The need for more and better infrastructure around the world will only get bigger over time, widening the trillion-dollar gap that already exists between planned investment and the amount needed to provide adequate global infrastructure.

According to The Atlantic Council, The global infrastructure financing gap is estimated to be around $15 trillion by 2040. To provide basic infrastructure for all people over the course of the next two decades, every year the world would need to spend just under $1 trillion more than the previous year in the infrastructure sector.

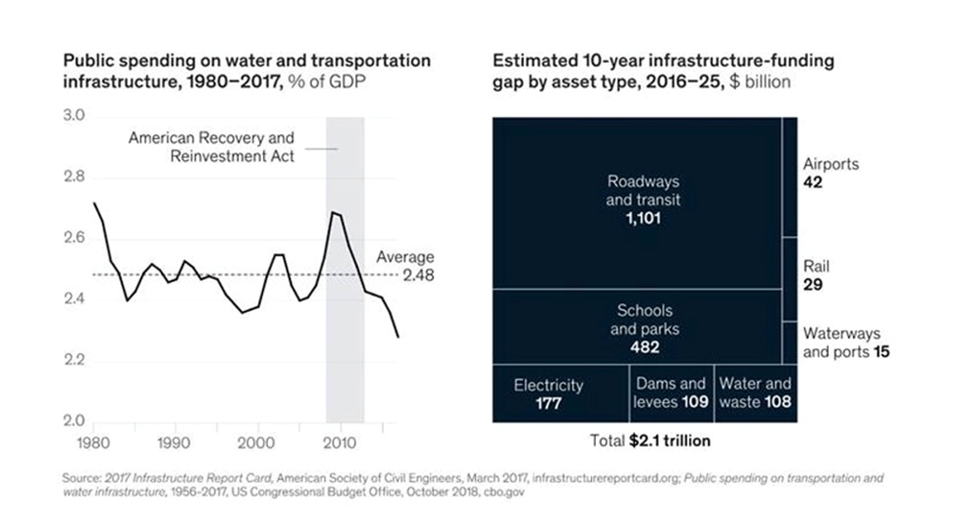

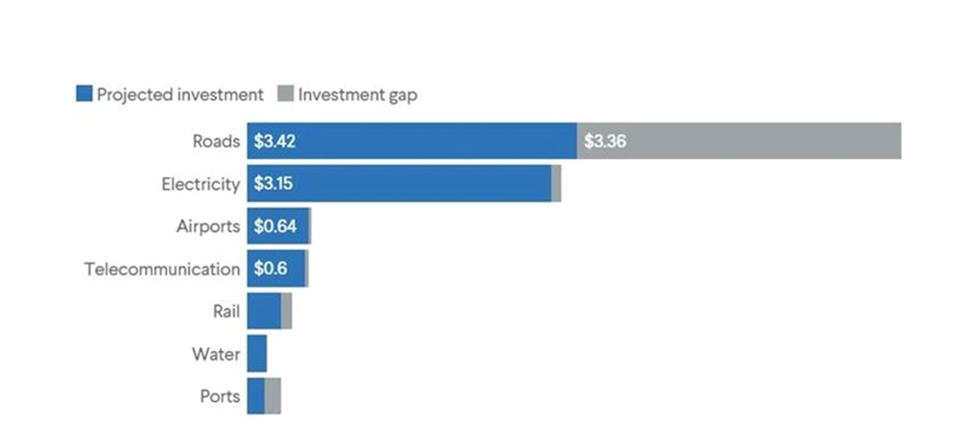

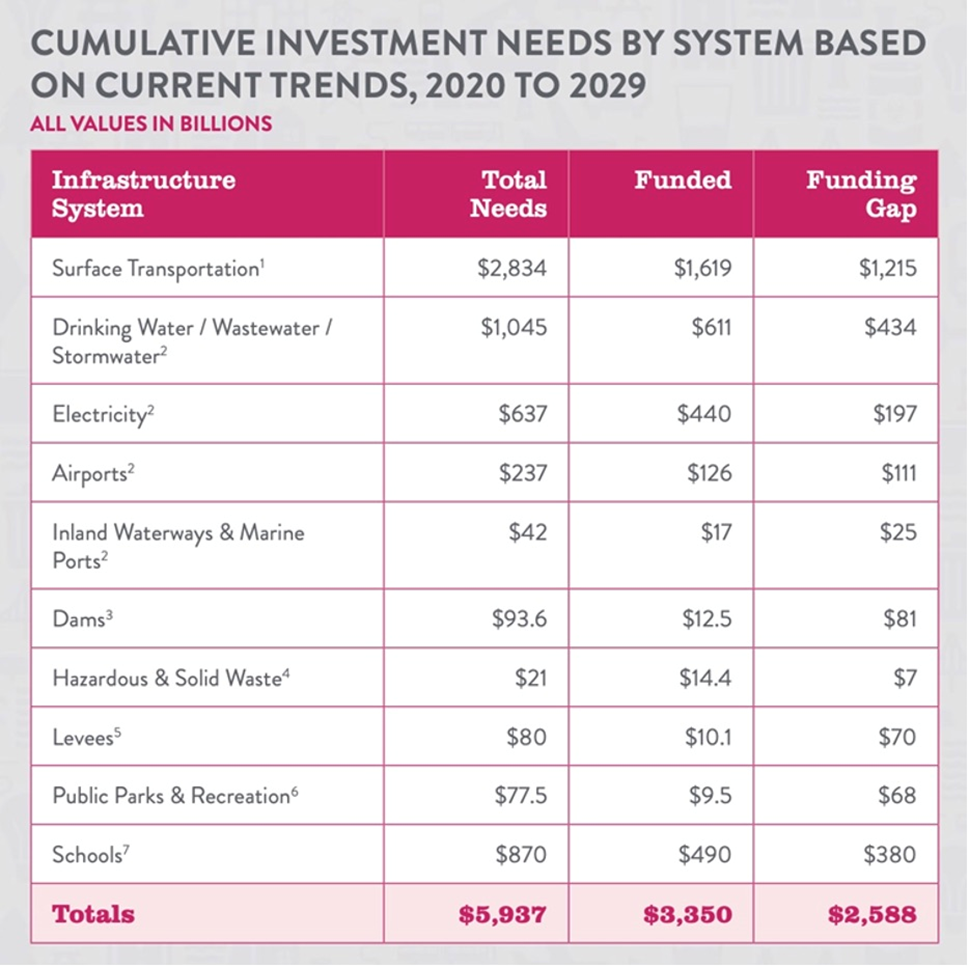

In the US, there is a $2.5 trillion infrastructure funding gap during the 10-year period from 2020 to 2029, based on figures provided by the American Society of Civil Engineers (ASCE). Failure to address it is estimated to result in the loss of $10 trillion in GDP by 2039.

The ASCE provides a report card for America’s infrastructure every four years. The latest, in 2021, gave the country a C-. If that sounds bad, it’s slightly better than the D+ given in 2017. A few examples of the problems facing civil engineers:

- An estimated 6 billion gallons of treated water are lost to water main breaks daily, enough to fill over 9,000 swimming pools.

- 43% of public roadways are in poor or mediocre condition.

- There are 30,000 miles of inventoried levies, and another 10,000 miles of levies whose location and condition are unknown.

Transportation will likely require the largest chunk of funding needs. According to the American Road and Transportation Builders Association, one in three bridges need to be repaired or replaced.

