Paul Souders/The Image Bank Unreleased via Getty Images

As most of you know, the returns of the broad market indexes have been dominated by large-cap technology stocks. That being the case, it makes sense for investors that think the trend could continue to have sought out funds that may benefit. One of those funds to consider might be the Vanguard Large-Cap ETF (NYSEARCA:VV), another in a long line of Vanguard funds with a very low expense ratio (0.04%) and a relatively strong long-term performance track record. But while I once slapped a BUY recommendation on this fund, I have since changed my tune. Today, I will take a fresh look at the VV ETF, explain my new rating and why the name of this ETF is arguably inappropriate, and suggest what are better alternatives for investors.

Investment Thesis

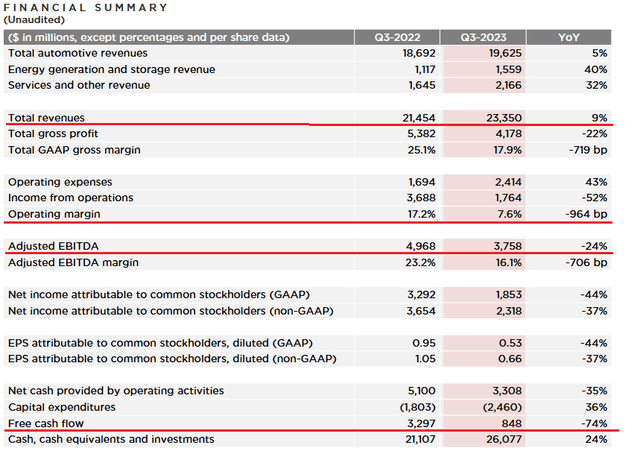

All investors know the investment thesis of owning “big-tech”: they all have well-established strong global brands that have excellent track records of delivering growth, generating tons of free-cash-flow, and have demonstrated superior market-beating returns. Indeed, over the past 10-years stocks like Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Google (GOOG) (GOOGL), and Meta Platforms (META) have generated total returns that have significantly outperformed the broad market as represented by the Vanguard S&P 500 ETF (VOO):

That said, finding an ETF or mutual fund that focuses only on the “best-of-the-best”, and little else, is hard to find (if not impossible). The Vanguard Large-Cap ETF is certainly not one of them. I say that because not only is the fund more diversified (i.e. not tech-sector focused), but it actually has less exposure to large-cap stocks than does the S&P 500. As a result, I am changing my rating on VV from BUY to SELL (and buy something else). I’ll explain why below.

Top-10 Holdings

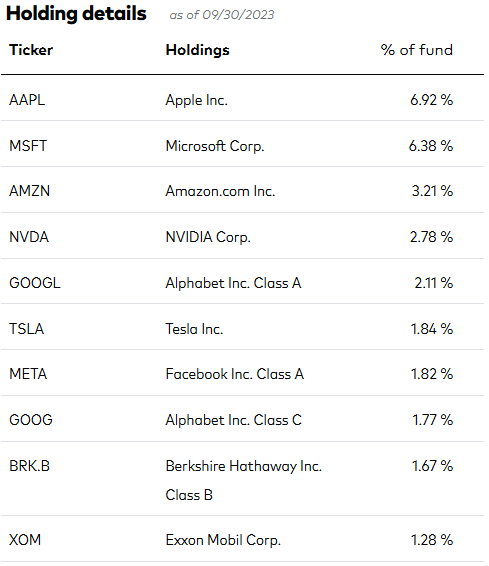

The top-10 holdings in the Vanguard Large-Cap ETF are shown below and were taken directly from the Vanguard VV ETF webpage where investors can find more detailed information on the fund:

Vanguard

First off, Vanguard does not keep its ETF holdings up-to-date on a day-to-day basis like many of the other fund management companies do. As a result, please note the top-10 list above is somewhat dated (i.e. the holdings above are from 9/30/2023).

