Wall Street economists and market strategists entered 2023 expecting a recession and predicting unusually weak returns for stocks.

What we got was resilient economic growth and a 24% surge in the S&P 500.

Today, everyone’s a bit more optimistic. Many economists expect continued growth, albeit slower growth. Those who warn of recession add that any downturn is likely to be short and shallow. Meanwhile, market strategists are looking for average stock returns.

Let’s take a closer look at the big stories driving these 2024 forecasts.

1. Labor market: How cool will it get?

U.S. employers have added jobs for 35 consecutive months. But the pace of job creation has been slowing steadily over the past two years.

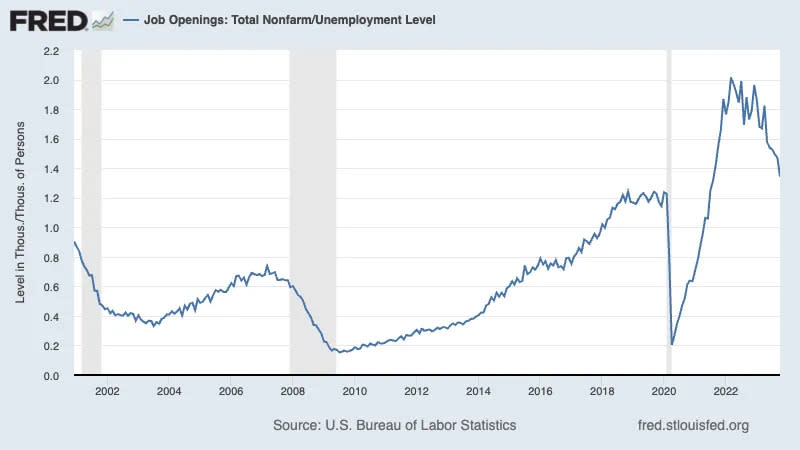

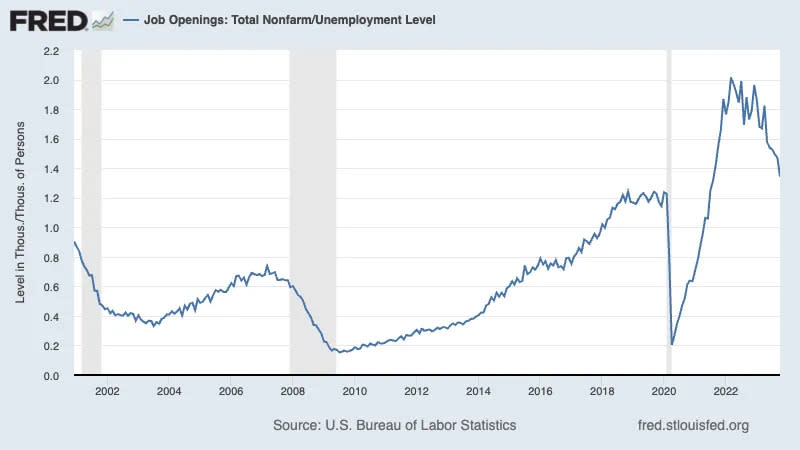

This cooling trend is echoed in the falling level of job openings.

According to the BLS’s Job Openings and Labor Turnover Survey, employers had 8.73 million job openings in October, down from the March 2022 high of 12.03 million.

During the month, there were 6.50 million unemployed people — meaning there were 1.3 job openings per unemployed person. This ratio — one of the most obvious signs of excess demand for labor — is almost back to down to prepandemic levels.

While it is true that the level of job openings remains high, it’s nowhere near its level earlier in the economic recovery. In other words, labor demand isn’t as hot as it used to be.

For more, read: The hot but cooling labor market in 16 charts

2. Inflation: Is the worst behind us?

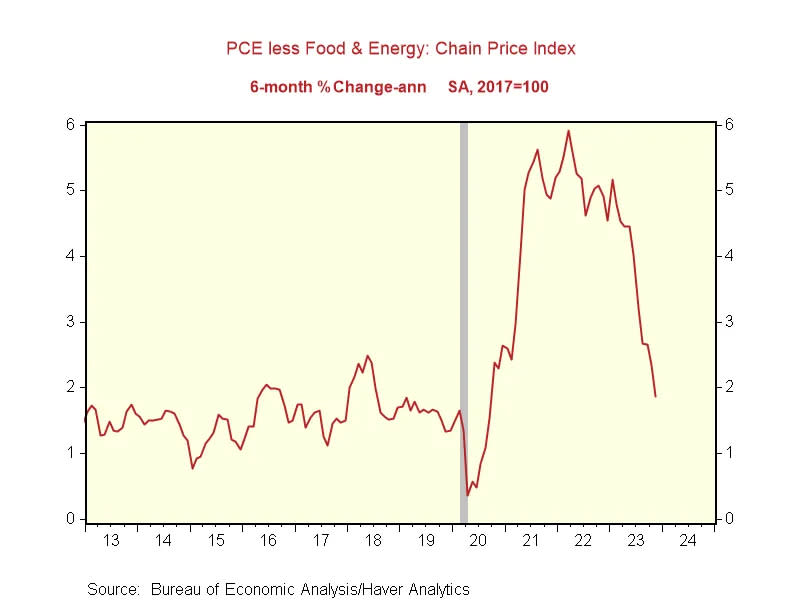

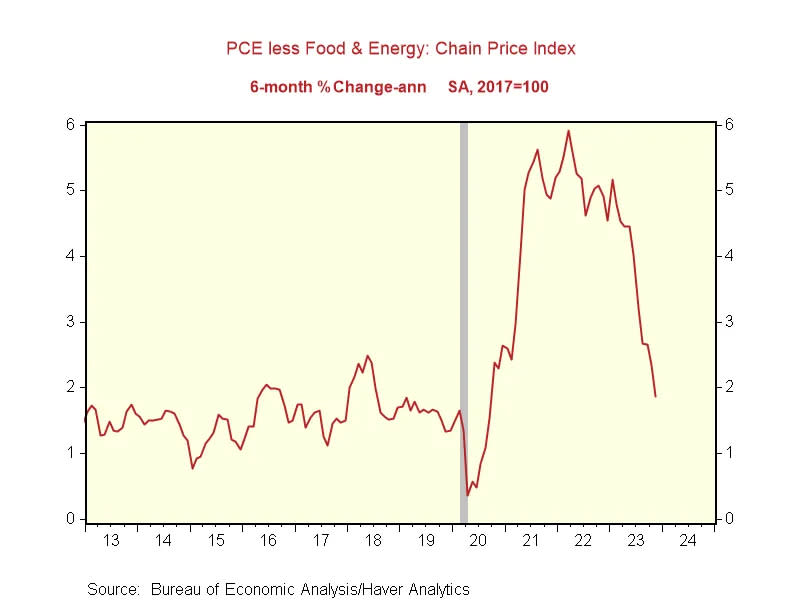

A wide variety of inflation metrics have been improving significantly since mid-2022.

