Investment property spending in the final quarter of 2023 dropped 59% year-on-year to the lowest level in Ireland in over a decade, according to BNP Paribas Real Estate Ireland.

With core international buyers on the sidelines, and with US and UK capital flows turning negative, domestic buyers accounted for 28.5% of spending during 2023 – their highest share since 2018.

Director John McCartney, head of research, said the Q4 spending tally of €435m of assets traded probably flatters the reality, as one transaction accounted for over half of total spending.

Turnover for the full year was €1.85bn, a 69% contraction compared with 2022, and the lowest outturn since 2012.

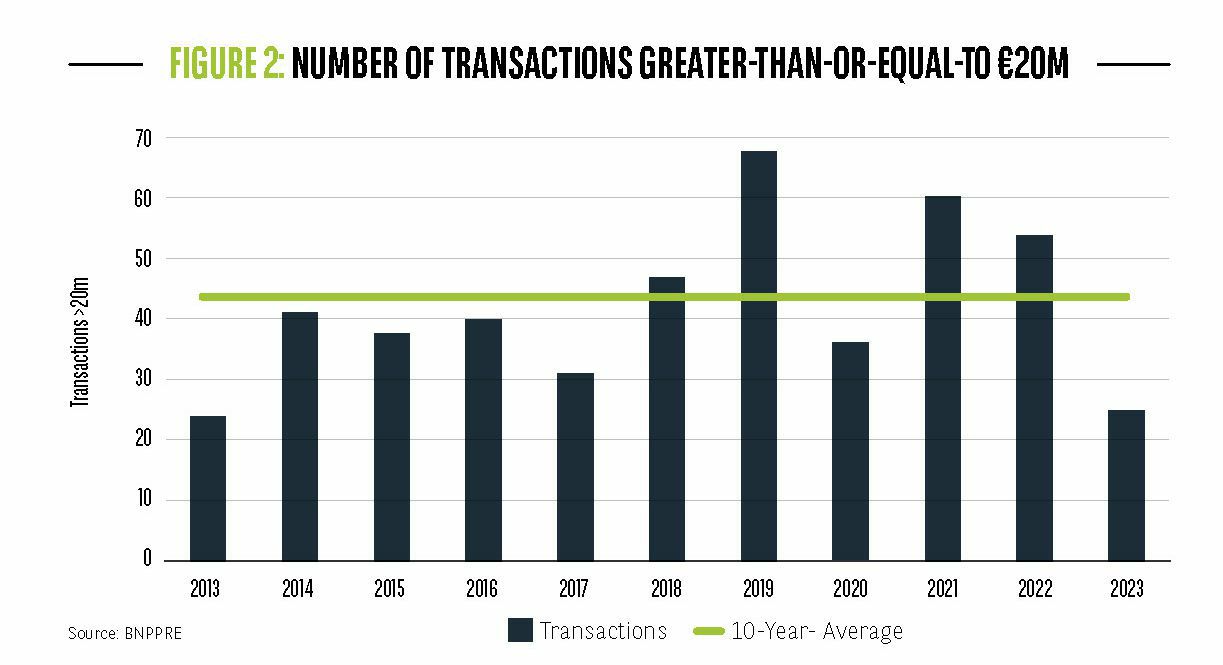

Just 114 deals were completed in 2023 compared with a 10-year average of 223, and the high-water mark of nearly 300 deals in both 2014 and 2016.

McCartney said a transactional logjam has been caused by “mispricing”.

He explained: “An age-old truism is that occupational markets set the rent and capital markets set the

multiple. At present, challenges from both sides are conspiring to drag on values.”

McCartney noted that the global macroeconomic backdrop has become less supportive of occupational property markets.

In Ireland, the Modified Domestic Demand and unemployment barometers “appear to be trending weaker”. Compounding this, sector-specific challenges are impacting on occupational demand, McCartney said.

Simultaneously, higher interest rates have reduced the amount of debt that is available to finance larger property transactions, while rebased bond yields have put competitive pressure on real estate investment yields.

“These dynamics are undoubtedly impacting values, but the extent of this is unclear due to a scarcity of comparable evidence,” said McCartney.

“The information vacuum has triggered a cautious reflex in both vendors and purchasers, resulting in bid-offer spreads that are too wide to bridge.

“This only serves to further prolong the transactions drought, particularly for core assets that are traditionally purchased by institutional investors.”

In the BNPRE analysis, Germany was the biggest international investor in the Irish market between 2019-2021, with over €3.2bn of capital deployed across 38 deals, accounting for over one-fifth of the total spend.

However, there was only one German buy in 2023, a small €18m deal in H1.

Meanwhile, US investors deployed €8.7bn in Irish property investments between 2013 and 2022. In 2023 their outlay was a meagre €112m.

“There was a net outflow of American capital in 2023 as US sellers divested €165m more than US investors purchased in the year,” said McCartney.

BNPRE expects that sluggish trading in 2023 will continue to cast a shadow on the market in 2024 as vendors and investors remain starved of transactional evidence.

“Moreover occupier market conditions, especially in the office sector which is under most pressure, may get worse before they get better,” says the property adviser.

However, McCartney believes that a milestone has been reached in the monetary cycle, and sovereign bond rates have tightened sharply. “With property yields expected to ultimately follow this lead, investors may be encouraged to advance with more confidence,” he said.

McCartney cautioned that in any investment market downswing, the limits of debt providers’ forbearance are eventually tested, particularly if there is a willing pool of buyers to sell assets to.

On that basis, he expects the flow of forced sales to strengthen as the year progresses.

“Clearly this is painful for the parties involved, but as it provides pricing transparency it should create more liquid trading conditions in the market,” he added.