Navigating our money lives can be messy.

The myriad decisions we make every day about good money habits, where to invest, and how to balance saving and paying down debt are no easy lift.

I regularly hear from readers asking for advice about their own situations and challenges.

The following is an edited sample of readers’ questions and my answers.

I am 79 years old. How should I invest?

Retirees should typically hold at least five, if not 10, years’ worth of living expenses in a combination of cash and high-quality bonds. That will provide protection against needing to dip into your stock investments if things head south. The yields on bonds and cash may not be party-worthy right now, but they’re still respectable. In fact, many certificates of deposit and high-yield savings accounts are paying around 4.75%.

In general, you should aim for a more conservative mix of investments as you get older so you don’t have to get queasy when the stock market slips and slides. To roughly determine what percentage of your portfolio should be in stocks, subtract your age from 110. So, as a 79-year-old, you should have just under a third of your investments in stocks and the rest in bonds and cash.

Learn more about high-yield savings accounts, money market accounts, and CD accounts.

I have two children (twins) who are 29 years old and neither is very savvy when it comes to managing money. My daughter is a good saver but my son, who is a doctor, cannot save a dime. They both acknowledge their lack of financial understanding. I was wondering if there are courses or books you would recommend.

You hit a pain point felt by many Americans, not just your children. American adults are woefully behind when it comes to financial literacy.

Most of us never were exposed to financial education growing up.

Although it’s too late for your adult children to have had that grounding, this oversight is morphing in a positive direction for today’s students — 35 states now require high school students to take a course in personal finance to graduate, up from 23 in 2022, according to the Council for Economic Education.

Now, for your children, here’s what I recommend. There are several good books you can suggest or gift to them, such as the bestselling “Get a Financial Life: Personal Finance In Your 20s and 30s” by Beth Kobliner, a noted personal finance commentator; Farnoosh Torabi’s “A Healthy State of Panic: Follow Your Fears to Build Wealth, Crush Your Career, and Win at Life” and Brian Preston’s “Millionaire Mission: A 9-Step System to Level-Up Your Finances and Build Wealth.”

Another book I applaud is Jonathan Clements’ “How to Think About Money.” “We want to seize control of our finances, so we have more control over our lives,” he writes. The goal, he notes, isn’t to get rich. “The goal is to have enough money to lead the life we want.”

Finally, Benjamin Graham’s classic, “The Intelligent Investor,” is still the “best book about investing,” according to Warren Buffett. The third edition is now out.

There are also a number of free online courses via platforms such as Coursera or edX. Some recent offerings include: Financial Planning for Young Adults, available from the University of Illinois, and Finance for Everyone: Smart Tools for Decision-Making, taught by University of Michigan professors.

Podcasts, too, are entertaining and educational. Right here on Yahoo Finance, there’s “Financial Freestyle” with Ross Mac. Others to check out: Jordan Grumet’s “Earn and Invest” and Morningstar’s “The Long View.”

I am 73, single, retired from my public service work last year, receiving a pension. I have collected Social Security since age 70, and started taking out Required Minimum Distributions from my 457(b) and traditional IRA accounts this year. But I am still working part time with a different employer (no pension, no retirement plan), receiving a W-2.

Am I still qualified to put $8,000 pre-tax money into an IRA account for the year 2024? (The gross income from my part-time job is more than $8,000.) Is there an income limit for traditional IRA deductions in my situation?