Importantly, the core PCE price index — the Federal Reserve’s preferred inflation gauge — is hovering near the central bank’s target 2% level.

According to BEA data, the core PCE price index rose by just 0.1% month over month in November. On a six-month annualized basis, that metric is at a very comfortable 1.9%.

While it’s great news that inflation rates are near target levels, Fed Chair Jerome Powell has made clear that he’d like to see those rates stay there for more than just a few months before declaring any kind of victory.

For more, read: The end of the inflation crisis

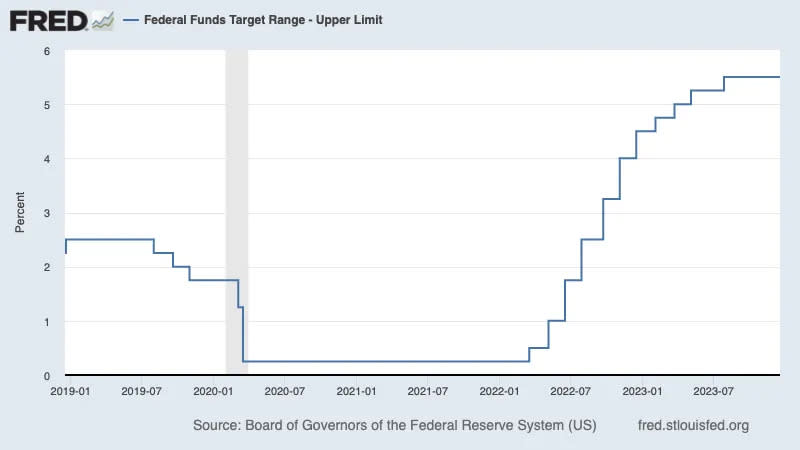

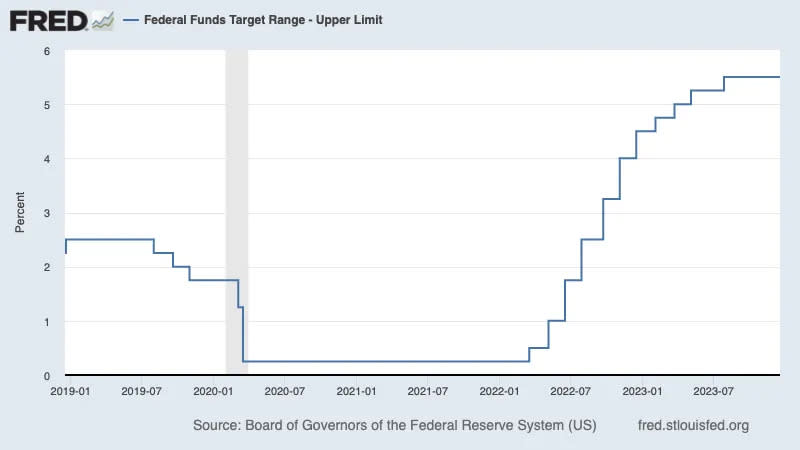

3. Monetary policy: Tight for how long?

The Fed has been tightening monetary policy by hiking interest rates over the past two years in its effort to bring inflation down.

With inflation rates near target levels, most agree that monetary policy doesn’t need to be tightened further. In fact, most experts, including many central bankers think the Fed will actually begin to cut interest rates in 2024.

Generally speaking, looser monetary policy would be good news for the financial markets. However, there’s also the possibility that future rate cuts are a response to significant deterioration in economic data, which would be bad news.

Of course, any actual decision to cut rates will depend on the direction of the incoming economic data including data on growth and inflation.

For more, read: Views on the economy have shifted dramatically over the past year and When the Fed-sponsored market beatings will end

