The EU’s executive has ventured further into the realm of national security with new rules to oversee, examine and possibly prohibit foreign investments in strategic sectors, like AI, microchips and biotech.

The European Commission on Wednesday unveiled a new proposal that would provide it and member states with a more detailed picture of foreign direct investment (FDI) that carries high risks for security and public order.

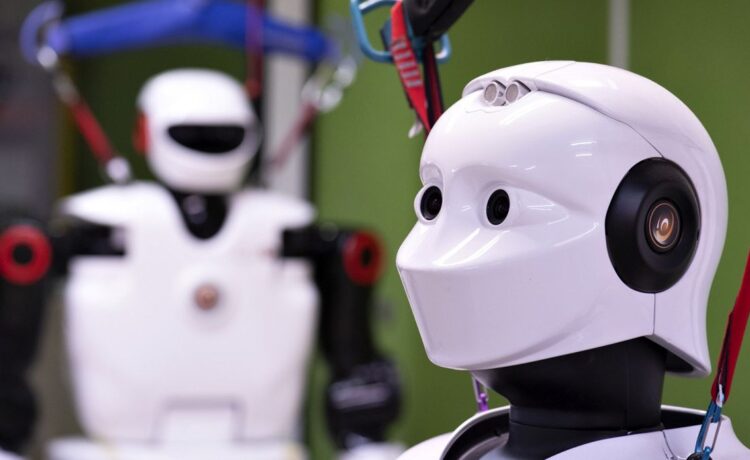

Quantum technology, cloud computing, robots, drones, virtual reality, advanced sensors, 6G networks, nuclear fusion, hydrogen, batteries and space surveillance, as well as military equipment, would also fall under the legislation.

The level of risk would be determined by looking at the effects that the investment, regardless of its size and origin, might have on critical infrastructure, supply chains, sensitive information and media pluralism. Money flows coming from authoritarian regimes, like China, Russia and Belarus, and people under EU sanctions would be immediately considered cause for inspection.

The magnified vigilance would also apply to investments that take place inside the bloc but are ultimately controlled by a non-EU person or company.

Under the new rules, the screening of FDI into high-risk sectors would become mandatory for all member states. As of today, four countries lack a proper system – Croatia, Bulgaria, Greece and Cyprus – while Ireland’s efforts are ongoing.

Once a country begins reviewing a suspicious investment, the Commission and the other capitals would be allowed to provide comments and voice concerns, turning the internal process into an EU-wide dialogue. However, the final decision to prohibit the FDI would be taken by the national authorities, never by Brussels.

Wednesday’s proposal is the first piece of legislation to emerge from the Economic Security Strategy presented in June by Ursula von der Leyen, a pioneering document that proposed a meaningful shift in the decades-long mantra of free and open markets.

The Commission has since then faced accusations of protectionism and dirigisme, in line with French interests, but the executive insists the focus on “de-risking” is a logical reaction to the fraught and confrontational political climate around the world, particularly in the aftermath of the COVID-19 pandemic, Russia’s invasion of Ukraine and China’s increased assertiveness. Last year, Beijing angered the west when it restricted exports of gallium and germanium, two rare-earth metals used for electronic components.

Brussels fears long-built dependencies on products necessary to modernise the bloc, including microchips and batteries, could one day backfire and wreak economic havoc of untold dimensions. By the same token, the thinking goes, opening the door to foreign investors without further scrutiny could enable the takeover of valuable firms, prompt the loss of exclusive know-how and, in the long term, weaken Europe’s competitiveness.

The proposed update to the rules comes barely a month after the Spanish government was forced to purchase a 10% stake in Telefonica, the country’s telecommunications company, to rival the 9.9% stake acquired by Saudi Telecom Company (STC). The move, which would have made the Saudi firm the largest stakeholder of the iconic brand, caught Madrid by surprise and triggered a debate on foreign interference and strategic autonomy.

“There is fierce competition worldwide for the technologies that we need the most,” said Margrethe Vestager, the Commission’s executive vice-president in charge of the digital agenda. “And in this competition, Europe cannot just be the playground for bigger players. We need to be able to play ourselves.”

Vestager stressed that the EU would remain “as open as possible, as close as necessary” and dispelled the notion of a protectionist conversion. Since the bloc introduced its first FDI screening rules in 2020, over 1,200 transactions have been examined, with Brussels issuing an opinion in less than 3% of cases.

The updated legislation will now undergo negotiations between the Council and the Parliament, a process set to be slowed down by the upcoming EU elections.

Inbound vs outbound

The Economic Security Strategy pitched foreign direct investment as one coin with two sides: inbound – the flows coming from other countries into the EU – and outbound – the flows going from the EU towards other countries.

But while Brussels has made considerable inroads in scrutinising inbound investment and keeping foreign subsidies in check, the control over outbound investment is negligible, despite the bloc being the world’s largest financier. In 2022, FDI held in the rest of the world by investors resident in the EU amounted to €9,382 billion.

The Commission worries that this massive lack of knowledge could pose security risks when EU companies engage in transactions abroad that involve sensitive technologies that might be used to enhance the military and intelligence capabilities of authoritarian regimes whose actions endanger global security.

For example, a German manufacturer invests in a microchip plant on the outskirts of Shanghai, transferring research and expertise that the Communist Party could then access by forcing the plant to disclose the information.

When von der Leyen presented the Economic Security Strategy in June, she promised her executive would soon develop the first-ever screening mechanism for outbound investment. However, the initiative was met with reservations from some member states and the private sector, who believe such a system would impinge on business freedom.

The backlash appeared to pay off on Wednesday: instead of a fully-fledged proposal, the Commission instead unveiled a “white paper,” a document completely devoid of legal power that is meant to kick-start a reflection among countries.

Brussels envisions a lengthy roadmap of public consultation and collection of evidence that will last until the summer of 2025. The Commission will then go through the facts and, if the need to mitigate risks persists, develop legislation for outbound screening. The law would then undergo at least two years of negotiations, meaning the mechanism would not be enforceable until the end of 2027 at the very earliest.

“The timeline, indeed, has slipped a bit,” Valdis Dombrovskis, the vice-president in charge of trade relations, acknowledged during the press conference with Vestager.

“Already from the onset, it was clear that this is an area where we need also respect institutional, so to say, prerogatives and the fact that national security is member states’ competences,” he went on, “something that we need to navigate carefully.”