Even when a business is losing money, it’s possible for shareholders to make money if they buy a good business at the right price. For example, Dyne Therapeutics (NASDAQ:DYN) shareholders have done very well over the last year, with the share price soaring by 299%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So notwithstanding the buoyant share price, we think it’s well worth asking whether Dyne Therapeutics’ cash burn is too risky. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let’s start with an examination of the business’ cash, relative to its cash burn.

Check out our latest analysis for Dyne Therapeutics

How Long Is Dyne Therapeutics’ Cash Runway?

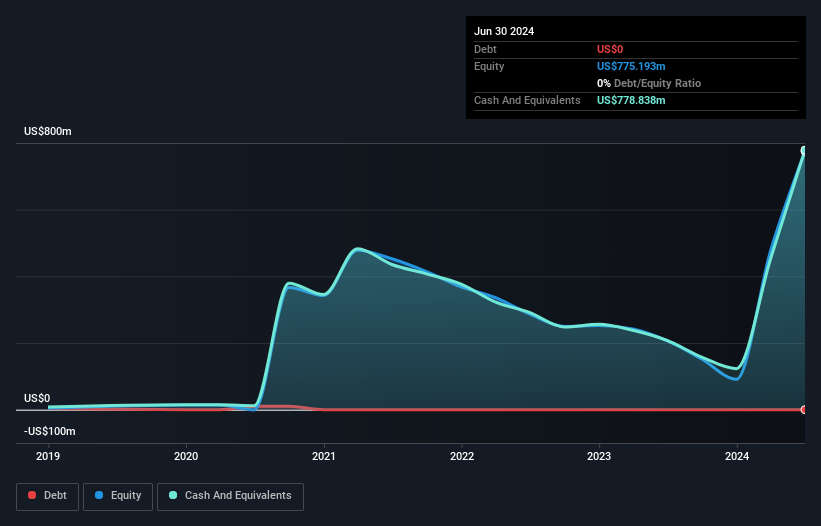

A company’s cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2024, Dyne Therapeutics had cash of US$779m and no debt. Looking at the last year, the company burnt through US$220m. Therefore, from June 2024 it had 3.5 years of cash runway. There’s no doubt that this is a reassuringly long runway. The image below shows how its cash balance has been changing over the last few years.

How Is Dyne Therapeutics’ Cash Burn Changing Over Time?

Dyne Therapeutics didn’t record any revenue over the last year, indicating that it’s an early stage company still developing its business. So while we can’t look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. With the cash burn rate up 25% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company’s true cash runway will therefore be shorter than suggested above, if spending continues to increase. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Dyne Therapeutics Raise Cash?

Given its cash burn trajectory, Dyne Therapeutics shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company’s cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year’s operations.

Since it has a market capitalisation of US$4.3b, Dyne Therapeutics’ US$220m in cash burn equates to about 5.1% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year’s growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Dyne Therapeutics’ Cash Burn Situation?

It may already be apparent to you that we’re relatively comfortable with the way Dyne Therapeutics is burning through its cash. For example, we think its cash runway suggests that the company is on a good path. While its increasing cash burn wasn’t great, the other factors mentioned in this article more than make up for weakness on that measure. Looking at all the measures in this article, together, we’re not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Separately, we looked at different risks affecting the company and spotted 4 warning signs for Dyne Therapeutics (of which 2 are a bit unpleasant!) you should know about.

Of course Dyne Therapeutics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.