The “Magnificent Seven” tech stocks have been a hot topic lately, thanks to the outsized influence these mega-caps have had on the broader market’s overall returns. The Mag 7 – a lineup that unofficially includes mega-cap names Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Meta (META), Alphabet (GOOGL), and Tesla (TSLA) – gained a staggering $5.1 trillion in total market cap during 2023. Collectively, U.S.-listed stocks would have advanced by just 12.6% last year without the Magnificent Seven’s influence, compared to 23.3% with their returns included.

Not to be outdone, European markets have their own supergroup of influential stocks, too. Europe’s answer to the Magnificent Seven are the GRANOLAS, a term initially coined back in 2020 by Goldman Sachs (GS). The members of this high-powered acronym include well-known names to any investor – GSK (GSK), Roche (RHHBY), ASML (ASML), Nestle (NSRGY), Novartis (NVS), Novo Nordisk (NVO), L’Oreal (LRLCF), LVMH (LVMUY), AstraZeneca (AZN), SAP (SAP) and Sanofi (SNY) – though the GRANOLAS offer a more distinct tilt toward healthcare and consumer discretionary stocks than the tech-heavy Mag 7.

But for investors seeking attractive valuations and upside potential in this market, investment bank JPMorgan (JPM) recently weighed in with its own top European stock picks. Here’s a look at three of those names, all of which are energy stocks that pay dividends.

1. Eni S.P.A. (E)

We start JPMorgan’s preferred list of European stocks with Eni (E). Founded in 1953 and focused on the exploration and production of oil and gas in Italy, the company has expanded its operations internationally, becoming a major integrated energy company. Its major segments include exploration and production; gas and power; and refining and marketing. Now operating in 62 countries, the company currently commands a market cap of $54.9 billion.

U.S.-traded shares of Eni are down 9.1% on a YTD basis. The stock offers a forward dividend yield of 6.75%, above the sector median of 3.78%.

Eni’s latest quarterly results were a disappointment as the company reported a 32.7% yearly decline in EPS to $1.06 – missing the consensus estimate. However, hydrocarbon production levels were up 6% from the previous year to 1,708 kboe/d from 1,617 kboe/d in the year-ago period.

Further, Eni plans to double its biorefining capacity to 3 million tons by 2025 with the addition of 300 new service stations. To help unlock shareholder value, the company is also eyeing spinoffs of its “satellite” businesses – Plenitude, focused on renewable energy and power generation, and Eni Sustainable Mobility.

The company looks reasonably priced to JPMorgan, valued at a forward price/earnings ratio of 6.3, with analysts expecting EPS growth of 2% in 2025.

Overall, analysts have deemed the stock a “Moderate Buy” with a mean target price of $34.55. This denotes an upside potential of about 11.7% from current levels. Out of 11 analysts covering the stock, 6 have a “Strong Buy” rating and 5 have a “Hold” rating.

2. TotalEnergies Se (TTE)

Founded in 1924, TotalEnergies (TTE) is perhaps one of the most well-known integrated energy companies in the world, with a diversified portfolio and numerous operating segments – including Exploration & Production, Integrated Gas, Renewables & Power, Refining & Chemicals, and Marketing & Services. Its market cap currently stands at a whopping $157.2 billion.

TotalEnergies stock is down 4.3% on a YTD basis. The stock offers a forward dividend yield of 4.90%, with the modest payout ratio of 35.4% suggesting there’s room for these dividends to grow.

In its results for the latest quarter, TTE reported a 27.3% yearly decline in earnings to $2.16 per share, which fell short of the consensus estimate. However, revenue of $54.77 billion beat Wall Street’s forecast.

Among TotalEnergies’ varied businesses is its majority stake in SunPower (SPWR), a leading US-distributed solar power generation company. It develops rooftop systems for residential, industrial and commercial buildings as well as solar carport solutions. With actual rooftop solar PV penetration in the US at a low 4%, the scope for growth remains considerable.

JPMorgan analysts are forecasting the company’s EPS to grow by 4% in 2025, with a forward P/E of 7.

