Real estate is by far the least popular investment among European pension funds, with almost a third of schemes wanting to sell real estate this year, according to a poll of 126 defined benefit (DB) pension funds in Europe conducted by Goldman Sachs Asset Management (GSAM).

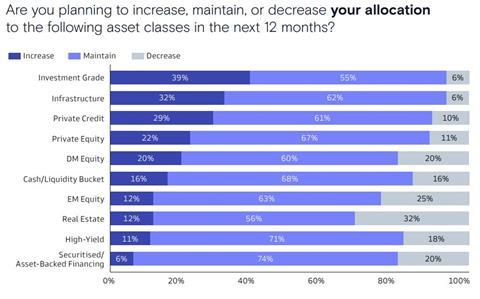

Instead, funds want to invest more in investment-grade bonds and private loans, which are also expected to provide the best returns.

Almost a third of the pension funds surveyed want to sell real estate this year, according to the survey. For no other asset class this percentage is as high. Only emerging market equities came somewhat close at 25%.

Gerald Cartigny, head of Benelux at GSAM, told IPE he is “surprised” that real estate is so unpopular. “In the Netherlands, all pension funds are very keen to invest in housing for example,” he said.

GSAM did not ask its survey participants what kind of real estate pension funds are planning to sell. “I do understand if pension funds want to invest less in offices, because the office market is completely at a standstill,” Cartigny added.

Investors have been cautious about real estate investments for some time. As a result of increased interest rates, financing costs have risen sharply. Niches such as healthcare real estate and student housing are still popular, however.

Real estate understandably also is at the bottom of the expected return table. Asked which asset classes will deliver the highest risk-adjusted returns over the next 12 months, pension funds are pinning their hopes on investment-grade bonds and private loans. Pension funds are also most likely to increase their allocations to these asset classes.

Whereas real estate is unpopular among pension funds, they actually want to continue investing more in other private assets. Not only private credit, but also private equity and infrastructure remain popular. All three are in the top five most popular investments, also in terms of expected returns.

Geopolitics

High-yield bonds, on the other hand, are much less popular. Only 11% of respondents want to invest more in that category. Other riskier categories such as emerging market equities and asset-backed securities are also not very popular among pension funds.

This may have to do with the fear of recession and an expectation of geopolitical conflicts escalating. Funds that answered the survey ticked these two risks most often in response to the question which macroeconomic risks they are most concerned about.

Greenwashing

GSAM also asked participating pension funds a series of questions about sustainability. Some 87% of respondents said they incorporate ESG as a critical or important factor in their decision-making process, and almost two-thirds (63%) allocate more than 10% of their portfolio to sustainable investments.

The survey also found that 84% of respondents agreed with the statement that ESG integration can help mitigate longer-term investment risks. According to GSAM, these numbers “reveal the extent to which sustainable investing has become embedded in European pension funds”.

However, three quarters of particiapting pension schemes are also concerned about greenwashing by asset managers.

According to Cartigny, this mistrust can be traced back to “the discussion about the SFDR”. Many asset managers used this sustainability regulation (sustainable finance disclosures regulation) as a marketing tool, putting unsustainable products in a green packaging, only to reverse course once transparency rules had been tightened.

GSAM launches green bond ETF

Pension funds can now also invest passively in green bonds at GSAM, which has been running several actively managed green bond funds since 2018.

“We already have a large market share for actively managed green bond funds, but not yet in the area of ETFs. We think we can gain market share there as well,” Bram Bos, head of green bonds at GSAM, explained the move.

The GSAM Green Bond ETF tracks a sustainable index of green corporate bonds developed specifically for GSAM by index provider Solactive.

“We exclude certain companies with high climate risk or no convincing transition policies,” he said.

The new ETF is “complementary” to already existing green bond funds, according to Bos. “We don’t want to encourage investors to switch from the actively managed fund to the ETF now.”