Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment grade (IG) e-trading hit 49% of total volume in US markets, the highest proportion ever, while high yield (HY) dawdled at 32%, giving a total average of 40.5% for credit e-trading in the US for that month.

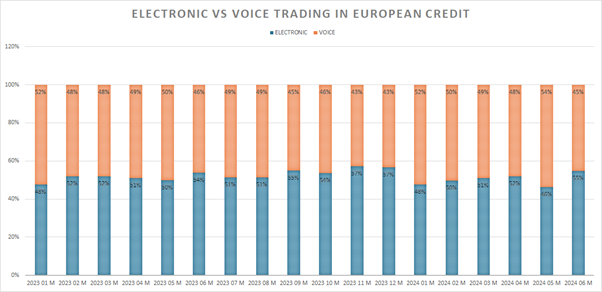

Looking at the European credit markets, analysis powered by Propellant technology found that in 2024, overall e-trading has averaged 50% a month in Europe including both IG and HY, but declined to 46% in May.

In the UK credit, monthly e-trading averaged 35% in 2024 and was also 35% of total credit trading in May. In the Propellant analysis, e-trading dealer-to-client (D2C) platform intermediated activity, while voice is direct D2C trading.

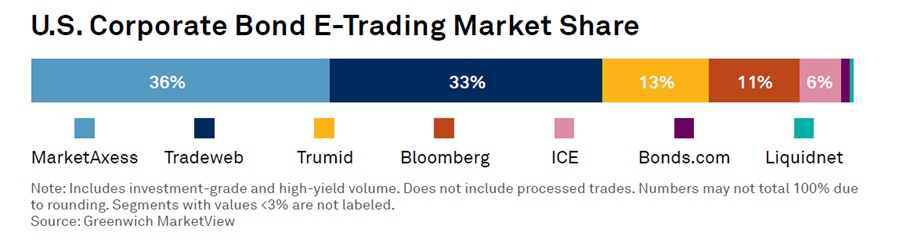

The Coalition Greenwich US market analysis included a breakdown of credit trading market share for e-trading platforms, indicating that MarketAxess is still dominant at 36% of total e-trading volume, while Tradeweb has successfully grown to 33%. Trumid – which reported its results early – is the third largest platform at 13%, just beating Bloomberg in fourth place with 11%. ICE makes up the top five with 6% share.

“We are excited that Bloomberg has begun reporting their US corporate bond trading volumes to [us],” wrote Kevin McPartland, report author and head of research for market structure and technology at Coalition Greenwich. “Bloomberg’s volume reported in MarketView includes TRACE-eligible investment-grade (IG) and high-yield (HY) volume across their ALLQ, BOLT, automation (ie, Rule Builder) and portfolio trading offerings. It does not include non-TRACE eligible trades (where no FINRA-registered broker-dealers are involved), trades booked via VCON or trades via single-dealer pages on the Terminal. We believe this view of Bloomberg’s trading volume presents the best apples-to-apples comparison with the other corporate bond trading venues.”

MarketAxess reported its US IG average daily volume (ADV) was US$6.1 billion, up 6% on a 15% increase in estimated market ADV. The strong increase in market volumes included a 35% increase in portfolio trading and dealer-to-dealer trading volume combined in May, which represented approximately 72% of the growth of the market year-over-year, the firms noted.

Its US high-yield ADV was reportedly US$1.3 billion, down 13%, with estimated market share of 13%, down from 17%.

“We believe the decrease in US high-yield estimated market share year-over-year was driven, in part, by lower levels of credit spread volatility and a greater focus on the new issue calendar by our long-only client segment,” the firm noted in a statement.

Chris Concannon, CEO of MarketAxess, said, “In May, we delivered strong growth in total credit ADV of 11%, driven by a 22% increase in emerging markets, a 25% increase in Eurobonds and a 43% increase in municipal bonds on record municipal bond market share of 8%. Our estimated market share of US high-grade portfolio trading was 22%, up from 13% in the prior year, and up from 15% in April, reflecting strong gains in portfolio trading. In May, approximately 55% of our portfolio trading volume was executed on X-Pro, as we continue the roll-out to our largest clients.”

Tradeweb reported its fully electronic US credit ADV was up 47% YoY to US$6.6 billion and European credit ADV was up 16% YoY to US$2.2 billion. It cited the higher volumes as driven by increased client adoption, most notably in request-for quote (RFQ), portfolio trading and Tradeweb AllTrade, while European credit volumes were driven by portfolio trading and the firm’s dealer selection tool (SNAP IOI) which is used via Automated Intelligent Execution (AiEX) and RFQ.

In the government bond space, Coalition Greenwich found D2C e-trading in US markets made up 63% of market activity for US Treasuries in May, where in May 2019 only 46% of D2C trading was electronic.

“Considering higher total market volumes between 2019 and today, that jump in e-trading is even more meaningful,” noted McPartland. “The average daily notional volume (ADNV) in May 2019 was US$554 billion with ~$255 billion traded electronically. In May 2024, the ADNV of US$823 billion included nearly $520 billion of electronic volume—a near doubling. These metrics are yet another sign of a market that has shifted from being very dealer-to-dealer centric to one where investors are huge driving forces of trading activity.”

UK government bond e-trading was 54% of D2C activity in the UK and 41% in Europe during May, while D2C European government bond e-trading was 49% of activity in the UK and 28% in Europe for the same month, according to analysis delivered by Propellant.

Tradeweb’s US government bond ADV was up 33% YoY to US$192.5 billion and European government bond ADV was down 0.4% YoY to US$41.4 billion. The firm noted that US government bond volumes were supported by growth across all client sectors, with increased adoption across a wide range of protocols and favourable market conditions contributing to the increase in volume with a positive contribution from recently acquired r8fin. In Europe market volatility and sustained primary issuance across Europe and the UK helped drive trading volume in European government bonds.

MarketAxess noted that its total rates ADV was US$18.8 billion in May, up 15% versus the prior year.