This is CNBC’s live blog covering European markets.

European markets edged higher on Monday after U.S. President Donald Trump hinted at tariff “flexibility.”

The pan-European Stoxx 600 was just 0.01% higher at 11:55 a.m. in London, with Germany’s DAX up 0.33%, France’s CAC up 0.09%, and the U.K.’s FTSE 100 0.02% higher.

The travel and leisure sector was up 0.5% after London’s Heathrow Airport reopened on Saturday following a power outage caused by a fire at a nearby electrical substation that disrupted Friday service. British Airways owner IAG was up 0.8%.

Swedish defense firm Saab was at the top of the Stoxx 600, up 6.3%, after UBS upgraded its stock from neutral to buy saying it’s “well-positioned for the defence spending upside.”

Overnight, Asia-Pacific markets were trading mostly higher Monday, but investors in the region are looking ahead to U.S. President Donald Trump’s April 2 tariff deadline.

Meanwhile, U.S. stock futures were higher, signaling that equities could extend their recent gains.

Last Friday, the three major U.S. averages closed higher, having rallied after Trump told reporters that there could potentially be “flexibility” for his reciprocal tariff plan. The president did stop short of suggesting that there could be some tariff exemptions, however, as he did similarly for automakers earlier in March.

On Sunday, the Wall Street Journal reported the tariffs are expected to be narrower in scope and will likely exclude some industry-specific duties, citing an administration official.

— CNBC’s Brian Evans contributed to this report.

German business activity higher, as manufacturing rebounds

German business activity grew at its quickest rate in 10 months in March, buoyed by its manufacturing sector which grew for the first time in nearly two years, according to a survey.

The German Purchasing Managers’ Index, collected by S&P Global, increased to 50.9 in March, up from 50.4 in February. A reading above 50 indicates an expansion. Meanwhile, manufacturing production rose to 52.1 in March, up from 48.9 in February.

The manufacturing index was still in contraction territory but increased to 48.3 from 46.5 in February. However, the services sector declined to 50.2, from 51.1 the prior month.

The growth in the manufacturing sector was pinned on strong demand with a modest rise in new orders since March 2022, according to the report.

“Economic growth in the first quarter looks promising, with the composite PMI staying above the expansionary threshold every month,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank said. “Thanks to the fiscal package, this could mark the beginning of a more sustained recovery.”

Germany’s parliament voted in favor of a major fiscal package last week, which would see increased spending on infrastructure and defense.

Rubia noted that the increase in manufacturing production in five of the past six months, may be due to tariff concerns in the U.S.

“It might be linked to the import boom from the US, where companies are snapping up goods from abroad to get ahead of looming tariffs. If that’s the case, we could see a bit of a setback once those tariffs kick in,” he added.

— Sawdah Bhaimiya

Bank of England may raise rates again by the end of the year, Wellington Management says

Paul Skinner, investment director at Wellington Management said the Bank of England may be raising rates again by the end of the year, amid persistent services inflation and wage growth.

“We think the low might be in now and by the end of this year, the U.K. could be raising rates again,” Skinner told CNBC’s “Squawk Box Europe” on Monday, referring to the BOE’s recent decision to hold interest rates steady in March and keep the central bank’s benchmark rate at 4.5%.

“If you look at what we’ve got in the U.K., we’ve got 6% wage growth across all sectors, we’ve got 5% services inflation and we’ve got the Bank of England raising their GDP, and they’re going to say they cut rates. Does it really all make sense?”

Skinner noted that the U.K. is in a structurally “more inflationary environment” and questioned the BOE’s response.

“The Bank of England have hardly been inflation fighters for the last 10 years now, so if that long end of the yield curve in gilts unhinges, it won’t be Rachel Reeves fault, it’ll be the Bank of England,” he added.

— Sawdah Bhaimiya

Turkey’s stock index opens slightly higher after weekend of mass protests

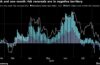

Turkey’s benchmark BIST 100 index opened roughly 3% higher in Istanbul, recouping some of last week’s dramatic losses following the controversial arrest of Istanbul Mayor Ekrem Imamoglu, who is seen as Turkish President Recep Tayyip Erdogan’s strongest political rival.

The index is still down 14.4% from the previous week.

The Turkish lira was trading at 37.772 to the dollar at around 11:00 a.m. local time, with the greenback up roughly 1% on the Turkish currency.

— Natasha Turak

White House reportedly plans to narrow scope of Trump’s April 2 tariffs

The White House is planning to issue a more narrow slate of tariffs than previously expected on April 2, according to a Wall Street Journal report on Sunday, citing an administration official.

Previously announced reciprocal duties are still planned to be announced on April 2, the report said, albeit likely without sector-specific duties that President Donald Trump had aimed at sectors including automobiles, pharmaceuticals and semiconductors.

— Brian Evans

European markets: Here are the opening calls

European markets are expected to open in positive territory Monday.

The U.K.’s FTSE 100 index is expected to open 14 points higher at 8,667, Germany’s DAX up 83 points at 22,966, France’s CAC 9 points higher at 8,057 and Italy’s FTSE MIB 171 points higher at 38,391, according to data from IG.

Traders will be keeping an eye on preliminary purchasing managers’ index (PMI) data from the U.K., France, Germany and the euro zone to get a gauge of business activity in the region’s manufacturing and services sectors.

— Holly Ellyatt