are no doubt well aware, many closed-end funds employ leverage as a method of boosting their returns beyond that of any of the underlying assets in the fund. The High Income Securities Fund is not an exception to this rule, although its leverage is nowhere near as high as the leverage of most funds. However, this fund does invest in other closed-end funds and in business development companies and both of these entities employ leverage to a significant degree. As such, it is important that any investor in this fund understands how this works.

As I explained in various previous articles:

In short, the fund borrows money and then uses that borrowed money to purchase equity securities issued by closed-end funds, business development companies, special purpose acquisition vehicles, and other income-producing assets. As long as the yield that the fund receives from the purchased securities is higher than the interest rate that the fund pays on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will normally be the case.

However, the use of leverage in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to an excessive level of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the High Income Securities Fund has leveraged assets comprising 1.06% of its portfolio. This is perhaps the lowest level of leverage that I have ever seen a closed-end fund possess, with the possible exception of a handful of funds that do not employ leverage. However, many of the assets in which this fund invests will be using a greater amount of leverage. As we have seen in a number of recent articles, most closed-end funds tend to have 25% to 35% of their assets purchased with debt. As such, we will probably see some of the volatility effects caused by leverage affecting this fund despite the fact that it is not leveraged to any great degree.

Distribution Analysis

The High Income Securities Fund invests its assets primarily in closed-end funds, business development companies, preferred stock, and other things that deliver the overwhelming majority of its total returns in the form of direct payments to the investors. The fund collects the money that it receives from these entities, combines it with any capital gains that it manages to realize, and then distributes it to its own shareholders, net of its expenses. As such, we might assume that this fund would have a very high distribution yield.

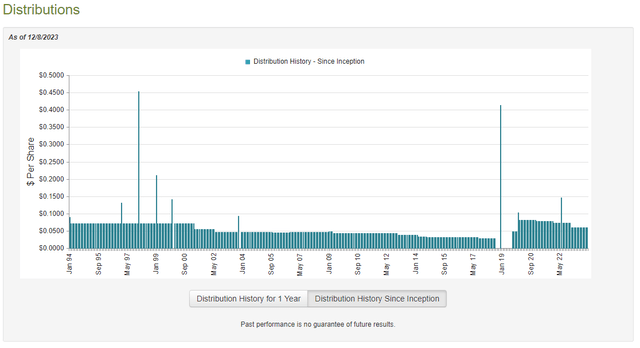

This is indeed the case, as the High Yield Securities Fund currently pays a monthly distribution of $0.0604 per share ($0.7248 per share annually). This gives the fund’s shares an 11.07% yield at the current share price. That is in line with the yield currently offered by most junk bond and leveraged loan funds, but as we have already seen this one is more diversified as it does not invest solely in high-yield debt securities. However, the fund has not been especially consistent with respect to its distribution, as it has varied by quite a lot over the years:

CEF Connect

This distribution history may be a bit of a turn-off for any investor who is seeking to earn a safe and secure income from the assets in their portfolios. The fact that the fund’s distribution has been declining since 2020 is also not very attractive as the inflation that we have experienced since that time has reduced the number of goods and services that could be purchased with a static distribution. The fact that this fund has been reducing its distribution since that time means that investors who depend on the money that they get from the fund have seen their purchasing power evaporate. This is the exact opposite of what we want.

However, anyone who purchases the fund today will receive the current distribution at the current yield. This individual will not be adversely affected by the actions that the fund has taken in the past with respect to its distribution. As such, the most important thing for anyone who is considering purchasing shares right now is how well the fund can sustain the current distribution. Let us investigate this.

Fortunately, we have a very recent document that we can consult for the purpose of our analysis. As mentioned earlier in this article, the High Yield Securities Fund’s most recent financial report corresponds to the full-year period that ended on August 31, 2023. This is a much more recent report than most closed-end funds have tendered thus far, and it could be quite useful for our purposes. As everyone reading this likely knows, the market experienced some pretty severe swings between September 2022 and August 2023. There was a period of optimism as traders started thinking that artificial intelligence would deliver an earnings boom and the Federal Reserve would pivot on interest rates during the first half of 2023. Meanwhile, both the second half of 2022 and the final month or two of the reporting period were characterized by stagnant or even falling asset prices as traders realized that the heady easy-money days immediately following the pandemic had ended. As such, this report should give us a pretty good idea of how well this fund performs in all market environments, which is exactly the kind of information that income-seeking investors desire.

During the full-year period, the High Income Securities Fund received $6,749,691 in dividends along with $864,794 in interest from the assets in its portfolio. This gives the fund a total investment income of $7,614,485 during the full-year period. The fund paid its expenses out of this amount, which left it with $6,373,293 available for shareholders. This was, unfortunately, not enough to cover the $13,589,615 that the fund actually paid out in distributions during the period. At first glance, this is almost certainly going to be concerning, as the fund clearly did not have sufficient net investment income to cover the distributions that it paid out.

However, there are other methods that the fund can use to obtain the money that it needs to cover the distribution. For example, it might have been able to realize some capital gains by selling assets during the first six months of 2023 when asset prices were rising. It also might have received some return of capital distributions from the closed-end funds in its portfolio. A return of capital distribution is not considered to be investment income for accounting or tax purposes, but it clearly represents money coming into the fund that can be paid out to investors.

Unfortunately, the fund did not have a great deal of success in obtaining money from alternative sources during the reporting period. It reported net realized losses of $1,362,709 but was able to partially offset this with $886,635 net unrealized gains. Nevertheless, the fund’s net assets declined by $7,692,396 after accounting for all inflows and outflows during the period. That is certainly not what we want to see.

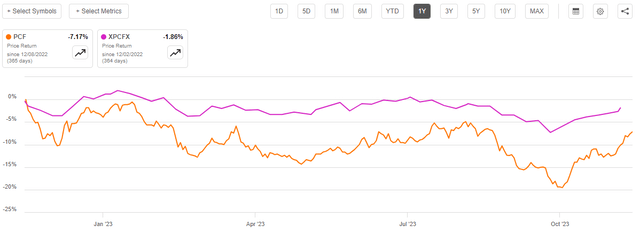

Over the past year, the fund’s net asset value per share has declined by 1.86%:

Seeking Alpha

In addition, its net asset value per share is down 0.94% since September 1, 2023. This suggests that the fund has failed to cover its distribution over the past year and failed to cover its distribution in the period since the most recent financial report was released. This is a discouraging sign that could suggest that another distribution cut could be on the horizon if the fund cannot improve its investment returns in the very near future.

Valuation

As of December 1, 2023 (the most recent date for which data is currently available), the High Income Securities Fund has a net asset value of $7.38 per share but the shares currently trade for $6.55 each. This gives the fund’s shares an 11.25% discount on net asset value at the current price. This is a very reasonable discount, but it is not as good as the 13.39% discount that the shares have had on average over the past month. As such, it might be possible to obtain a better price by waiting a bit. However, a double-digit discount generally represents a reasonable price to pay for any fund, so the current price is not really too bad if you are interested in adding this fund to your portfolio.

Conclusion

In conclusion, the High Income Securities Fund is one of the more unique closed-end funds available on the market due to the types of things that it invests in. This is one of the few funds that does not invest in ordinary stocks or fixed-income securities. Rather, this fund invests in closed-end funds, business development companies, and other investment companies. This provides the fund with a great deal of diversification, which it can add to the portfolio of an income-focused investor without forcing them to sacrifice their income potential. Unfortunately, it appears that it may be struggling to maintain the distribution at the current level. This somewhat explains the large discount, as a possible cut could be priced in here.