Torsten Asmus

Dear Partners,

Today marks the first day of trading for our new fund Protean Aktiesparfond Norden. It is a Nordic long-only fund that combines the low fees of index funds with the potential of active management to outperform the index. The best of two worlds. In addition, the fee will be lowered as the fund grows bigger, sharing the scale advantages with investors. We launch the fund with approximately USD 30m in AuM, and we thank all who have dared to believe in the concept from day one. Now we will try to prove ourselves.

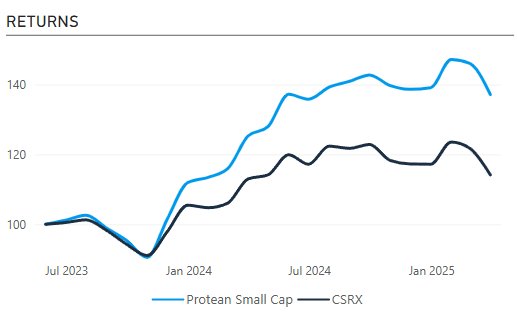

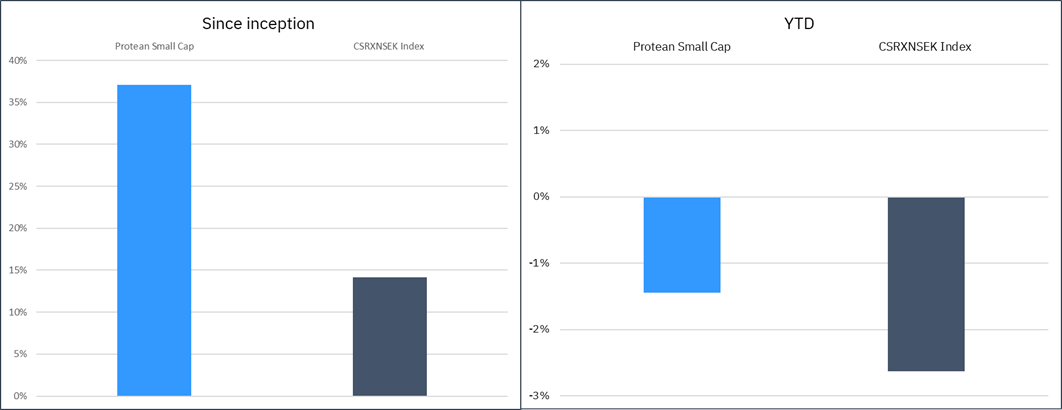

Local indices had a terrible March. While managing to (marginally) beat its benchmark, Protean Small Cap suffered also. It returned -6.1%, outperforming its index by 0.1%. Since launching in June 2023, it has gained 37.1%, which is 23% ahead of the Carnegie Nordic Small Cap Index.

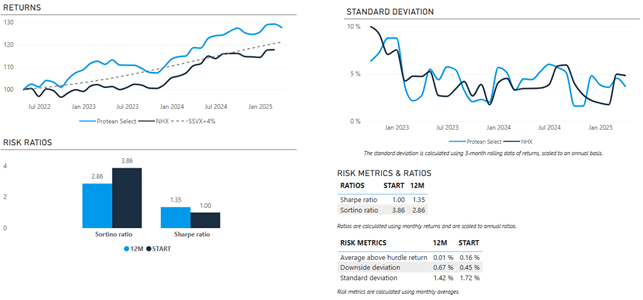

The hedge fund Protean Select returned -1.2% in March, staying true to its objective of avoiding large drawdowns. We are approaching the 3-year mark in April, and since launch the fund has returned 27.6% with (far) less than a third of the market’s volatility.

This month’s letter elaborates on why on earth we are starting a low-cost active fund. We follow up last month’s “Is this really happening?” with the conclusions from spending time on the ground in both the US and Mexico (hint: it’s not great). And, as usual, provide color on winners and losers in both the hedge fund and the small cap fund.

Thank you for being an investor!

