(Bloomberg) — Asian equity benchmarks open higher Tuesday following a rally in several large technology companies which drove US stocks to another record.

Most Read from Bloomberg

Japanese, South Korean and Australian shares climbed in early trading, while futures contracts for stocks in Hong Kong showed gains. That comes after the S&P 500 hit its 30th record this year, defying concerns about narrow breadth that could make the market more vulnerable to surprises.

The US benchmark index topped 5,470, with Tesla Inc. and Apple Inc. leading gains in megacaps. The Nasdaq 100 came closer to the 20,000 mark as Micron Technology Inc. climbed to a record after some firms raised their targets. Broadcom Inc. jumped over 5%.

Ahead of Wednesday’s holiday in the US, traders geared up for retail-sales data and a slew of Federal Reserve speakers. Treasuries steadied after falling Monday amid a flurry of high-grade corporate bond sales that exceeded $21 billion, led by Home Depot Inc. The dollar weakened against all of its Group-of-10 peers.

“We believe the S&P 500 can reach 6,000 by year-end as the combination of better earnings and one or two rate cuts is like a turbo booster for stock prices,” said James Demmert at Main Street Research. “The Fed may not need to cut rates this year — but if they do, it will be even more bullish for equities, particularly tech.”

Optimism over a resilient economy, improving corporate earnings and the potential start of rate cuts have pushed US equities up about 15% this year. Fed Bank of Philadelphia President Patrick Harker said he sees one rate cut as appropriate for this year based on his current forecast.

While there’s been no shortage of headlines about the latest record highs on the S&P 500, the highs have been less significant as a sign of market strength than as an influence on investor sentiment, according to Tim Hayes at Ned Davis Research.

“As record highs were reached by major benchmarks, breadth has weakened,” he said. “Benchmark records are not confirmed by most markets, sectors and stocks.”

Elsewhere, French stocks rebounded after last week’s tumble. Yet the Stoxx Europe 600 Index was little changed as Citigroup Inc. downgraded the region’s equities, citing “heightened political risks” among other reasons.

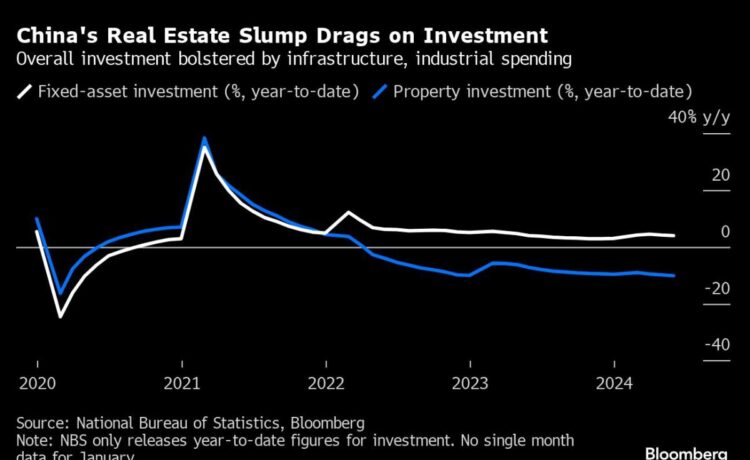

In Asia, traders are still digesting China’s disappointing data dump from Monday, which showed the nation’s housing slump deepened in May, triggering new calls for the government to pump cash and credit into the economy. Declines in real estate investment and home prices both gathered pace last month.

There will also be a close watch on the implecations of Beijing’s latest move in its trade tensions with Brussels, after China launched an anti-dumping probe on pork imports from the European Union. That comes as the bloc looks at Chinese subsidies across a range of industries and will impose tariffs on electric car imports from July.

Meanwhile, Australia’s central bank on Tuesday will likely keep the cash rate at a 12-year high of 4.35% for a fifth straight meeting, economists surveyed by Bloomberg predicted. The nation’s 10-year yield advanced one basis point to 4.12%.

New Highs

In the US, gains in the shares of technology giants are likely to keep pushing the S&P 500 to new highs, says Citigroup Inc.’s Scott Chronert.

The bank’s US equity strategist boosted his year-end forecast for the stock benchmark on Monday, to 5,600 from 5,100. He cited continued strength in the so-called Magnificent Seven stocks and expectations for earnings growth to extend to other S&P 500 companies.

Citigroup is the third firm since Friday’s close to lift its forecast for the gauge, joining Goldman Sachs Group Inc. and Evercore ISI as US stocks keep climbing to records.

In commodities, oil steadied after gaining on Monday where it built on its biggest weekly advance since early April. Goldwas little changed after slipping in the previous session.

Key events this week:

-

Australia rate decision, Tuesday

-

Eurozone CPI, Tuesday

-

US retail sales, business inventories, industrial production, Tuesday

-

Fed’s Thomas Barkin, Lorie Logan, Adriana Kugler, Alberto Musalem, Austan Goolsbee speak, Tuesday

-

UK CPI, Wednesday

-

US Juneteenth holiday, Wednesday

-

China loan prime rates, Thursday

-

Eurozone consumer confidence, Thursday

-

UK BOE rate decision, Thursday

-

US housing starts, initial jobless claims, Thursday

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

-

US existing home sales, Conf. Board leading index, Friday

-

Fed’s Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 9:20 a.m. Tokyo time

-

Hang Seng futures rose 0.4%

-

Japan’s Topix rose 0.8%

-

Australia’s S&P/ASX 200 rose 0.6%

-

Euro Stoxx 50 futures rose 0.8%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0737

-

The Japanese yen was little changed at 157.66 per dollar

-

The offshore yuan was little changed at 7.2715 per dollar

-

The Australian dollar was little changed at $0.6615

Cryptocurrencies

-

Bitcoin was little changed at $66,310.27

-

Ether fell 0.6% to $3,493.69

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.27%

-

Japan’s 10-year yield advanced one basis point to 0.935%

-

Australia’s 10-year yield advanced one basis point to 4.12%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.