(Bloomberg) — Asia-Pacific shares look to be poised for modest gains to open the week, even as traders eye the potential for crude oil to extend its climb amid violence in the Middle East.

Most Read from Bloomberg

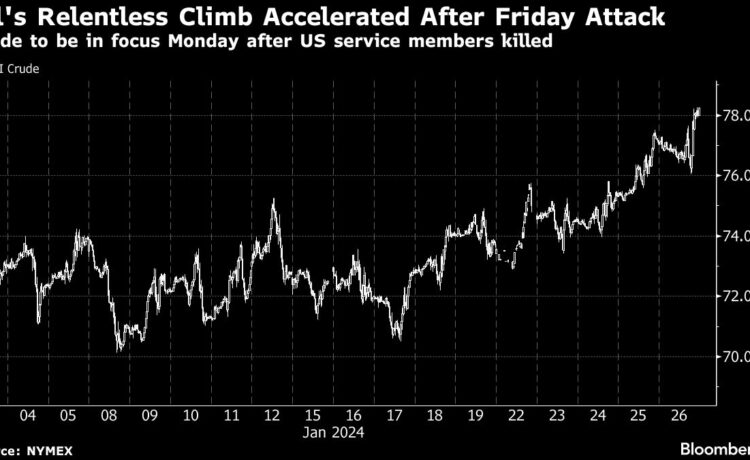

Futures pointed to gains for Tokyo, Hong Kong and Sydney benchmarks. Oil will be in focus after the US said Iranian-backed militants killed three service members near the Syrian border, the first American deaths under enemy attack since Israel and Hamas went to war. West Texas Intermediate rose to top $78 a barrel on Friday, the highest since November, after Houthi rebels attacked a vessel carrying Russian fuel.

Stocks wavered and bonds retreated in the US on Friday, as mixed economic data spurred concerns the Federal Reserve will signal patience about the pace of interest-rate cuts when it meets on Wednesday. This week also brings a slew of key data, from European GDP on Tuesday, to China PMI and Australian inflation on Wednesday, then European inflation and a Bank of England policy decision on Thursday.

“We think the Fed is likely to reiterate its data-dependent stance and caution that it is willing to exercise patience,” analysts at ANZ Bank Ltd., including Miles Workman, wrote in a report. “The Fed will be cautious about any reacceleration of inflation pressures from above-trend growth and the resilient labor market.”

Chinese equities will look to build on their first weekly gain since the end of December, after the nation’s securities regulator announced Sunday it will halt the lending of certain shares for short selling from Monday. The authorities are taking measures following an alarming slide in Chinese stocks — the MSCI China Index has lost 60% from a February 2021 peak.

Singapore’s central bank will likely keep its tight monetary policy settings for a third straight review when it meets Monday, while retaining its sharp focus on still-elevated inflation.

Stocks

-

S&P 500 fell 0.1% to 4,890.97 on Friday

-

Nikkei 225 futures rose 0.6%

-

Hang Seng futures rose 0.8%

-

S&P/ASX 200 futures rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.0845 at 7:15 a.m. in Tokyo

-

The Japanese yen was little changed at 148.13 per dollar

-

The offshore yuan was little changed at 7.1862 per dollar

Cryptocurrencies

-

Bitcoin fell 0.2% to $41,890.26

-

Ether fell 0.1% to $2,260.9

Bonds

Commodities

-

West Texas Intermediate crude rose 0.8% to $78.01 a barrel on Friday

-

Spot gold fell 0.1% to $2,018.52 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.