// Team Protean

Protean Small Cap

– Carl’s update for March

Protean Small Cap returned -6.1% in March. That is 0.1%-points ahead of the CSXRN (SEK) benchmark index for the month. This puts the fund 23.0%-points ahead of our index (CSRXN SEK) since inception. The fund now manages ca. SEK530m. Thank you for your trust.

Rejlers, Lindex and Getinge (OTCPK:GNGBF) were our main winners for the month. Rejlers released new long-term targets during the month, reinforcing our view that this technical consultant has potential to grow both revenues and margins in the coming years. Valuation is far below its peers, despite a solid track record in recent years.

We were also helped by those with pure Nordic exposure, with names such as Coor, Ambea and Meko performing relatively well during the month. The well-executed IPO of Asker also netted us a good benefit.

Detractors were plentiful during a very poor month for Nordic equities. Devyser was our biggest loser during the month, with MT Højgaard and Sdiptech (OTC:SDTHF) close behind.

The big movements during March also created opportunities and we have added a few new names to the portfolio. The Swedish medtech Arjo (OTCPK:ARRJF) offers a compelling risk/reward, with the severe flu season acting as a benefit in the very near-term. We have long been skeptical of Arjo, as inflated expectations were attached to the SEM scanner product which proved emblematic for a period of overpromising and underdelivering for Arjo. As this costly endeavor now has been scrapped, as well as the CEO being replaced, we believe this rebasing has created a good entry opportunity. Arjo’s bed rental business should have helped them during the first quarter.

The Finnish landlord Kojamo (OTCPK:KOJAF) also entered the portfolio during March. Having added a lot of new capacity to the market during the last couple of years, vacancy rates increased markedly for Kojamo during 2023-2024. We believe vacancy rates will improve in 2025, as the new capacity is gradually being absorbed by the continued urbanization in Finland as well as very limited new construction taking place currently. The share traded at all-time low levels during March, despite this being a ‘safe haven’ (although we often doubt such things exist) in a period of uncertainty in the global arena. We have also gradually increased our holdings in several names, these including long-term attractive growth stories such as Sdiptech and Vitrolife (OTCPK:VTRLY).

Finding new names also means selling others. BTS had to leave but will remain on our radar. While their leadership training session might add a lot of long-term value to its clients, they are also a discretionary spend that can be delayed. We have sold Elekta (OTCPK:EKTAF) and OMA Savings Bank. While trading at intriguing levels, these names both suffer from a level of complexity and lack of near-term operational momentum that makes them unattractive now.

Protean Small Cap vs Index since inception

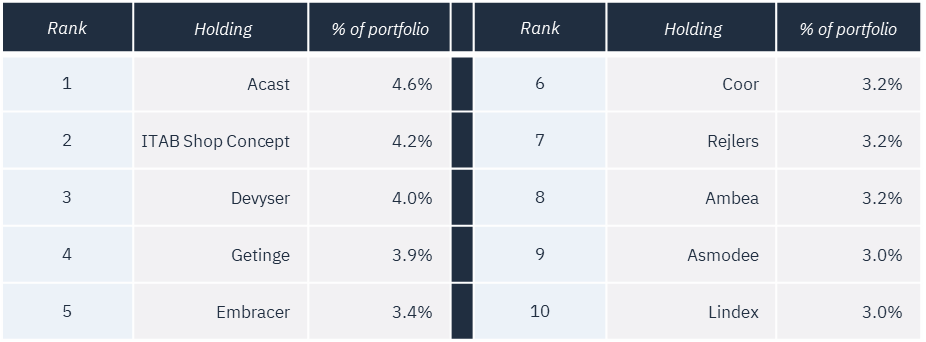

The ten largest positions in Protean Small Cap as we enter April:

Protean Select

– Pontus’ update for March

| *We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is 6.3275% annualized (4% + 90-day Swedish T-bills). All figures are net of fees and ratios in the above charts are calculated using monthly returns. |

Protean Select returned -1.2% in a murky March where local indices were down around 7-8%. While it’s not pleasing to have a small drawdown, this is an acceptable result for a net long strategy. We averaged 25% net exposure for the month. Since inception in May 2022 the fund has generated performance of 27.6%, with low volatility.