4. Sentiment: Finally a vibe-spansion?

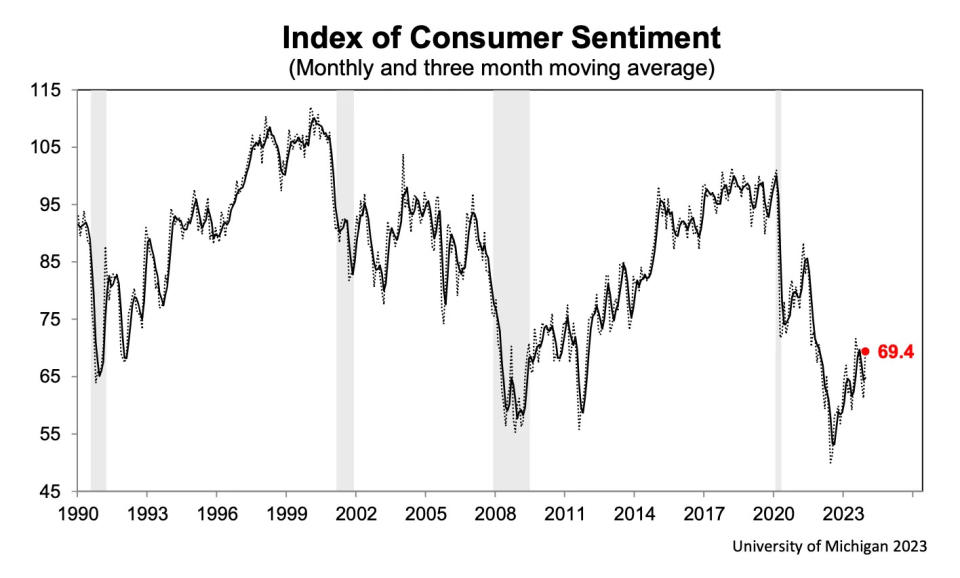

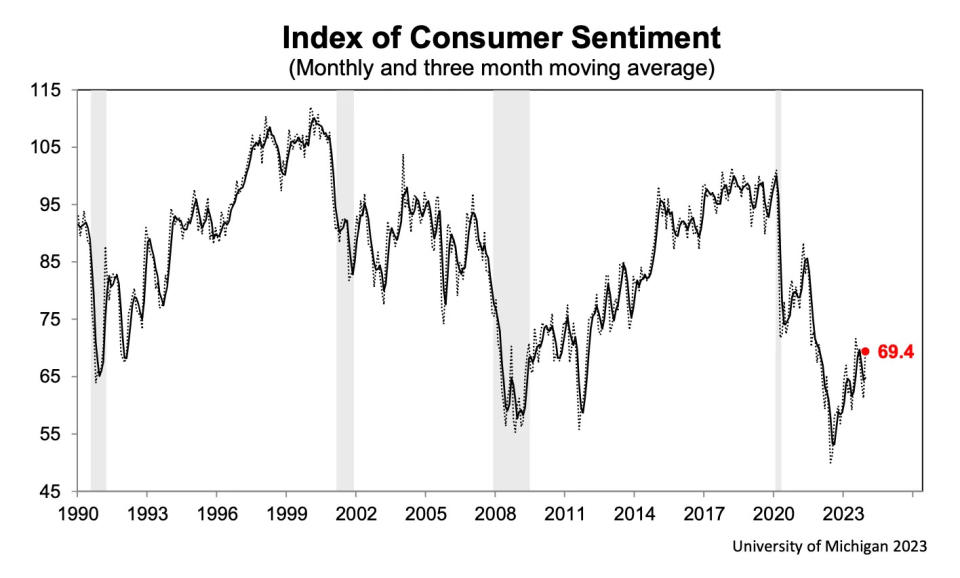

One of the most fascinating economic developments of the past three years is the resilience in consumer spending despite a major deterioration in consumer sentiment.

While the “vibes” have been negative, this bullish contradiction has generally been positive for economic activity, corporate profits, and stock prices.

More recently, the vibes have been on an upswing, with the University of Michigan’s consumer sentiment index and the Conference Board’s consumer confidence index both taking noticeable legs up in their most recent editions.

From the University of Michigan: “Consumer sentiment soared 13% in December, erasing all declines from the previous four months, primarily on the basis of improvements in the expected trajectory of inflation.“

From the Conference Board: “December’s increase in consumer confidence reflected more positive ratings of current business conditions and job availability, as well as less pessimistic views of business, labor market, and personal income prospects over the next six months.“

For more, read: Don’t underestimate the American consumer

5. Economic growth: Slowdown, recession, or something else?

The economy has gone from very hot to pretty good over the past two years as massive unusual tailwinds have been fading.

In the context of inflation, this has been a positive development, as easing demand has allowed prices to cool.

For now, it’s looking like we’re experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

Simply put, the economy has been normalizing.

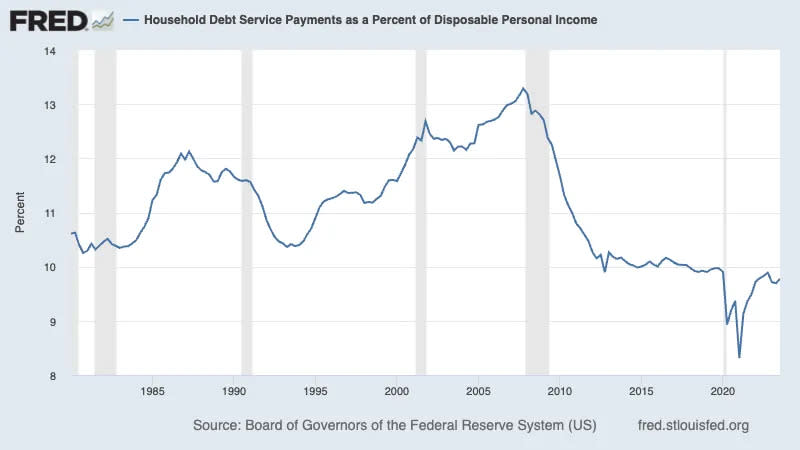

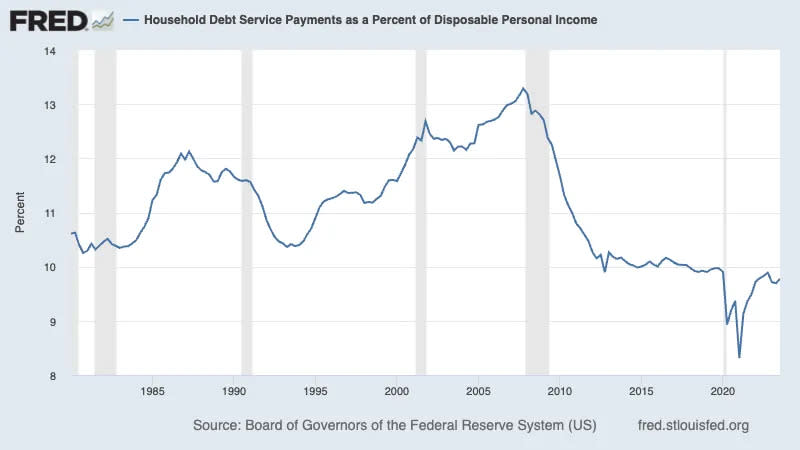

But the normalization has also meant deterioration in metrics like debt delinquencies. And it could eventually mean a more meaningful increase in the unemployment rate, which currently sits at unusually low levels.

It’s probably premature to sound alarms, especially considering the financial strength of U.S. consumers. (More here, here, here, here, and here.)

Nevertheless, it’s always prudent to at least consider the possibility that growth will plateau and perhaps turn negative in the coming months.

For more, read: The economy has gone from very hot to pretty good and Be mindful of the warning signs