Secondly, it is both interesting and disappointing to see that the fund’s top-10 holdings generally have a lower weight in the top large-cap tech stocks than does the S&P 500 ETF VOO. For example, the VOO ETF has a 7.00% weight in Apple and a 6.96% weight in Microsoft. One reason for this odd disparity is that the VV ETF, despite advertising itself as a “Large-Cap” focused fund, actually holds 528 stocks – or 28 more companies than the S&P 500.

That is why the VV ETF is not aptly named in my opinion because in reality, it is actually less of a “large-cap” oriented fund than is the plain-old S&P 500. So while the top-10 holdings in both the VV and VOO ETFs are virtually identical, the S&P 500 fund has slightly higher allocations in the biggest names. Also, consider the chart below (data from SlickCharts):

| Company | S&P 500 Rank | Market Cap |

| Microsoft | #1 | $3 trillion |

| Cigna Group | #100 | $89.1 billion |

| Martin Marietta Materials | #250 | $30.9 billion |

| News Corporation | #500 | $14.1 billion |

As you can see, the last component in the S&P 500 is News Corporation. (NWS), which has a market cap of only $14.1 billion. In an era of multi-trillion dollar tech stocks, I’d argue that a $14 billion market-cap is no longer a “large-cap” but is in today’s market more of a “mid-cap”. And the VV ETF even goes beyond that, owning an additional 28 companies outside of the S&P 500. Indeed, VV’s smallest holding is Paramount Global (PARAA), which has a market cap of only $9.1 billion. That being the case, in my opinion VV, is practically just another S&P 500 fund as opposed to one focused solely on “Large-Cap” stocks, as the name implies.

Counting both classes of Google stock (Class A and Class C) – sorry, I am old school so “Alphabet” will always be “Google” to me – Google is actually the 3rd largest holding in the VV ETF with a 3.88% allocation. And this is good news in my opinion as Google remains my favorite big-tech stock. Consider this: at the end of Q3, Google held a whopping $120 billion in cash, cash equivalents, and marketable securities. All things being equal (but acknowledging they seldom are …) if that cash was simply put in a money market fund currently yielding 5%, that equates to an annual “income” of $6 billion … which is more than the total revenue of some of the smaller companies in the S&P 500.

But of course that is not the only reason I find Google stock attractive here. Q3 total revenue was up 11% to $76.6 billion while net income was $21.3 billion, for a very impressive net margin of 27.8%. Q3 EPS was $1.55/share (+46% yoy) as the company’s bottom-line benefited from top-line growth, cost-cutting measures, and the impact of a lower outstanding share count as a result of significant stock buybacks ($45.3 billion worth over the first 9-months of 2023). All this and the stock trades with a TTM P/E of only 28.5x, a slight premium to the S&P 500 P/E = 26.4x.

However, all is not well in the large-cap tech space in my opinion. Apple, for instance, is trading at a TTM P/E = 31.8x, a whopping 20% premium to the S&P 500 despite the fact that Apple posted stagnant top-line revenue and earnings growth in FY2023. For that investors are paying a 20% premium to the S&P 500? In addition, Apple faces strong headwinds in China, from both a consumer and supply-chain standpoint. Why an investor would buy Apple here instead of Google here is quite perplexing to me.

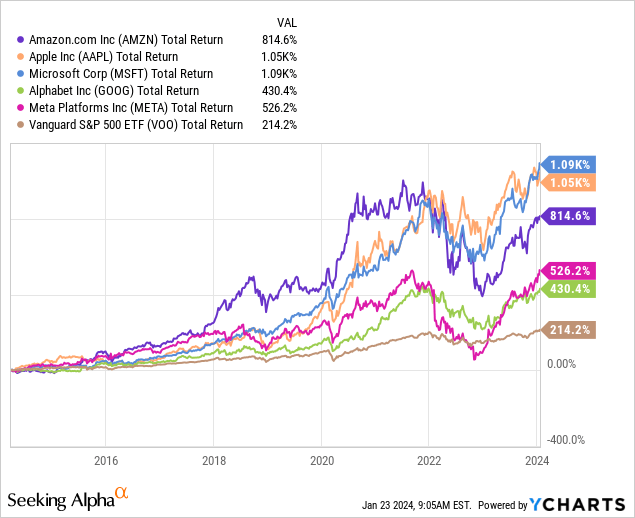

Another large-cap tech stock that looks less than healthy these days is Tesla (TSLA), which in my opinion had the weakest Q3 of all the “Magnificent-7” companies (by far):