Top contributors were all short positions: index futures, a basket of small caps, Atlas Copco (OTCPK:ATLKY), Lagercrantz. Notable detractors were Novo Nordisk (NVO), Devyser, Hexagon (OTCPK:HXGBF) and RaySearch (OTCPK:RSLBF).

We exit March with 23% beta-adjusted net long exposure and 119% gross exposure (adjusted for cash and cash equivalents). The portfolio remains diversified, with no single position >4% of assets.

To survive

Things that have never happened, happen all the time. I think about this whenever someone draws historical parallels about markets, levels, valuations and other ephemeral things. There is a first for everything.

I think managing a hedge fund is about generating decent returns, but it is also about protecting capital. Year to date the fund is up 1.6%. Tolerable.

Protean Aktiesparfond Norden

– Richard’s update

The fund has now launched. While this is all very exciting, we must remember investing is a game of patience. Compounding capital with a sensible and low-cost approach should be boring.

Nowhere is patience more rewarded than in the stock market. Patience, low costs and avoiding silly and overvalued companies that do not create value is how one creates the best conditions for potentially beating the index.

This is what we are trying to do, and the more that join, the lower the cost will be. That’s the beauty of Aktiesparfonden.

Going forward we will intermittently publish thoughts, updates and observations on www.aktiesparfonden.se .

Pontus’ personal reflection

Today—April 1st—is the first trading day for Protean Nordic Equity Savings Fund, or Aktiesparfonden in Swedish. From the outside, it might seem like this marks the beginning, but for me, it’s more of a part closure.

For many years, I’ve been fascinated by the rise of index funds. It’s entirely logical from an investor’s perspective: when active funds consistently underperform indices over time, we are satisfied simply getting the market return. Countless research papers draw the same conclusion: the primary reason active funds underperform the index is their higher fees.

The reverse is also true: both Charles Schwab and Jack Bogle—the fathers of low-cost financial products—say that the greatest innovation index funds brought to the market is precisely that: low fees. For those interested in the emergence of this massive industry, I recommend Charles Schwab’s autobiography “Invested” and “Trillions” by journalist Robin Wigglesworth.

Beat the index, lower the fees, or go away

So why don’t active funds lower their fees to compete with the inflow into index funds? Because they can’t, and because they don’t have to.

Many find investing complicated, and stocks especially difficult. Complexity earns respect from the public for financial products, prompting people to listen to authorities. It is often difficult to understand exactly what you’re paying for a fund, and comparing funds presents additional pitfalls.

The investment market is sluggish. Many are satisfied simply listening to the bank’s salesperson and the funds offered. People accept both the (poor) returns and the (‘high’) fees because they have better, more important things to focus on, which is entirely reasonable.

The occupational pension market, however, is worse. Pension insurances are procured from a handful of oligopolists who, although it has improved, charge unclear “capital fees” and take at least half of any management fees from funds that manage to qualify for their, often-limited, selections. Encouraged by private equity-owned advisory firms, a structure is cemented where funds must be expensive (especially compared to index funds) for the equation with thousands of advisors and nationwide offices to be profitable. Fund selections are not driven by what’s best for the customer. A cheap fund faces a double hurdle to be included in pension solutions. Consumer power is sidelined.

If I had to guess why a certain index fund is Sweden’s largest, I’d say it’s probably because it’s also Sweden’s most expensive. And ESG labelled. Double bingo: everyone scratches their bureaucratic itch without offending anyone.

Big gets bigger

Established fund companies are living on borrowed time with their expensive funds. Outflows and underperformance accelerate consolidation— driven by a panic to continue harvesting the economies of scale that large funds provide. It doesn’t require more managers, administrators, or bigger offices to manage 50 billion compared to 50 million. Costs are essentially fixed from day one. After a few billion, every additional managed krona is pure profit. Lower fees? Forget it.