6. Corporate profit margins: Will they hold up?

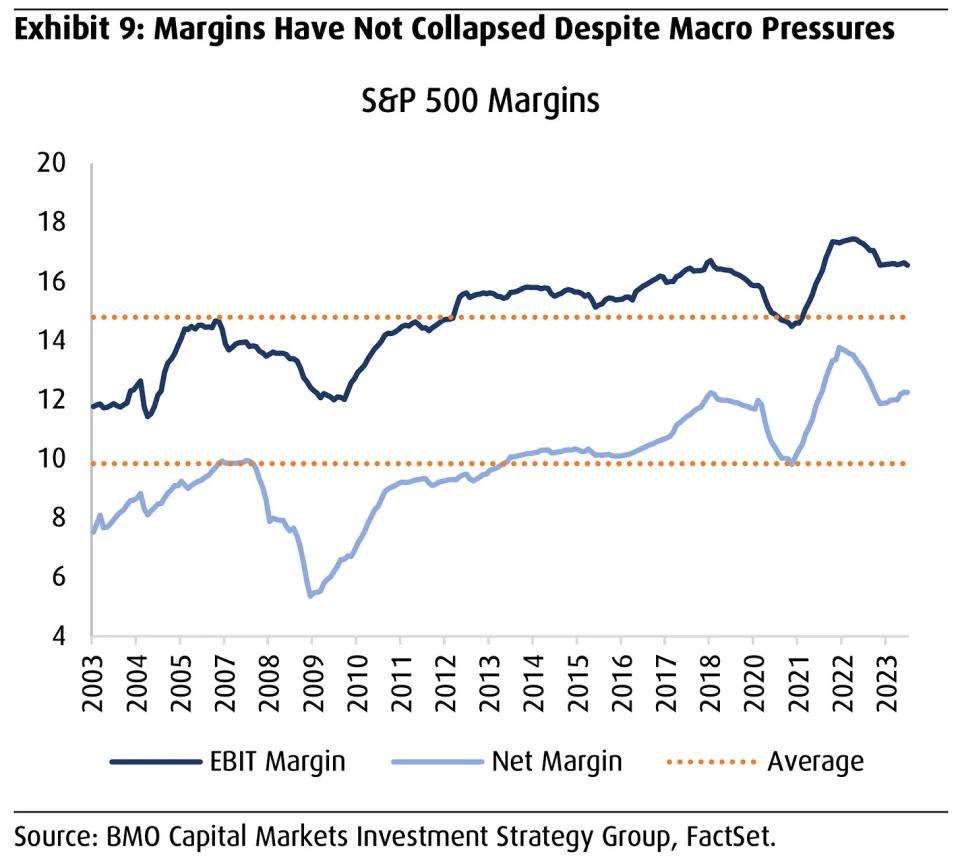

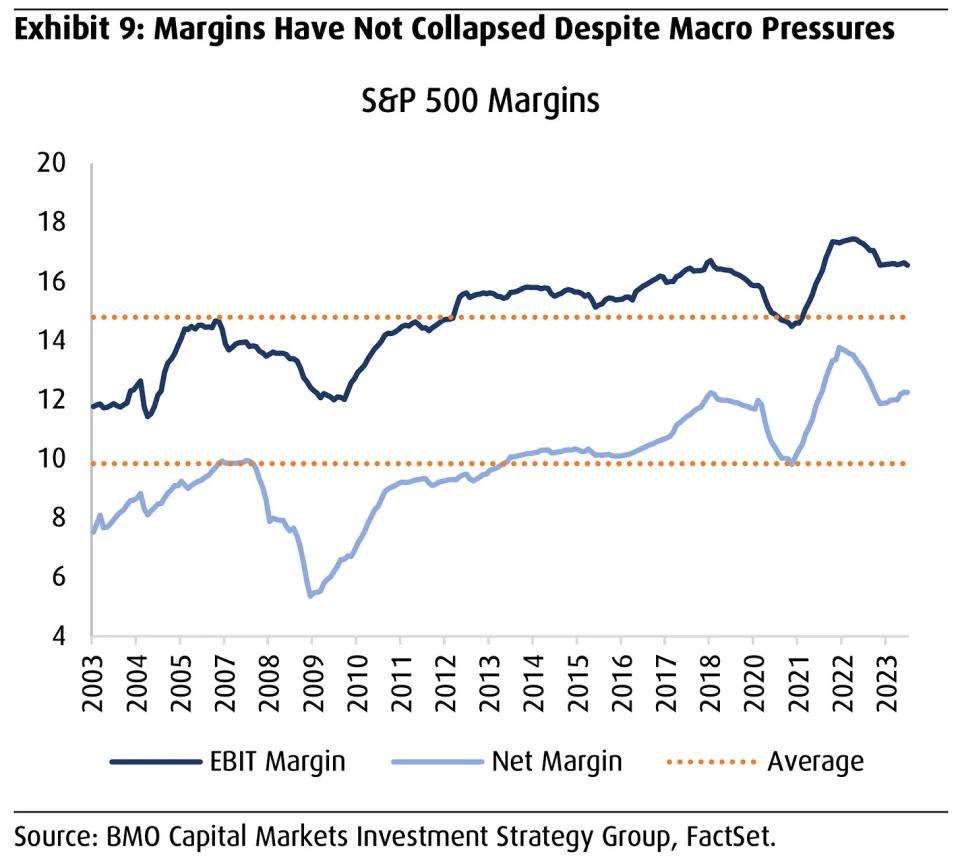

Record-high corporate profit margins may have been the most unexpected big story of 2021, 2022, and 2023.

As inflation rates surged in 2021, analysts were convinced rising costs would crush profit margins. But the opposite happened: Profit margins actually rose to record levels. During this period, many companies were able to pass higher costs to their customers through higher prices. Combined with improved operating efficiencies, this dynamic led to record profits. It was a reminder that it’s “dangerous to underestimate Corporate America.”

Surprising to some, high profit margins have persisted. And after a modest dip in a year ago, profit margin expansion resumed in Q2 and into Q3 of 2023.

Thanks to improved operating efficiencies, many — but not all — strategists expect profit margins to stay high, which could help amplify earnings growth even with modest revenue growth.

