3D_generator

The Liberty All-Star Equity Fund (NYSE:USA) is one of the oldest and most established closed end funds trading today. We have covered USA before, outlining what makes the fund a great option for retired investors. The fund is an “All-Star” among retirees due to a prudent management structure, responsible distribution policy, and transparency. USA has been providing shareholders with income since 1986, setting a track record which is hardly matched by any competitor.

However, today we are going to take a contrarian approach and discuss why buying USA may not be the best approach. As much as it pains me to author an article called “Why To Skip USA…”, we are going to illustrate an opportunity for investors to think creatively and recreate the magic of USA with more efficiency and flexibility.

Fund Overview

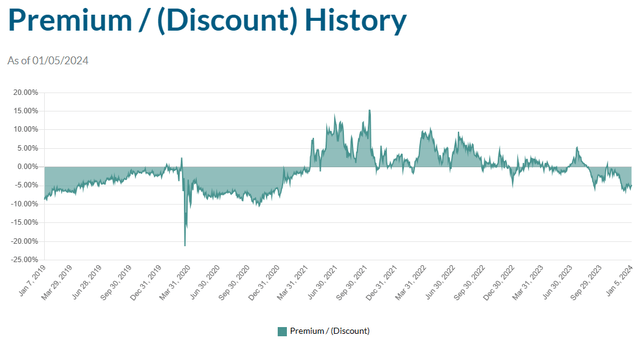

The Liberty All-Star Equity Fund is a closed-end fund with a unique management structure. USA is a large fund, managing $1.8 billion in total assets. The fund does not employ leverage. Today, USA trades at a discount to NAV of approximately 5%. The fund has not traded with a consistent discount since the pandemic era, so investors may find value in the opportunity to purchase a portfolio of equities at a modestly discounted price.

Investors who are familiar with USA typically speak highly of the fund’s management, consistency, and transparency. As such, USA has remained strong in terms of managed assets and performance relative to its underlying index and other competing actively managed equity funds. Most investors who are interested in USA are likely investing for the fund’s quarterly dividend.

Distribution Policy

USA’s value to shareholders is driven by the fund’s dividend. Like most closed end funds, USA distributes substantial income to shareholders making it attractive to retirees and other investors seeking cash flow. The dividend is driven by an uncommon distribution policy which pays a set percentage of the fund’s assets on a quarterly basis. USA sends 10% of net asset value (2.5% of NAV per quarter) to shareholders annually in the form of quarterly distributions. Should USA’s NAV grow over time, the distribution grows in lock step. Historically, this strategy has been effective given the equity markets have delivered consistent double digit returns which have grown the distribution while protecting NAV.

However, this is an important consideration for investors. The dividend and underlying growth of the dividend is not driven by income producing assets. Instead, the dividend is powered by the growth of the equity markets. Meaning, should the equity markets lie flat for a prolonged period, USA’s NAV and dividend will erode.

Portfolio Management

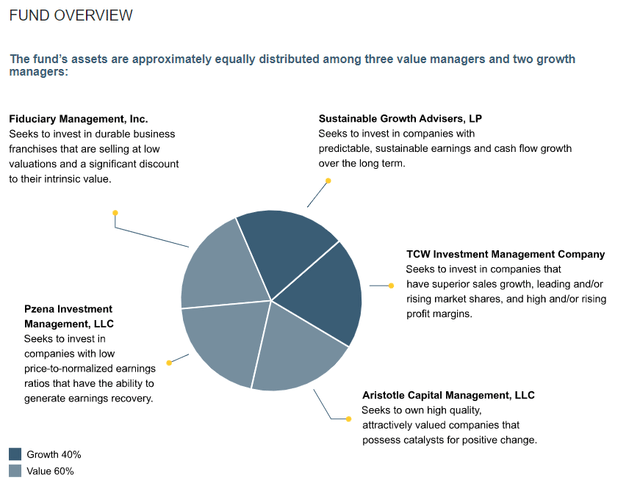

Management of USA is split between five different managers, each individually focusing on their respective area of expertise. The five managers are Fiduciary Management, Sustainable Growth Advisers, Pzena Investment Management, TCW Investment Management, and Aristotle Capital Management. The fund allocates capital on an equal basis between these different managers, providing shareholders with a layer of diversified management. Three managers have a value orientation and two focus on growth investing.

USA’s management teams have remained consistent over time. The asset management teams listed above have lengthy (and successful) track record managing USA’s assets. For investors seeking a growth focused iteration of USA, Liberty manages the All-Star Growth Fund (ASG), a similarly structured closed end fund.