Consolidation is a dangerous strategy: research shows that size negatively correlates with returns. Larger funds find it (even) harder to beat the index. If you compare Sweden’s 5-6 largest funds, they predominantly hold similar top 10 investments. Their size forces them to crows in large companies. Small-cap funds face a similar issue. It’s hard to significantly deviate from the index with a large fund. It requires uncomfortable decisions. Employees, being salaried, have limited incentives to deviate substantially from the index (which – remember – is required to beat it). It’s better to be wrong in a group and not stand out. I believe we need more owner-led fund companies, not fewer.

The market slowly moves towards banning commissions. It’s unreasonable for distributors to retain 50% of fund management fees. Increasingly more platforms (we cheer the upcoming launch of challenger Montrose!) and independent advisors return all fund commissions/kickbacks to customers.

Our hedge fund Protean Select and small-cap fund Protean Small Cap stand out because they are small and highly active. They aren’t typical funds; we’ve tried to optimize for returns, not to maximize assets under management and thus income for the fund company. That’s why they trade monthly and have a size cap. They cannot—and should not—compete with large and index funds. But someone should.

Why Equity Savings Fund?

Years ago, I had a complex idea: let management fees compound into new fund units, with returns benefiting investors—allowing them to enjoy compound interest effects usually lost when fees are deducted annually. The problem was fund companies wouldn’t have income until investors withdrew funds, which could take a very long time (think pension savings). Another issue was bookkeeping and taxation. It was (still is?) unfeasible.

For Protean Funds, founded three years ago and recently turning profitable with two niche products, starting a fund designed to challenge industry fees isn’t obvious. To be profitable with low fees you need a large fund —several billion at least. So, what to do?

Reading William Green’s excellent book “Richer, Wiser, Happier” sparked an idea. It described Nomad Partnership’s focus on companies whose products improved and became cheaper with growth. Economies of scale were shared with customers, creating a self-reinforcing cycle. Amazon (AMZN) and Costco (COST) were prime examples. Could this be done in fund management?

There’s a strategy likely to outperform indices long-term even at substantial sizes: focusing on proven, value-creating businesses, avoiding costly mistakes—like large investment firms such as Investor or Berkshire Hathaway. Low costs, long horizons, solid companies.

The uniqueness of sharing

This insight isn’t unique. Several successful funds follow long-term, quality-focused strategies despite high fees. Examples include Sweden’s Selektiv funds from Handelsbanken, some Carnegie funds, or Fundsmith in the UK, which grew to £245 billion under management. Terry Smith’s strategy: “Long-term, reasonable companies, minimal activity.” Wise man, Terry.

But—what they DON’T do is lower fees as the fund grows. THAT shares economies of scale. THAT compensates for large funds’ difficulty in outperforming indices. THAT lowers the barrier to competing with index funds. It also reduces profitability, which is why no one does it.

Pitching this Equity Savings Fund to an investor in a fund management company would be laughable: actively managed, Nordic, long-only, needs billions to be profitable.

“Are you nuts, you’re NEVER going to make money from that fund. People want index funds or sexy thematic funds.”

Yet, here we are

On the day of launch. With a couple hundred million from anchor investors believing it should exist and could succeed.

My dream: lower the fees at 10 billion, again at 20, 30, and once more at 50 billion. I believe someone needs to challenge passive investing. It is vital for maintaining the Nordic ownership model which has served us well and ensuring effective market pricing and functioning. Without a thriving eco-system of independent fund managers, how do you suppose IPO’s of smaller companies will be done in the future?

I hope investors in Aktiesparfonden/The Equity Savings Fund have patience. We will evaluate performance after three years, seriously after five. It will underperform the index at times—this is nearly certain. Sometimes the underperformance could last for a long time. But if we’re more right than wrong, it’ll turn out well over time.

Off we go.

Is This Really Happening?