For more, read: A bullish earnings story is brewing

7. Interest expense: Will it become a problem?

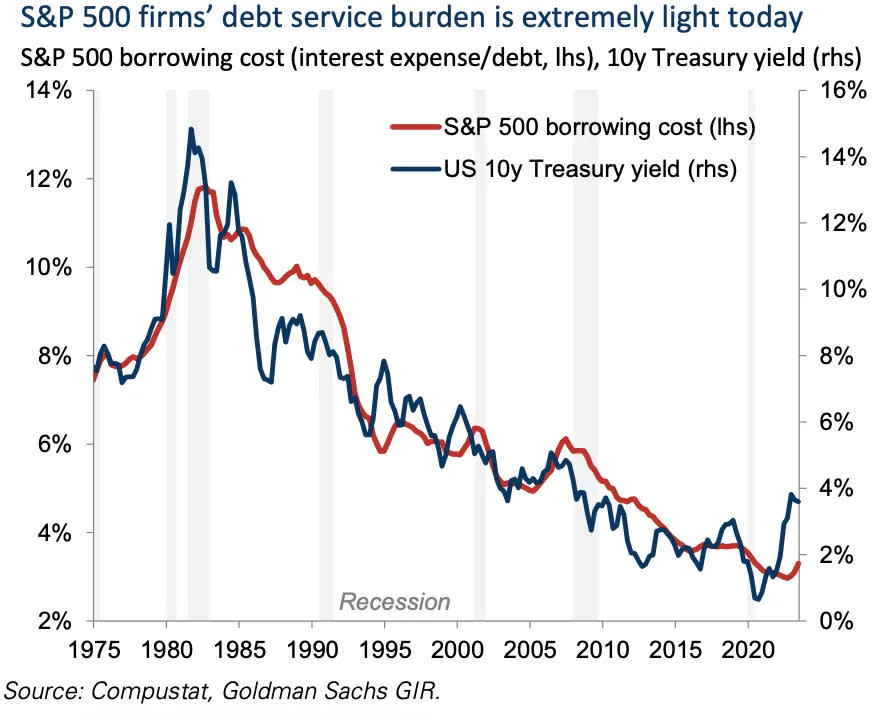

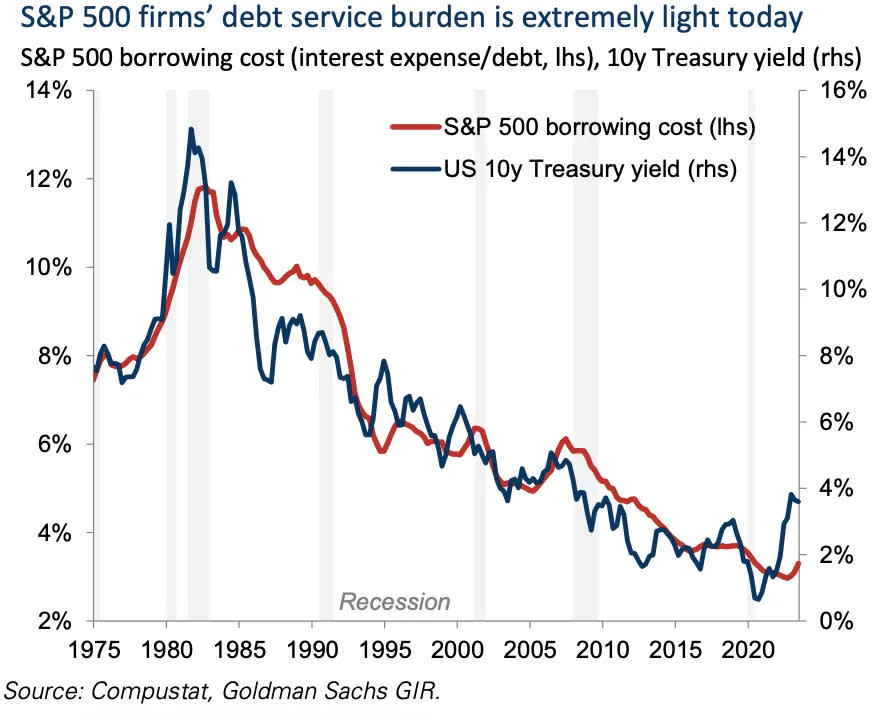

Similar to how most homeowners locked in their mortgages at very low rates, large corporations did a lot of refinancing in recent years, locking in low interest rates before borrowing costs surged.

As a result of these activities, nearly half of S&P 500 debt is set to mature after 2030, and interest expenses haven’t really budged amid elevated rates.

That said, there will still be some companies having to refinance debt in a more challenging borrowing environment.

We’ll have to keep an eye on the oscillations in interest rates and corporate bond spreads as we consider the impact of new borrowing.

For more, read: Why higher interest rates haven’t crushed corporate profits

8. Corporate earnings: Better or worse than the growth expected?

As we often say at TKer, earnings are the most important driver of stock prices in the long run. It’s literally the bottom line.

As the bottom line, earnings will be sensitive to almost every other big story we’ve discussed above. Economic strength will be reflected in sales. Inflation will affect nominal sales as well as costs. And profit margins will determine how much of those sales hit the bottom line.

Currently, analysts expect S&P 500 earnings to rise about 10% year over year in 2024 and another 12% in 2025.

