Moreover, sovereign wealth funds and government-owned entities are among overseas investors that have likely purchased domestic stocks, shows the analysis of the data from the National Securities Depository Ltd (NSDL).

To be sure, the FPI selling was believed to be driven by passive funds—exchange traded funds or index funds—selling Indian stocks and buying China or Taiwan equities.

Assets under custody (AUC) of foreign portfolio investors have fallen almost 13% from ₹78 trillion at the end of September 2024 to ₹68 trillion as of January 2025, the data shows. However, the total market cap of companies listed on the National Stock Exchange fell 10.5% from ₹470.65 trillion to ₹421.22 trillion during the period, according to exchange data.

The decline in FPI assets exceeds the erosion of NSE market capitalization by 2.5 percentage points, suggesting that actual sale by certain FPIs have also contributed to the decline in the value of their assets, apart from a fall in stock prices.

Read more: Manufacturing PMI: Q4 is a litmus test, but no fireworks so far

“Even though large-cap valuations have fallen below their historic average, the aggressive FPI selling seen on Friday, when MSCI undertook the quarterly rebalancing of its indices, indicates that outflows could continue, prompted by higher bond yields and tax cuts in the US and rising global tariff tensions,” said Nilesh Shah, managing director at Kotak Mahindra Asset Management Co. Ltd.

Investment managers and advisors, corporations, pension funds, insurance funds and appropriately regulated funds are among the active foreign portfolio investor (FPI) sub-categories that have sold substantially in this correction, shows the analysis of NSDL data.

An entity is called appropriately regulated if it is regulated in its home jurisdiction.