Part II – Remain vigilant

A month ago, I wrote “I’m mildly surprised to see stock markets taking this seismic geopolitical shift in stride and see few reasons to position ourselves other than cautiously.”

Since then, our local markets have tumbled 6-7% during, and the wave of relentless nonsense from the US shows no sign of abating. During March I physically went to the US and Mexico to get first-hand information, and to cut out the middlemen doing the interpretations for us in the media and research departments. I met with heads of business, consultants, Economists, senior diplomats and journalists.

I came back strategically more concerned than when I left, and during the trip added short positions in several USD-sensitive and US-exposed Nordic companies.

Thoughts on global politics

Just as the stock market, diplomacy, and business worlds now oscillate between two opposing thoughts: “it’s just a negotiation tactic, it will pass,” and “damn, these are entirely new rules now—might makes right—we must act swiftly.”

The senior diplomats I spoke with admit it increasingly appears as a historical shift rather than an anomaly, and it’s probably correct to have both a bit of Weltschmerz and prepare for “the worst” (unclear exactly what).

Perhaps it’s as simple as someone who believes they’ve received a mission from God finding it easier to justify the collateral damage that results when uncomfortable or unpopular decisions are implemented. Countering this is the pettiness revealed in various crypto shenanigans and tit-for-tat models involving payments for meetings and favours. It doesn’t quite fit the narrative to worry about Trump being driven by uncompromising patrimonialism or Bannon’s deglobalization frenzy, when he’s simultaneously cashing in relatively small sums through near-outright fraud.

Tactical Discussion

“Resistance” to Trump has so far been disorganized, fragmented, and lacking direction and management. As the shock wears off (about now?), reactions from both business (to be seen, excluding Tesla’s weak warning?) and civil society/Democrats (the ongoing mutiny against Schumer is telling) will emerge.

Less media-friendly, one executive order after another is being struck down by judges in various jurisdictions. There’s a good chance the narrative will stabilize, if not reverse, in the near term.

The problem is this reasoning might be short-lived. Playing both demand and supply-side economics simultaneously means demand hits immediately while supply takes a long time, structurally characterized by “moving more manufacturing to the U.S. through tariff threats, transactional security policy, and a weakened dollar.” Anecdotally, house prices in Washington are down 20% in one month due to mass layoffs at various institutions. Some things move incredibly fast.

The U.S. Midterms aren’t until November 2026. The entire House and 33 of 100 Senate seats are up for election. It’s suggested this election could moderate Trump’s rhetoric to avoid scaring off voters in tight races. When does this campaign start? Early 2026? Still too far away for tactical considerations, but it’s a factor.

The European picture differs. Suddenly, its largest country is abandoning a debt brake in place since Weimar (anyone remembering hyperinflation is long gone). European sovereign yields have seen unprecedented movements recently—a straightforward supply/demand situation.

Approaching this cynically, within six months a (temporary?) “solution” to the Ukraine war may emerge. Trump needs a win. Ukraine has signalled its willingness (how could they not?). Russia is inscrutable, but endlessly grinding down its young men (and some tens of thousands of North Korean p*rn-surfers) for negligible territorial gains seems unsustainable. If all involved, including an EU viewing a ceasefire positively (despite lost Ukrainian territory), can save face, a truce will ultimately happen.

A revitalized European collaboration can bring positives. I’m pleasantly surprised by the Omnibus package cutting some reporting red tape for European businesses—the first-ever EU regulation reduction? More of that, please. Continue reforming the CFRD directive and eliminate virtue-signalling “Article 8” funds.

First-level thinking perhaps, but further debt-financed European expansion will drive growth and demand. Unemployment, the critical economic variable, will not be our issue when building defence infrastructure, stockpiling deterrence materials, and hiring many young men as soldiers and officers.

What we will suffer from eventually is that defence investment is unproductive, akin to funding dividends with increased debt. There are counterarguments—military R&D has historically produced disproportionate global productivity-enhancing innovations. Perhaps superconductors or fusion power will finally be solved? Weak arguments all around, though, as they cut both ways, and there is no progress or confidence when security issues make us fear for our collective future.

