Got your tax relief after topping up your Supplementary Retirement Scheme (SRS) account?

Great job! It feels good to be on top of your finances, right?

But don’t stop there. You need to invest your SRS funds to make your money work harder. If you leave the monies in the account, it could earn a mere 0.05% interest per year, which is too low and may not be enough to beat inflation.

I was shocked to see that 19% of SRS funds remained as cash balance at the end of 2023. Keeping such a high cash balance earning close to nothing is not advisable. Even risk-averse investors would be better off buying T-bills or fixed deposits, which yield higher in this high-interest environment.

There have been some improvements over the years, though. Investors reduced the cash balance from 24% in 2021 to 19% in 2023, deploying funds into “Others,” which can include Singapore Government Bonds, Corporate Bonds, Foreign Currency Fixed Deposits, or Fund Management. Bonds have been attractive due to their high interest rates. An alternate investment to consider is stocks.

How about investing in a basket of US Blue Chips?

Many investors might not be keen on investing in individual stocks because they don’t have the expertise or the interest to study companies. Investing in stocks can also be done via ETFs, which offer a convenient way to invest in a broad range of stocks with lower fees. The good news is that SRS allows investors to use SRS funds to invest in ETFs. There is an approved list of ETFs listed on the SGX for SRS investments.

It is important to note that SRS funds cannot be used to buy stocks or ETFs traded on overseas exchanges; they must be traded on the Singapore Exchange (SGX). However, this doesn’t mean you need to limit your investments to Singapore companies. There are ETFs listed on SGX that provide access to foreign markets, making your SRS funds eligible for investing in them.

For example, you may be interested in investing in the US stock market, which has been performing well not just in recent years but also over the past many decades. Investing in the world’s biggest economy, with companies having significant influence globally, remains a sound practice. As Warren Buffett has said, “Never bet against America.” A hundred years ago, John Pierpont Morgan noted, “Any man who is a bear on the future of this country will go broke.” It pays to have some exposure to US stocks.

The easiest way to invest in US stocks is by buying ETFs that track major US indices. The SPDR Dow Jones Industrial Average ETF Trust (D07) is one such ETF, traded on SGX and eligible for SRS funds investment. The Dow Jones Industrial Average (DJIA), the index D07 tracks, was established in 1896. This makes the DJIA the oldest US index, with more than 100 years of track record.

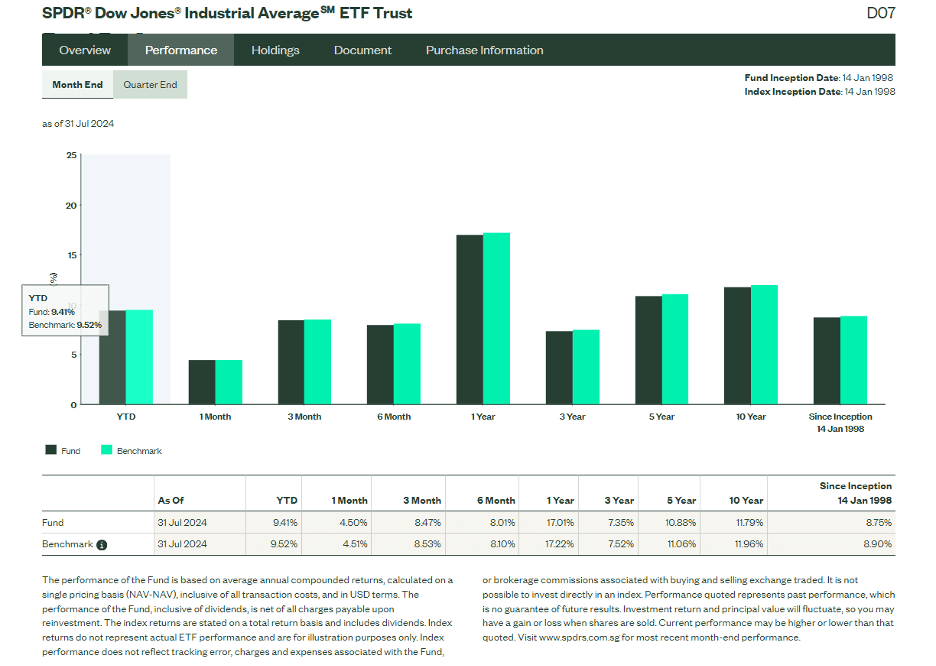

Since its inception on January 14, 1998, the ETF has delivered an annual return of 8.75% as of 31 July 2024, including dividend reinvestment. This impressive track record over 26 years is noteworthy, as few investments can sustain such returns.

