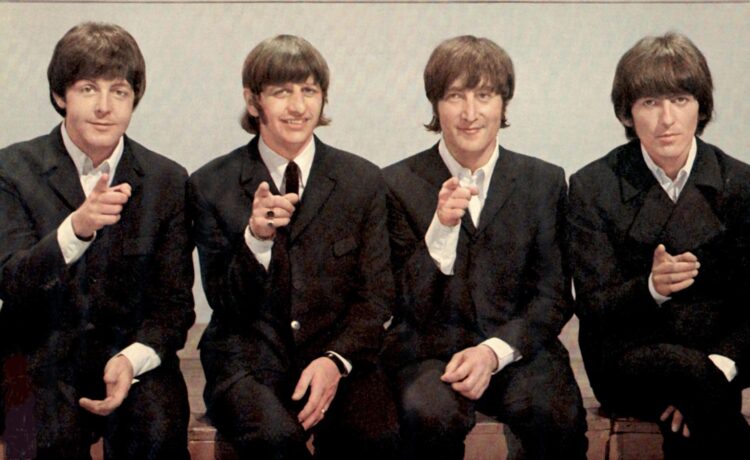

BEATLES 1966 Paul McCartney, Ringo Starr, John Lennon and George Harrison at Top Of The Pops

What makes stock prices go up and down? I don’t know but my guess is it all depends on how a company performs compared to investor expectations.

When it comes to the the seven biggest tech stocks propelling the S&P 500 — this hypothesis holds up well when examining their performance in the first three months of 2024.

The so-called fab four — Nvidia, Meta Platforms

FB

MSFT

AMZN

Here’s how those four stocks performed in the first quarter compared to the S&P 500 which rose 10.7%:

- Nvidia: +90%

- Meta Platforms: +42.7%

- Amazon: 20.4%

- Microsoft: +14.6%

The other two lost ground. Here is how poorly they fared:

- Tesla: -31%

- Apple: -15.5%

There seems to be a relationship between how each of these companies performed relative to expectations in their most recent financial report and their stock price trajectories.

Consider buying companies from these lists you think will exceed expectations and raise their guidance when they next report quarterly results. Conversely, consider selling shares of the companies you expect to fall short of investor expectations.

How The Fabulous Four Fared Against Expectations

Nvidia, Meta, Amazon, and Microsoft did better than expectations. The relative performance of their stock prices in the first quarter seem to sync with their revenue growth.

Nvidia’s 265% Revenue Growth Leads The Pack

But Nvidia defied the pessimists when it reported results for the quarter ending January 2024, I wrote in a February 2024 Forbes post.

After reporting faster than expected growth in the previous quarter and raising guidance for the current one, investors sent Nvidia stock up more than 14% in off-hours trading on February 21.

Here are the key numbers:

- Q4 2023 revenue up 265% to $22.1 billion — $1.5 billion more than analysts’ consensus of $20.6 billion for the period ending January 28, according to London Stock Exchange Group.

- Q4 2023 adjusted earnings per share up 804% to $5.15 per share — 56 cents per share more than the analyst consensus of $4.59, according to Barron’s.

- Q1 2024 revenue guidance of 300% growth to $24 billion — $2,4 billion more than the $21.6 billion analysts’ consensus, according to the Wall Street Journal.

Nvidia’s stock continued to rise for the rest of the first quarter of 2024. When it reports results in May, the stock could come crashing down unless it exceeds that 300% growth the chip maker forecast.

Meta Platforms’ 25% Growth And High Net Margin Sent Its Stock Up

Meta — with a 29% net margin in 2023 — grew faster and offered better guidance than Amazon did. Meta also initiated a 50 cents per share dividend, I wrote in a February 2024 Forbes post.

Here are the key numbers for Meta:

- Q4 2023 Revenue: $40.1 billion — up 25% and $1 billion more than analysts forecast, according to Investor’s Business Daily.

- Q4 2023 Earnings per share: $5.33 — up 203% and 51 cents a share above the FactSet projection, reported IBD

IBD

- Q1 2024 Revenue forecast: $35.8 billion — up 11.2% at the midpoint of the range — $1.9 billion above the FactSet consensus, noted IBD.

Amazon’s 14% Revenue Growth Beat Expectations; Guidance Did Not

Amazon — which generated a 17% net margin last year — is growing more slowly, but catching up in Generative AI, I wrote in a February 2024 Forbes post.

The highlights of Amazon’s report included:

- Q4 2023 revenue: $170 billion — up 14% and $3.8 billion more than London Stock Exchange polled analysts forecast, according to CNBC.

