Ark Invest and its leading exchange-traded fund, the Ark Innovation ETF (NYSEMKT: ARKK), have gained significant attention in recent years. The investment management firm led by Cathy Wood and its various industry-specific funds likely influenced investors to more closely examine companies that are focused on innovation.

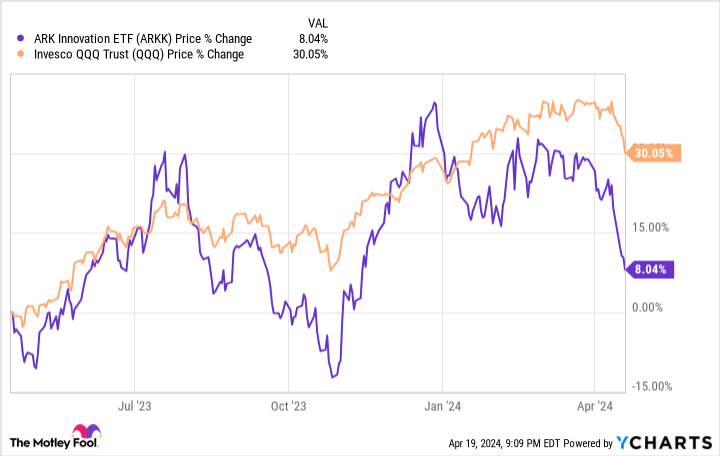

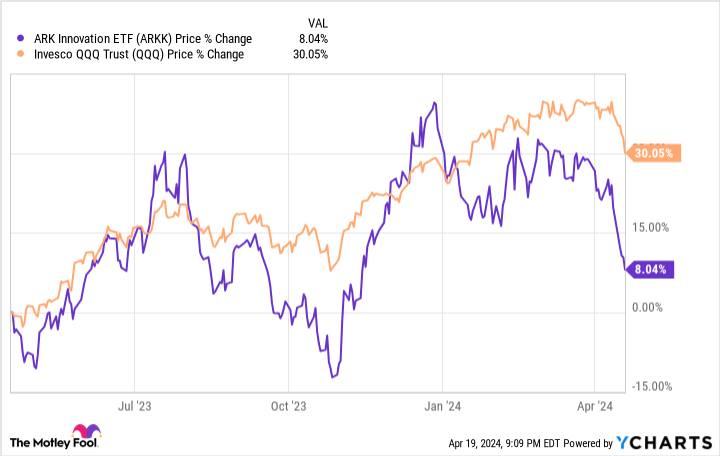

However, for all the publicity Wood has attracted, the Ark Innovation ETF has typically underperformed the Invesco QQQ Trust (NASDAQ: QQQ), a passively managed fund that tracks the tech-heavy Nasdaq-100 index. Due to that fact alone, the Ark Innovation ETF will have much to prove before investors should choose it over the Invesco fund.

The Ark Innovation ETF

At least 65% of the Ark Innovation ETF’s assets are held in the stocks of companies with businesses built on what it terms “disruptive innovation.” In particular, that description encompasses domestic and foreign companies making advancements in four areas:

-

The “genomic revolution,” or work devoted to DNA technologies.

-

Robotics, automation, and energy storage.

-

The “next generation internet,” which includes artificial intelligence (AI).

-

Fintech.

At the height of the 2021 bull market, the Ark Innovation ETF looked like the new Nasdaq, as it was dramatically outperforming the Nasdaq-100. However, the subsequent bear market in 2022 exposed the fund’s shortcomings, and it experienced considerable underperformance. Over the last five years, Ark Innovation investors paid an annual expense ratio of 0.75% to watch their actively managed fund fall by 11%.

Moreover, the fund largely failed to profit from 2023’s bull market in AI stocks. Over the past 12 months, the Invesco QQQ, which has an annual expense ratio of just 0.2%, rose by 30%. The Ark Innovation ETF returned around 8%. Outside of two brief periods during the past year, Ark Innovation lagged.

Ark’s Innovation successes

The Ark Innovations fund’s No. 1 holding, at nearly 10% of assets, is Tesla. Admittedly, Wood’s initial forecast for that company proved correct. In 2018, Ark Invest predicted that Tesla would reach $267 per share at a time when the stock was trading at less than 10% of that value. While it has since pulled back below that level, Tesla had risen to that price by 2021.

Now, Ark Invest forecasts that Tesla will reach $2,000 per share by 2027, a prediction based on the expectation that it will deliver major advancements in self-driving technology in the interim. Only time will tell whether Tesla will reach that level, but Ark’s previous correct call does give its current view some added credibility.

Other successes for Ark include Bitcoin, which it first bought at $250. While the cryptocurrency has not reached the $1 million per coin level predicted by Ark Invest, Bitcoin’s recent price of around $66,000 has provided the fund with massive returns.

Where Ark Innovation has fallen short

Nonetheless, other aggressive calls have thus far fallen short. Ark Invest predicted Roku would reach $605 per share in 2026. While conditions could change, Roku’s current share price is less than 10% of that.

That challenge is even more significant with Zoom Video Communications. Ark Invest predicted that Zoom will reach $1,500 per share by 2026 as a base case. However, from its current price of about $60 per share, reaching that level would require a 25-fold gain. Even Ark’s $700 per share bear case for Zoom looks extremely ambitious, given that it’s currently trading at less than 10% of that.

Furthermore, Ark Invest has missed with stocks like Teladoc Health, a one-time major holding that is now Ark Invest’s 16th-largest position. The fund’s Teladoc position has changed little, even as Teladoc fell from more than $300 per share at the height of the pandemic to about $13 per share as of the time of this writing.

Hence, while Ark Invest’s correct calls have bolstered the reputation of the fund, its missed calls (at least so far) have proven costly.

Should investors buy the Ark Innovation ETF?

Although Ark Invest could make a comeback, most investors would likely be better off putting their tech-sector money into the Invesco QQQ trust. True, Ark Invest’s team made some aggressive calls that proved correct. And some of the picks that can currently be viewed as “missed calls” could turn out to be issues of timing. Investors should not write off the possibility that many Wood investments now languishing could eventually produce impressive comebacks.

Nonetheless, the Ark Innovation ETF has typically underperformed the Invesco QQQ and charged higher fees for those weaker returns. Until the Ark fund’s returns prove otherwise, it is hard to argue against the idea that investors looking for tech-sector exposure should choose the Invesco QQQ Trust instead.

Should you invest $1,000 in Ark ETF Trust – Ark Innovation ETF right now?

Before you buy stock in Ark ETF Trust – Ark Innovation ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ark ETF Trust – Ark Innovation ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Will Healy has positions in Roku and Zoom Video Communications. The Motley Fool has positions in and recommends Bitcoin, Roku, Teladoc Health, Tesla, and Zoom Video Communications. The Motley Fool has a disclosure policy.

Why Investors Should Choose the Nasdaq-100 Over the Ark Innovation ETF was originally published by The Motley Fool