Note:

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

As Blackstone Inc. announced the final close in January of the largest-ever private equity secondaries fund — the $22.2 billion Strategic Partners Fund IX — it also closed on the $2.7 billion Strategic Partners GP Solutions LP, its first fund targeting general partner-led transactions. The closing of the Blackstone funds put 2023 on track to be one of the best years ever for secondaries fundraising.

General partner-led secondaries have long since shed the “zombie funds” label, becoming a widely accepted strategy to extend the value-creation runway for prized assets while creating a liquidity opportunity for limited partners. Extending the investment period in a trophy asset may be even more appealing at a time when valuations are still recovering from widespread declines in 2022.

Single-asset continuation vehicles sold at smaller discounts than other private equity secondaries in the first half of the year, a sign that investors see value in the strategy, too.

Read more about the dynamics that influence general partner-led single-asset transactions on the private equity secondaries market.

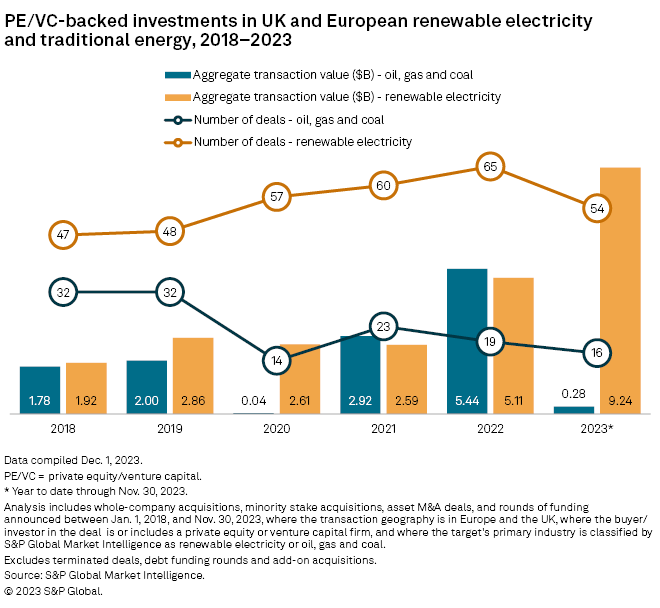

CHART OF THE WEEK: Energy transition shapes PE investment in Europe, UK

⮞ Private equity and venture capital firms are betting big on the energy transition in Europe and the UK while pulling way back on investments in oil, gas and coal.

⮞ Investments in UK and European renewable energy companies between Jan. 1 and Nov. 30 came to $9.24 billion, up nearly 81% from the 2022 full-year total. Investments in oil, gas and coal companies through the first 11 months of the year amounted to just $280 million, down about 95% from the total for the entire 2022, according to S&P Global Market Intelligence data.

⮞ Renewable energy deal value increased in 2023 even as the total number of deals fell to 54 as of Nov. 30, trailing the 65 deals tallied in 2022, likely a sign of rising valuations in the sector.

TOP DEALS AND FUNDRAISING

– Life sciences company ZimVie Inc. agreed to sell its spine business to H.I.G. Capital LLC for $375 million. The transaction is likely to close during the first half of 2024.

– Funds managed by The Carlyle Group Inc. and Insight Venture Management LLC, or Insight Partners, agreed to take a majority stake in software-as-a-service company Exiger LLC. As part of the deal, existing Exiger backer Carrick Capital Partners will reinvest equity alongside the company’s management and founders.

– EQT AB (publ)’s EQT X fund agreed to buy custom polymer component company Zeus Co. Inc. from the Tourville family.

– Eurazeo SE, Ardian, Mérieux Equity Partners SAS and Eximium SAS divested their stakes in mineral-based specialty product maker Humens to French decarbonization-focused private equity firm Leto Partners.

MIDDLE-MARKET HIGHLIGHTS

– Hildred Capital Management LLC acquired baby and family care product company Unconditional Love Inc., or Hello Bello.

– Main Capital Partners BV bought a majority stake in Epona Legal BV, a Dutch legal technology software provider.

– Monomoy Capital Management LP agreed to purchase iron casting company Waupaca Foundry Inc.

– Sudo Biosciences Inc. raised $116 million in a series B funding round. TPG Capital LP co-led the round.

– Gullspång Re:Food II Invest AB led a $45 million series D round for NewLeaf Symbiotics Inc.

– Atavistik Bio Inc. secured $40 million in a funding round that included participation from Lux Capital Management LLC, Nextech Invest Ltd. and The Column Group Management LP.

For further private equity deals, read our latest In Play report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

__________________________________________________

S&P Global Market Intelligence has launched its seventh annual private equity and venture capital outlook survey to gauge private markets sentiment in 2024. Take the survey here.