What You Should Know:

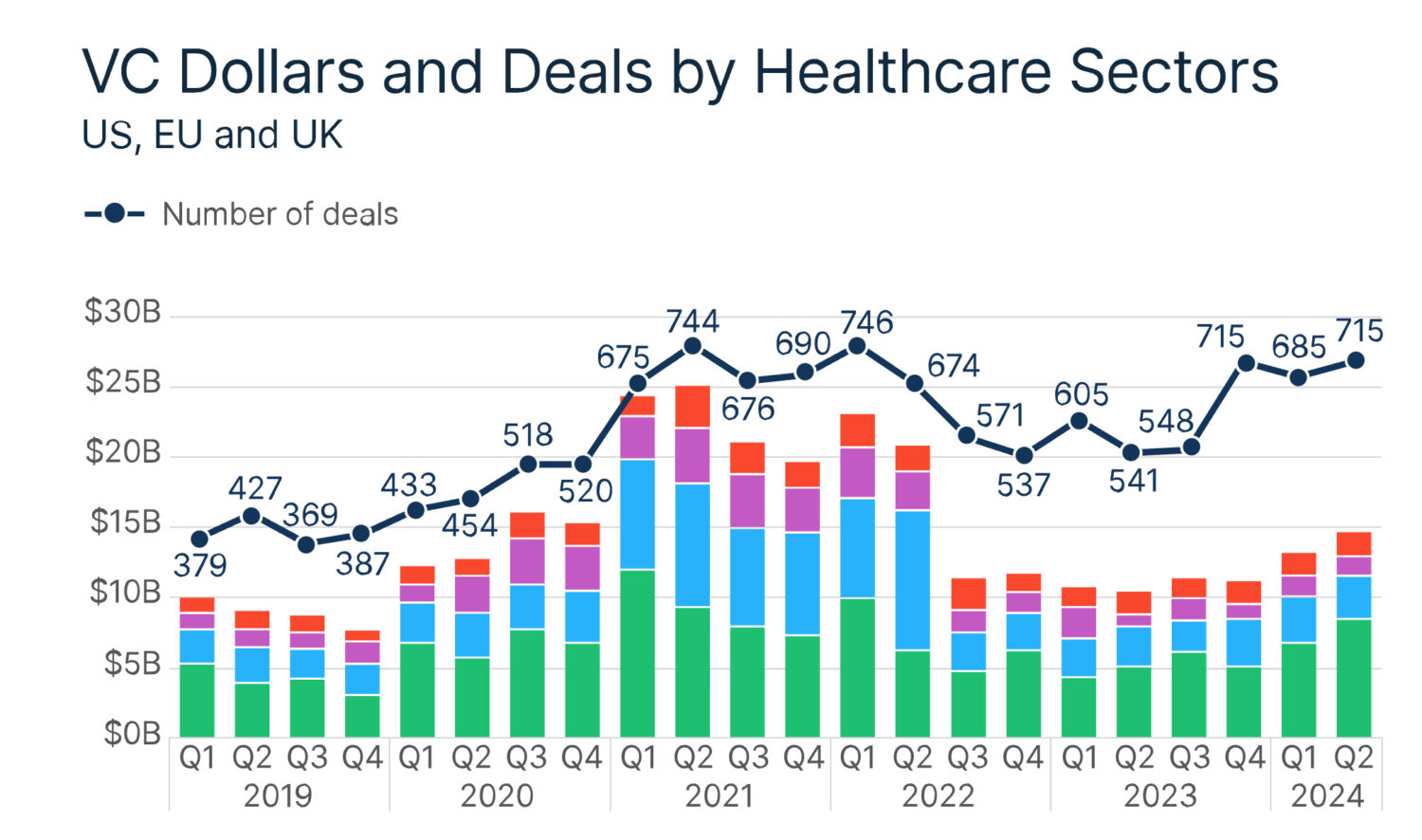

– The healthcare venture capital landscape experienced a resurgence in the first half of 2024, according to a new report from Silicon Valley Bank (SVB). Despite ongoing economic challenges, 89% of US VC funds exceeding $25M successfully met their fundraising targets.

– The report, “2024 Mid-Year Healthcare Investments and Exits,” delves into venture capital activity across the healthcare sector, including biopharma, healthtech, medical device, and diagnostics/tools (dx/tools).

Key Findings from the SVB Mid-Year Healthcare Investments and Exits Report:

- Biopharma Sector Thrives: The biopharma sector continues to attract significant investor interest, with a record-breaking first half of the year for Series A investments. While rare disease funding is still below pre-pandemic levels, the sector shows promise for growth.

- Healthtech Recovers: The healthtech sector experienced a rebound in Series A investments, signaling a potential recovery from the previous year’s challenges. However, later-stage companies are grappling with valuation adjustments after the pandemic-era boom.

- Medical Device Funding Focuses on Pivotal Studies: Investors are increasingly backing medical device companies with a clear path to regulatory approval, emphasizing the importance of clinical trials.

- Dx/Tools Sector Faces Challenges: The diagnostics and tools sector remains challenging, with investors prioritizing solutions that offer clear value propositions and reduced risk.

Fundraising and Exit Trends

The report highlights a stabilization of VC fundraising in the healthcare sector, with an estimated $20 billion raised in the first half of 2024. However, the valuation landscape remains cautious, with a significant portion of companies experiencing flat or down rounds.

Looking Ahead

The second half of 2024 could see continued growth, driven by large-scale deals, AI-powered innovations, and successful public market exits. The healthcare industry’s ability to navigate economic challenges and deliver impactful solutions will be crucial for driving future investment.

“Companies are still working to achieve growth that matches high pandemic-era valuations,” said Jackie Spencer, Head of Relationship Management for Life Science and Healthcare Banking at Silicon Valley Bank and author of the report. “While each sector has its own story to tell, it’s clear that 2024 activity shows investment in life sciences and healthcare is finding a path forward despite headwinds. With a continued focus on prioritizing profitability over growth and rationalizing valuations, we expect healthy and sustainable investment for the second half of the year.”