US aviation infrastructure is also overburdened, with 20% of arrivals and departures delayed in 2022. US commercial rail is among the most developed in the world, but passenger rail is lacking. Amtrak, the main provider of intercity passenger rail, has an estimated repair backlog of over $45 billion, according to the American Society of Civil Engineers.

The country’s water and energy systems are also under stress. The Environmental Protection Agency estimates that drinking and wastewater systems will require at least $744 billion in additional investment over the next decade. The operators of the US electrical grid are struggling to make the necessary investments, and increasing power outages are costing the economy billions of dollars, says the Council on Foreign Relations. In 2021 in Texas, 5 million homes were without electricity for days.

High-speed internet access continues to be an issue, with 14 million Americans unable to access a broadband network. Thirty-four states and territories have signed onto a federal initiative to invest $45B in US broadband by 2030.

NPR reported that 11 of the 17 infrastructure categories evaluated in the March 2021 report card graded in the D range. The transit system got the lowest grade, a D-. Of particular concern was the state of the country’s bridges, with 42% of 617,000 bridges more than 50 years old, and over 46,000 rated as structurally deficient.

According to the ASCE, the US is spending only half of what it should invest in infrastructure improvements just to keep systems up to par.

Renewable Energy Magazine reports nearly 25% of California’s local roads will be gone this year without action; almost half of the state’s roadways need rehabilitation. Buffalo, New York and San Juan, Puerto Rico are among cities at risk of a major water infrastructure failure. Many still have lead pipes, despite the Flint, Michigan water crisis.

