Dublin, July 02, 2024 (GLOBE NEWSWIRE) — The “Sweden Data Center Market – Investment Analysis & Growth Opportunities 2024-2029” report has been added to ResearchAndMarkets.com’s offering.

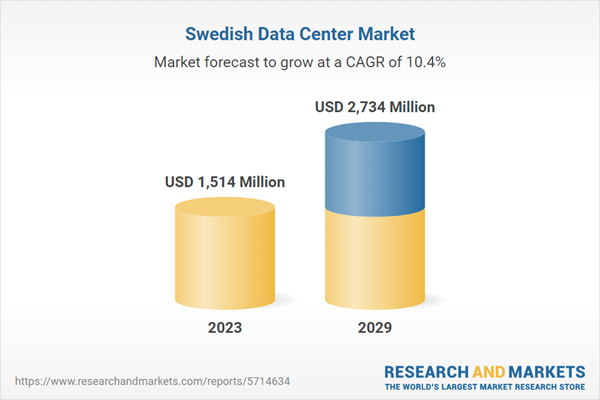

The Sweden Data Center Market was valued at USD 1.51 billion in 2023, and is expected to reach USD 2.73 billion by 2029, rising at a CAGR of 10.35%

This report analyses the Sweden data center market share. It elaboratively analyses the existing and upcoming facilities and investments in IT, electrical, mechanical infrastructure, general construction, and tier standards. It discusses market sizing and investment estimation for different segments.

Stockholm, Gothenburg, Malmo, and Lulea have emerged as top destinations in the Sweden data center market for investments, powered by an expanding pool of STEM graduates and more foreign investment, resulting in higher data center deployments and job possibilities.

Providers in the Sweden data center market include Digital Realty, EcoDataCenter, atNorth, Conapto, Ember, Equinix, GlobalConnect, Northern Data, Servercentralen, and STACK Infrastructure. The Sweden data center market has a presence of global cloud service providers such as Microsoft and Google. Local cloud service providers include Akamai Technologies, Bahnhof, Glesys, and Multigrid.

In Sweden, leading colocation, cloud data centers, and hyperscalers rapidly establish renewable energy partnerships with major vendors such as Vattenfall, Jamtkraft, Deep Wind Offshore, and Neoen. For instance, Microsoft has entered into 24/7 Power Purchase Agreements (PPAs), collaborating with Vattenfall in Sweden. New entrants such as Evroc, HIVE Digital Technologies, and T.Loop are entering the Sweden data center market and acquiring significant growth opportunities.

Inland connection in Sweden is improving, thanks to establishing significant internet exchange points such as Netnod IX Stockholm, Stockholm Internet eXchange (STHIX), and Euro-IX. Major telecom companies such as Telenor, Telia, and Tele2 have commercially introduced 5G in Sweden.

Sweden aims for carbon neutrality by 2045, with a projected electricity demand of 300 terawatt-hours by 2040. So, beginning in 2025, new data centers in the Sweden data center market, such as EcoDataCenter, plan to reuse their waste heat by incorporating it into district heating systems to warm neighboring households and companies.

In Sweden, municipalities leverage Big Data and AI to enhance urban functionality and services. For example, Helsingborg, a city dedicated to Smart City initiatives, partners with Univrses (a leading Smart City solutions provider). They employ the universities’ innovative 3DAI City computer vision technology for urban surveillance and management, optimizing city operations.

Sweden’s target for 2030 is to reach a 4.5% ICT specialists rate and employ 20 million people aged 15 to 74 using the DESI framework.

WHY SHOULD YOU BUY THIS RESEARCH?

- Market size regarding investment, area, power capacity, and Sweden’s colocation market revenue is available.

- An assessment of the data center investment in Sweden by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across cities in the country.

- A detailed study of the existing Sweden data center market landscape, an in-depth market analysis, and insightful predictions about industry size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in Sweden

- I. Facilities Covered (Existing): 36

- II. Facilities Identified (Upcoming): 09

- III. Coverage: 9+ Cities

- IV. Existing vs. Upcoming (Area)

- V. Existing vs. Upcoming (IT Load Capacity)

- Data Center Colocation Market in Sweden

- I. Market Revenue & Forecast (2023-2029)

- II. Retail & Whole Colocation Pricing

- The Sweden data center market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the industry.

KEY QUESTIONS ANSWERED

- How big is the Sweden data center market?

- How many data centers are there in Sweden?

- What is the growth rate of the Sweden data center market?

- What are the driving factors in the Sweden data center market?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 125 |

| Forecast Period | 2023 – 2029 |

| Estimated Market Value (USD) in 2023 | $1514 Million |

| Forecasted Market Value (USD) by 2029 | $2734 Million |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Sweden |

EXISTING VS. UPCOMING DATA CENTERS

Existing Facilities in the Region (Area and Power Capacity)

List of Upcoming Facilities in the Region (Area and Power Capacity)

VENDORS

IT Infrastructure Providers

- Arista Networks

- Atos

- Broadcom

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Lenovo

- NetApp

Data Center Construction Contractors & Sub-Contractors

- AFEC

- Bravida

- Coromatic

- Dornan

- DPR Construction

- Granlund

- Kirby Group Engineering

- NCC

- Red Engineering

- STS Group

- Skansa

- Sweco

- Swedish Modules (KeyPlants)

Support Infrastructure Providers

- ABB

- Alfa Laval

- Caterpillar

- Carrier

- Cummins

- Eaton

- FlaktGroup

- HITEC Power Protection

- KOHLER-SDMO

- Legrand

- NetNordic

- Rittal

- Riello UPS

- Rolls-Royce

- Schneider Electric

- Socomec

- STULZ

- Swegon

- Vertiv

Data Center Investors

- atNorth

- Bahnhof

- Conapto

- Digital Realty

- EcoDataCenter

- Ember

- Equinix

- GleSYS

- Meta (Facebook)

- Microsoft

- Multigrid

- Northern Data

- STACK Infrastructure

New Entrants

- Evroc

- Hive Digital Technologies

- STORESPEED

- T.Loop

REPORT COVERAGE

IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

Electrical Infrastructure

- UPS Systems

- Generators

- Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers, and Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- Data Center Infrastructure Management (DCIM)

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

For more information about this report visit https://www.researchandmarkets.com/r/ylxym6

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.