Investors will find many of the best growth stocks in the world on the Nasdaq exchange. An even more exclusive club is in the Nasdaq-100 index, which includes the largest nonfinancial stocks on the exchange.

The Invesco QQQ Trust (QQQ -1.26%) tracks the Nasdaq-100, and it’s a popular exchange-traded fund (ETF) for many growth-oriented investors. Below, I’ll go over how a $50,000 investment into this ETF might grow over the long haul, and whether it can get to $1 million by the time you retire.

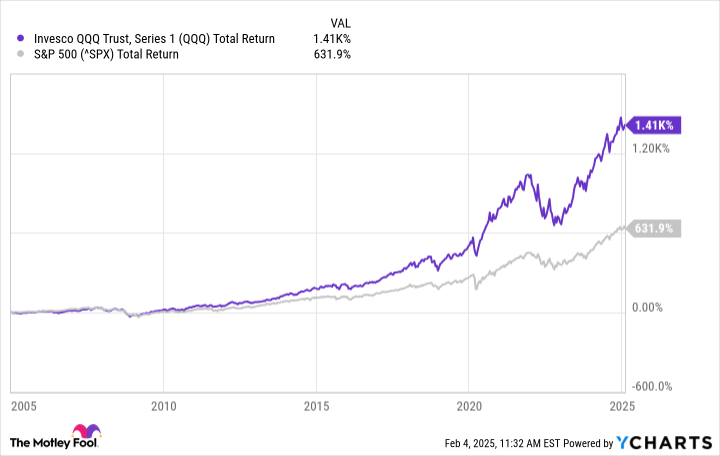

QQQ Total Return Level data by YCharts

Can Invesco’s market-beating returns continue for decades?

As you can see from the chart above, the Invesco fund has been a solid, market-beating fund for not just years but decades, as it has outperformed the S&P 500 by a considerable margin.

While that looks great, investors should remember that past returns don’t predict future performance. It has been more than 20 years since the dot-com crash, and with many tech stocks trading at or around record levels, a strong case can be made for why they might underperform in the future. A crash may not happen this year but investors may want to brace for at least the possibility of milder returns over the long run.

However, since the Nasdaq-100 changes over time, I’m optimistic that this can remain a market-beating investment over the long haul, and that it can still be a great ETF to put in your portfolio until you retire.

Here’s how much a $50,000 investment in the Invesco Fund might be years from now

To forecast what a $50,000 investment might look like in the future, you need to consider how many investing years you have left before you plan to retire, and what annual return you expect to earn. To consider multiple scenarios, I’ve created the table below to show you how this size of an investment might grow over time, at varying interest rates and years to retirement.

| Projecting a $50,000 Investment Into the Future | ||||

|---|---|---|---|---|

| Annual Growth Rate | ||||

| Years to Retirement | 8% | 9% | 10% | 11% |

| 25 | $342,424 | $431,154 | $541,735 | $679,273 |

| 26 | $369,818 | $469,958 | $595,909 | $753,993 |

| 27 | $399,403 | $512,254 | $655,500 | $836,932 |

| 28 | $431,355 | $558,357 | $721,050 | $928,995 |

| 29 | $465,864 | $608,609 | $793,155 | $1,031,185 |

| 30 | $503,133 | $663,384 | $872,470 | $1,144,615 |

| 31 | $543,383 | $723,088 | $959,717 | $1,270,522 |

| 32 | $586,854 | $788,166 | $1,055,689 | $1,410,280 |

| 33 | $633,802 | $859,101 | $1,161,258 | $1,565,411 |

| 34 | $684,507 | $936,421 | $1,277,383 | $1,737,606 |

| 35 | $739,267 | $1,020,698 | $1,405,122 | $1,928,743 |

Data source: Calculations by author.

It’s possible for your investment to grow to more than $1 million, but two things are clear from the above table. The first is that you’ll likely need to remain invested for more than 30 years. Second, the fund will need to generate an annual return of at least 10% — which is the S&P 500’s long-run average. While that might seem probable, remember that this is if you invest now, while stocks are trading at elevated levels. It’s by no means a sure thing.

Investors should hope for the best but invest in preparation for the worst

There is no guarantee that a $50,000 investment, even into one of the best growth ETFs in the world, will be enough to get you to $1 million by the time to retire.

You can, however, increase the odds of getting to that level by adding to your investment. Any amount that you can add to your ETF over the years will result in more money that gets compounded, leading to a higher portfolio balance in the end, rather than if you just let the money sit. By doing that, you can increase the odds that you hit your retirement goals. And in the best-case scenario, your investment does better than you expect and you have even more money for retirement.