Joe Hennessy, market analyst at Solar Media, discusses findings from the UK Green Hydrogen Project Database, including the annual submitted capacity of projects with a full planning application submitted to a local planning authority (LPA).

With the new Labour government pledging to invest £500 million in capital for Green Hydrogen production, coupled with the goal to reach 5GW by 2030, this article looks at the current landscape of Green Hydrogen production in the UK.

The analysis and graphics are taken directly from the latest release of the UK Green Hydrogen Project Database.

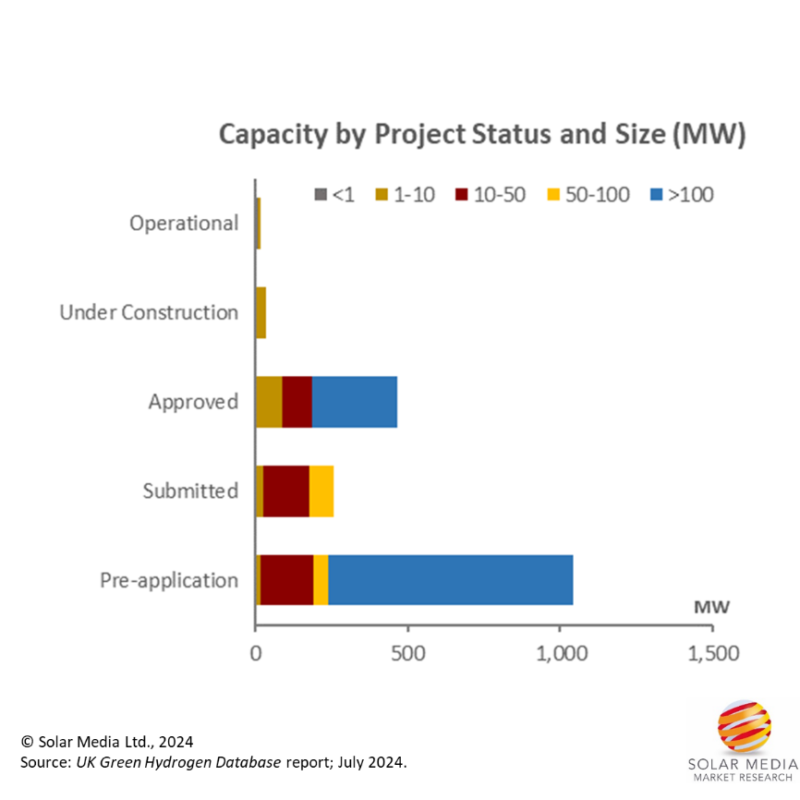

Figure 1: A pipeline approaching 2 GW has been amassed for Green Hydrogen production in the UK, with full planning applications now accounting for a significant part of this pipeline.

Figure 1 above shows the cumulative planned capacity for Green Hydrogen projects where a planning application (either scoping or full planning status) has been submitted. The total pipeline of these projects is more than 1.8GW, with a host of additional projects (yet to move from concept to planning) potentially contributing to a strong upward revision to current pipeline capacity levels in the coming years.

Looking at figure 1 in more detail: the ‘pre-application’ stage includes some large projects which could take some time until a full application is prepared. The ‘submitted’ stage has mostly 10-50 MW sites which, if accepted, could start construction within the next few years.

Projects in the ‘approved’ stage have more variety in their sizes, including some 1-10MW in size, several in the 10-50MW range, and two larger sites of > 100 MW. These sites account for a total of 465 MW.

So far, noting the industry is still in its early phases of growth, there is typically about four years between project acceptance and final construction. It is expected that this time lag will contract, leading up to a potential rush to hit the 2030 targets.

Currently, almost all sites ‘under construction’ are 1-10MW in size; this trend is expected to change going forward, given the capacity levels making up the pipeline, coming from the approved group of projects.

Looking now at the projects submitted in the UK’s first Hydrogen Allocation Round (HAR1), seven of the eleven have been accepted, with developers pushing to start construction within the next 12 months.