As you can see, while Tesla’s top-line revenue growth of 9% was decent, the rest of the report was an unmitigated disaster: operating margin was down 9.64 percentage points yoy, adjusted EBITDA swooned 24% yoy, and free-cash-flow dropped a whopping 74%. This was all primarily a result of significant price-cuts that were required to move inventory in China as a result of increased competition (primary by BYD (OTCPK:BYDDY) (OTCPK:BYDDF) and growing competition in the U.S. from rising South Korean star Hyundai/Kia (OTCPK:HYMTF). I even went so far as to write a recent Seeking Alpha article recommending investors Sell Tesla, Buy Toyota. Indeed, just since the beginning of the year Toyota (TM) has outperformed TSLA by a whopping 24%.

Luckily for the VV ETF (and the S&P 500 as a whole), the outlook and performance by companies like Microsoft, Nvidia, Google, Amazon, and Meta are much better and will likely help to prop up the indexes despite weakness in the laggards.

Performance

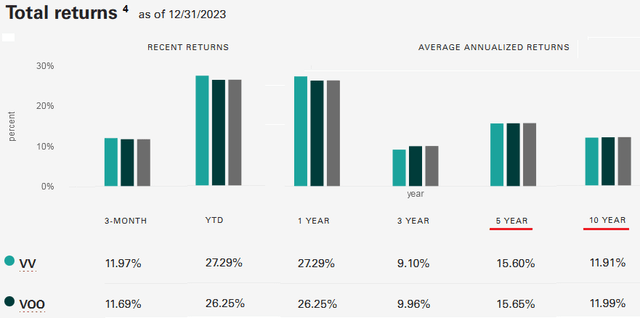

From a performance perspective, and as you might expect from the previous discussion and the fact that the S&P 500 has performed very well (hitting new all-time highs this week), the VV ETF has decent 5-year and 10-year track records. However, note that the returns closely mimic the VOO S&P 500 ETF but actually trail the VOO ETF by a slight amount over the past 5- and 10-year periods:

Although investors likely aren’t buying either of these funds for yield, the VOO ETF also has a slightly higher 30-day yield as compared to the VV ETF (1.456% versus 1.412%).

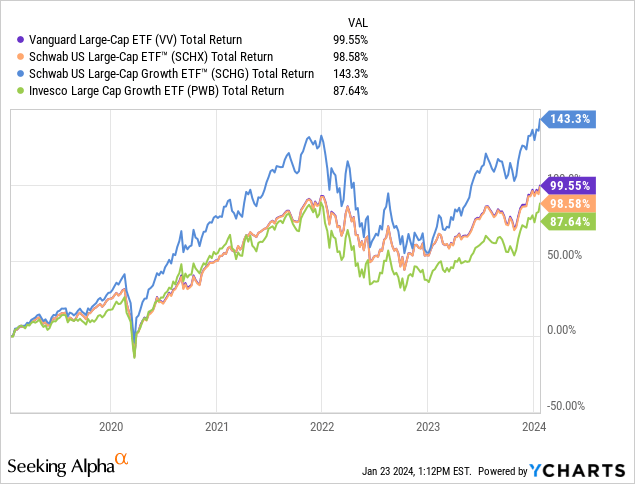

The chart below compares the VV with a direct competitor – the Schwab U.S. Large-Cap ETF (SCHX) along with two large-cap growth-oriented funds: the Schwab U.S. Large-Cap Growth ETF (SCHG) and the Invesco Large-Cap Growth ETF (PWB):

As you can see, the Vanguard and Schwab Large-Cap ETFs have roughly equivalent returns and both significantly outperformed the PWB ETF. However, the out-performer of the group is clearly the Schwab Large-Cap Growth ETF, which has climbed 143% over the past 5 years. One primary reason why the SCHG ETF outperforms is because it only holds 251 companies, and therefore has roughly double the concentration in the biggest and best companies as compared to the VV ETF.

