Most people invest and try to anticipate (or guess) what the stock market, bond market, and interest rates will do, and then change their investment strategy based on where they think the markets are headed.

This is a flawed strategy.

People who invest based on where they think the stock market, interest rates, or energy prices will go — pick just about any economic variable — will soon become very frustrated. That’s because no one can know for certain what markets or the economy will do in the short term. Anyone who claims they can is either misguided or dishonest.

Two decades ago, Wealth Enhancement Group developed and trademarked the Your Money Matrix. This is a proprietary tool that helps you visualize — almost in 3D — how you’ll be able to generate the steady, reliable income you need over your lifetime. It explicitly doesn’t rely on unreliable market forecasts; using this tool, we fully acknowledge that we don’t know what will happen in the markets in the short term — but the important point is that it doesn’t matter what the markets do in the short run.

How does Your Money Matrix work?

The Your Money Matrix approach begins by determining how much sustainable cash flow you will need to generate each year from your retirement assets. It should reflect your goals for how you want to spend your golden years. It’s also designed to give you confidence that your savings are structured to meet your goals. (Footnote: This is for educational purposes; not to be construed as investment advice).

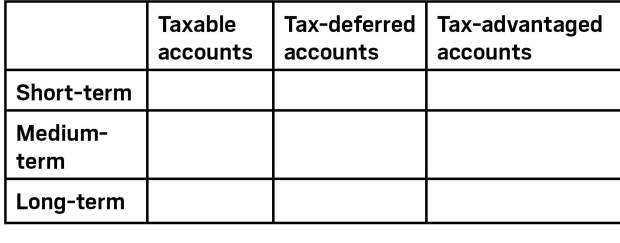

Here’s how you might set up your portfolio using the Your Money Matrix approach. Imagine drawing a tic-tac-toe game inside a square box (see figure below). Across the top (or horizontal axis), label the three-column headers of the three ways your investments are taxed. Then, on the left side (or vertical axis), label three rows showing timeframes in which you’ll need money:

Taxable accounts: These are brokerage and other liquid accounts with realized capital gains and income is taxed at year-end, usually at rates that are lower than those levied on ordinary income.

Tax-deferred investment accounts: With tax-deferred accounts, you pay no tax on accumulation in your IRA or 401(k) today, but distributions are taxed as ordinary income in the year they are withdrawn. Plus, withdrawals made before age 59½ are generally subject to a 10% federal penalty.

Tax-advantaged investment accounts: No tax deduction is available to contributions to a Roth IRA or Roth 401(k) account, but earnings accumulate tax-free, and withdrawals can be tax-free.

Now, let us explain the implications of each timeframe shown on the vertical axis of Your Money Matrix:

Short-term: In the short-term bucket, you’ll want to set aside an emergency fund of three to six months of income to cover large, unexpected expenditures such as a new furnace or roof, or for a medical procedure that’s not covered by insurance. The short-term bucket should hold mostly risk-hedging assets, such as cash and Treasurys. The purpose of this bucket is not to grow — it’s to give you greater certainty that your cash needs will be met over the next few years. A secondary benefit is reducing the impact of short-term market volatility on your portfolio.

Medium-term: For the medium-term “buffer” bucket, you’ll want to earmark money for intermediate financial needs such as contributing to your kids’ education, paying down a mortgage, or starting a part-time business. The medium-term bucket holds income-generating investments, including low-risk, low-volatility stocks for stable capital gains. Doing this may help you avoid the common problem of having to sell growth-oriented assets on short notice. The medium-term bucket also can serve as a buffer between the short-term bucket and the long-term bucket and can be used to “top off” the short-term bucket as needed.

Long-term bucket: The remainder of your portfolio can be allocated to a long-term, growth-oriented bucket that is aligned to your values and long-range financial needs — whether it’s to cover significant long-term health care costs, to leave a legacy for your children or other heirs, or philanthropic purposes. The long-term bucket generally should hold growth assets, such as stocks. Although stocks can be more volatile in the short term, they historically have been able to sustain an investor’s portfolio in the later years of retirement. Assets in the long-term bucket can be also used to replenish the short- and medium-term buckets as needed.

When doing distribution planning that properly aligns with our clients’ financial goals, we will often advise clients to draw from each of these buckets over a multi-year strategy, depending on their cash-flow needs, prevailing and expected future tax rates, and the timing for when they need the money. Importantly, this approach removes the guesswork of what the markets will do in the short term, which is difficult if not impossible to predict with any consistency.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.