Industry insiders anticipate that health care private equity deal activity will increase in the second half of 2024.

In the behavioral health sector, sluggish deal flow could be picking up. Several notable transactions have crossed the finish line as investors increasingly focus on outpatient care rather than full continuum care, according to a new report from Pitchbook.

“With the market reopening and reimbursement and demand tailwinds appearing strong for the foreseeable future, now is a good time for investors to look again at mental health,” the report’s author wrote.

The report identified several key trends in PE-backed behavioral health deals.

Firstly, investors are increasingly turning to outpatient services, largely due to lower reimbursement rates. While industry insiders have told Behavioral Health Business that inpatient and residential treatment will always be necessary for higher acuity patients, several challenges exist for investors of full-continuum behavioral health businesses.

Firstly, inpatient and residential facilities often draw their patient base from a wide geographic area, creating a challenge when building adequate geographic coverage to serve a significant patient population.

Payers are also increasingly pushing for more home- and community-based treatment options and shorter inpatient or residential stays.

While labor cost inflation has fallen from around 8% in 2022 to lower than 5% in the fourth quarter of 2023, higher-acuity business segments struggle to retain employees more than outpatient businesses.

The report also predicted that private equity-backed behavioral health operators may be more likely to accept government health plans due to improvements in Medicare coverage and increased pressure for Medicare Advantage to enhance behavioral health access.

Medicaid reimbursement rates vary by state, but they can equal or exceed commercial rates for some services, according to the report.

Notably, virtual mental health provider Talkspace entered the Medicare market a few months ago, making its services available to 13 million members in 11 states and planning to further expand its coverage.

Overall, the behavioral health scene is currently set for several platform trades and platform consolidations.

More than a dozen private equity-backed mental health companies in the U.S. or Canada have been held by their current sponsors for over five years, including The Carlyle Group-backed Odyssey Behavioral Healthcare and Webster Equity Partners-backed Discovery Behavioral Health. Both Odyssey and Discovery were among the companies Behavioral Health Business recently identified as worth watching for a potential sale.

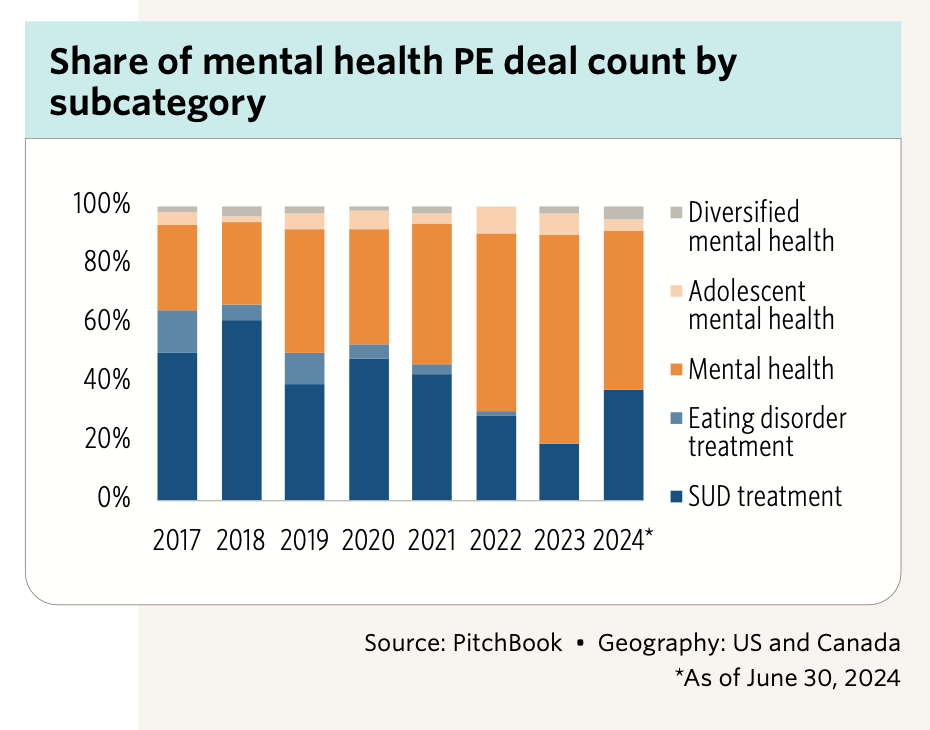

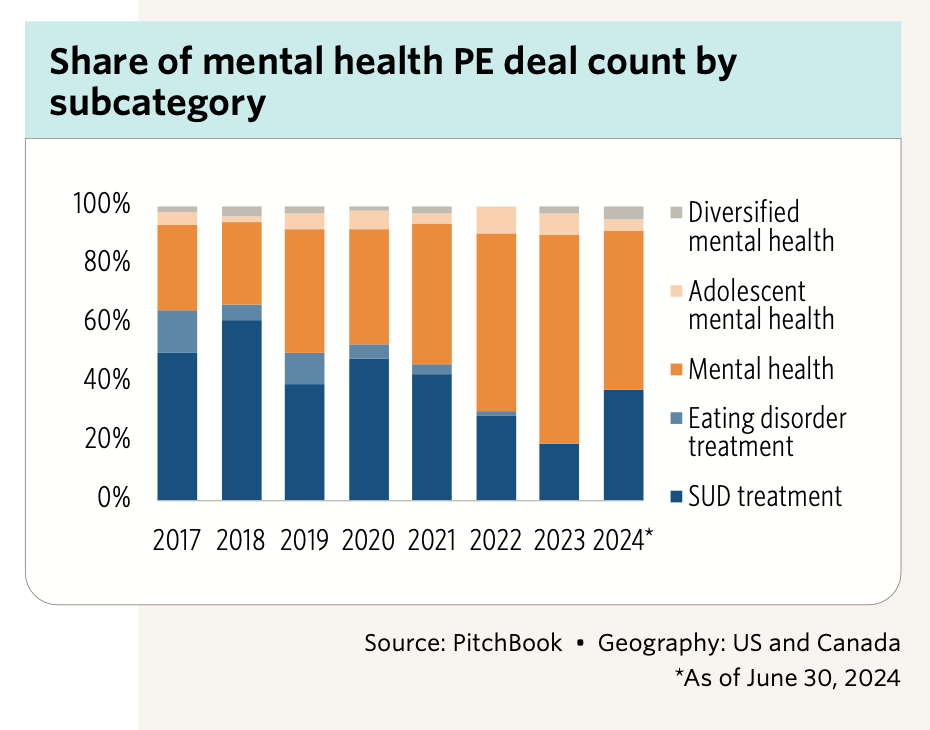

Among the behavioral health segments, mental health has increased in its proportion of deal activity in recent years, the report found, making up 29% of the deal activity in 2017 to 71% in 2023.

However, headline risk is a significant factor that could further diminish investors’ interest in higher-acuity behavioral health segments, especially for adolescent patients.

“A paper published in June by the US Senate Committee on Finance outlined reported abuse and neglect of children at several residential treatment facilities,” the report read. “Although no PE-backed companies were named in the report, according to Tommy Barletta, founder at Jones Point, the Senate Committee on Finance Chair, Ron Wyden, may introduce legislation in response to the report before November given bipartisan concerns, and efforts related to the investigation are likely to continue after the election.”

Headline risk fears are unlikely to be shaken by any outcome of the 2024 presidential election, according to the report.