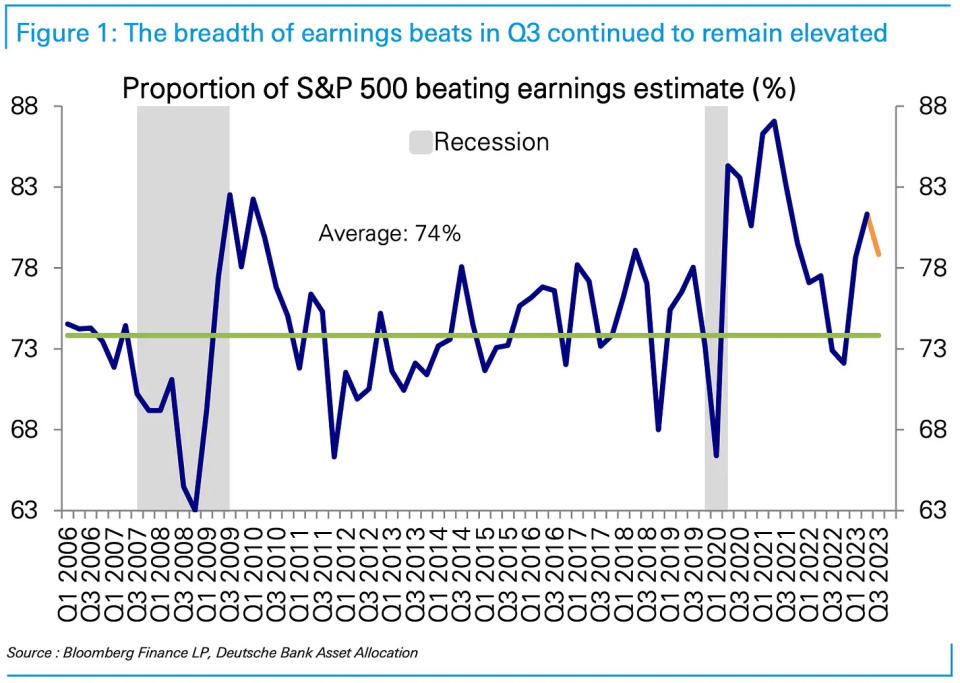

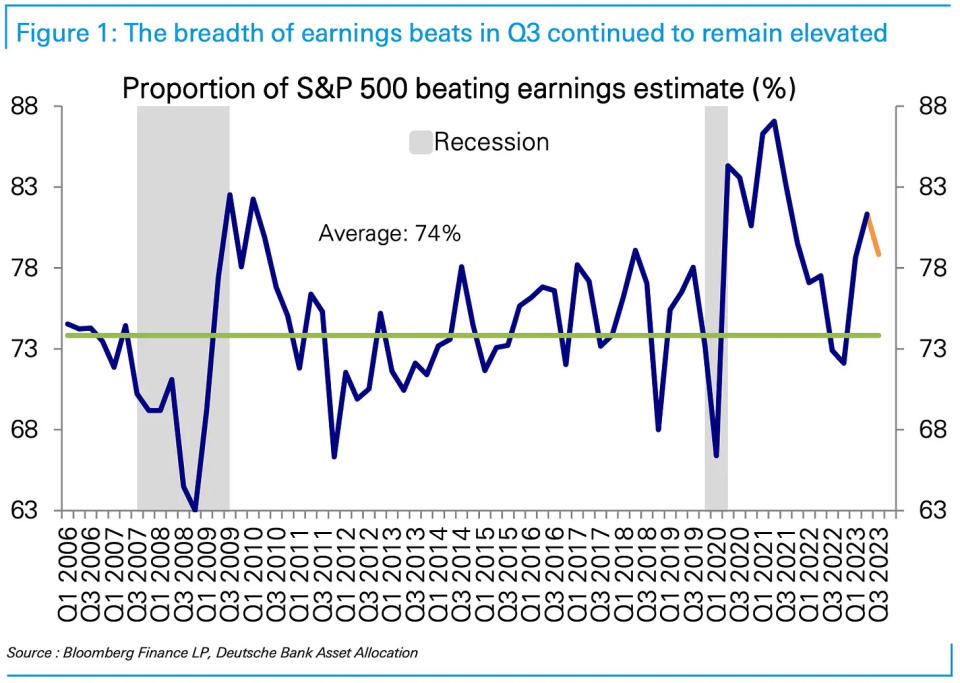

There are two things to remember when it comes to earnings estimates as 2024 unfolds: 1) Analysts typically cut their earnings estimates going into quarterly earnings season, and 2) most companies beat analysts’ quarterly earnings estimates.

For more, read: How to think of analysts’ earnings estimates

9. Stock market: Will it do what it usually does?

It is incredibly difficult to predict precisely what the stock market will do in any given year.

Even metrics like earnings growth and the forward P/E ratio, regardless of whether they are high or low, have a very weak relationship with the next-12 month’s market performance.

We do, however, know that the stock market usually goes up. Since 1950, we’ve been in a bull market 83% of the time.

There are tons of charts and stats I could share showing why the odds favor the bulls.

For now, I’ll share two from Carson Group’s Ryan Detrick.

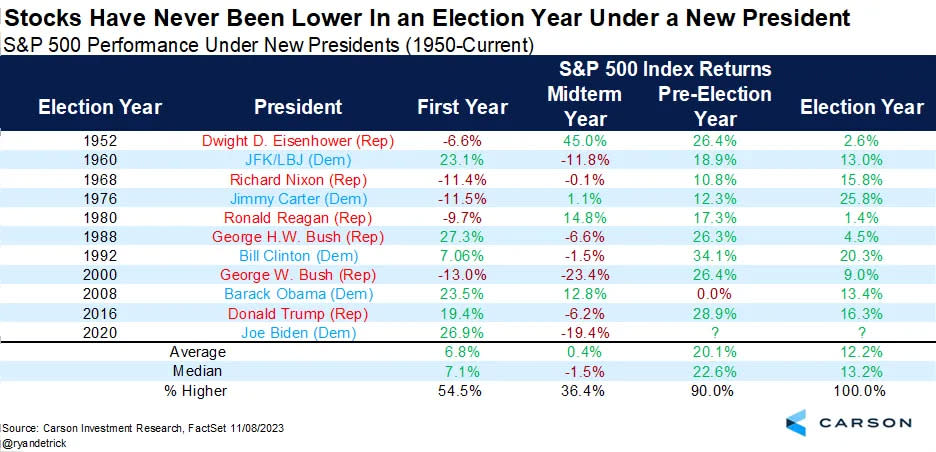

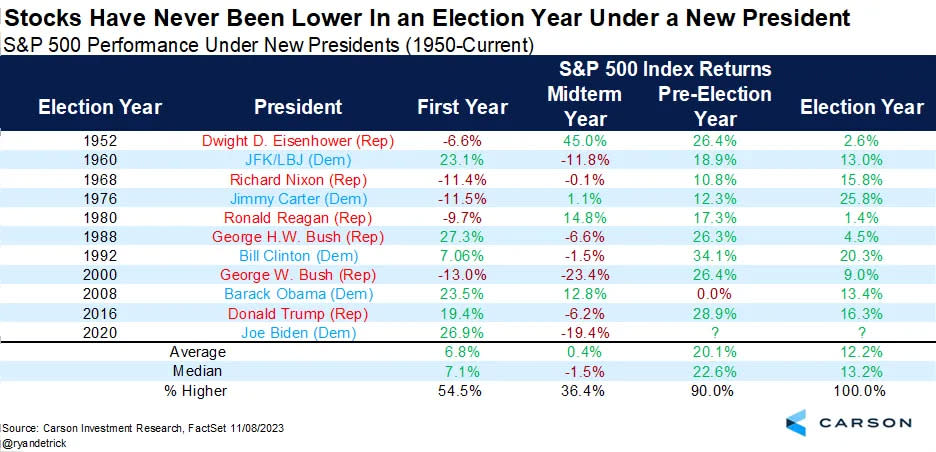

First: “[S]tocks have been higher during an election year of a new President going back to the past 10 Presidents! Even the historically strong pre-election year can’t say that. Higher the past 10 times and up 12.2% on average isn’t anything to ignore and that is inline with a potential low double-digit return in 2024.“

