Table of Contents

Show more

Show less

Capital at risk. All investments carry a varying degree of risk and it’s important you understand the nature of these. The value of your investments can go down as well as up and you may get back less than you put in. Where we promote an affiliate partner that provides investment products, our promotion is limited to that of their listed stocks & shares investment platform. We do not promote or encourage any other products such as contract for difference, spread betting or forex. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK. Accurate at the point of publication.

The UK agriculture sector has faced significant challenges in recent years, from worker shortages exacerbated by Covid-19 to supply chain disruptions triggered by the Russia-Ukraine war.

At the same time, climate change concerns and an expanding global population are pushing the industry to improve efficiency and become more sustainable.

Growing demand and pressure to innovate means agriculture has ample growth opportunities, making it an appealing sector for many from an investment perspective.

Here’s a look at the advantages and risks of investing in agriculture, along with the main options open to retail investors.

How big is the agriculture sector?

Producing food and textiles for more than eight billion people is an enormous undertaking – and the agriculture market reflects this.

According to Research and Markets data, the global agriculture industry was worth $13,398.27 billion as of 2023.

The market encompassess several areas, including:

- crop and livestock production

- textile production

- processing

- distribution

- food vending

- fertilisers, pesticides and other chemical products

- equipment and vehicles

- seed production

- animal feed production.

While farms tend to be private businesses, there are many other avenues for retail investors with an interest in the sector to pursue (more on these below).

Why invest in agriculture

According to the Organisation for Economic Co-operation and Development projections, the global population will reach 9.7 billion by 2050, meaning increased demand for food and giving agriculture industries significant growth potential.

Jason Hollands, managing director at Bestinvest, says: “Global population growth is placing huge demands on food production, and this is exacerbated by climate change, which is fuelling the need for more efficient forms of farming that are also, in turn, sustainable.

“This creates significant opportunities for firms developing new technologies and scientific breakthroughs.”

Technological developments such as genetically modified crops, vertical farming and automation could also allow businesses to produce more food with less space and fewer resources. And improved productivity could mean growth for shareholders.

Investing in agriculture could also help diversify your portfolio.

Rob Burgeman, investment manager at RBC Brewin Dolphin, says: “Agricultural product prices have quite a low correlation with global stock markets, meaning that they can reduce the risk of an equity-based portfolio.”

Risks and drawbacks of investing in agriculture

Investing in agriculture is not without risk, however. The sector is vulnerable to weather and climate change, which have a direct impact on crop yields.

Another challenge for the sector is energy. Planting, harvesting, storing and transporting food is energy-intensive and vulnerable to fluctuations in fuel and energy prices.

Reliable renewable energy could go some way towards mitigating these problems, but powering heavy machinery using batteries could be difficult.

Geo-political events, such as Russia’s invasion of Ukraine, also have a direct impact on the sector’s performance. Russia and Ukraine account for over a quarter of global wheat exports, while Russia is a major fertiliser producer.

Between disrupted supply networks and economic sanctions, the conflict has had a significant impact on global wheat prices, which soared 28% during the early phases of the war. Equally, changing patterns of demand, lockdown-induced labour shortages and travel restrictions left the sector hard-hit during the Covid-19 pandemic.

The comparative lack of publicly-listed companies is another potential drawback when it comes to investing in agriculture.

Mr Hollands says: “It’s a very narrow opportunity set given that there are relatively few listed companies globally, many of which are smaller companies where liquidity isn’t great.

Funds investing in this space tend to have quite concentrated portfolios, making them relatively risky strategies. Over the last decade, global agriculture stock market indices have underperformed broader global indices.”

Agriculture investment options

When it comes to investing in agriculture, there are several routes to consider…

Individual stocks

Investors can gain exposure to a sector by purchasing stocks in individual companies. This can be challenging when it comes to agriculture, since farms don’t tend to be publicly listed.

Mr Hollands says: “From an investment perspective, agriculture is a very niche sector because there are relatively few publicly-listed businesses of size as most farms and food producers are privately owned.”

That says, there are a number of publicly listed companies that operate in the agriculture space, including:

- Deer Group – produces tractors and agricultural machinery

- Bunge Global – manufactures and sells edible oil products

- Yara International – Norway-based producer of agrichemicals such as fertiliser

- Sakata Seed Corp – a major seed producer based in Japan

- Compass Group – mass catering, vending and facilities management firm based in the UK

- WH Group – a Chinese multinational food processing company

- Kemira Oyj – produces agricultural chemicals such as biocides

- Monsanto Group – leading producer of genetically modified seeds.