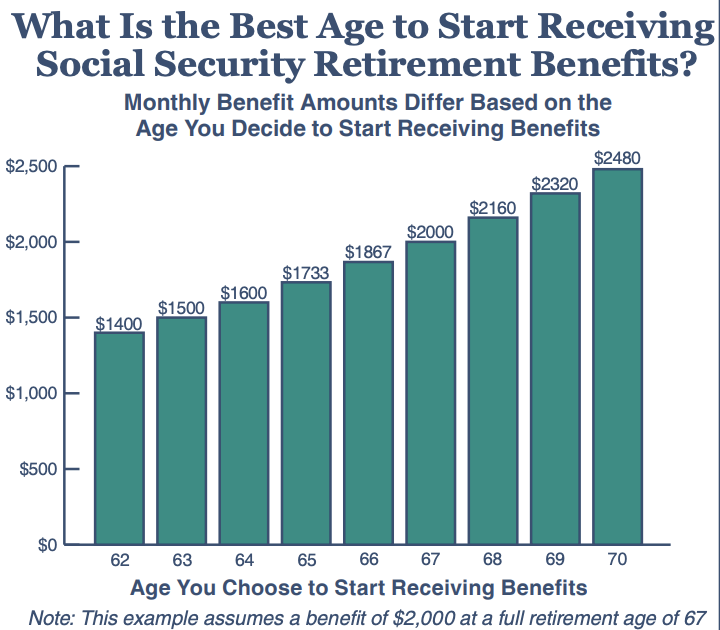

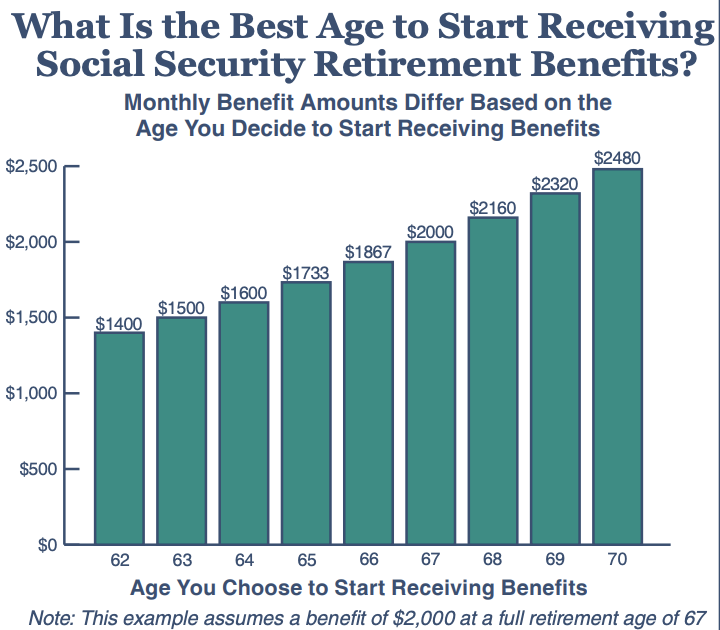

Congrats on waiting until age 70 to turn on your Social Security checks. That means you will have the biggest possible amount moving forward compared to starting them back at your full retirement age.

By pushing back tapping your benefits from your IRA until age 70, you earned delayed retirement credits. Those came to roughly an 8% annual increase in your benefit for each year until you hit 70 when the credits stopped accruing.

Read more: What is the retirement age for Social Security, 401(k), and IRA withdrawals?

Now, as for those contributions, you sure can contribute. There is no age restriction on making regular contributions to traditional or Roth IRAs.

A traditional tax-deductible IRA, if you’re not covered by a retirement plan at work, has no income restrictions. If you expect to be in a lower tax bracket in the next few years, the immediate tax deduction and pushing back that tax bill makes sense. Although you’re already taking your RMDs, new contributions can whittle down your taxable income.

But if you’re already in a low tax bracket, I would consider a Roth IRA.

Contributions to a Roth IRA aren’t deductible. They’re made with after-tax dollars, so you don’t report the contributions on your tax return, but you can take money and any earnings out tax-free if you hold the account for at least five years.

How much you can set aside does depend on your total income. For tax year 2024, your modified adjusted gross income limit for single filers is $146,000 with a reduced amount up to $161,000. For 2025, the income limit for contributing is between $150,000 and $165,000.

Since RMDs are never required in Roth IRAs, this is a great way to keep on saving.

For the 2024 tax year, the maximum contribution is $7,000, or $8,000 for those 50 or older who take advantage of the $1,000 catch-up contribution. That’s you. And you can contribute to a 2024 IRA until the April 15 tax filing deadline in 202 5 .

I need to purchase a car at the end of April 2025. I’m saving for a down payment between now and then so I can take out a lower loan amount. I’m also paying down my debt so my credit score increases, helping me with a better interest rate on my loan. I don’t seem to be making much progress on either. Which of the two do you recommend concentrating on more?

If you can put the brakes on buying a car for a bit longer, do it. I recommend focusing on slashing your debt. I’m not sure what kind of debt you’re whittling down, but if your interest rate is sky-high, you have to take control of that first.

Raising your credit score takes time, and adding new debt is not your best option if you can hold off on that big purchase.

Read more: 10 tips to improve your credit score in 2025

If you are paying off revolving credit card debt that keeps rolling over month to month, it’s daunting. The average credit card interest rate is over 20%. That’s pretty hard to get out from under without some real elbow grease. You need to pay much more than your minimum monthly amount to make a dent.

Your debt level is a big factor in your credit score calculation. The higher your credit score, the lower your annual percentage rate (APR) will be on your car loan. The average auto loan interest rate for new cars in the third quarter of 2024 was 6.6%, while the average used car loan interest rate was 11.7%, according to Experian’s State of the Automotive Finance Market report.

Folks with excellent scores — 800 and higher — can find rates as low as 5.25% for new car loans, but that can triple for borrowers with poor credit scores, according to Experian research.

There are a few schools of thought on how to pay down your current debt. With the so-called avalanche method, you pay off debt with the highest interest rate first. Other people opt for the snowball method, which involves focusing on smaller debts first. I am in the avalanche school, but whatever works best for you matters.

Other moves to kick up your score: If you know you’re going to buy a new car, for instance, don’t open new credit card accounts, or close accounts. You need to show that you know how to manage credit by paying balances on time. Never miss a payment or due date. All it takes is one late payment to smash your score and make lenders cautious.

In addition to your credit score, other factors contribute to your interest rate, such as the lender and the length of the loan, which brings us back to saving up a bigger down payment.

I feel your frustration. To get the best car loan, you’ll probably need sizable savings for a down payment, which can be as much as 20% for a new car and closer to 10% for a used one. So saving up is critical, but in my experience, getting your debt under control and your credit score cleaned up has to come first.

Thanks to the readers who felt comfortable sending along your questions. Keep ’em coming.

Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist, and the author of 14 books, including “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Get Rich.” Follow her on Bluesky.

Read the latest financial and business news from Yahoo Finance