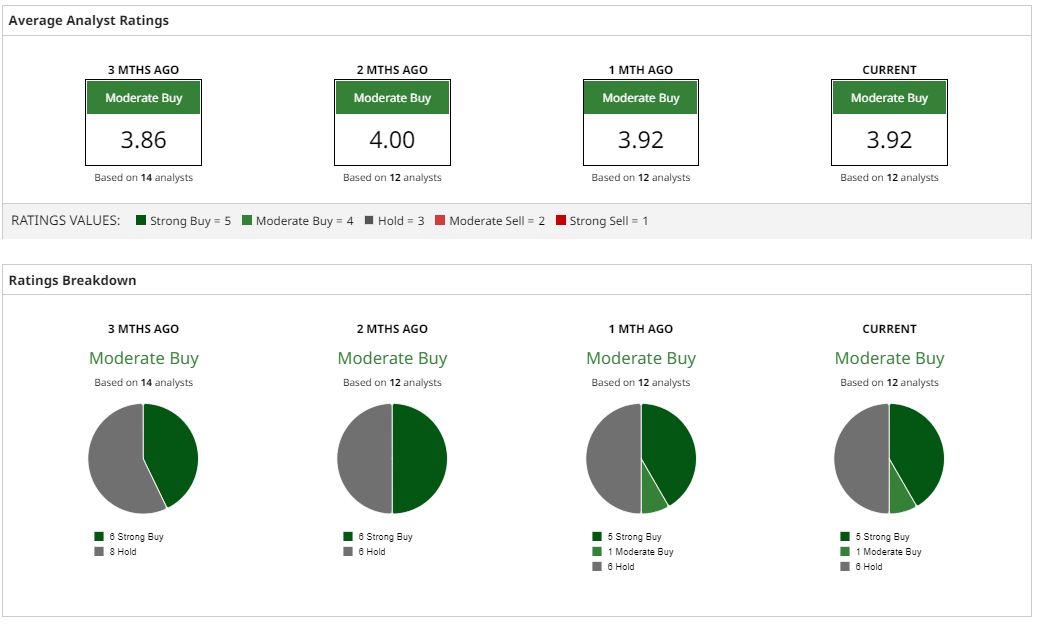

Overall, analysts have a rating of “Moderate Buy” for TTE stock, with a mean target price of $72.58. This denotes an upside potential of about 12.5% from current levels. Out of 12 analysts covering the stock, 5 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, and 6 have a “Hold” rating.

3. Royal Dutch Shell (SHEL)

We conclude our list with Royal Dutch Shell (SHEL), which was formed in 1907 through the merger of the Royal Dutch Petroleum Company of the Netherlands and The “Shell” Transport and Trading Company of the UK. One of the largest producers of oil (CLJ24) in the world, the integrated oil and gas company is engaged in both upstream and downstream activities, as well as integrated gas and renewables. SHEL currently commands a huge market cap of $204.9 billion.

Shell stock is down 2.5% on a YTD basis. The stock offers a dividend yield of 4.38%, outpacing its energy sector peers. Moreover, a low payout ratio of 15.5% gives it plenty of ceiling to raise its dividend in the future.

SHEL reported EPS of $2.22 for its most recent quarterly results – a yearly decline of 20.1%, but still way above the consensus estimate. The oil major also reduced its net debt levels by 3% from the previous year to $43.5 billion.

Notably, the company is realigning its focus on its core business, and slowly offloading stakes in its overseas ventures. This includes exiting the two offshore production-sharing contracts in Malaysia’s Baram Delta, the sale of its 35% participating interest in Indonesia’s Masela block, the sale of a 51.8% interest in Aera Energy, and the sale of its onshore business in Nigeria.

Instead, the company is focusing on its Sparta project in the Garden Banks area, off the Gulf Coast of Louisiana. A deep-water oil development project, Sparta is expected to commence production in 2028 and is estimated to produce 90Mboe/d with 244MMboe in recoverable resources. In the near term, management anticipates having 500Mbbl/d of new production coming online by 2025.

JPMorgan analysts are expecting EPS growth of 5% for SHEL in 2025, with the forward P/E pegged at 7.7.

Overall, analysts think SHEL stock is a “Strong Buy,” with a mean target price of $75.17 – which indicates an upside potential of roughly 18% from current levels. Out of 11 analysts covering the stock, 8 have a “Strong Buy” rating, and 3 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.