The DJIA Index has 30 component and are weighted by price rather than market capitalization. This means that stocks with higher share prices will get a higher weightage in the index. There is a committee to decide on the addition and deletion of component stocks, beyond the rules and math employed. These differences are technicalities that may not significantly impact their performances.

You should find most of the names familiar, and you may even be a customer of some. These represent the finest multinational companies with global businesses. Investors should feel comfortable owning such a portfolio of stocks. The table below lists the 30 component stocks of the DJIA, provided for informational purposes only.

| Name | Index Weight % | Name | Index Weight % |

| 3M | 1.72 | IBM | 2.90 |

| Amazon | 3.25 | Johnson & Johnson | 2.45 |

| American Express | 3.89 | JPMorgan Chase | 3.40 |

| Amgen | 5.25 | McDonald’s | 4.28 |

| Apple | 3.54 | Merck | 2.08 |

| Boeing | 3.06 | Microsoft | 7.51 |

| Caterpillar | 5.59 | NIKE | 1.27 |

| Chevron | 2.63 | Procter & Gamble | 2.77 |

| Cisco Systems | 0.80 | Salesforce | 4.32 |

| Coca-Cola | 1.07 | Travelers | 3.41 |

| Dow | 0.89 | UnitedHealth | 8.55 |

| Goldman Sachs Group | 7.60 | Verizon | 0.69 |

| Home Depot | 5.78 | Visa | 4.41 |

| Honeywell International | 3.59 | Walmart | 1.14 |

| Intel Corp | 0.52 | Walt Disney | 1.67 |

Buying SPDR Dow Jones Industrial Average ETF Trust with SRS Funds

The SPDR Dow Jones Industrial Average ETF Trust (D07) has an expense ratio of 0.16%. It is traded in USD, while your SRS funds are in SGD, but your broker will convert the SGD to USD to purchase the ETF. The minimum lot size is one share, and SGX has made ETF investing more accessible by reducing the board lot size. Therefore, your minimum investment in D07 will be based on the prevailing quoted share price, which was US$421.44 as of 19 September 2024 . This makes the minimum investment over S$500.

If you already have an SRS account and a brokerage account, you can link them and start using your SRS funds to invest in ETFs like D07. Not all brokers offer SRS investments, but some that do are POEMS.

So there you go. I hope you are not leaving your SRS funds untouched. The interest rate of 0.05% is just too low. Even if you don’t know what to invest in, I hope I have given you options to consider. US stocks’ performance remains strong, and it doesn’t pay to bet against them.

Getting some exposure is beneficial for one’s portfolio. The SPDR Dow Jones Industrial Average ETF Trust (D07) is a convenient way to gain exposure to 30 US blue chips, many of which are well-known brands around the world. Hopefully, you will compound your SRS funds over time and amass a sum of money to fund your desired retirement lifestyle!

Learn more about the SPDR Dow Jones Industrial Average ETF Trust (D07).

State Street Global Advisors Singapore Limited (“SSGA”), 168, Robinson Road, #33-01 Capital Tower, Singapore 068912 (Company Reg. No: 200002719D, regulated by the Monetary Authority of Singapore). T: +65 6826-7555. F: +65 6826-7501.

All forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone.

The prospectus in respect of the offer of the units (the “Units”) in the SPDR® Dow Jones Industrial Average ETF Trust (the “Fund”) is available and may be obtained upon request. Investors should read the prospectus before deciding whether to acquire Units in the Fund. The value of Units and the income accruing to such Units may fall or rise. Brokerage commissions and ETF expenses will reduce returns. Units in the Fund are not obligations of, deposits in, or guaranteed by, SSGA or any of its affiliates. An investment in Units is subject to investment risks, including the possible loss of the principal amount invested. Such activities may not be suitable for everyone. Past performance figures are not necessarily indicative of future performance of the Fund. Investors have no right to request SSGA to redeem their Units while the Units are listed. It is intended that holders of Units may only deal in their Units through trading on the Singapore Exchange Securities Trading Limited (“SGX-ST”) or NYSE Arca Inc. (“NYSE Arca”). Listing of the Units on the SGX-ST or the NYSE Arca does not guarantee a liquid market for the Units.

Diversification does not ensure a profit or guarantee against loss.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

This advertisement or publication is intended solely for audiences in Singapore and has not been reviewed by the Monetary Authority of Singapore.

For more risk information, please visit www.ssga.com/sg