Actively managed Funds

Investment funds pool cash from many individual investors, and use it to buy a range of assets, such as shares or bonds.

If you’re keen to invest in agriculture, there are several themed investment funds to consider. Below are a few options.

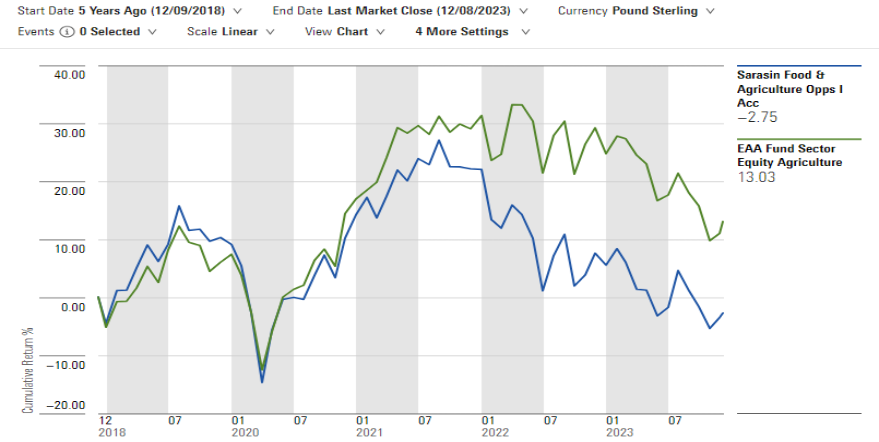

Sarasin Food & Agriculture Opportunities Launched in 2013, this fund invests in a range of companies with exposure to the food and agriculture sectors.

While its holdings span the globe, around 70% are concentrated in North America and continental Europe. Its areas of focus include food production, processing and retail, along with agricultural equipment and animal feeds.

Top holdings include Compass Group PLC, Bunge Global, Deere & Company and salmon farming giant, Mowi ASA.

Source: Morningstar Direct

Its performance dipped during the pandemic, but rebounded strongly in 2021. Returns have been in decline since early 2022, however.

A £1,000 investment in the fund made in December 2018 would be worth around £973 today. This represents a cumulative loss of 2.75% – somewhat higher than the 0.56% loss agriculture funds experienced on average over the same period.

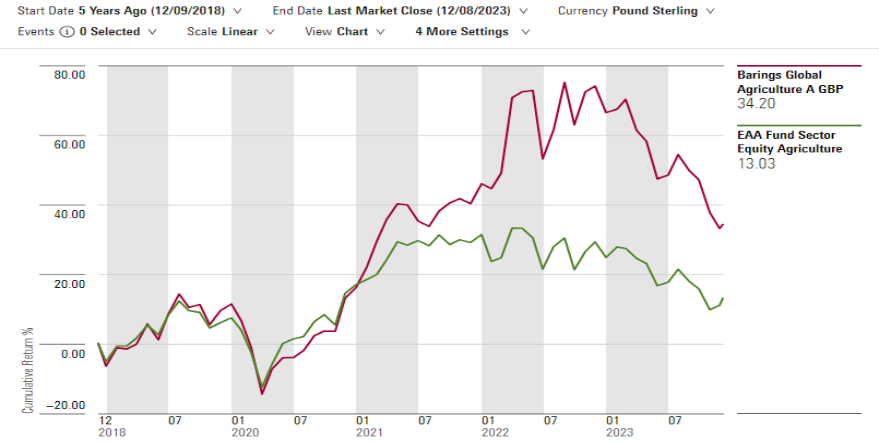

Barings Global Agriculture This actively managed fund was launched in 2009, with the goal of investing in companies that support the production, processing and distribution of agricultural products.

While the fund invests internationally, over half of the fund (52.1%) is held in US-based companies.

Key areas for investment include fertilisers, agricultural machinery and crop production. Its top holdings are Corteva Inc – a producer of agrichemicals such as herbicides and insecticides – and Nutrien Ltd, the world’s largest producer of potash fertiliser.

Bunge Limited and Deere & Company also feature prominently.

Source: Morningstar Direct

Returns edged steadily higher following a covid-related dip, but have petered off in 2023.

