If you don’t have a ton of money to get started with investing in the stock market, you shouldn’t get discouraged. Over time, you can slowly build up your portfolio and add to your holdings. While everyone would love to have tens of thousands of dollars at their disposal when they start to invest, that usually isn’t the case.

Below, I’ll show you how to get started with a $1,000 investment. This will allow you to keep your risk fairly low but also give you a reason to stay interested in the market’s developments and track individual stocks.

Start with investing $500 in a diversified fund

A good starting point for any investor is to have a pillar to build their portfolio around. If you don’t have a lot of money to spread across multiple investments, an effective way to diversify is to invest in an exchange-traded fund (ETF). An ETF will give you exposure to many stocks with just a single investment.

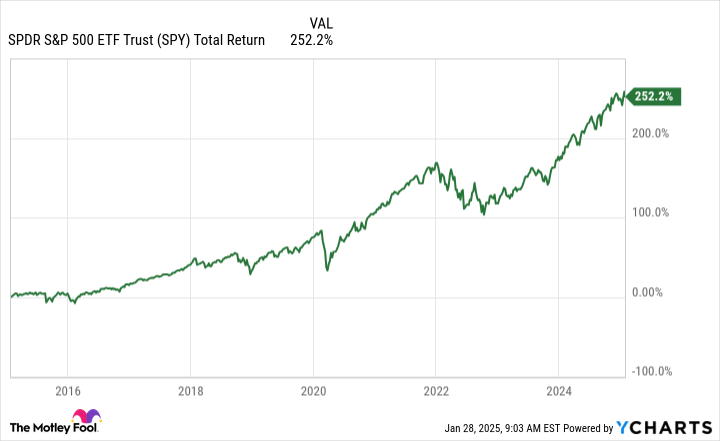

The SPDR S&P 500 ETF Trust (SPY 0.54%) is a solid ETF to consider since, as the name suggests, you’ll get exposure to the S&P 500 — a collection of the top 500 stocks on the market. These are among the safest stocks you can invest in and include top companies such as Microsoft and Costco. The SPDR S&P 500 ETF tracks the broad index and attempts to mirror its returns, which can be a great strategy as, over the long run, the index has averaged an annual return of around 10%.

SPY Total Return Level data by YCharts.

By putting $500 of the $1,000 you have available to invest into this fund, you can ensure that half of your investment is in a safe, diversified ETF. Over time, you can continue putting money into the ETF. Having it as your go-to option to put any savings into can make it easier to build up a habit of investing on a regular basis.

Otherwise, the process could become too cumbersome and complicated if you needed to analyze stocks and determine which stocks were the best to buy every time you wanted to invest. But if you put money into this ETF every time you want to invest, it can make the process easy and straightforward.

Invest another $500 in one more blue chip stocks

Many investors may find investing in only an ETF a bit boring, which is why I suggest allocating the remaining $500 to businesses you’re familiar with. You can put the full amount into a single stock or spread it across multiple ones. But the key is to invest in safe investments and not get tempted by risky penny stocks or struggling businesses that may look cheap but, in reality, are just value traps.

You can also target stocks on the S&P 500, such as Microsoft or Costco, even though you’ll already have exposure to them through the ETF noted earlier. Investing directly in these stocks will give you a greater position in them and enable you to benefit more directly from their performances.

Investing in stocks individually, rather than ETFs, may make you more interested in tracking their movements and the markets as a whole. And if you’re investing in strong, well-known businesses with strong financials, you still won’t be taking on much risk. While the overall market can and will fluctuate in value over the short term, by investing in blue chip stocks, you’re likely to see your investment rise over the long haul.

Investing with a modest amount of money can be a better move than going big right away

Investing takes years and is a long-term process. It’s important to start as early as possible and build up your position over time. Not having a big lump sum you can invest right away shouldn’t impede setting up a diversified portfolio. And as you add more money to it over the years, it can be broader and include more investments.

Starting slow and learning about the stock market’s sometimes erratic behaviors can be crucial to understanding the markets and making better decisions. Making a big investment right off the bat when you may be unfamiliar with investing and aren’t sure which stocks are safe and which aren’t could result in significant losses and end up being a bad strategy. Beginning with more modest investment amounts and steadily building your position over time can be a much better move in the long run.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.