Dividend funds have a strong following, and it’s easy to understand their appeal.

Dividends provide tangible cash flow to a fund’s investors and often provide regular income, and a number of dividend-oriented funds have the characteristics of great long-term investments.

However, different dividend funds use different strategies to reach their goal. Income-oriented funds seek a higher yield than the market by holding higher-yielding stocks. Dividend growth funds focus on stocks that consistently grow their regular cash dividends over long periods of time. And some funds blend these preferences to deliver current income as well as expected dividend growth.

Morningstar’s latest paper, “Searching for Great Dividend Funds,” outlines the characteristics that typically define each style, the trade-offs in their expected performance, and how to apply that knowledge to find a great dividend fund.

3 Types of Dividend Funds

One of the most important distinctions among dividend strategies is the way they use dividends to select stocks for a portfolio, which leads to differences in their associated risks.

Morningstar classifies dividend funds into three different cohorts:

- Dividend income funds focus heavily on dividend yield or income;

- Dividend growth funds hold stocks that consistently increase their dividends over time, thus signaling overall resilience and future growth; and

- Dividend growth and income funds strike a balance between future growth and current income.

Dividend income portfolios typically hold stocks with higher yields than the market, but they tend to grow their dividend payments at a slower rate, if at all.

- These may be mature companies with limited growth opportunities or those faced with deteriorating business conditions.

- They tend to pay a larger share of their earnings as dividends, which usually leads to lower earnings growth and, as a result, lower dividend growth than the average company. In either case, these funds typically sport lower average valuations than the market and land on the value side of the Morningstar Style Box.

- They can be among the riskier dividend strategies available.

Dividend growth funds have less exposure to dividend cuts.

- They are willing to accept lower current yields in exchange for higher future payouts and typically favor stocks with durable competitive advantages, long histories of dividend growth, and strong profitability.

- The stocks they invest in tend to trade at higher price multiples than those with higher dividend yields, reflecting their better outlooks but also raising the hurdle for future returns.

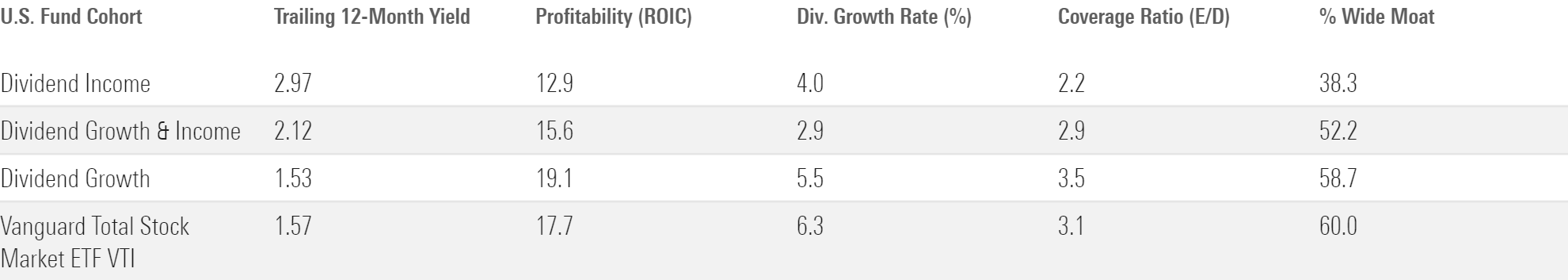

The exhibit below shows how these characteristics stack up across U.S. dividend fund cohorts. Similar differences exist across the international/global cohorts.