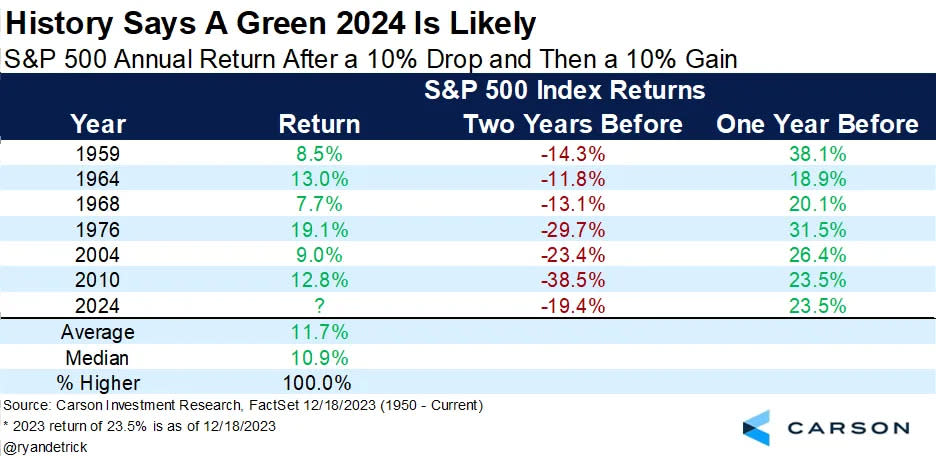

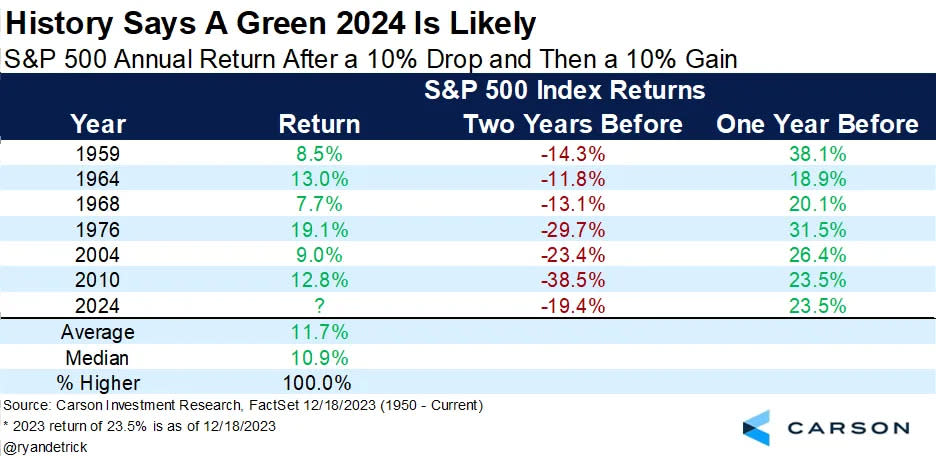

Second: “[W]hen stocks have dropped more than 10% (like 2022), then jumped more than 10% (like this year), that following year tended to be quite solid, up six out of six times with an 11.7% gain on average, which would likely make most bulls smile in ’24.

Oppenheimer’s Ari Wald had another two fascinating stats.

