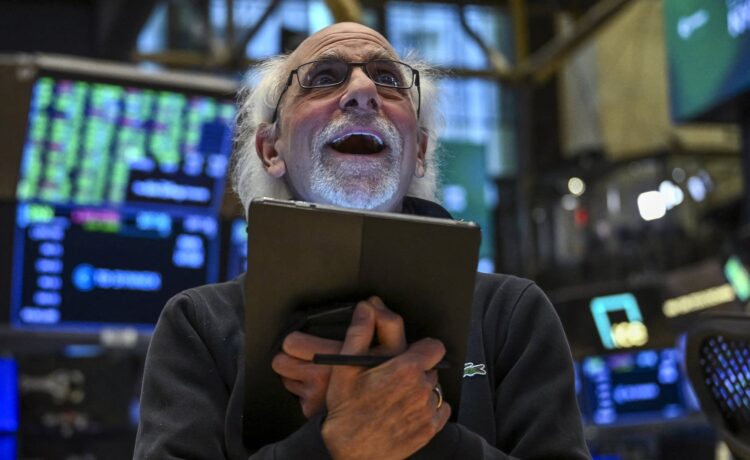

The headlines have started to surface — speculation about whether traders in financial markets are pushing prices higher, to the point where they’re not exactly justified by underlying values and fundamentals. Is it cause for concern?

“Marketplace Morning Report” host David Brancaccio spoke with Barry Ritholtz, chairman and chief investment officer at Ritholtz Wealth Management in New York. The following is an edited transcript of their conversation.

David Brancaccio: The stock market seems to be going, and people seem to be — what’s the term these people use … “risk on?” Trees grow to the sky, they seem to go to space. Stock market indicators are up. Meme stocks are back. Crypto is in. Does that worry you?

Barry Ritholtz: So everything you’re describing has been a characteristic of the market, I don’t know, since we made the lows in March 2009. We’ve seen meme stocks come and go. We’ve seen crypto explode. I’m more intrigued by the fact that, for the first time in, I don’t know, a dozen years, emerging markets are doing well. Europe is substantially outperforming the United States, at least in terms of market returns. I’m not sure everybody’s focus should be solely on what’s going on in the U.S. Obviously, American markets are the most influential and largest part of the global equity world. When we look at earnings, it’s kind of hard to say, “Hey, this is unjustified froth.” Look at Microsoft, look at Facebook. These guys are shooting the lights out. It’s no surprise their stocks are at or near all-time highs

Brancaccio: Some people will say, “Well, I’ve done very well since that market mess in April, I do have questions about whether this continues, time to take profits.” I mean, the challenge there is that does sound a little like market timing, and it’s hard to get market timing right.

Ritholtz: We’ve seen a lot of all-time highs, and whenever we hit all-time highs, I invariably get a run of emails saying, “Hey, the market looks toppy. It looks frothy. All-time highs make me nervous.” So I wrote up a column explaining, “Here’s the history of all-time highs and why markets tend to do well when they make all-time highs,” and published it. And got a ton of pushback on it. The problem is, that column was published at Bloomberg in 2014. Imagine if you said, “The market looks toppy, we’re at new all-time highs. I’m tapping out.” That was 60%, 65% ago. It’s really, really difficult, if not impossible, to guess when the market is making that key reversal at the top. I don’t want to suggest there aren’t problems, that everything is perfect, but on average, when you have low inflation and low unemployment, kind of hard to be too bearish on the overall stock market.