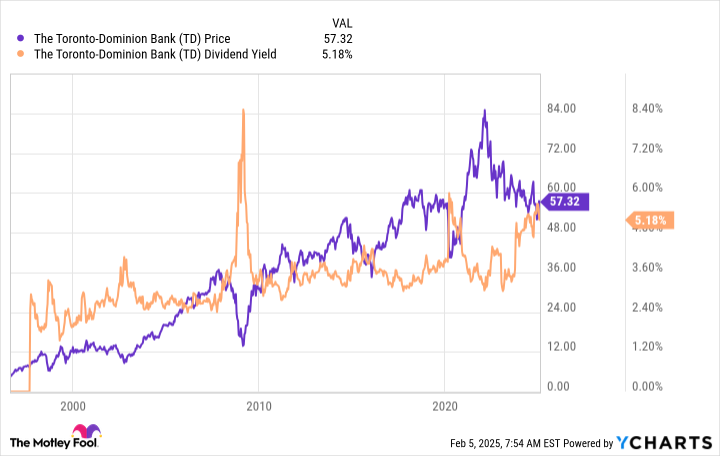

Toronto-Dominion Bank (TD -0.02%), often called TD Bank, has a huge 5.1% dividend yield. Stocks in the S&P 500 yield a scant 1.2% on average, and the average bank is only offering 2.3%. If you are looking for a high-yield bank investment, TD Bank should be sitting near the top of your research list.

If you have $500 (or any amount, really) in available cash that isn’t needed to pay monthly bills, reduce short-term debt, or bolster an emergency fund, you might want to consider putting it toward an investment in this stock. Here’s why.

Why is Toronto-Dominion’s yield so high?

Getting the ugly news out right up front, TD Bank allowed its U.S. division to be used for money laundering. That’s bad — no, that’s very bad. The bank’s internal controls simply weren’t up to the task of catching the problem, which amounted to its employees agreeing to work for illicit purposes. U.S. regulators figured all this out, which is a good thing in some respects, and have held TD Bank accountable for its shortfalls.

Image source: Getty Images.

For TD Bank, that means it had to pay a very large fine. It has also been asked to swiftly update its internal controls. And while it is updating its money laundering controls, TD Bank is operating under an asset cap in the United States. That last one is the big concern on Wall Street, and it is a problem very reasonable to be worried about.

Essentially, U.S. regulators have said TD Bank can’t grow its business until it has assuaged regulator concerns about its money laundering controls. There are two big fallouts from this. First, in 2025, TD Bank is going to rework its balance sheet in the U.S. business so that it can continue to serve its customers’ needs without going over the asset cap. This move will likely be a drag on the bank’s financial performance. All in all, 2025 is likely to be a very tough year for TD Bank.

Second, TD Bank’s U.S. business was expected to be its long-term growth engine. So, until the bank gets beyond this problem, it will likely be treading water. At the very least, it will grow vastly more slowly than many on Wall Street had been expecting before the money laundering issue broke. Given that backdrop, it is easy to see why the stock has been laid low and now offers a historically high yield.

Data by YCharts.

TD Bank is a risk/reward story with a time arbitrage angle

Here’s the thing: TD Bank is one of the largest banks in Canada. That business is unaffected by the U.S. money laundering problem. So, TD Bank still has a very strong core. And while 2025 is likely to be bad for the U.S. division, 2026 and beyond will likely be much better. Even if there’s no growth for a number of years, the 2025 performance isn’t going to be indicative of the bank’s capabilities. It is a turnaround year, if you will.

If you can stomach buying while other investors are selling, TD Bank looks like a fairly low-risk, high-reward turnaround story. Indeed, you can collect an above-industry average and historically high 5.1% dividend yield while you wait for what is still a strong bank to muddle through its regulatory issues. You are getting paid handsomely for the risk here, but that risk probably isn’t all that high.

Note, for example, that the dividend was increased by 3% at the end of fiscal 2024 (ended Oct. 31, 2024). Management and the board were well aware of the regulatory issues when they made that decision. That is not the decision a company would make if it were deeply worried about its ability to continue paying its dividend.

Essentially, TD Bank is out of favor for a good reason. But it is working through the issues it faces, which are not likely to derail its long-term growth potential. Sure, the stock may be moribund in the near term, but that’s an opportunity for investors who think in decades and don’t mind taking a contrarian position in a stock. Given enough time, the most likely outcome is that TD Bank gets back on track. You’ll be paid very well for your patience by that huge dividend.

TD Bank is the best high-yield bank if you can stomach it

Buying TD Bank won’t be a great option for every investor. It requires taking a long-term view of what is currently a troubling situation. More conservative investors might want to wait for further proof that positive change is taking place. Wait too long, however, and you could miss what might be the best opportunity to buy TD Bank since the Great Recession.