The Risk and Reward Profiles of Different Dividend Funds

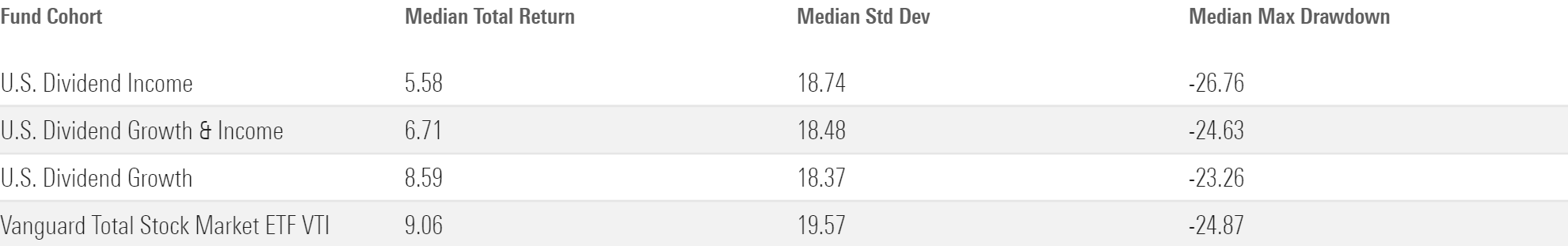

The different fundamentals and risk profiles of each cohort help explain how it tends to perform. In general, dividend income funds incur more risk than dividend growth funds, though the additional risk doesn’t always show up in performance. Dividend growth funds usually bear less risk, but they usually capture less of the market’s upside.

Dividend income funds: Portfolios focused on these funds almost always have a value orientation. Value-oriented funds can have merit, but pursuing yield without sufficiently controlling risk can be precarious. That’s because the highest-yielding portfolios often trade in the cheapest, and sometimes riskiest, stocks in the market. Those at the bottom of the barrel are there for a reason: The market expects them to grow at a relatively slower pace, if at all. Some of the stocks in these portfolios might be facing existential threats to their business. Their prices may have further to fall, and future dividend payments may get cut if the company decides to preserve cash.

Dividend growth funds: On the other hand, dividend growth funds typically steer clear of such stocks. They key in on companies with greater profitability and strong competitive advantages that usually translate into better performance during volatile periods. But that stability comes with a caveat: They don’t always keep pace with the broader market during rallies. Dividend growth funds typically underperform the market during periods of exceptionally strong growth, when expensive stocks that pay little, if any, dividends fuel the market’s rise.

Dividend growth and income funds walk the line between these two. Exhibit 2 shows how a typical fund in each cohort performed over the five years through September 2023. Each cohort had a similar level of volatility, but the dividend income cohort was riskier as measured by maximum drawdown. Many funds in that cohort performed poorly during the coronavirus drawdown in early 2020—a reflection of the risks that their portfolios tend to incur.

What to Look for in a Dividend Fund

Yield, on its own, isn’t a great metric to prioritize, for a few reasons:

- Strategies with higher yields usually mean higher price volatility, lower price appreciation, and greater exposure to companies that are likely to cut their dividends.

- Funds focusing solely on yield often forgo diversification by taking large positions in a few high-yielding segments of the market or concentrating their portfolios in a select few high-yielding stocks.

- Not to mention, fund providers often charge higher fees for high-yield portfolios. Collectively, those undesirable traits weigh on a fund’s total and risk-adjusted performance.

Rather, great index-tracking dividend funds have a strong foundation built from low fees and broad diversification. Overall, investors should look for funds with the following characteristics:

- They should hold at least 100 stocks and have one third or less of their assets parked in their 10 largest holdings. (Active managers can get away with fewer, provided they’re a prudent judge of the stocks they ultimately select for their portfolios.)

- They should keep turnover within reasonable limits, ideally around 40% or less. That prevents a fund from racking up trading costs and can indicate that it isn’t churning through stocks to chase after dividend-payers.

That said, a simple way to find great dividend funds is to use a great benchmark possessing those characteristics to help gauge the riskiness of others. Income strategies built around high-yielding stocks are inherently risky. So, the growth and income cohort is a better place to find funds that reasonably balance risk and reward.

Two all-around great choices to start with are Vanguard High Dividend Yield ETF VYM, which has a Morningstar Medalist Rating of Gold, and Silver-rated Vanguard International High Dividend Yield ETF VYMI, which land in the U.S. and international/global growth and income cohorts, respectively. Both have low fees and well-diversified portfolios that have consistently delivered a reasonably higher yield than their respective market. Funds with incrementally higher yields are most likely incurring incrementally greater risks to deliver that yield. Investors should prepare themselves for the possibility of higher volatility and deeper drawdowns as they consider investing in funds with higher yields than VYM or VYMI.

For investors seeking active management, we like Silver-rated JPMorgan Equity Income HLIEX. Like VYM and VYMI, this income-oriented fund strikes a balance between income and sound risk management and lands in the growth and income cohort. Lead manager Clare Hart is retiring in fall 2024 after two decades at the helm, so its People rating recently dropped to Above Average from High. That said, portfolio managers Andy Brandon and David Silberman are seasoned and skilled. They’re plying the same High-rated Process that has delivered very steady income, solid defense in down markets, and great long-term total returns.