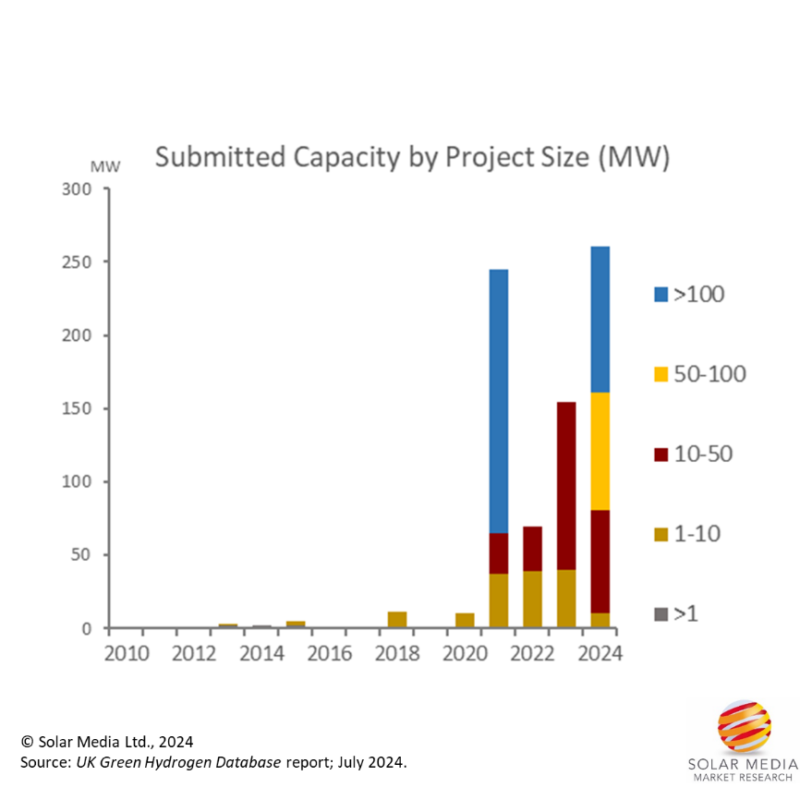

Figure 2: Green Hydrogen projects have been the subject of increased planning activity since 2021, with sites in the range 10-100MW being the most common seen until now.

Figure 2 above displays the annual submitted capacity of projects that have had a full planning application submitted to a local planning authority (LPA).

Up to 2021, early projects were almost all linked to refuelling stations and pilot plant demonstrators. This changed when the UK government released its UK Hydrogen Strategy, prompting a significant uptick in new planning applications.

Since then, the sector has moved into a new growth phase, characterised by the volume of projects now at the pre-application stage.

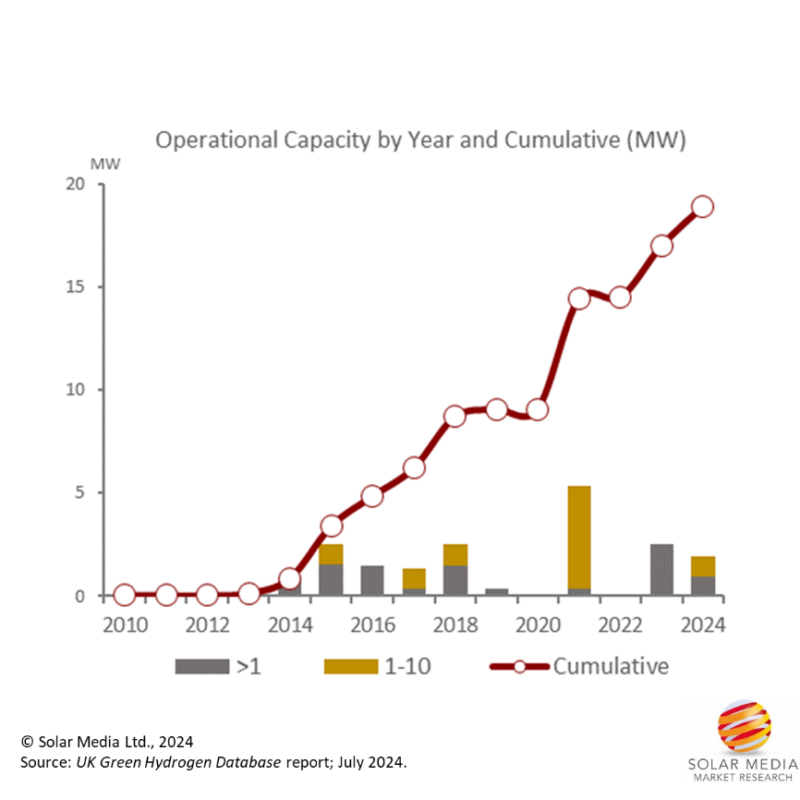

Figure 3: Operational capacity of Green Hydrogen projects in the UK is currently only at the 20MW level, comprised of small projects at the MW-level.

Figure 3 above shows the operational capacity of Green Hydrogen in the UK, with the cumulative total just below 20MW, comprised of small projects that are either early-stage pilot plants or located at hydrogen refuelling stations. This is probably to be expected given the nascent nature of this emerging technology. However, all this is set to change in coming years, as larger projects – driven by institutional investments – start to have a meaningful impact on cumulative capacity moving into mass production.

The UK Green Hydrogen Project Database, released monthly by the Solar Media market research team, contains a full audit-trail of all Green Hydrogen projects in the UK, including planning status and all key stakeholders behind the projects being operated and proposed in the future.