- Q4 2023 earnings per share: $1.00 — up from 3 cents a share the year before and 20 cents a share above the LSEG projection, reported CNBC.

- Q1 2024 revenue forecast: $141 billion at the midpoint of the range — up 10.5% and $1.1 billion below above the LSEG consensus, noted CNBC.

Both companies cut costs. Meta cut 22% of its people — ending 2023 with 67,317 employees, noted IBD. Amazon laid off roughly 27,000 employees a year ago — ending 2023 slightly below the year-earlier level of 1.53 million, according to the Wall Street Journal.

Microsoft’s 17.6% Revenue Growth Beats While Guidance Disappoints

Microsoft’s guidance for the current quarter fell short even as the company beat earnings expectations due to rapid growth in its Azure unit, according to CNBC. Results were also helped by Microsoft’s acquisition of video game publisher Activision

ATVI

Here are the key numbers:

- Q2 2024 revenue: $62.02 billion — up 17.6% from the year before and nearly $1 billion more than expected, according to CNBC.

- Q2 2024 earnings: $2.93 per share — up 32% and 15 cents higher than expected according to the London Stock Exchange Group consensus.

- Q2 2024 net income: $21.87 billion — up 33% from the year before, noted CNBC.

- Q2 2024 Azure cloud revenue grew 30% — three percentage points faster than analysts’ estimates of 27%, according to the Wall Street Journal. Microsoft said “six percentage points of Azure’s growth came from AI demand. That doubled the amount AI contributed to Azure in the previous quarter,” noted the Journal.

- Q3 2024 revenue forecast: $60.5 billion in the middle of the range — $430 million short of the LSEG consensus.

Why Apple And Tesla Lost Ground

Apple and Tesla deliver investors disappointing results and their share prices fell.

As I wrote in a January 2024 Forbes post, Tesla issued a disappointing fourth quarter report and delivered weak guidance for 2024.

While Tesla’s revenue was up, it fell short of expectations while the vehicle maker’s operating margin fell significantly and the company forecast lower growth. Here are the key numbers:

- Q4 Revenue: $25.17 billion — up 3% from Q4 2023 and about $500 million short of LSEG expectations. A “reduced average selling price following steep price cuts around the world in the second half of the year” contributed to the meager revenue growth, according to CNBC.

- Q4 Operating Margin: 8.2% — roughly half the Q4 2023 figure, CNBC reported.

- 2024 Vehicle Volume Forecast: Electric vehicle volume growth in 2024 “may be notably lower” than the rate observed last year — Tesla “shipped 1.8 million cars in 2023,” CNBC wrote. The absence of a specific 2024 production target departs from previous years. In 2023, deliveries rose 38% — well short of the 50% target. Analysts predict a 20% increase in 2024, noted Bloomberg.

The drumbeat of bad Tesla news persisted with the company’s April 2 news of weak first quarter deliveries of 386,810 vehicles in the first quarter, “which was substantially below analyst consensus estimate of 449,080,” noted investment manager, Louis Navellier.

Competition from BYD and Li Auto capturing Chinese market share from Tesla continued. With Tesla’s Model 3 and Model Y accounting for 96% of Tesla’s first-quarter deliveries, pressure on Tesla to introduce its Model 2 became “imperative,” noted Navellier.

Meanwhile, a Wall Street analyst forecast Apple revenue could drop for the first time since 2016 when it reports in May. Ananda Baruah, an analyst at Loop Capital, cut his earnings estimates for the iPhone-maker, reported Quartz.

Baruah estimated Apple’s iPhone revenue for the March 2024-ending quarter would total $44 billion while estimating the company’s total revenue would fall $3.2 billion below Wall Street’s forecast of $91 billion, Quartz noted.

Underlying Baruah’s bearish forecast were low iPhone unit shipments due to lower organic demand and stronger competition as well as flattening average selling prices. With Apple depending heavily on the Chinese smartphone market, the company was hurt by the 7% decline in demand in China and the resurgence of Huawei which released a new series of smartphones, reported Quartz.

If Baruah is correct, Apple will fall way short of Wall Street expectations. He wrote that Wall Street forecasts for iPhone unit sales and revenue could be 20% too high while the company’s overall revenue and earnings per share could be 10% higher than what Apple will report, Quartz wrote.

The lesson for investors is simple in concept: Bet on companies that grow the fastest by getting the most innovative products to market before their rivals do.

The hard part is that some of the fastest growing companies have raised investor expectations so high, that their shares could plunge if the companies cannot keep raising expectations.