PUBLISHED : 27 Jan 2024 at 04:00

RECAP: The rally in most Asian markets was interrupted yesterday, with profit-taking seen in Hong Kong and Shanghai as traders await more guidance on China’s plans to support the country’s battered economy.

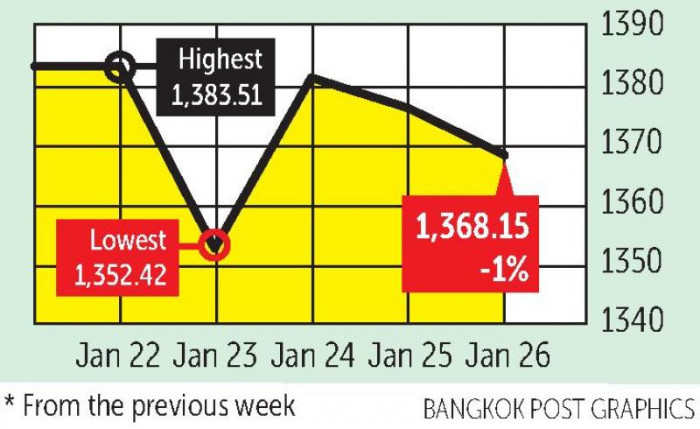

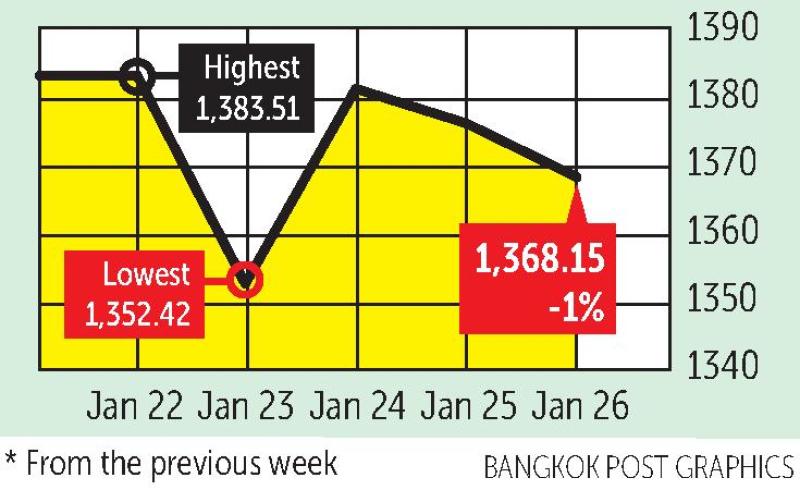

Thai shares moved in a range of 1,352.42 and 1,383.51 points this week, before closing yesterday at 1,368.15, down 1% from the previous week, with daily turnover averaging 48.53 billion baht.

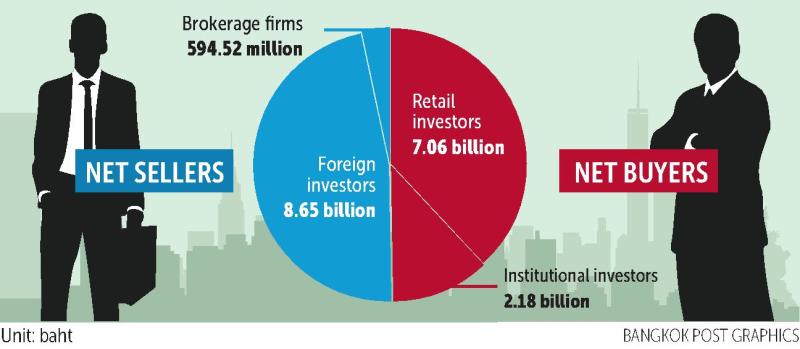

Retail investors were net buyers of 7.06 billion baht, followed by institutional investors at 2.18 billion. Foreign investors were net sellers of 8.65 billion baht, followed by brokers at 594.52 million.

