4-minute read

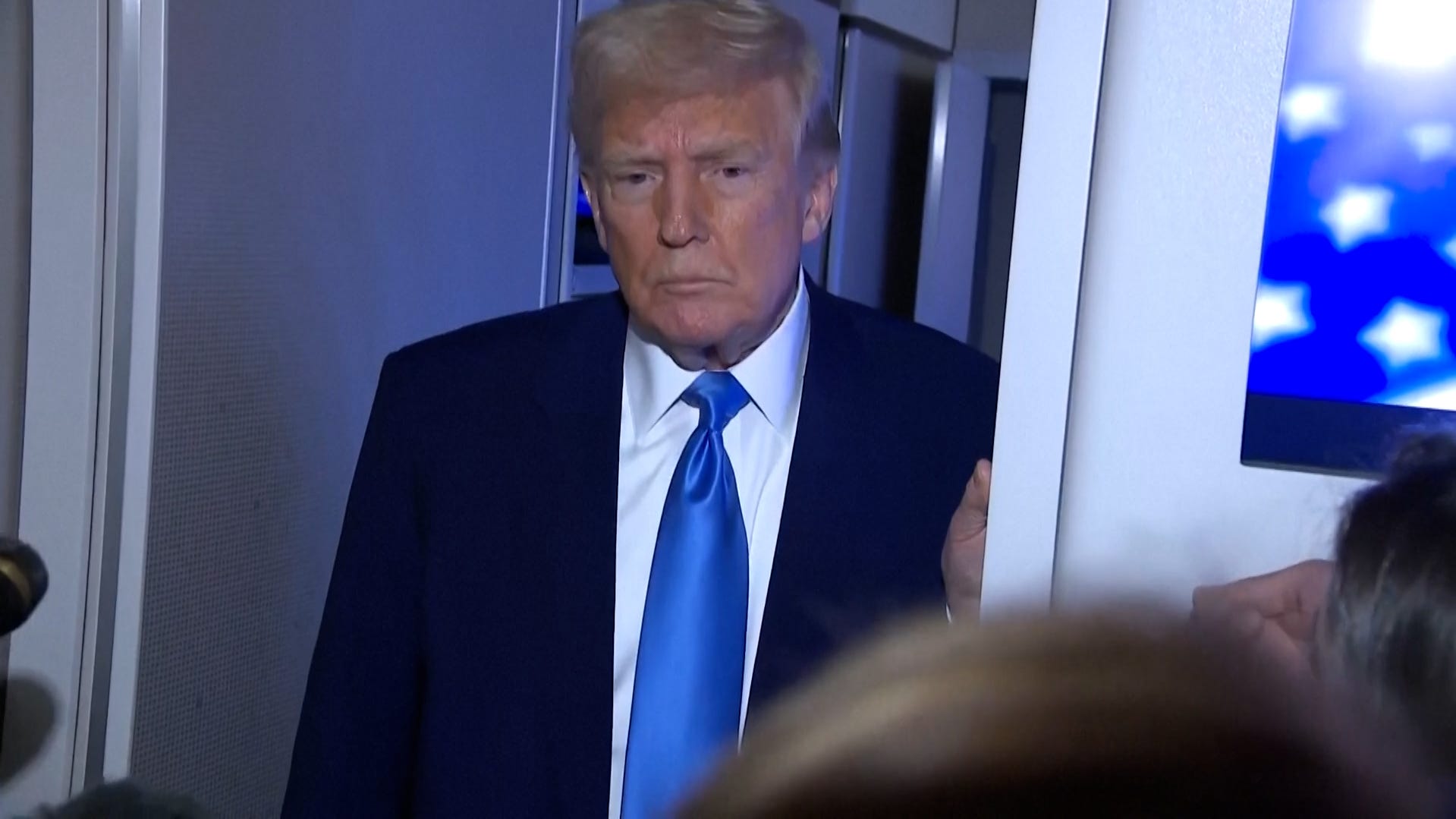

President Trump calls tariffs ‘medicine’ as stock market plunges

President Donald Trump spent the weekend at a golf tournament in Florida as the stock market continued to plunge.

- The worst market crash was seen in 1929 and led to the Great Depression. It was caused by speculative investments, excessive debt and banking system weakness.

- The Dot-Com Bubble collapse caused a global financial crisis from 2007 to 2009.

- COVID-19 caused a sharp and rapid decline in the market, but it also was short-lived and regarded as one of the shortest plunges in history.

The U.S. stock market took a sharp dive over the past week, with the Dow Jones Industrial Average dropping more than 10% from April 2 to the morning of April 7.