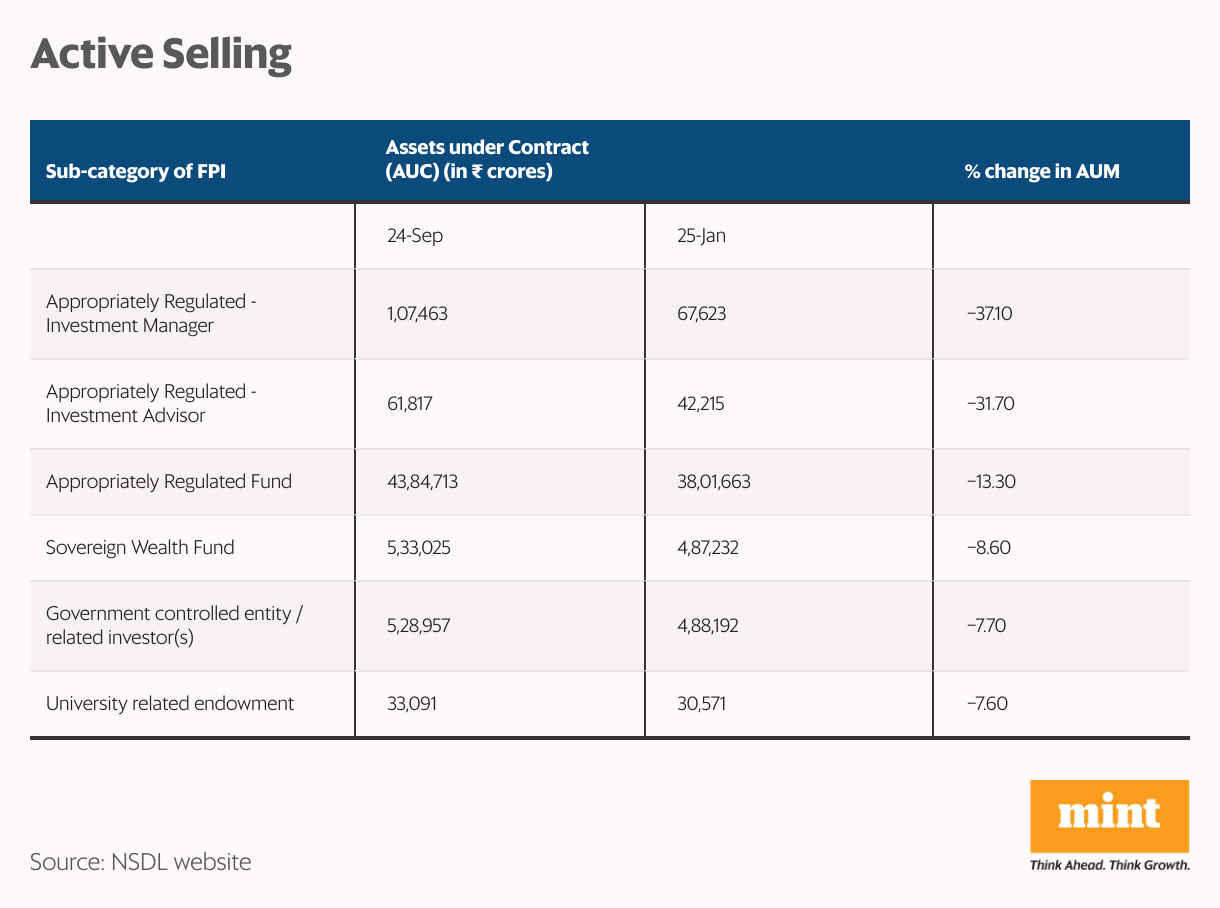

The FPI selling was led by appropriately regulated investment manager as the assets under custody for the category plunged 37% from ₹1.07 trillion to ₹67,623 crore between September-end to January-end, the analysis shows. This drop is way more than the 10.5% erosion in m-cap of stocks listed on the NSE.

This is followed by appropriately regulated investment advisors, whose assets have plunged 31.7% from ₹61,817 crore to ₹42,215 crore over the same period.

Appropriately regulated entities such as banks, asset management companies, investment managers and investment advisors and portfolio managers are Category 1 FPIs. All insurance entities and funds from FATF members also fall under Category I FPIs.

FATF or Financial Action Task Force is the global money laundering and terrorist financing watchdog. Besides India, its 40 members include the US, the UK, Hong Kong, and Singapore. The Russian Federation was suspended as a member on 24 February.

Funds from non-FATF member countries are classified as Category II FPIs.

Corporate bodies, defined as Category II FPIs, have also seen assets fall by almost 19% from ₹54,696 crore to ₹44,434 crore.

Assets of exchange-traded or passive funds, which fall under the appropriately regulated fund category, have comparatively fallen a lesser 13%. A higher drop compared with a 10.5% decline in NSE market-cap shows that active funds have been selling more than passive funds.

The likely buyers

FPIs whose assets have fallen lesser than the decline in NSE total m-cap include sovereign wealth funds, whose assets have fallen 8.6% from ₹5.3 trillion to ₹4.87 trillion; and government-owned entities that have seen their assets drop 7.5% from ₹5.3 trillion as of end-September to ₹4.9 trillion as of January-end.

Another category of active buyers includes university-related endowments, whose AUC have fallen 7.6%, and appropriately regulated bank that have witnessed 5.5% fall in assets.

Short-term bounce ahead?

Despite global index provider MSCI rebalancing its India index, leading to estimated inflows of $1 billion by passive funds, overall FPI outflows on the day stood at a net ₹12,026.05 crore, indicating that gross selloff by overseas investors stood at over ₹20,000 crore.

India’s benchmark indices ended marginally lower on Monday, with Nifty 50 closing at 22,119.30.

Read more: Anxious about investing? These five debt-free stocks could bring peace of mind.

Domestic investors would defend the election day result closing low of 21,884.5 vigorously, which could result in a bounce, for now, despite persisting FPI outflows, said UR Bhat, co-founder of Alphaniti Fintech.

However, weekly data of Nifty options shows a bearish bias with the put-call ratio at 0.7. This means for every 100 calls sold, traders were selling only 70 puts out of fear of heavy losses if markets decline further.

Nifty is likely to get strong support at 22,000 followed by 21,900 and face stiff resistance at 22,400 in the current week, according to analysts. However, any increase in global trade tensions or correction in developed markets could hurt Indian markets more.