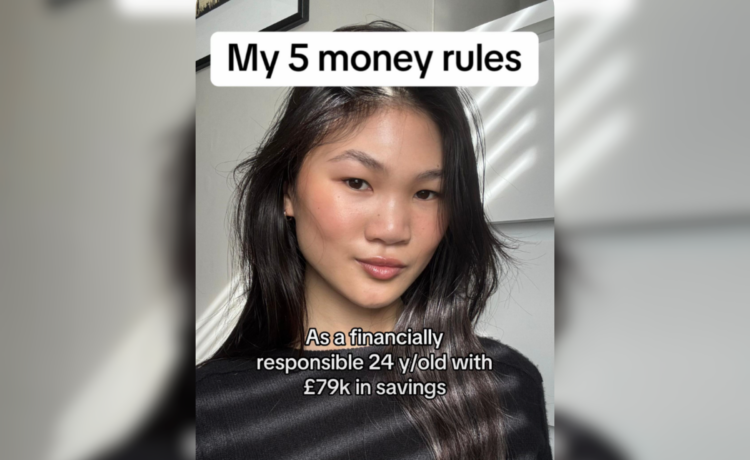

A 24-year-old woman has gone viral after sharing her five “money rules” which helped her save over $100,000, and financial experts have given Newsweek their thoughts.

Being savvy with money can be a challenge, but not for Mia McGrath. While she was studying at university, she was already putting thousands of pounds aside, and over the last five years, her savings have continued to grow.

Now, at the age of 24, McGrath, from London in the U.K., has managed to save £79,000 (approximately $102,000).

The Generation Zer (people born between 1997 and 2012) attributes this accomplishment to five key tips:

- Her investments “eat first,” meaning she prioritizes them ahead of other expenditures.

- Eating out is only for socializing and special occasions (that includes grabbing coffees).

- She only uses her credit card to improve her credit score, “not for irresponsible spending.”

- She tracks every expense.

- She keeps 25 percent of her savings and investments in cash.

While these “money rules” have certainly worked well for McGrath, Tom Alessi, an investment advisor with 25 years of experience, has told Newsweek that they might be “too extreme for most people.”

McGrath shared her tips on TikTok (@miarosemcgrath) and the post went viral with 778,900 views and 29,700 likes in just a matter of days.

Newsweek contacted McGrath via email for comment.

What Are the Perks of Investing?

Alessi, who is the President of the ARIES Foundation for Financial Education, Inc., refers to F.I.R.E., an acronym for “financially independent, retire early.”

When it comes to prioritizing investments, Alessi recommends “treating yourself like a bill.” Just like you pay your rent or mortgage, pay into your investments each month too.

This rule is also a great way to make saving a non-negotiable habit, according to personal finance expert Maxine McCreadie from UK Debt Expert. McCreadie told Newsweek that this will allow you to “take advantage of compounding interest” by making it a routine.

“That being said, it’s key to balance investing with other financial priorities, such as paying down debt and maintaining a cash emergency fund,” she said.

The Cost of Socializing

Being mindful of spending is wise, but it shouldn’t be too restrictive to the point of affecting your lifestyle. Financial goals should be realistic and sustainable, which is why McCreadie encourages people not to cut too many costs.

If your saving habits become limiting, this can lead to “burnout and impulse spending down the line,” McCreadie explained.

Grabbing a coffee before work or taking an Uber instead of walking are expenses that you should consider. But it’s possible to cut costs without taking away enjoyment and happiness too.

@miarosemcgrath / TikTok

Credit Card Spending

McGrath only uses her credit card to help with her credit score, which Alessi thinks is a great rule to follow.

He said: “We try to counsel a cooling off period, especially for bigger ticket items. I wait a couple of weeks or months, and in the interim set aside what I would have been paying in interest, so that I have saved up even more before I go ahead and purchase.”

If that’s not possible, McCreadie suggests paying credit card purchases off within the month to avoid interest charges. High-interest debt should be prioritized to avoid it snowballing.

Tracking Expenses

This is one of the most crucial rules, according to McCreadie, especially for anyone facing debt. Whether you do this through spreadsheets or an app, this can give you a good understanding of your spending habits and any unnecessary costs.

“Understanding your incomings and outgoings is key because it gives you a clear understanding of where your money is going and where any overspending may be cropping up. Without this knowledge, it’s hard to make informed financial decisions,” McCreadie told Newsweek.

Reviewing your spending can also help you renegotiate certain bills which might free up some cash.

Keeping Cash Savings

As well as her investments, McGrath keeps 25 percent of her savings in cash as an emergency fund.

Alessi and McCreadie both agree with this rule as it provides liquidity in case any unexpected costs arise. It can also mean you don’t have to dip into your funds or go into debt to cover any large costs you hadn’t budgeted for.

Regardless of why you’re saving, it’s important to have a goal in mind. Create a plan that works for you and offers a healthy balance between saving and living.

“Having a clear goal can keep you motivated and make it easier to stay disciplined. Without that, it’s easy to lose focus and spend money on things that don’t align with your long-term financial well-being,” McCreadie said.

“Personal finance isn’t one-size-fits-all and what works for one person may not work for another. The key is to create a plan that fits your lifestyle and financial goals while allowing room for flexibility,” she added.

Since McGrath shared her advice online, the post has gained over 260 comments on TikTok. Plenty of internet users were keen to learn more about her savings routine.

One TikTok user commented: “it depends all on what you make a month, but that’s a good strategy.”

Another person responded: “Love tip #2, plus its healthier to cook and eat at home.”

While one comment reads: “Well done! Love seeing more women sharing about their finance journey.”

Do you have a monetary dilemma? Let us know via [email protected]. We can ask experts for advice, and your story could be featured on Newsweek.