Some of the newer financial technology stocks (or fintechs) have endured wide-ranging interest rates, making for a wild ride. Upstart Holdings (NASDAQ: UPST) and SoFi Technologies (NASDAQ: SOFI) went public between 2020 and 2021 amid zero-percent interest rates intended to buoy the U.S. economy during the coronavirus epidemic.

However, these rates ultimately inflated a stock market bubble that popped once the Fed aggressively raised rates to combat post-pandemic inflation. Today, both stocks remain well below their former highs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Early-stage growing companies like these are never easy to gauge, and the volatile economy has only added to the challenge. So, which fintech stock is the better buy for the future?

Here is what you need to know.

Exploring our two contenders:

SoFi Technologies is primarily a digital bank, although it has a fintech unit (Galileo) that provides technology services for 160 million users across various financial apps and products. SoFi’s banking business continues to grow. Its customer count has risen from just over a million in early 2020 to 9.3 million as of the third quarter of 2024.

The company’s explosive user growth helped it expand its top and bottom lines. It became profitable on the basis of generally accepted accounting principles (GAAP) in 2024 despite facing headwinds caused by a federal student loan repayment pause from 2020 to 2023. Student loan financing was SoFi’s largest business before the pandemic.

Upstart uses proprietary artificial intelligence (AI) algorithms to evaluate borrowers’ creditworthiness for consumer loans. The company prefers to originate loans and refer them to partner banks or institutional investors. It has proved it can be highly profitable, generating a significant GAAP profit in 2021.

Rate hikes happened so quickly from 2022 to 2023 that Upstart’s business collapsed. Loan demand faltered, and the company got stuck holding loans on its books after buyers dried up. Today, the company is losing money, and its loan volume hasn’t recovered, though growth has returned since the Fed started lowering rates late last year.

One company has a slight edge in today’s economy.

Following its zero-percent policy, the Fed’s 2022-2023 rate hikes created one of history’s steepest cycles. Barring extreme circumstances, the Fed should move slower to change rates. Now is the right time to evaluate how each company may fare in today’s economy.

Banks like SoFi earn net interest income from the difference between what they pay on deposits and what they earn on loans. Higher rates can widen that spread, but they must not be so high that fewer people borrow. As the federal pause ends and financing activity picks up, it could be a boon for SoFi’s student loan business.

Upstart’s business has begun picking up momentum. The company has been able to move loans off its balance sheet, and loan volumes have improved since the Fed stopped hiking rates last year.

To reduce the volatility in its business, management also began arranging funding partners for its loans, meaning there are committed buyers rather than having to try to sell loans to a live market.

Both SoFi and Upstart depend on consumer lending at their core (Upstart more so than SoFi), so a recession or other event that disrupts borrowing would hurt each business.

There is a clear winner, though the runner-up has long-term potential.

SoFi’s user increase has helped it grow and turn profitable through its student loan headwinds. I think that makes the stock a safer investment right now. Upstart’s business has evolved over the past couple of years, but it was so susceptible to interest rate changes that investors may hesitate to trust the company until it proves itself for a while longer.

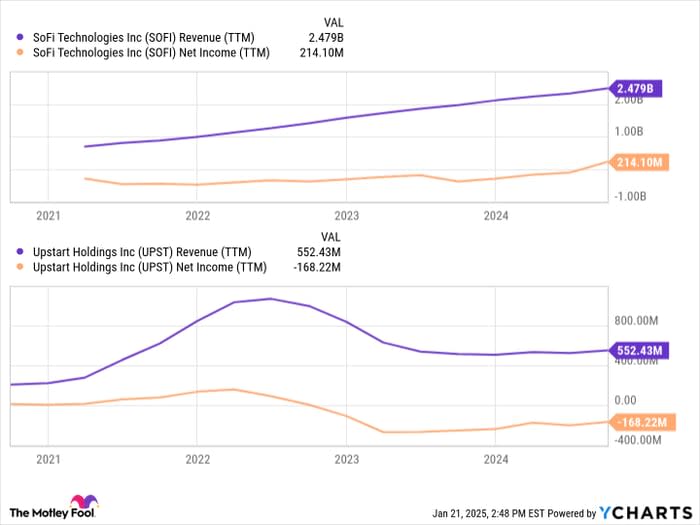

A picture (or a chart) can say a thousand words. Just look at how SoFi’s revenue and earnings trajectory are far more stable than Upstart’s:

SOFI revenue (TTM) data by YCharts; TTM = trailing 12 months.

That’s not to say Upstart doesn’t have potential. The company’s credit evaluation AI seems to work, and there are massive expansion opportunities outside personal loans, such as automotive loans, home equity, and business loans.

The bottom line? SoFi offers the better combination of dependability and upside today. Analysts estimate it will grow earnings by an average of 50% annually over the next three to five years. I think that’s doable because of the bank’s growth catalysts, which include:

-

User growth (35% in the third quarter of 2024).

-

Cross-selling of services within its app.

-

Student loan upside as borrowing and refinancing recovers.

Meanwhile, the stock trades at a forward price-to-earnings ratio (P/E) of 56 today. While that’s expensive for most companies, SoFi’s anticipated growth makes a rock-solid argument for buying the stock today.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $369,816!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,191!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $527,206!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 21, 2025

Justin Pope has positions in Upstart. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure policy.