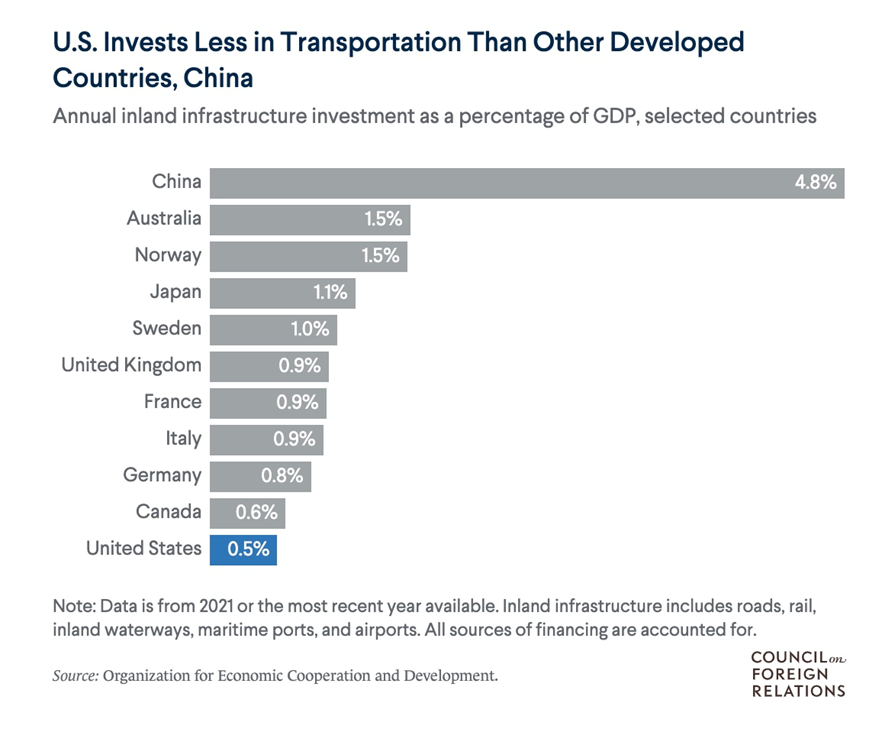

How does US infrastructure spending compare internationally? Quite poorly, it appears. The Council on Foreign Relations says the quality of US infrastructure has been declining over the past two decades, and ranks near the bottom of G20 countries. For example US passenger trains travel at half the speed of Europe’s high-speed rail, and only five US airports rank in the world’s top 50.

According to the OECD, the US invests less in transportation infrastructure as a percentage of GDP than France, Germany, Japan and the United Kingdom. China spends 10x more.

The COFR notes that Australia, Canada, France and the UK have developed national infrastructure frameworks that allow the central government to prioritize projects in a way that the US’s more decentralized system has struggled to do.

Less than half of US public infrastructure and transportation funding came from the federal government in 2020.

(Washington channels funding for transportation infrastructure through direct grants to states. The largest disbursement comes from the Highway Trust Fund, which raises money through the gasoline tax and other transportation-related taxes. The 1998 Transportation Infrastructure Finance and Innovation Act provides low-interest loans to local governments. The federal government also supports the municipal bond market, through tax incentives, which is what local governments rely on to finance infrastructure projects.)

Sources of funding

But it’s not all gloom and doom. In November 2021, the Biden administration passed the Infrastructure Investment and Jobs Act (IIJA), allocating $1.2 trillion for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, among other items.

The IIJA is the largest expenditure on US infrastructure since the Federal Highways Act of 1956. Rolled out over 10 years, it includes $550B in new spending.

The COFR says the plan also involves tens of billions of dollars to modernize the electrical grid, spur the adoption of electric vehicles, and expand broadband internet access. In August 2023, The White House said that implementation of the IIJA had already provided more than $280 billion in announced financing for almost seven thousand projects, with at least $120 billion directed toward highways.

The states with the largest populations got the most funding, with California receiving $20 billion and Texas getting $15 billion. New Hampshire got the least, $855 million. (Renewable Energy Magazine)

Biden’s other signature piece of infrastructure legislation is the Inflation Reduction Act, passed by Congress in August 2022. It includes more than $150 billion in infrastructure financing, with the bulk of the funding directed towards transportation and clean energy projects.

Which states have benefited the most, so far, from the IRA?

