More than 1,700 investors who pumped a total of $550 million into Par Funding, a Philadelphia business lender seized by a court-ordered receiver in 2020, are hoping to learn March 4 when they’ll get some of their money back during a lawyers’ conference to be held on Zoom.

“We are eagerly awaiting our settlement money,” said Jack Belli, a Bucks County retiree who invested with Par through the A Better Financial Plan, the former King of Prussia company of insurance agent Dean Vagnozzi.

Par, Vagnozzi’s agency, and related businesses were taken over by the receiver, Florida lawyer Ryan Stumphauzer, after the Securities and Exchange Commission filed civil fraud charges against Par owners Joseph LaForte and his wife, Lisa McElhone; financial officer Joseph Cole Barleta; and four salesmen who raised funds from people like Belli to finance Par’s high-interest loans for small businesses that couldn’t get bank credit.

Most of the investors put up more than $100,000 each in savings. They were drawn by annual returns on Par investments of 10% and more each year — until Par stopped paying in March 2020.

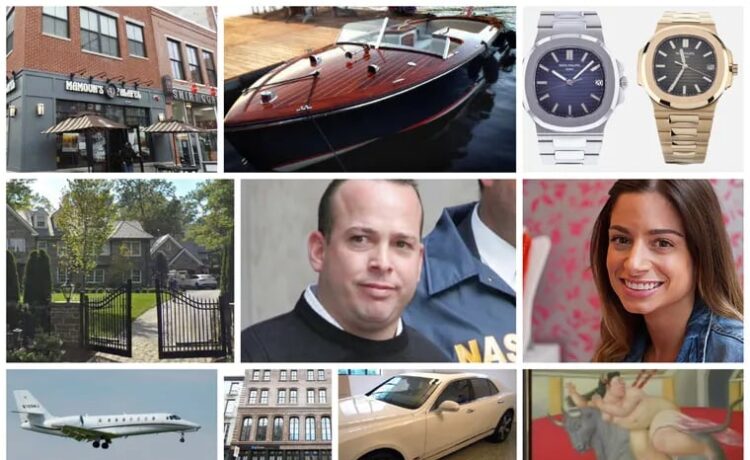

The SEC complaint and a separate criminal case by federal prosecutors in Philadelphia allege that Par’s owners made high-interest loans to borrowers who too often couldn’t pay back; lied about the risks to investors who funded the loans; failed to disclose LaForte’s criminal history, and drained the company of cash to build their own fortunes. LaForte and McElhone used some of the money to buy themselves dozens of homes and business properties, mostly in Philadelphia, plus a corporate jet, powerboats, cars, watches, and artwork, the investigation found.

Previous lawyer conferences before South Florida-based U.S. District Judge Rodolfo Ruiz, who is overseeing the case, attracted hundreds of Par investors. In December, Ruiz urged receivers to come up with a plan to return at least some of the $250 million in principal still owed to investors by the March 4 conference.

Some investors whose claims were rejected by the receiver are appealing with the hope they also can get paid.

The LaFortes agreed not to contest the civil charges. Ruiz said they would need to pay nearly $200 million to settle the civil case — an amount the LaFortes are contesting.

LaForte, his brother James, McElhone, and Barleta also face criminal conspiracy, racketeering, fraud, and tax charges. A pretrial hearing in that case is scheduled for Monday.

The LaForte brothers, convicted of fraud and other federal felonies in unrelated cases in the early 2000s, are in prison awaiting trial, which is scheduled for April.

Accountants for receiver Stumphauzer said in a January report that his staff and consultants have collected cash and assets totaling more than $175 million for potential restitution to investors. That includes:

-

At least $140 million from bank and investment accounts, borrower payments, payments by former investment salesmen Perry Abbonizio and Vagnozzi, who connected clients to Par, and the sale of properties, including Joseph LaForte’s former home in Haverford.

-

Remaining real estate worth around $35 million, including the LaForte’s former Jupiter, Fla., estate and other properties, mostly in Philadelphia. The sale of the Florida property has been delayed by an IRS lien against McElhone for unpaid income taxes.

Separately, federal authorities have control of the LaFortes’ former Cessna private jet and an investment account.

The receiver hopes to also raise additional cash, including:

-

As much as $60 million still owed to Par by borrowers. The receiver has been writing down the value of these potential assets, as many of the loans have proven to be uncollectible because the borrowers have gone out of business.

-

Up to $45 million from an insurance settlement agreement with Vagnozzi’s longtime lawyer, John Pauciulo, and his former law firm Eckert Seamans. The SEC says Pauciulo should have urged Vagnozzi to register Par investments as securities and follow the law requiring disclosure of investment risks. That settlement is not final. Pauciulo left the firm and was assessed a $125,000 fine by the SEC in 2022.

-

A refund of several million dollars in federal taxes Par paid in years when it claimed to be making money, but federal officials have since concluded the company was actually losing money.

The SEC is also suing Long Island-based AG Morgan Financial Advisors, Vagnozzi’s brother Albert, and others who sold Par investments.

Others are demanding payments for losses they say they suffered from Par, which could delay or prevent some funds from being returned to investors. Par borrowers led by Tzvi Ozer, also known as Harold “Steven” Ozer, are suing in federal court in New York to collect damages from Eckert and from some of Par’s investors. Dean and Albert Vagnozzi and a group of former Par salespeople also have filed lawsuits in hopes of collecting from Eckert.

Robert Hawrylak, a Par investor from Delaware County, says he thinks the authorities should also hold responsible the radio stations that ran the ads that helped persuade him and others to make the ill-fated investment. “I’m down to my last $20,000 of savings to live off,” he said Friday. At 69, “I may have to get a job.”

The hearing is scheduled for March 4 at 10 a.m. Eastern time.