By Sergei Grechkin, Chief Risk Officer, Cayros Capital

In my career, I have navigated the intricate world of mergers and acquisitions (M&A) and financial modeling. As part of my responsibilities, I constructed financial models for a bank group, which was the first time I encountered the methodology of Funds Transfer Pricing (FTP). This sophisticated tool has proven indispensable for banks, yet it remains underutilized by asset management companies in the EU, USA, and UK. Let’s explore the FTP process and rules and highlight its potential to revolutionize liquidity management and advanced management accounting in asset management firms.

FTP As an Essential Tool in Banking

Banks utilize FTP to measure the profitability of different business units, manage liquidity risk, and align internal incentives with the institution’s overall strategic objectives. One application of FTP is to support internal pricing mechanisms. In relation to Liquidity Transfer Pricing (LTP), Liquidity Management Information Systems (LMIS) enables the costs, benefits, and risks of liquidity to be attributed to appropriate business activities, which is crucial for effective decision-making and resource allocation. Well-designed FTP rules can be part of the remuneration process, showing and detecting the best performance on a very granular level.

The Advantages of FTP for Asset Management Firms

Despite the obvious benefits, asset management companies, particularly those managing Alternative Investment Funds (AIFs) and Undertakings for the Collective Investment in Transferable Securities (UCITS), often overlook FTP. This oversight is surprising given the tool’s capacity to enhance liquidity management and advanced management accounting. FTP provides a granular view of where value is created within an organization, which is priceless for asset managers looking to optimize their operations and improve profitability.

According to the latest reports, the asset management industry is gradually growing and thriving, highlighting the need for a more thorough approach. And when, if not now, to implement FTP, since it transforms business processes and delivers long-term viability and growth.

For AIF managers (AIFMs), adopting FTP can offer also several advantages:

- Enhanced Profitability Analysis. FTP can accurately determine the profitability of each department, division, or individual within the firm. By assigning costs and revenues appropriately, AIFMs can identify which areas are generating value and which are underperforming.

- Improved Client Capital Management. With a clear understanding of the matched-maturity marginal cost of funds, AIFMs can make informed decisions about whether to attract new clients or focus on existing ones. This is critical for maintaining optimal liquidity levels and ensuring sustainable growth.

- Strategic Decision Making. FTP provides insights into the cost and value of internal fund transfers, helping firms allocate resources more efficiently. This can lead to better investment decisions and improved overall performance.

- Alignment with Business Nature. FTP methodologies can be tailored to fit the specific nature of the business, whether it is a retail bank, corporate bank, investment bank, AIF, or UCITS. This customization ensures that the FTP framework is relevant and effective.

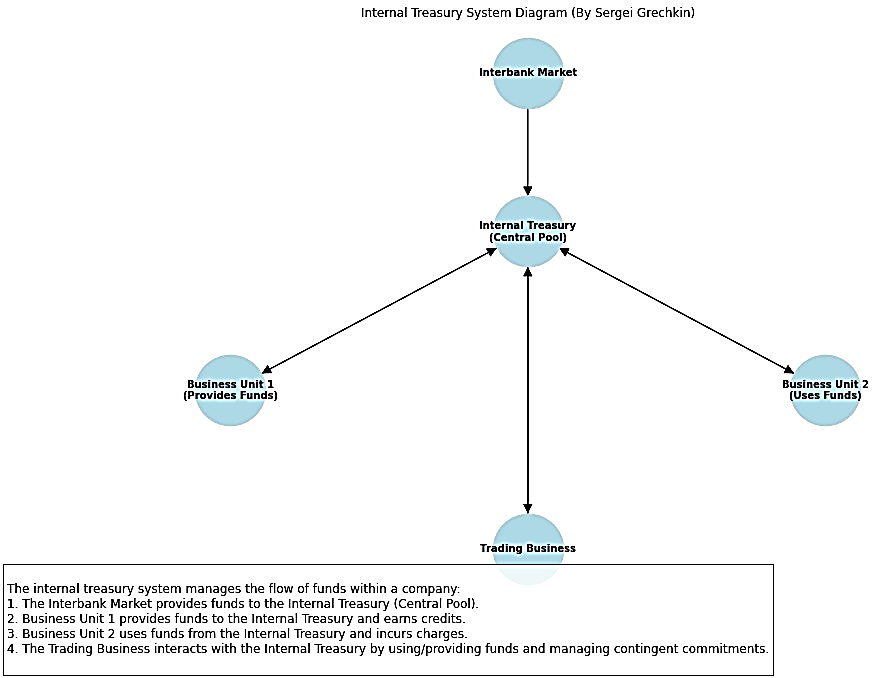

The general workflow of FTP can be found in the graph below.

Internal Treasury System Diagram

Source: made by the author

Advanced FTP Approaches in 2024

As of 2024, the most advanced FTP approaches incorporate dynamic and real-time data analytics, leveraging Machine Learning (ML) and Artificial Intelligence (AI) to enhance accuracy and predictive capabilities.

These technologies enable institutions to predict future liquidity needs. By analyzing historical data and market trends, advanced FTP systems can forecast future liquidity requirements, helping firms stay ahead of potential challenges.

Moreover, ML and AI may optimize fund allocation. AI-driven models can suggest optimal fund allocation strategies, ensuring that resources are used where they can generate the most value.

Last but not least, enhancement of risk management. Advanced FTP frameworks integrate with risk management systems to provide a holistic view of the firm’s financial health, enabling proactive management of liquidity and credit risks.

Implementation and Leadership For Asset Management

In banks, the Treasury Department is typically in charge of the implementation and management of FTP rules and liquidity. However, asset management firms often lack a dedicated treasury function. In such cases, risk managers, as part of the broader risk management system, can take the lead in implementing and controlling the FTP process. By integrating FTP into the risk management framework, asset managers can ensure comprehensive oversight and effective utilization of this powerful tool.

Embracing FTP Will Raise Competitiveness

Funds Transfer Pricing is a powerful methodology that can significantly enhance the financial management capabilities of asset management firms. By adopting FTP, AIFMs can gain deeper insights into profitability, improve client capital management, and make more informed strategic decisions. As the financial industry evolves, embracing advanced FTP approaches will be crucial for staying competitive and achieving sustainable growth. It is time for asset management companies to recognize the potential of FTP and integrate it into their financial management practices for a more transparent, efficient, and profitable future.