Advice

My followers know I advise them to build a well-diversified portfolio with a good low-cost S&P 500 fund as its foundation (the VOO ETF is perfect) and to hold the portfolio through the market’s up-and-down cycles. They also know that I have been on a campaign over the past few years to significantly reduce the total number of equities I own, both to make my portfolio much easier to track and analyze, but also to – hopefully – boost my returns by focusing only on what I feel are the best and essential holdings. That being the case, the VV ETF does not make the cut. It is much too similar to the S&P 500 to rationalize any capital allocation and hold another equity in the portfolio, not to mention that – in my opinion – the VV fund does not live up to its advertisement as a “Large-Cap” oriented fund. Since there is very little differentiation between the VV ETF and the VOO ETF, which should be a core-holding in a well-diversified portfolio, my advice is to sell VV and move the proceeds into the VOO ETF.

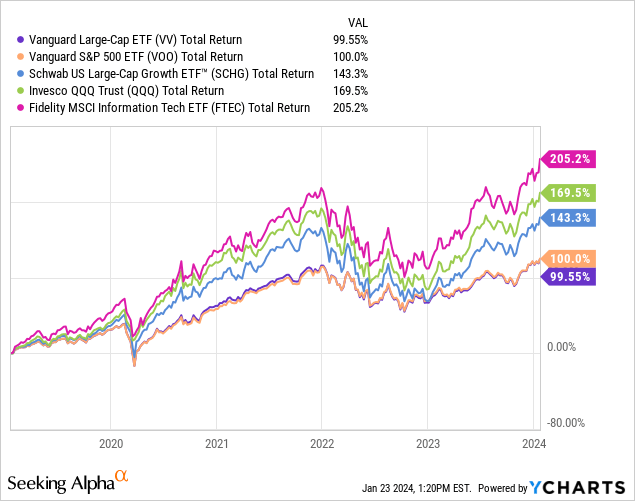

If you are willing to take on a modicum of additional rest but want to stay in the “Large-Cap” sector, I favor the SCHG ETF (its expense ratio is also 0.04%). And, in my opinion, even the Nasdaq-100 Trust (QQQ) and the Fidelity MSCI IT Index Fund (FTEC) are much better proxies for large-cap stocks. That said, both of these funds are obviously more focused on the technology sector than is the VV ETF (i.e. you won’t find Exxon (XOM) in the top-10 holding as you do in VV), but why focus on the “Large-Cap” space if you are not going to focus on the large-cap technology stock winners within that space?

Summary & Conclusion

The VV “Large-Cap” ETF has a solid long-term track record, with a 10-year average annual return of 11.91%. However, the S&P 500 ETF is actually a bit more heavily weighted toward “Large-Cap” companies and has a slightly better 10-year average annual return (11.99%). So, while owning the VV ETF is obviously better than having the funds in cash, I recommend those investors who want to “do like Mike” and slim down the total number of the equities in their portfolios SELL the VV ETF and, at a minimum, move the proceeds into the VOO ETF (or whatever S&P 500 fund you happen to hold, assuming it is a cost-efficient fund). If you want to “goose” your returns by owning more large-cap technology companies, consider moving the funds into one of the following ETFs: SCHG, QQQ, or FTEC or, if you cannot make up your mind, perhaps pick two and split your allocation 50/50.

I’ll end with a 5-year total returns chart comparing the VV, VOO, SCHG, QQQ, and FTEC ETFs to better illustrate my point:

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.