If you’re interested in making the most out of your money, you should learn how to invest your savings towards your long-term goals, such as retiring, starting a business or buying your first home. This article will teach you how, using clear language and established sources, with the goal of empowering you to take the reins of your financial future.

What does it mean to invest your money?

Investing, simply put, involves the purchase of something of value, aka an asset, which offers evidence for generating more value into the future. The gains expected from an investment in a given asset, and how long you might have to wait to reap them, should align with a financial goal of a similar time frame.

Stocks

Stocks represent the value of businesses, are sold by the share, and require the longest wait among all asset classes to see a satisfactory return. This is because a portfolio of profitable businesses still has ups and downs, aka volatility, depending on the economic climate, and could take many years for gains and losses to average out into more money in your pocket.

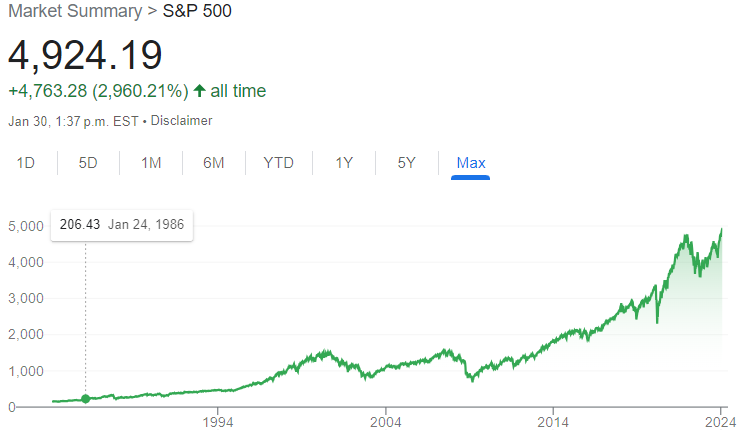

According to Money’s analysis of the S&P 500 – an index of some of the biggest U.S. stocks that has returned about 10 per cent annually since inception in 1957 – it’ll be about 20 years before your risk of losing money from investing in the index is virtually zero. From a broader perspective, owning a diversified portfolio of global stocks has rewarded investors with an inflation-adjusted average annual return of about 5 per cent going back over a century.

Stocks’ high volatility is understandable on an intuitive level. A business is hard to run, and problems are constant companions for every entrepreneur, whether it’s filling in for employees calling in sick, shipments arriving late, or unexpected changes in government regulations that affect the bottom line. If these problems pile on, a business could fail, causing its stock price to fall and shareholders to carry a loss in the hopes of a turnaround story and eventual recovery.

Since 1992, the volatility for the S&P 500 has averaged around 15 per cent, with drawdowns flirting with 50 per cent on numerous occasions, including the Dot-Com Bubble and the Great Financial Crisis, while a global portfolio of stocks showed annual volatility of 17.4 per cent from 1900 to 2018, and a maximum yearly drawdown of 41.4 per cent.

It’s holding on through this volatility over the long term, confident in your stocks’ underlying profitability, that separates money-making investors from those who sell too soon and put their future financial goals at risk.

Bonds

Bonds, like stocks, are securities, or contracts attesting ownership, but instead of representing businesses, they represent loans, either to a company or a government.

Like all loans, bonds are issued for a specific amount of money, known as principal, with an attached interest rate to be paid to the owner, most commonly monthly or bi-annually, as well as a maturity date, on which the owner will be repaid their principal. The longer a bond’s maturity, the more volatile it will be, because no company or government can be sure that it will survive, much less thrive, indefinitely into the future.

The Government of Canada, for example, might issue 10-year bonds with a principal value of C$10,000 to finance the construction of new roads and be willing to pay investors an annual interest rate of 4 per cent, or C$100, to own them.

Compared with stocks, bonds have a slightly tamer history of volatility, with a global portfolio posting 11 per cent annual volatility, a maximum yearly drawdown of 31.6 per cent, and inflation-adjusted average annual returns of 1.9 per cent from 1900 to 2018. This is because bond interest payments and the return of principal are built into the contract between buyer and seller, and bondholders receive first access to capital in the event of the bond issuer’s bankruptcy. Stocks, in contrast, are last in line to be repaid from liquidation, and come with no obligation on the part of companies to produce a return on your money, placing the onus on investors and their research to make their money grow.

Alternative asset classes

Besides stocks and bonds, which make up the majority of retail portfolios, investors can also make use of more niche asset classes such as real estate, commodities, private equity, private credit and cryptocurrency to optimize how they put their money to work.

Allocating into these asset classes can carry higher risk, compared with a diversified portfolio of stocks and bonds, because they are tied to specific industries and sectors, each with their own unique value-creation systems that may or may not align with your life plans.

Owning real estate, for example, may not make you money if you choose a stagnating neighbourhood to buy property in, or rent to irresponsible people. The same could be true for commodities, such as gold or oil, if the economic climate weighs on their prices by lowering demand.

Which investments are right for you?

The first thing to determine when choosing an asset allocation, or your particular mix of investments, is what you’re saving for.

If your goal is less than three years away, such as putting a down payment on a house, a high-yield savings account is the safest place to keep your money. Even though cash will likely underperform inflation over the long term, your money will be there for you once it’s time to pay, supposing you’re saving in a stable currency such as the Canadian dollar or U.S. dollar.