Tactical conclusion: One might speculate that expectations have soon adjusted, which would likely provide a short-lived tactical bottom.

Strategic Discussion

My stomach churns further (beyond the already existing discomfort) knowing senior diplomats share my bigger picture concerns. The reshaping—or dismantling—of the Western rules-bases world order is alarmingly swift. Speculations about “the Mar-a-Lago Accord” provoke disbelief and distress. Transactional global “leadership” akin to Jackson Pollock’s chaos.

The intersection I watch closely is between blatant corruption (somewhat tolerable—”he’s an idiot”) and ideology. The US administration’s willingness to accept stock market declines or even recession indicates Trump 2.0 is far more ideologically driven than Trump 1.0. Equally troubling are appointments clearly unqualified professionally but highly qualified for loyalty.

Orwell couldn’t have scripted Trump better, yet his henchmen nod fervently. Witnessing a cult emerge in real-time is fascinating. Navarro, a Cuban anti-communist, flattering Putin causes considerable cognitive dissonance (though Putin isn’t necessarily communist, rather an autocratic traditionalist). Seeing 90% Trump propaganda merchandise at the stands at Dulles airport feels disturbingly North Korean.

Yet, one should remain aware of psychological proximity bias clouding judgment. Sensational headlines and dystopian predictions (Atwood or Huxley like scenarios) are tempting during uncertainty. Remember, we are likely experiencing shock-and-awe from the new administration. Competing in pessimism feels safer now. Who wants to be branded a Pollyanna?

Reflexively (to borrow from Soros), Europe enhancing defence capabilities reduces U.S. influence proportionately. This fact hasn’t widely registered yet, but it remains true. Germany, a dormant juggernaut, might replace China as its primary market with European rearmament. Rheinmetall potentially converting VW factories into tank production is a telling sign. Interesting years ahead.

China holds roughly $750 billion in U.S. Treasuries; a coordinated EU27 holds quadruple that. Who has leverage?

A road leading directly into Dante’s seventh circle cannot be discounted. Markets haven’t priced that in.

If China moves on Taiwan, if the U.S. escalates rhetoric against Greenland (as it undoubtedly is), Panama, or Canada, if Turkey pivots towards Russia, or another Middle Eastern conflict (Iran holding military drills with Russia and China, smuggling oil continuously, seems a prime target) ignites, normal distribution assumptions in financial markets collapse, and become dominated entirely by left tail risks.

Strategic conclusion: Remain vigilant. Capital preservation should be prioritized. A scenario where not just the world order but also global markets collapse is non-zero in probability.

A telling sign of a bigger shift in the making is that for the first time in as long as I can remember, the USD is not rallying when other safe haven assets are. With lower consumer confidence and the introduction of tariffs, comes both a negative growth impulse and an inflationary driver.

Take notice: the market is telling us there is stagflation ahead.

The monthy reminder

We optimize for performance, not for convenience, size, or marketing. You can withdraw money only quarterly (monthly in Small Cap). We tell you very little about our holdings. Our strategy is tricky to describe as we aim to be versatile. A hedge fund can lose money even if markets are up. We charge a performance fee if we do well. You do not get a discount if you have a larger sum to invest. We do not have a long track record.

Aktiesparfonden’s reminder

We aim to generate above index returns over 3-5 years, but there are no guarantees. The fund is daily traded, but that doesn’t mean you should. To beat the index, you need to deviate from the index. This means taking uncomfortable positions. Be aware that the fund can underperform the index during periods. Sometimes, long periods. We lower the fee as the fund grows. The first 10 basis point cut comes at 10bn SEK in AuM.

Thank you for being an investor.

Pontus Dackmo

CEO & Investment Manager

Protean Funds Scandinavia AB

| DISCLAIMER: Investments in a fund can both increase and decrease in value. You are not guaranteed preservation of invested capital. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.