The U.S. stock market has been on fire lately. The S&P 500, a widely used measure of the market’s performance, briefly touched 5,000 for the first time a few days ago, driven by three main factors: Strong sales of drugs for obesity, soaring demand for semiconductors that can handle generative artificial intelligence workloads, and the anticipation that the Federal Reserve would lower interest rates in early summer.

However, the market took a hit on Tuesday after the U.S. Labor Department reported a higher-than-expected inflation rate for January, raising concerns that the Fed may postpone its rate cut and that inflation may be picking up speed. The Fed’s policymakers will probably want to see more data on inflation in the next few months before deciding to adjust interest rates downward.

Image source: Getty Images.

This crucial macroeconomic issue is unsettling markets because the Fed may be losing its ability to orchestrate a so-called “soft landing” for the economy. Although January’s higher-than-expected inflation numbers might be a one-off due to seasonal price increases, there are worrisome signs the broader economy might be in real trouble, which could affect the performance of popular indexed exchange-traded funds (ETFs) like those from Vanguard.

Is sticky inflation a reason to pause buying these popular Vanguard funds?

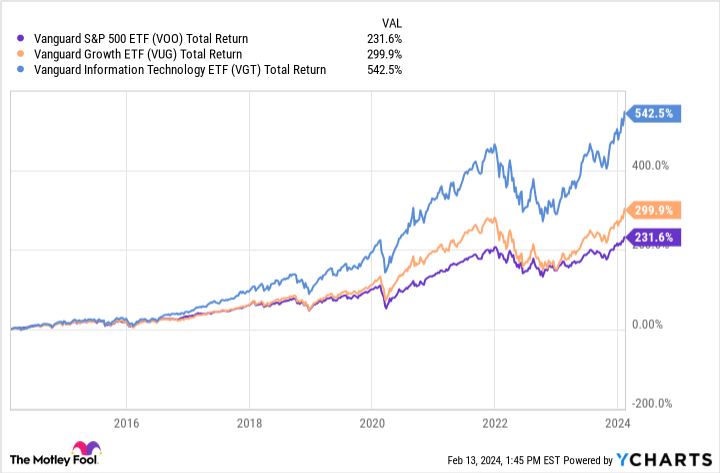

Some of the most popular ETFs among investors are the Vanguard 500 Index Fund (VOO 0.95%), the Vanguard Growth Index Fund (VUG 1.31%), and the Vanguard Information Technology Index Fund (VGT 1.34%). These funds have a large exposure to growth-oriented companies, especially in the technology sector. Moreover, they have been among the market’s best-performing, low-cost ETFs over the past 10 years. The table below illustrates this point:

|

Fund |

Expense ratio |

Turnover |

Alpha |

Beta |

10-Year Total Returns |

|---|---|---|---|---|---|

|

Vanguard 500 Index Fund |

0.03% |

2% |

(0.04) |

1 |

231.6% |

|

Vanguard Growth Index Fund |

0.04% |

5% |

(2.78) |

1.18 |

299.9% |

|

Vanguard Information Technology Index Fund |

0.10% |

15% |

6.36 |

1.24 |

542.5% |

Data sources: Vanguard and Charles Schwab.

One of the key advantages of investing in these funds is that they allow investors to apply a simple but effective strategy called dollar-cost averaging. Dollar-cost averaging means investing a fixed amount of money at regular intervals, regardless of the market conditions. This way, investors can benefit from the power of compounding and avoid the pitfalls of market timing. The following charts illustrate how this strategy has paid off for investors in these funds over the past decade:

VOO Total Return Level data by YCharts.

As you can see, these funds have mirrored the performance of the U.S. stock market, which has experienced several ups and downs due to various factors, such as the pandemic, interest rate changes, or inflationary pressures. However, these funds have also shown a clear upward trend over time, rewarding investors who stayed invested and kept buying more shares.

For instance, investors who panicked and sold their shares in March 2020 when the market crashed due to COVID-19 would have missed out on the rapid recovery that soon followed this brief dip.

Likewise, investors who listened to the pessimistic predictions of some analysts who expected a major market correction in March 2022 when the Fed began to hike interest rates would have seriously regretted their decision. Many growth stocks, especially in the tech sector, proved to be resilient and continued to soar to new heights.

These examples demonstrate why investors should not let short-term fluctuations or fears affect their long-term goals. These Vanguard funds may experience some volatility in response to higher and longer-lasting inflation, but they will likely bounce back.

Key takeaway

The best course of action for investors who have at least a decade before retirement is to stick to their dollar-cost averaging plan and hold these funds for the long haul. These funds have a bright future ahead of them, thanks to the enormous potential of artificial intelligence, the rapid advances in biotechnology, and the strength of the U.S. economy. These factors will ensure that these popular Vanguard funds will continue to generate positive returns for their shareholders over the next 10 years and perhaps far longer into the future.

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. George Budwell has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Charles Schwab, Vanguard Index Funds-Vanguard Growth ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: short March 2024 $65 puts on Charles Schwab. The Motley Fool has a disclosure policy.