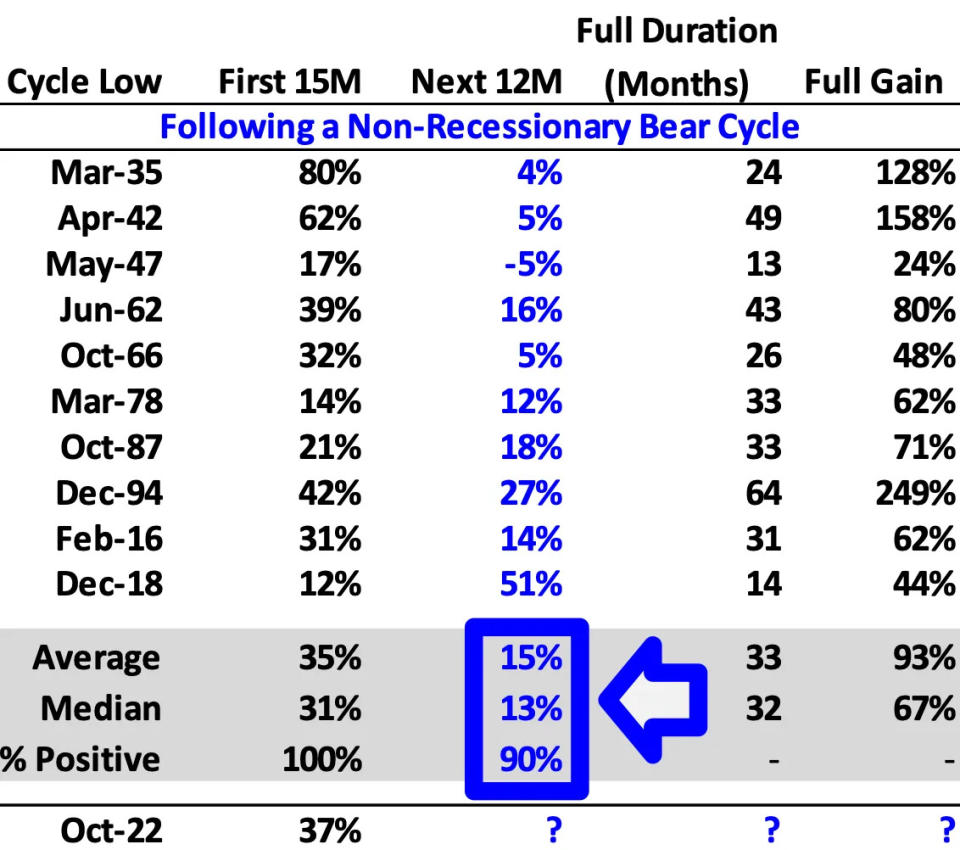

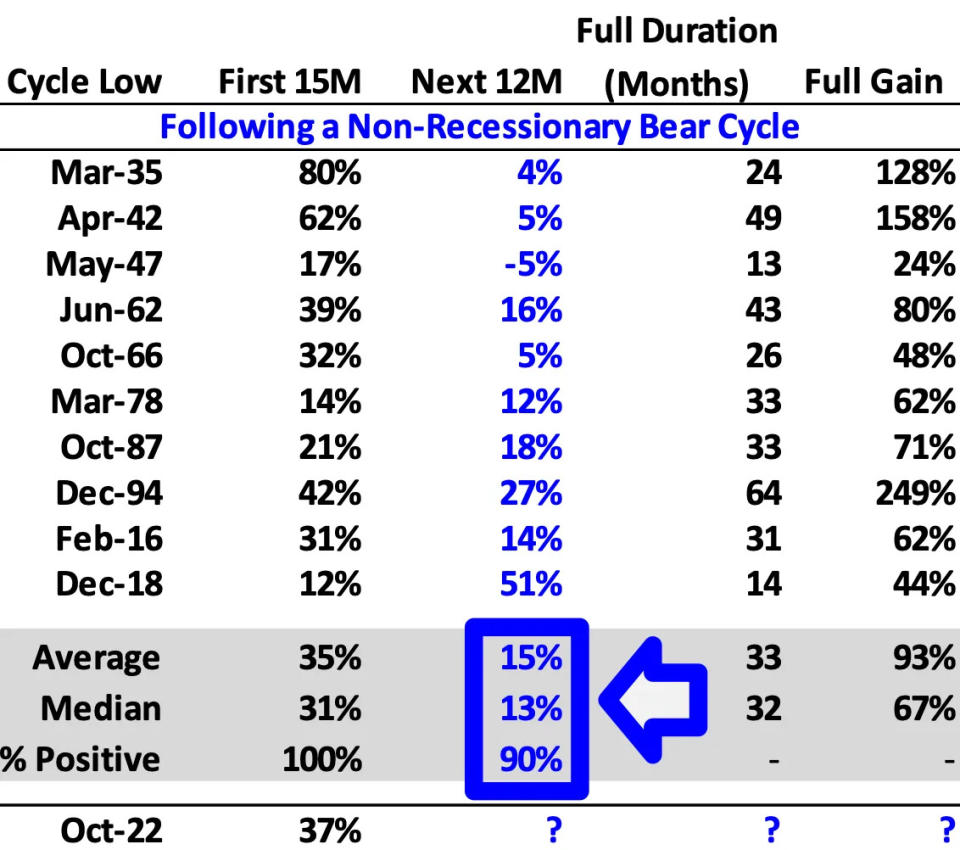

First: “Looking at bull cycles following a recessionary vs. non-recessionary bear, we’ve found the latter are usually steadier (lower year-1 returns followed by higher year-2 returns) and last just as long (median=32 months). The 37% gain since Oct. 2022 is on par with typical returns following a non-recessionary reset, and the median return between months 15 and 27 (Dec. 2023 to Dec. 2024) has been 13% which is the basis for our expectation for S&P 5,400.“

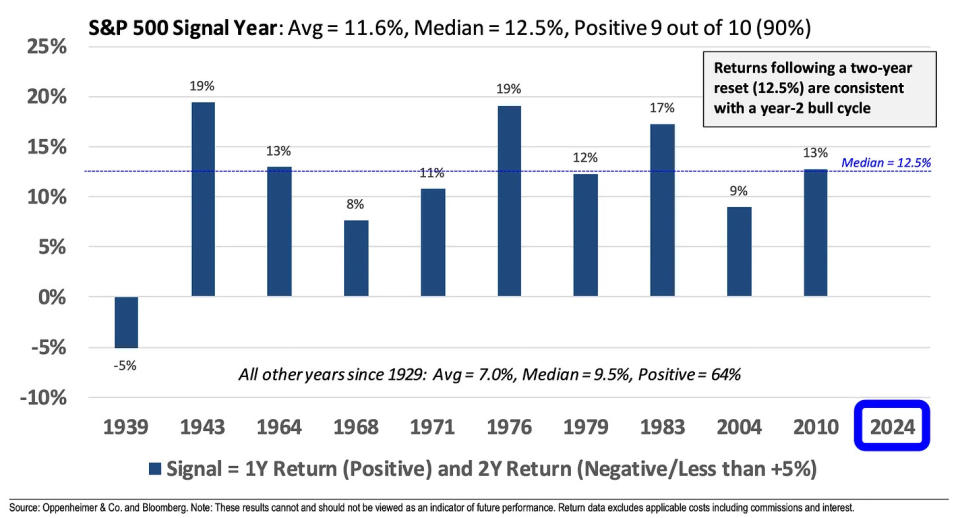

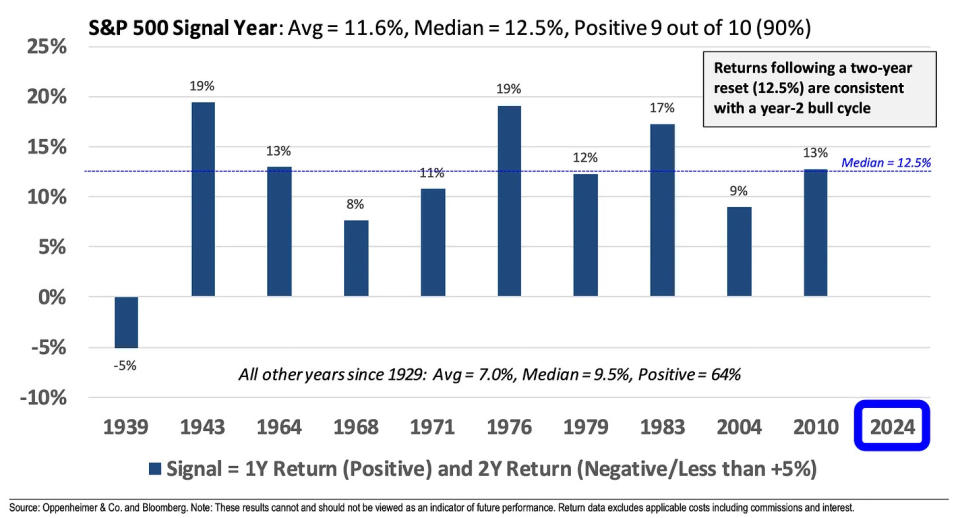

Second: “2024 will mark the 11th time since 1928 when the S&P 500 ended the prior year with a gain and was still flat-to-negative over a two-year period, indicative of positive momentum developing within a longer-term reset in price. In the ensuing year, the S&P 500 posted a median gain of 12.5% and traded positively 9 out of 10 times (90%). These returns are consistent with a year-2 bull cycle.“

I think it goes without saying that there are no sure things in life and the stock market. Just because something usually happens does not mean it always happens.

That said, we shouldn’t be surprised if the stock market does what it usually does.

For more, read: Wall Street’s 2024 outlook for stocks

Expect revised targets

TKer published Wall Street’s 2024 outlook for stocks on Dec. 3 when the S&P 500 was just below 4,600. At the time, the mean and median target year-end targets for the index was 4,800, implying about a 4% return.

In the days that followed, stocks continued to rally. And that came with strategists publishing more bullish forecasts for stocks, with at least two revising their targets higher. Currently, the mean and median year-end targets for the S&P 500 is 5,000.

But the S&P is now trading at around 4,770, implying about a 5% return.

Unless there’s a big deterioration in stock prices and their fundamentals in the coming weeks, expect Wall Street strategists to revise their targets higher, as they generally like to forecast 8%-10% gains in prices on rolling 12-month bases.

Having said all that, as I always say, predicting the stock market over one-year periods is incredibly difficult.

For more, read: The bulls get some company

Beware the unknown

Uncertainty is always high. It’s one of the cold hard truths about the stock market.

While there’s uncertainty about all the big talked-about stories — including the stories above — it’s the stuff that we’re not talking about that seemingly emerges out of nowhere that tends to be most destabilizing to markets.

Will there be a big unexpected event in 2024 that sends shockwaves through the economy and markets? Unfortunately, we’ll only know in hindsight.

For more, read: Sorry, but uncertainty will always be high

Zooming out

There are lots of unanswered questions out there. This is always the case when it comes to investing in the stock market.

For long-term investors, the best we can do is be as informed as possible as news comes in as we put in the time.