A £1,000 investment in Barings Global Agriculture made in December 2018 would be worth £1,342 today, representing a cumulative return of 34.20% and significantly outperforming the average for funds in this area.

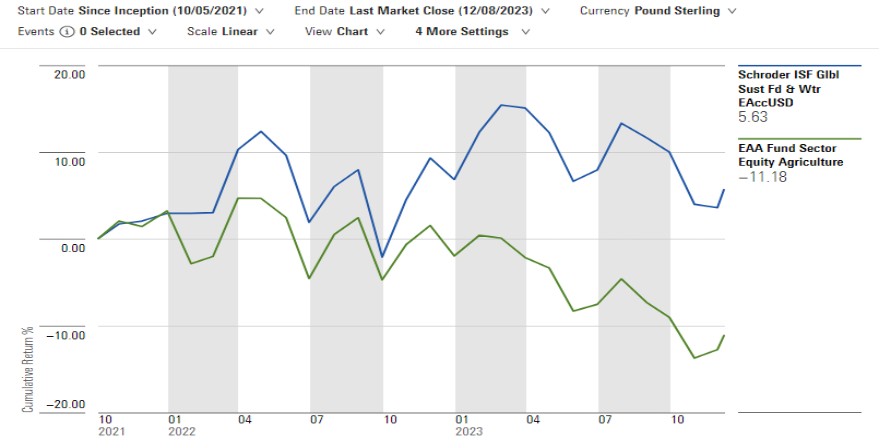

Schroder Global Sustainable Food and Water Schoder’s Global Sustainable Food and Water fund invests in companies that support the transition towards sustainable food and water production.

It was launched in 2021 and according to its mandate, at least 75% of holdings must meet certain sustainability criteria.

The fund invests in areas such as consumer food stables, retail and agrichemicals. Its top holdings include Yara International ADA, Kemira Ojy and European supermarket chain, Carrefour SA.

A £1,000 investment in the fund when it launched in October 2021 would be worth £1,056.35 today – a cumulative return of 5.63%. In the same period, the average return for agriculture funds declined 11.18%.

Exchange traded funds (ETFs)

Agriculture-related ETFs are another option to consider if you want to gain exposure to the sector. These passively-managed funds (they are run by computers which buy or sell stocks to track an index) invest in a collection of assets in a single area.

For example, the iShares Agribusiness UCITS ETF invests in a collection of 68 shares, including agricultural giants such as Nutrien Ltd, Deere and Company and Bunge Global.

The fund aims to replicate the S&P Commodity Producers Index – a stock market index that tracks the performance of the largest agriculture businesses around the world.

Being passively managed, ETFs more broadly tend to have lower management fees than their actively managed counterparts.

Because there are comparatively few listed businesses in the agricultural sector, funds in this area are not hugely diversified, and can prove risky.

Mr Hollands says: “While the MSCI ACWI Select Agriculture Producers Index has 148 constituents, comprising companies involved in food production, farming machinery and fertilisers, a whopping 21% of the entire index is accounted for by one company – US-listed Deere.

“Only 10 stocks globally have a market value of more than $1 billion. In fact, the five biggest stocks make up 45% of the index.”

Agricultural commodities

Agricultural commodities, such as wheat, corn, coffee, soybeans and livestock, offer another avenue for investing in agriculture.

Retail investors can gain exposure to agriculture commodities through ETFs that invest in commodity futures – contracts between buyers and sellers that set out a fixed price for the commodity at a future date.

Some examples of commodity ETFs include the Invesco DB Agriculture Fund, the WisdomTree Agriculture (GBP) ETF and the iShares MSCI Agriculture Producers ETF.

Commodity prices can be volatile, and fluctuate in value based on market supply and demand.

Mr Burgeman of Brewin Dolphin says: “Covid and the Ukraine war showed how supply constraints saw commodity prices rise, even as equity markets fell. But the opposite can, of course, also be true. As equity markets have recovered somewhat during 2023 and inflation has begun to come down, agricultural commodities have seen much more muted returns.”

The agricultural sector clearly offers a range of investment options with investment growth potential.

However, since its performance is closely tied to factors such as climate, weather and geo-political events, would-be investors should carefully weigh up the risks, and consider agricultural holdings in the context of a diversified portfolio.

Mr Burgeman says: “Does agriculture have a role to play in portfolios? Certainly. The growth in the world population, together with climate change, has placed pressure on global food resources.

“At the same time, though, there is a cap on how high the prices can go, if only because of relative affordability.”