The state-by-state breakdown is interesting.

According to Canary Media, most of the clean energy manufacturing investment and job creation is in the so-called “Battery Belt” of the southeastern US. As of last August, more than 100 new facilities or factory expansions had been announced totaling nearly $80B in new investments. While projects are currently planned for 27 states, most are clustered in the Battery Belt.

Canary Media notes Georgia is the hands-down winner when it comes to clean-tech investment and new jobs:

With more than $18 billion in investment spread across 19 different battery, EV and solar manufacturing projects, the state has won more than a fifth of all new clean energy manufacturing investments. Two big battery projects account for much of Georgia’s lead: Hyundai and SK have announced a joint investment of up to $5 for an EV battery facility, and Hyundai is also partnering with LG Energy Solution to invest $4.3 billion in another EV battery plant…

Unsurprisingly, Georgia is also at the top in terms of expected new jobs, with a total of more than 11,000 clean energy manufacturing positions projected to be created in the state in the next few years. The Hyundai-SK joint venture alone has announced 3,500 new jobs, and two Qcells solar manufacturing plants are together expected to create 2,500 jobs. Michigan comes in second with over 9,000 new jobs, mostly in new EV battery plants and EV assembly facilities.

According to CNBC, the wind, solar and EV manufacturing sectors are spawning the new positions, which include electricians, mechanics, construction workers and technicians.

Canary Media says that, of the ~ 70,000 new jobs created by clean energy investments since the IRA passed (as of September 2023), many of the districts poised to see the most job growth are represented in Congress by Republicans, none of whom voted for the IRA.

Oilprice.com pursues this concept further, noting that in 2022, red states claimed more IRA finds and installed more wind and solar power than blue states.

Two of the reddest states, Iowa and Oklahoma, lead the nation in wind power production. Texas, also a red state, is a leader in both solar and wind. California, a blue state, and Texas are the largest producers of solar power.

Oilprice.com reports Republican-held districts are now home to more than 80% of all utility-scale wind, solar farms and battery projects currently under development.

If states were to adopt clean energy technologies at the pace and scale needed to meet 2030 climate goals, red states would receive $4,221 in IRA funds per capita, compared to just $2,427 per person in blue states.

The ones to watch

Last October, advocacy group Climate Power launched an $80 million ad campaign to talk up the Inflation Reduction Act and Biden’s role in shaping it. (E&E News)

The campaign targeted seven swing states, which could decide whether Biden gets a second term: Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin. Collectively, the last three states on the list have seen an influx of nearly 62,000 jobs and roughly $68 billion in private and clean energy funding. Following is a summary (drawn from E&E and edited) of what is happening in each of these swing states.

Arizona voted 49.4% for Biden and 49.1% for Trump in 2020. The state has gained 12,270 clean energy jobs and $8.3B in funding since the IRA passed. Once solidly Republican, Arizona has leaned more Democrat in recent years. Democratic Rep. Raul Grijalva is running for re-election partly on the strength of the IRA.

The state has become a battery manufacturing powerhouse, with two battery makers investing more than $5B. South Korea’s LG Energy Solution last year said it would quadruple a planned EV battery factory outside Phoenix. Kore Power received an $850 million loan to build a battery storage manufacturing plant that will create 3,000 full-time jobs by 2025.

Georgia voted 49.5% for Biden and 49.2% for Trump. The state has gained 16,678 clean energy jobs and $18.8B in funding since the IRA passed. As mentioned Georgia has been one of the top recipients of IRA incentives. The QCells solar plant employs about 1,300 in Dalton with plans to hire double and make a $2.5B investment to expand the plant and build a new one near Atlanta. Hyundai opened a new EV manufacturing facility and Rivian plans to open a new factory this year, although the latter has been delayed.

Two staunch Republican opponents of Biden have embraced the clean energy boom — Gov. Brian Kemp and Rep. Marjorie Taylor Greene.

Michigan voted 50.6% for Biden and 47.8% for Trump. The state has gained 15,856 clean energy jobs and $21B in funding since the IRA passed. The biggest clean energy project assisted by the IRA is Ford’s $3.5B BlueOval Battery Park Michigan. Billions in other battery-making facilities have been announced, including Next Energy’s $1.6 billion in Wayne County and Gotion’s $2.4 billion factory in Big Rapids.