If your goal is between five and seven years away, say, saving for a car or a wedding, bonds can be introduced into the picture with an even split across short, medium and long-term maturities, which will ensure a smooth investment journey as you collect periodic interest payments. Bonds do, on occasion, experience precipitous falls, such as during liquidity crunches or periods of hawkish monetary policy, meaning that you should only introduce them within your comfort level and periodically convert them into cash as your goal approaches.

It’s only when your financial goal is over 10 years away, like retirement or money to start a new career, that stocks become an appropriate investment vehicle, giving them plenty of time to whipsaw this way and that over the short term on their way to reflecting rising profits with a higher share price. It’s reasonable to move your stocks into bonds and cash as your goals grow near, keeping in mind that an unexpected drawdown could take years to recover from.

Once your goals are in place – whether they call for cash, bonds, stocks, or the optionality of all three – you will need to understand the difference between the two dominant styles of investing before making your first purchase.

Passive investing

Passive investing refers to the purchase of index funds or exchange-traded funds (ETFs) that hold virtually all of the stocks or bonds in a given industry, geography, or market sector, such that no assumption is made in terms of which investments will do better than the rest.

Over the past two decades, the annual S&P Indices Versus Active (SPIVA) study has shown that this all-encompassing approach, especially in the broadest sense of entire countries, substantially outperforms professional attempts at outperforming these markets over the long term. Approximately 94.57 per cent of Canadian money managers have underperformed the TSX index over the past 10 years, with firms such as Vanguard and BlackRock spearheading the growing indexing contingent.

Active investing

Active investing, passive’s optimistic sibling, seeks to identify securities in a given market that are best positioned to rise in price. Practitioners use established sources such as Stockhouse to analyze metrics such as price-to-earnings ratio, free cash flow and debt level, as well as qualitative measures such as management experience and industry prospects, to determine whether an investment is warranted. It is common for active investors to endure prolonged losses if their chosen markets happen to fall out of favor, as has been the case with value investing since the Great Financial Crisis.

With a skosh over 5 per cent of professional Canadian active investors doing the bare minimum since 2014, there is no statistical reason for you to try your hand at picking individual securities, unless you consider yourself especially skilled and/or happen to enjoy the research process. That said, it’s no surprise that the chosen few firms that have managed to establish long-term active investing track records – such as Fidelity, PIMCO and Warren Buffett’s Berkshire Hathaway – think your money would be best parked with them.

How to buy your investments

Now that you know where you stand on the passive-active spectrum, and have a sense of the right asset allocation for your unique circumstances, the time has come for you to open an investment account and build your portfolio.

In Canada, investors enjoy access to account types that cover every stage of life:

- A taxable or non-registered account requires you to pay taxes on all income and capital gains earned

- An RRSP allows you to lower your taxable income and defer taxes on your investment gains until the time of withdrawal, which must begin in the year you turn 71, subject to contribution limits

- A TFSA, the most advantaged of all Canadian investment accounts, allows you to keep all of your investment gains without paying any taxes, subject to contribution limits

- Readers can also make use of the registered education savings plan (RESP) to save for a child’s post-secondary studies costs, and the registered disability savings plan (RDSP) if eligible for the disability tax credit

Reliable providers of these accounts include the low-fee Wealthsimple and Questrade, with more robust offerings available from the Big 6 Banks (Royal Bank of Canada, Toronto Dominion Bank, Bank of Montreal, Scotiabank, National Bank, Canadian Imperial Bank of Commerce).

Once you provide the required documentation and open your account, it’s best practice to put a regular contribution plan in place, usually monthly of bi-weekly to coincide with your paycheque, to make sure you take advantage of compound interest, the seemingly magical phenomenon behind long-term investment growth.

The balance in your account can now be put towards your first investment. Simply navigate to your provider’s order section, search the name of your company or fund, input the number of shares you want to buy, specify a limit order at the current seller or ask price to ensure stability, and hit enter.

Note that your order might not be filled immediately, and might even be cancelled at the end of the trading day (M-F, 9 am to 4 pm ET), if it can’t be matched with a seller in your provider’s marketplace. If your order finds no takers, you may try again another day.

How to manage your investments

As you save more money, build your portfolio, and make your life goals a reality, you should prepare to shift your asset mix to reflect your changing relationship with risk over time.

The idea of taking maximal risk with 100-per-cent stocks might make sense in your 20s, but this is unlikely to be the case once children and a mortgage enter the picture, requiring greater cash on hand in the case of emergencies.

On the flip side, if you happen to win C$20 million playing the lottery, and are now sitting on more cash than you need for the rest of your life, a portion of your winnings could be invested in stocks to ensure the quality of life of your grandchildren, and their children, and so on.

The process of returning your portfolio within the bounds of your risk profile is known as rebalancing, and it’s essential to keep your cool during unexpected market volatility.

Money is a means to the life you deserve

Learning how to invest is lifelong by definition because it takes decades for compound interest to take hold and make your nest egg soar, and a few decades more for you to draw it down, as you evolve and build memories through meaningful experiences.

It follows that, without a working idea of how you want to spend your time, investing becomes a pointless endeavor because, contrary to popular opinion, there are no redeeming qualities to having the highest account balance in the room.

So, in parting, and before you put your first dollar to work, take your time and outline the aspirations you’re compelled to pursue. It is only through them that you’ll find the discipline to delay gratification and consistently sock money away for your future self, who will doubtlessly be thankful you did.

Join the discussion: Find out how other investors are navigating their journeys in the market on Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.