For investors seeking dividend growth funds, Vanguard Dividend Appreciation ETF VIG and Vanguard International Dividend Appreciation ETF VIGI are great starting points. Both have tended to capture the risk/reward profile that’s emblematic of dividend growth portfolios, modestly lagging the domestic and foreign market, respectively, during strong rallies and outperforming during drawdowns. Both funds are cheap within their respective Morningstar Categories, so funds that charge more or turn over their portfolio more frequently will have to take on more risk to overcome those hurdles.

For an actively managed dividend growth option, Gold-rated T. Rowe Price Dividend Growth PRDGX and its ETF version, TDVG, are excellent choices. Manager Tom Huber believes stocks with growing dividends offer outperformance with lower volatility. That’s just what this strategy has delivered to investors, outperforming 85% of other dividend growth funds with volatility lower than almost 85% of them over the past decade.

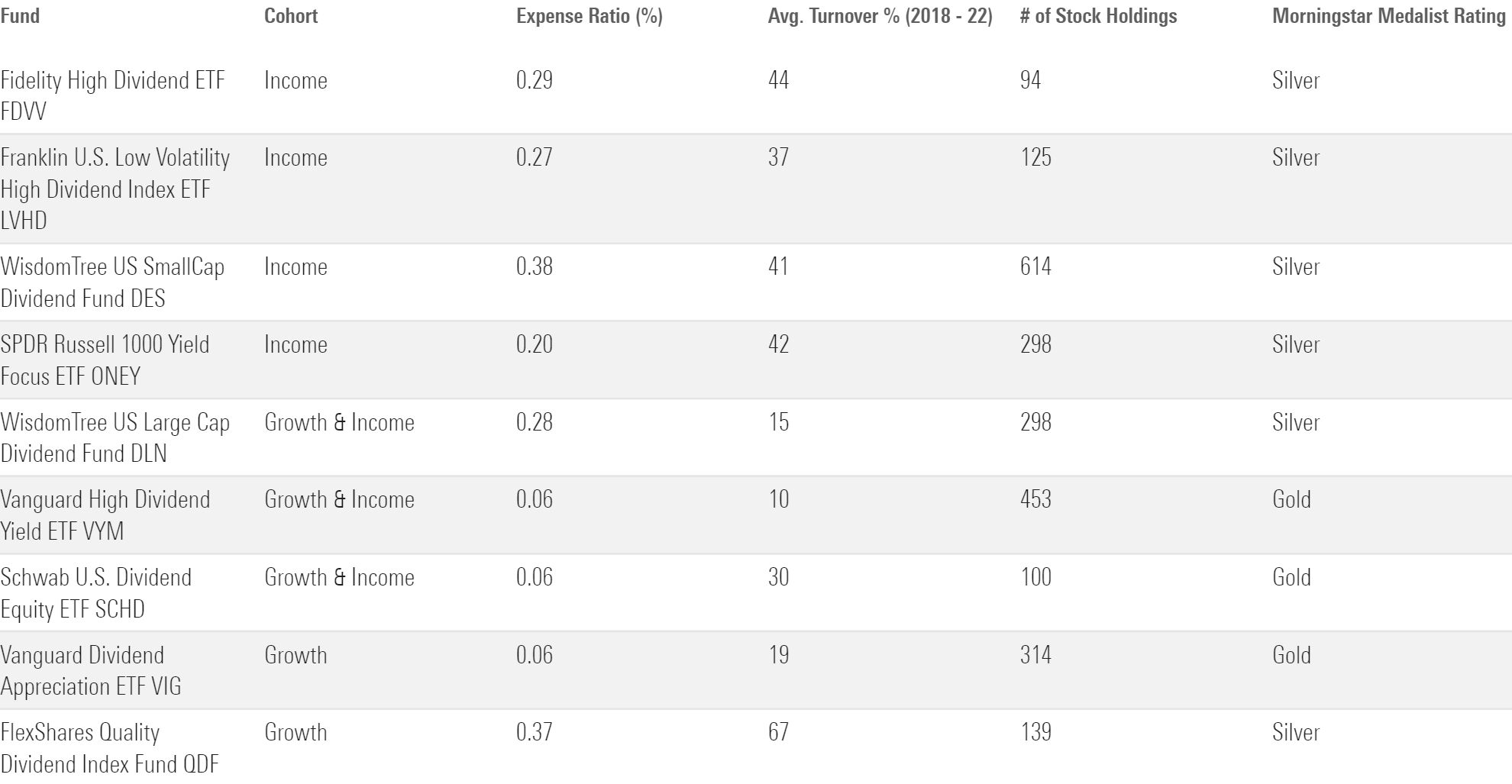

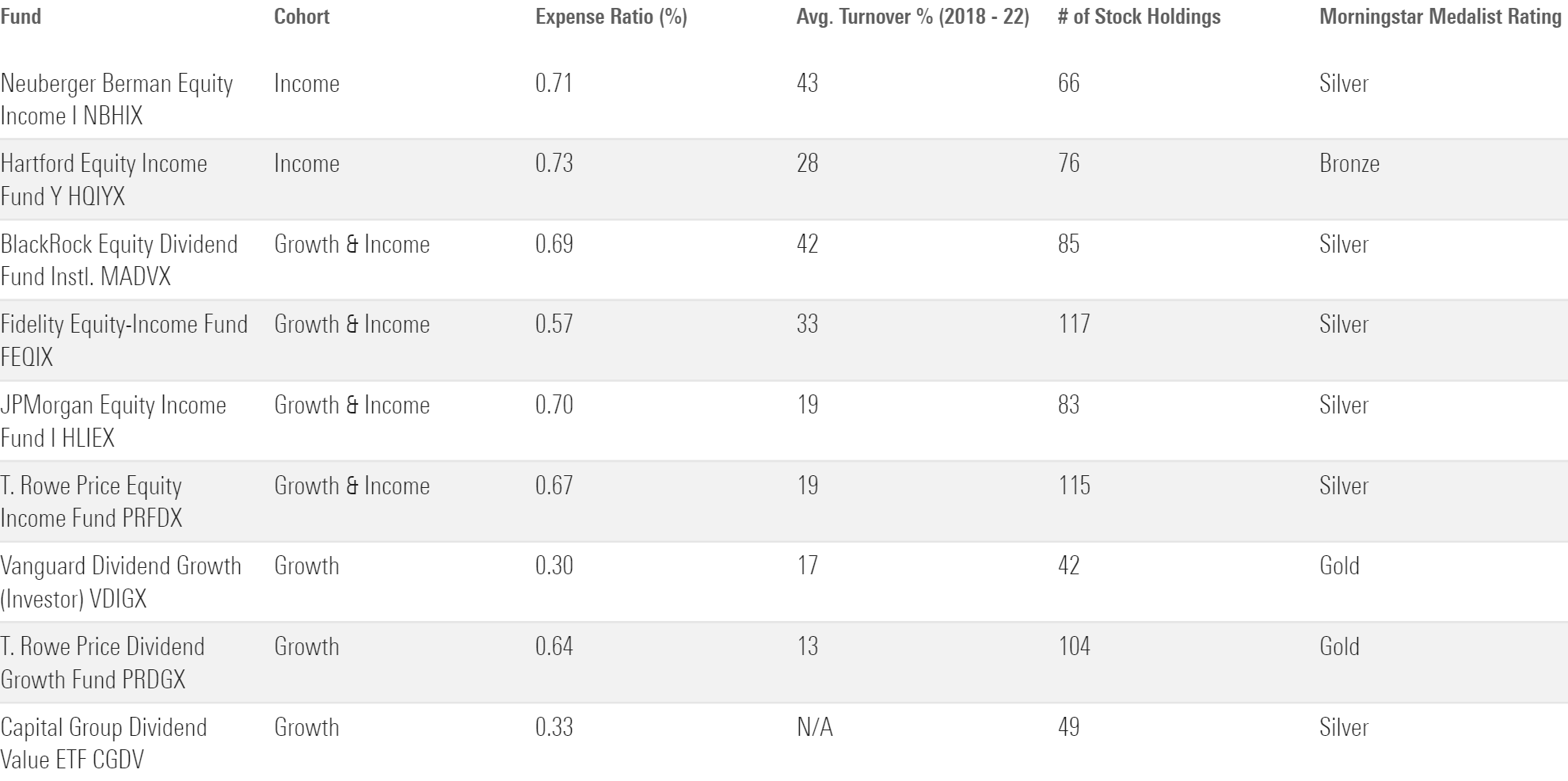

Exhibits 3 and 4 summarize index-tracking funds and actively managed funds with Morningstar Medalist Ratings in each cohort.