Nevada voted 50.1% for Biden and 47.7% for Trump. The state has gained 11,500 clean energy jobs and $9.1B in funding since the IRA passed. Unimacts, a company that makes components for solar panel arrays, opened in Las Vegas, hiring 80 people. Panasonic announced an expansion of its battery production at Tesla’s gigafactory outside of Reno. Democratic Sen. Jacky Rosen, who faces a tight re-election race, has campaigned on her support for the Inflation Reduction Act. Her Republican opponents have pledged to repeal the law.

North Carolina voted 50.1% for Trump and 48.7% for Biden. The state has gained 4,145 clean energy jobs and $9.6B in funding since the IRA passed. Gov. Roy Cooper, a Democrat, has battled the GOP-controlled state legislature over climate policies, and he has embraced the job-creating provisions of the IRA. North Carolina — along with Michigan and Georgia — is part of the Battery Belt. The state is also poised for a lithium-mining revival as part of the administration’s efforts to bring critical mineral production back to the US from China.

Pennsylvania voted Biden 50% for Trump and 48.8% for Biden. The state has gained 457 clean energy jobs and $197 million in funding since the IRA passed. In 2022, voters sent Democrats Josh Shapiro to the governor’s office and John Fetterman to the Senate. Both ran on their support for the Inflation Reduction Act. Pennsylvania, a top fossil-fuel-producing state, has had little benefit from the energy provisions of the Inflation Reduction Act. Re:Build Manufacturing announced an $81 million investment to expand its clean energy component manufacturing campus in Westmoreland County, which will create 300 new jobs.

Wisconsin voted 49.6% for Biden and 48.9% for Trump. The state has gained 500 clean energy jobs and $445 million in funding since the IRA passed. Last August, Democratic Gov. Tony Evers stood with Biden on stage during the president’s national effort to tout the IRA. But like Pennsylvania, Wisconsin has seen little benefit so far from the law. ABB announced a $100 million investment to build electric drive units for EVs in New Berlin, creating 100 jobs, and Ingeteam announced 100 new jobs would be created at a Milwaukee factory that makes EV chargers.

Conclusion

Less than half of US public infrastructure and transportation funding comes from the federal government, putting most of the burden on the states, which pressure local municipalities to manage their own buildings, roadways and transportation systems.

The lack of centralized planning is at least partially responsible for the country’s $2.5 trillion infrastructure funding gap.

Yet over the last two years, new sources of funding have emerged, not so much for traditional infrastructure (though some money is available for that), but for transportation and clean energy projects, especially electric-vehicle battery plants, solar and wind power facilities.

One might think that following the money doled out by the clean energy-focused Inflation Reduction Act would lead to Democrat recipients in blue states. In fact the opposite has occurred.

Republican-held districts are home to more than 80% of all utility-scale wind, solar farms and battery projects currently under development.

According to a Washington Post-University of Maryland poll conducted last July, 71% said they have heard little or nothing about the Inflation Reduction Act, and 57% polled said they disapproved of Biden’s handling of climate change.

Another question is what will happen to all of this clean-tech funding if Trump beats Biden as many now expect he will? Trump has expressed dislike for the IRA in election speeches and his officials told the media last year, “We’d be looking to cut a lot of that spending.”

According to GreenBiz, investors are worried Trump will repeal the IRA, which has created over 300,000 jobs as of June 20.

Moreover, the legislation has so far funded over $391B in government spending or tax write-offs. It may just be too lucrative for Trump to overhaul. For example, the IRA give companies a tax credit worth 30% of what they spend on green energy projects. And according to the Investment Monitor Database,

States from across the political spectrum are investing historic amounts of capital, thanks in large part to the available funds from the IRA. In the past four quarters, Georgia and Tennessee each invested almost $8 billion, followed by Michigan’s nearly $6 billion and Ohio’s nearly $5 billion.

While a Republican administration might try to restrict certain tax credits, some credits have a 10-year life, meaning that applications approved today can’t be rescinded by the next administration.

Ongoing industry support for the IRA may impede radical tampering, states Greenbiz, noting that Shell CEO Wael Sawan recently spoke in favor of preserving the bill.

And finally many manufacturing firms are moving from abroad to the US to take advantage of the IRA.

The fact that the IRA’s funds are congressionally appropriated means a Republican victory in the White House will still require a Republican-led Congress to formally repeal or limit funds, the publication stated.

The IRA may not close the infrastructure funding gap but it has made progress in building new “made in America” clean transportation and energy supply chains.

Whether it remains in place after November’s election remains to be seen.

(By Richard Mills)

Legal Notice/Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.