NEWSMAKERS: US gross domestic product (GDP) grew by 3.3% year-on-year in the fourth quarter of 2023, down from 4.9% in the previous quarter but in line with pre-pandemic growth, and well ahead of the 2% economists had expected, underlining the continued resilience of the economy.

- The US Consumer Confidence Index for January beat expectations and was the highest since July 2021, backed by greater optimism about the economy and future prospects, as inflation concerns eased.

- US new home sales in December increased 4.4% year on year to 664,000 units, higher than market expectations.

- The European Central Bank (ECB) on Thursday kept its key interest rate steady at a record high of 4% as widely expected, and reiterated it would keep rates high for long enough to bring inflation, now at 2.9%, down to its 2% target.

- The People’s Bank of China on Wednesday made a 50-basis-points cut, the biggest in two years, in the cash reserve requirement for banks. The move will inject about $140 billion into the system, sending a strong signal of support for a fragile economy. The PBOC earlier left its benchmark one-year loan prime rate unchanged.

- China is preparing to introduce a $278-billion package to revitalise stock markets through share purchases, primarily financed by the foreign accounts of state-owned enterprises.

- China reported a 14% year-on-year increase in imports of machinery for chip manufacturing in 2023, to nearly $40 billion, as companies sought to counteract the impact of US sanctions on Chinese high-tech industries.

- China’s transport ministry expects record-breaking travel during the 40-day Chunyun period, including Chinese New Year on Feb 10, with 9 billion trips.

- North Dakota, the third-largest oil-producing state in the US, has resumed oil production after a shutdown due to extremely cold weather. The US Energy Information said crude oil inventories fell by 9.2 million barrels in the week to Jan 19, indicating strong demand in the market.

- Bank of Japan Governor Kazuo Ueda said monetary conditions would remain accommodative even after the central bank decides to end negative interest rates, with its 2% inflation target in sight.

- Netflix said it signed up 13.1 million customers, 4 million more than market forecasts, in the final three months of 2023, the streaming giant’s best quarter of growth since viewers were stuck at home in the early days of the pandemic. Fourth-quarter revenue of $8.83 billion also beat market expectations, and it forecast 24% revenue growth this year.

- Toyota Motor Corp chairman Akio Toyoda believes the market share of battery electric is unlikely to ever top 30%, with the rest taken up by hybrids, hydrogen fuel cell and fuel-burning cars.

- Bitcoin steadied around $40,000 amid a slowdown in outflows from US exchange-traded funds. The cryptocurrency hit a high of $49,021 on the day the ETFs went live earlier this month.

- Alibaba shares gained the most in six months on reports that billionaire co-founder Jack Ma bought $50 million in stock and chairman Joseph Tsai chipped in $150 million in the last quarter, signalling confidence in the company.

- Tesla shares plunged 9% amid forecasts for slower growth, even as founder Elon Musk urged investors to take a longer view. The company spent all of 2023 cutting prices to boost sales, which ate into profits.

- The luxury goods group LVMH posted a 10% rise in fourth-quarter sales, driven by resilient demand for its high-end fashion labels. Sales at the world’s biggest luxury group, which owns Louis Vuitton, Dior and Tiffany, came to nearly €24 billion.

- The subway operator Tokyo Metro Co plans to go public this year, as the Japanese and Tokyo Metropolitan governments start selling half of their combined shares, Nikkei reported.

- Taiwan reported a 16% year-on-year drop in export orders in December to $43.8 billion, the lowest since July 2023. Export orders for January are expected to contract by as much as 20% year-on-year.

- Moody’s has a negative outlook on the credit ratings of countries in the Asia-Pacific region for 2024 due to China’s economic slowdown, financial tightening and geopolitical risks.

- The National Economic and Social Development Council (NESDC) lowered its estimate for Thailand’s 2023 GDP growth to 1.8%, citing a continuous 14-month contraction in industrial production. This indicates a sustained but non-crisis slowdown in economic expansion. The NESDC will release the final official figures for 2023 on Feb 19.

