April 25, 2024 4:01 AM | 2 min read |

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

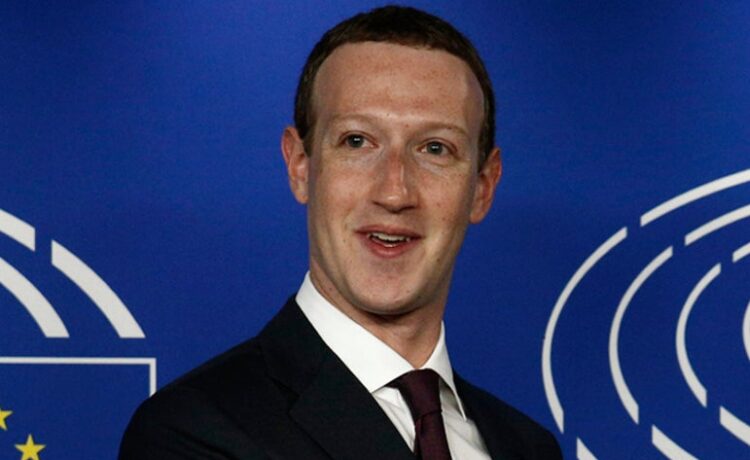

Mark Zuckerberg has outlined three strategies for Meta Platforms Inc. (NASDAQ:META) to monetize its substantial investments in artificial intelligence (AI.)

What Happened: Zuckerberg, during the March 2024 quarter earnings call, expressed his confidence in Meta’s AI capabilities, particularly with the launch of Llama 3, the company’s latest AI model.

ENTER TO WIN $500 IN STOCK OR CRYPTO

Enter your email and you’ll also get Benzinga’s ultimate morning update AND a free $30 gift card and more!

He stated that Meta will “invest significantly more over the coming years to build even more advanced models and the largest scale AI services in the world.”

Despite the substantial costs associated with this ambition, Meta plans to increase its capital expenditure for this year to $35 billion to $40 billion, primarily for AI investments. This announcement resulted in a 16% stock drop in after-hours trading.

See Also: Elon Musk Says Morgan Freeman Is ‘Awesome’ After American Actor Says He’s A Huge Fan Of Tesla CEO

Zuckerberg, however, is confident that Meta’s AI investments will yield significant profits in the future. He outlined three specific ways in which AI could become a “massive business” for Meta.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Zuckerberg’s 3-Step Plan To Monetize AI Investments:

1. Charging Companies For Using Generative AI Tools

The first method involves companies paying Meta for generative AI tools, such as services supporting automated interactions with users and customers. This could become a reality within the next five years, according to Zuckerberg.

FREE REPORT: How To Learn Options Trading Fast

In this special report, you will learn the four best strategies for trading options, how to stay safe as a complete beginner, a 411% trade case study, PLUS how to access two new potential winning options trades starting today.Claim Your Free Report Here.

2. Advertisements

The second approach is to integrate ads or paid content into AI interactions. This aligns with Meta’s core business of selling digital advertising.

3. Monetizing Large AI Models

The third potential revenue stream is charging for access to Meta’s increasingly larger AI models.

Why It Matters: Zuckerberg’s announcement comes after Meta announced plans to significantly increase its capital expenditure for AI investments.

This move has raised concerns among investors, given the company’s history of overspending on new technologies, such as the Metaverse.

These strategies align with Meta’s recent AI initiatives, including the launch of its latest AI model, Llama 3, which has outperformed other AI models in benchmark tests.

Price Action: Meta stock closed 0.52% lower at $493.50 on Wednesday, according to Benzinga Pro.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Mark Zuckerberg Photo by Alexandros Michailidis on Shutterstock

27% profit every 20 days?

This is what Nic Chahine averages with his option buys. Not selling covered calls or spreads… BUYING options. Most traders don’t even have a winning percentage of 27% buying options. He has an 83% win rate. Here’s how he does it.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.