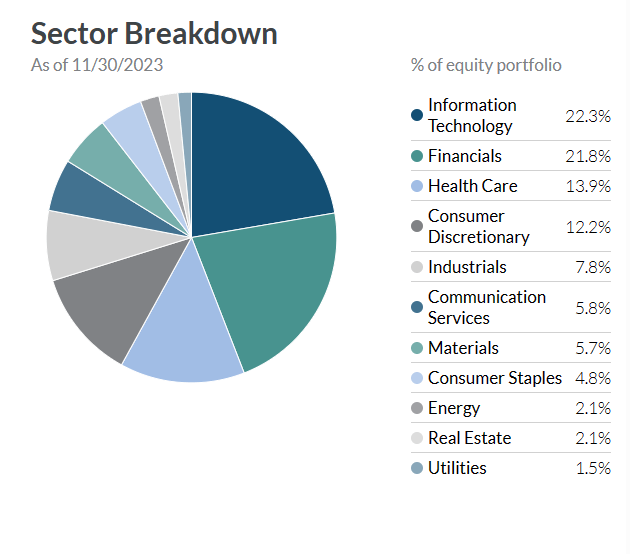

USA is allocated across sectors consistently with broad market indices. The largest allocations of the fund are Information Technology (22.3%) followed by Financials (21.8%).

USA

What To Do Instead

USA is a viable option for investors seeking a closed end fund providing high income driven by the equity markets. The fund is transparent in setting the dividend and is backed by a top-tier asset management team. Additionally, the fund’s expenses are relatively modest at 0.94% of assets under management according to the fund’s website.

However, there is an opportunity for shareholders to enhance flexibility, cut management fees, and receive a superior total return. As we mentioned, USA’s portfolio is driven by common stock, meaning the portfolio is simple and transparent. Additionally, the fund is diversified across growth and value investments. Furthermore, USA’s portfolio is diversified across market capitalization, but heavily weighted towards large capitalization companies. With these three considerations, we uncover that USA’s portfolio is actually similar to a broad market exchange traded fund, such as the Vanguard Total Stock Market Index Fund ETF (VTI).

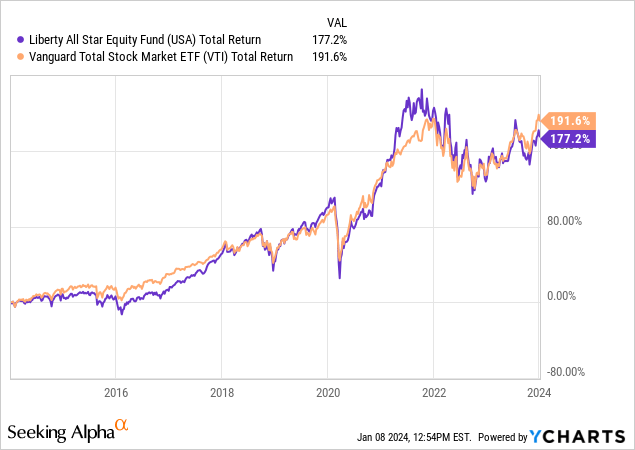

VTI is one of the largest index funds with portfolio of nearly every publicly traded company. VTI is passively managed and is weighted by market capitalization, whereas USA is actively managed by the aforementioned asset management teams. In theory, active management provides superior long-term performance, but as illustrated below, VTI has outperformed USA over the past ten years. One driver of this superior performance is VTI’s expense ratio of 0.03%, 91 basis points below USA’s.

Investors looking to recreate the high yield strategy of USA can collect the quarterly distribution of VTI and supplement by selling approximately 2.0% of your position. On paper, this sounds unsustainable, given you are continuously selling shares and reducing your position. However, remember, USA sells appreciated assets to cover their dividend distribution. Additionally, the DIY method provides flexibility to increase or decrease the “distribution” as expense or market conditions rise or fall.

The reality is that investors are exposed to the same underlying risk conditions which would cause USA’s strategy to fail. A prolonged drop in broad market indices would lead to a decrease in income for both investments.

Conclusion

USA is a great fund which has been supporting the income of retirees for generations. As we mentioned, the fund is backed by five experienced asset managers who have been managing USA’s assets for a substantial amount of time. If you are looking for an option which provides you with equity backed income with no effort, USA provides a great option. However, if you are willing to roll up your sleeves, you can recreate the magic behind the distribution of USA and save money along the way. Given that USA has not delivered a substantial premium in terms of total return to indexed options such as VTI, the extra expense is most likely not worth the money, especially when there are more cost-efficient options available.