The Switzerland market ended marginally down on Wednesday after spending much of the day’s session in negative territory, as investors largely refrained from making significant moves, choosing to wait for more clarity about the quantum of interest rate cut by the Federal Reserve. Despite this cautious environment, dividend stocks continue to attract attention due to their potential for stable income and resilience in uncertain times. In this article, we will explore three top dividend stocks on the SIX Swiss Exchange that are yielding up to 6.5%, providing a closer look at what makes them appealing choices in today’s market conditions.

Top 10 Dividend Stocks In Switzerland

|

Name |

Dividend Yield |

Dividend Rating |

|

Cembra Money Bank (SWX:CMBN) |

5.16% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.70% |

★★★★★★ |

|

EFG International (SWX:EFGN) |

4.54% |

★★★★★☆ |

|

Compagnie Financière Tradition (SWX:CFT) |

4.10% |

★★★★★☆ |

|

Julius Bär Gruppe (SWX:BAER) |

5.22% |

★★★★★☆ |

|

Helvetia Holding (SWX:HELN) |

4.76% |

★★★★★☆ |

|

Holcim (SWX:HOLN) |

3.47% |

★★★★★☆ |

|

Basellandschaftliche Kantonalbank (SWX:BLKB) |

4.68% |

★★★★★☆ |

|

DKSH Holding (SWX:DKSH) |

3.35% |

★★★★★☆ |

|

St. Galler Kantonalbank (SWX:SGKN) |

4.50% |

★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private and corporate customers in Switzerland, with a market cap of CHF1.85 billion.

Operations: Basellandschaftliche Kantonalbank generates CHF466.77 million in revenue from its banking products and services.

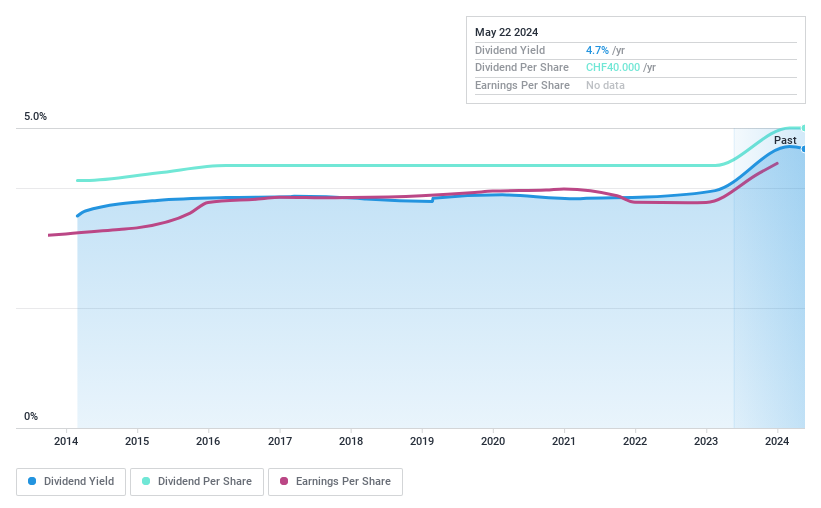

Dividend Yield: 4.7%

Basellandschaftliche Kantonalbank reported net income of CHF 67.06 million for the half year ended June 30, 2024, up from CHF 63.23 million a year ago. The bank offers a high and reliable dividend yield of 4.68%, placing it in the top 25% of Swiss dividend payers. Dividends have been stable and growing over the past decade, with payments covered by earnings given a reasonable payout ratio of 56.7%.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Luzerner Kantonalbank AG offers a range of banking products and services in Switzerland, with a market cap of CHF3.23 billion.

Operations: Luzerner Kantonalbank AG generates revenue through various banking products and services within Switzerland.

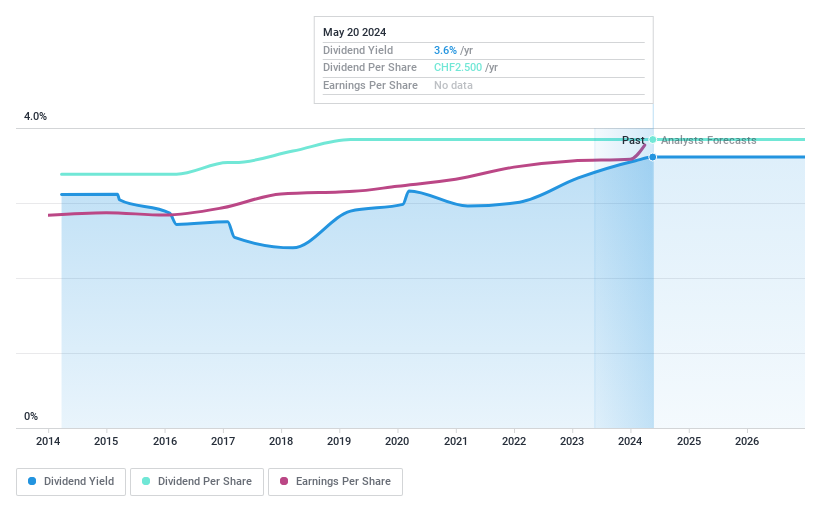

Dividend Yield: 3.8%

Luzerner Kantonalbank’s dividends have been stable and growing over the past decade, supported by a low payout ratio of 46.5%. Although its dividend yield of 3.81% is below the top quartile in Switzerland, it remains reliable. The stock trades at a significant discount to its estimated fair value, and earnings grew by 20.2% last year, indicating potential for continued dividend sustainability.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, along with its subsidiaries, manufactures and sells components for industrial customers globally and has a market cap of CHF416.40 million.

Operations: Phoenix Mecano AG’s revenue is derived from three main segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348 million).

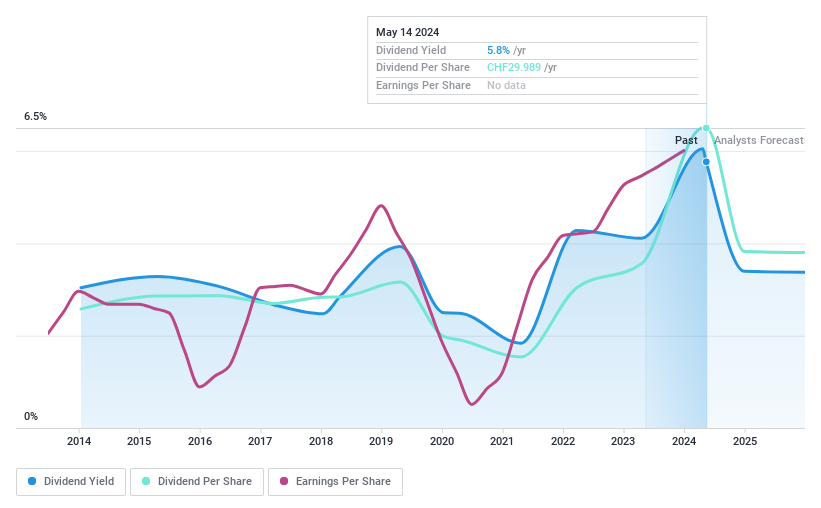

Dividend Yield: 6.6%

Phoenix Mecano’s dividend yield of 6.56% ranks in the top 25% of Swiss dividend payers, but its dividends have been volatile and are not well covered by free cash flow, with a high cash payout ratio of 118.5%. Despite recent earnings decline—sales dropped to €382.8 million and net income to €17.2 million—the company approved an ordinary and special dividend totaling CHF 30 per share at its May AGM, indicating commitment to shareholder returns despite financial pressures.

Make It Happen

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BLKB SWX:LUKN and SWX:PMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]