- The International Monetary Fund forecasts 4.4% GDP growth for Thailand this year if the government’s digital wallet programme goes ahead.

- Prime Minister Srettha Thavisin said the government is preparing more economic stimulus measures in view of lower GDP growth, and these will not include the digital wallet.

- Thailand’s exports rose for a fifth straight month in December, but the 4.7% annualised gain was down slightly from 4.9% in November. The Ministry of Commerce said it expected modest export growth in 2024 after a slight drop last year.

- The struggling local media company JKN Global Group Plc said it would sell a 50% stake in its Miss Universe business for $16 million (570 million baht) to the Mexican businessman Raul Rocha Cantu.

- Franklin Templeton is weighing expansion in Thailand, seeking to lure local investors in offshore products as the US-based asset manager strengthens its Asia operations.

- The Securities and Exchange Commission plans to restrict Thais from investing in non-voting depository receipts (NVDRs) and is seeking comments on a proposal to prohibit securities companies from providing such services.

- The Ministry of Energy is monitoring global oil prices to decide whether to continue lowering gasoline prices after the 2.50-baht reduction in Gasohol 91 prices expires on Jan 31.

- The Chinese carmaker Changan Automobile is upbeat about Thailand’s EV market, designating the country as its strategic export base with an ambitious target of selling 20,000 EVs in the country this year.

- Production of lithium in Phangnga province could begin in about two years, boosting the country’s ambitions to become a regional electric vehicle (EV) production hub, according to government and company officials involved.

- The Real Estate Information Center said the home construction cost index was 134.5 in the final quarter of 2023, an increase of 2% year-on-year.

- The Department of Business Development expects 90,000 to 95,000 new businesses to register in 2024, an increase of at least 5%. Foreign investment in Thailand is projected to be between 130 billion and 150 billion baht, up 5-15%.

- The Ministry of Tourism and Sports reported 715,579 foreign arrivals between Jan 15 and 21, up 3% from a week earlier, with the top five countries of origin being China, Malaysia, South Korea, Russia and India.

- Airports of Thailand (AOT) is planning to develop commercial areas at Suvarnabhumi Airport to diversify its revenue. It is increasing capacity, including improving cargo efficiency. A study of the investment is expected to be completed this year.

COMING UP: On Tuesday, the US will release the November housing price index and Japan will release December retail sales and industrial production. Also due are EU January consumer confidence and Chinese manufacturing PMI. On Wednesday, the EU will release fourth-quarter GDP and Japan will report household confidence. The US Federal Reserve will release its interest-rate decision on Wednesday (Thursday 2am Thailand time) and the US will release January unemployment data on Friday.

STOCKS TO WATCH: InnovestX Securities recommends accumulating defensive and fundamental stocks based on two main themes. First, for medium-term investors, it recommends high-quality dividend stocks of firms that have paid a consistent dividend for at least 10 years and have ESG ratings of AAA or AA, a yield above 5%, and expected year-on-year profit growth in 2024. Top picks are AP, BCP and KTB.

- Second, for long-term investors, it recommends dollar-cost averaging investment as the SET has fallen significantly so downside risk is low. Suggested stocks are BBL, BDMS, BEM, CPALL, PTT and SCC, all in the SET100 and leaders in their sectors with ESG ratings of AAA and AA, valuations below the 10-year average and strong operating results.

- Asia Plus Securities recommends earnings recovery plays. The first group comprises firms expected to report Q4 profits and whose stock prices have dropped significantly. They include SCC, ITD, IRPC, PSH, KKP, SIRI, KTB, EA, CPN, AP, BBL, BEM, GUNKUL, CK, KBANK, and TOP. The second group includes stocks expected to see profits recover this quarter, among them KTB, KBANK, BBL, SCCC, CK, GULF, INTUCH, CPN, SJWD, AOT and BEM.

TECHNICAL VIEW: InnovestX Securities sees support at 1,354 points and resistance at 1,395. Krungsri Securities sees support at 1,350 and resistance at 1,390.