Though market declines are nothing new, this dip, fueled by rising global trade tensions linked to President Donald Trump’s tariff strategy, could signal the start of something more significant. Some of the most notable market downturns have been triggered by a mix of economic, political and global factors.

The S&P 500, which had already fallen more than 17% from its February peak, opened on April 7 more than 19% below those highs, indicating a potential shift toward bear market territory. On April 6, Trump reaffirmed his position on tariffs. They would remain, he said, unless other countries “pay a lot of money.”

Story continues below photo gallery.

What happens from here is anyone’s guess, but the long-term prognosis is recovery. The U.S. stock market recovered in just four months after the crash of March 2020 amid the COVID-19 pandemic. By contrast, the bear market that began in December 2021 took 18 months to resolve. That slower recovery was dragged down by global inflation, supply shortages and Russia’s invasion of Ukraine, but it nonetheless happened.

Studies analyzing major crashes of 20% or more since the 1870s have found great variety in sell-offs. The most famous, the 1929 crash that marked the start of the Great Depression, has been identified by the overwhelming majority of economists as the most severe. The 79% drop in terms of real total returns was followed by a prolonged recovery that lasted until 1936, according to a 2009 CFA Institute study, “The History and Economics of Stock Market Crashes,” and an April 1 follow-up report from the financial services firm Morningstar. In contrast, shorter crashes, like those triggered by the Cuban Missile Crisis in the early 1960s, were less impactful.

Major market sell-offs typically occur about once every five to 10 years, the study found, but they come at various times for various reasons. Some were sparked by wars, and others were driven by shifts in monetary policy, speculative bubbles or inflation. In all cases, the market eventually recovered to reach new highs for long-term investors willing and able to wait out the occasional daunting bump in the road.

Here are a few other notable crashes, with details from the CFA and Morningstar reports.

- The 1929 Stock Market Crash and the Great Depression: The most severe drop in U.S. history occurred after the stock market peaked in August 1929. The market lost about 79% of its value by May 1932, dragging the economy into the Great Depression. The recovery from this crash took several years. The market did not return to its pre-crash levels until late 1936. The causes of the crash included speculative investments, excessive debt and weaknesses in the banking system. All contributed to the depth and duration of the decline.

- The Dot-Com Bubble and the Great Recession: The collapse of the tech bubble in 2000 and the global financial crisis from 2007 to 2009 marked two of the largest declines in modern history. The market dropped about 54% from its peak in 2000, hitting bottom in 2009. The crash was driven by the collapse of major financial institutions, a housing market collapse and widespread economic instability. It took until May 2013 for the market to recover fully.

- The Inflationary Crisis of the 1970s: From December 1972 to September 1974, the market fell by nearly 52%. This crash was the result of rising inflation, the oil crisis and the political instability surrounding the Watergate scandal. The recession that followed caused widespread economic hardship, but the market began to recover in the early 1980s as inflation was brought under control.

- The 1987 Stock Market Crash: On what is known as “Black Monday,” the market dropped 22.6% on Oct. 19, 1987, in one of the most abrupt declines in history. The causes of this crash remain debated, but factors like computerized trading, concerns about rising interest rates and investor panic contributed to the sharp fall. The market rebounded relatively quickly, returning to pre-crash levels by 1989.

- The Panic of 1907: A precursor to the 1929 crash, the Panic of 1907 saw the market lose about 34% of its value from January 1906 to October 1907. The trigger was a banking crisis fueled by speculative investments in copper and trust companies. The government stepped in to provide liquidity and stabilized the financial system, but the effects of the crash lingered for years.

- The COVID-19 Pandemic: In 2020, global markets experienced a sharp and rapid decline in response to the onset of the COVID-19 pandemic. From February 2020 to March 2020, the market lost nearly 20% of its value. This decline was the result of widespread uncertainty about the pandemic’s economic impact and the global shutdowns that followed. However, that recent market plunge was also one of the shortest in history. The market rebounded as the U.S. government enacted massive stimulus measures and drugmakers rapidly developed vaccines.

- The 1946-1948 Post-War Bear Market: After World War II, the market experienced a 37.2% decline from May 1946 to February 1948, driven by the end of wartime spending, inflation fears and the transition to a peacetime economy. The market recovered as the economy adjusted to the post-war period.

- The 1937-1938 Recession: The U.S. stock market fell by roughly 50% between February 1937 and March 1938. The drop followed the initial recovery from the Great Depression and was exacerbated by government fiscal policies, including tax hikes and cuts in public spending. The market did not fully recover until the U.S. entered World War II in 1941.