(Bloomberg) — European stock futures edged higher after a late recovery in Asian shares, reversing earlier weakness caused by Federal Reserve meeting minutes indicating interest rates will remain elevated for longer.

Most Read from Bloomberg

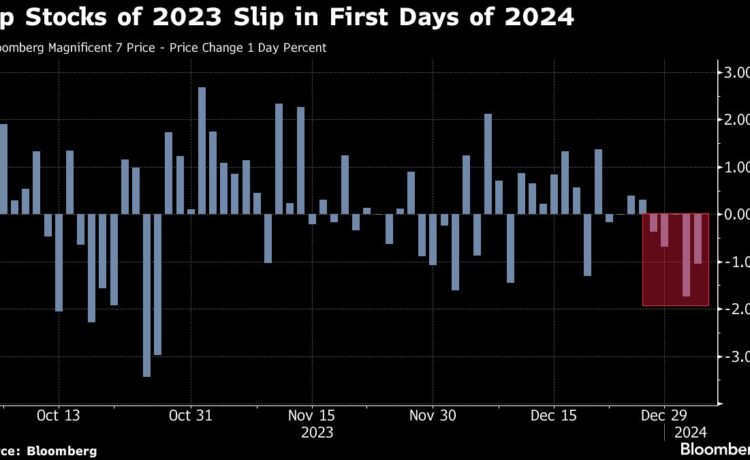

The Euro Stoxx 50 contract rose 0.2%, tracking gains in US counterparts. The S&P 500 ended Wednesday 0.8% lower, extending a run of daily declines that began on the last trading day of 2023. The Nasdaq 100 fell 1.1%, a fourth daily drop, and the longest losing streak in two months.

Treasuries steadied in Asia, stemming declines from one of the worst opening days to a year on record, as the Fed minutes showed the possibility of slowing the pace of quantitative tightening. The 10-year Treasury yield inched one basis point lower to 3.9% Wednesday.

A gauge for Asian shares rose 0.2%, after falling as much as 0.4% earlier. Japan’s Topix Index closed higher on the first trading day of the new year after a holiday break, while Chinese equities pared some of their earlier losses.

“Markets have borrowed performance from 2024, and it’s gonna have to give some of it back,” Richard Harris, chief executive of Port Shelter Investment Management said in a Bloomberg television interview. “Rates are not gonna come down as much as people think.”

Attention now turns to upcoming US jobs data on Friday after minutes from the Fed’s December meeting suggested rates could remain at restrictive levels “for some time.” Swaps traders have been reining in their bets on rate cuts after factoring in a full quarter point cut to the benchmark rate by the March meeting.

Chinese stocks remained the biggest drag in Asia following a report that showed wages offered to Chinese workers in major cities declined by the most on record. The CSI 300 benchmark index was down 0.9% after having slid as much as 1.6%. The selling came even as a private gauge of the country’s services activity climbed to the highest in five months in December.

Meantime, Chinese government bond yields fell to the lowest in more than three years, while the offshore yuan was steady. The People’s Bank of China weakened Wednesday’s currency fixing by the most in over six months, a sign policymakers may have shifted their focus from stabilizing the currency to monetary easing. The country’s finance minister said government spending will rise this year.

Chinese equities are “still trying to find a bottom” and likely to “stay weak in January,” said Redmond Wong, a market strategist at Saxo Capital Markets. “I will not short the China/Hong Kong markets here but need confirmation for a meaning rally.”

In currencies, a gauge measuring dollar strength was little changed after a recent rally and best run since November. The yen traded over 143 per dollar after weakening almost 1% against the greenback in the prior session.

The Japanese currency is coming under renewed pressure as the recent powerful earthquake makes it harder for the central bank to abolish negative interest rates.

Elsewhere, geopolitics remained in focus. Oil prices rose nearly 1% amid escalating geopolitical tensions in Middle East, supply disruptions in Libya and OPEC statement pledging to stabilize prices. Iran said attacks that killed almost 100 people in the country were carried out to punish its stance against Israel, intensifying tensions in the region.

Bitcoin advanced after slumping Wednesday which saw the cryptocurrency erase almost all gains it had made so far this year. Gold edged higher.

-

Eurozone S&P Global Eurozone Services PMI, Thursday

-

US initial jobless claims, ADP employment, Thursday

-

Eurozone CPI, PPI, Friday

-

US nonfarm payrolls/unemployment, factory orders, ISM services index, Friday

-

Richmond Fed President Tom Barkin — an FOMC voter in 2024 — speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.1% as of 3:43 p.m. Tokyo time

-

Nadaq 100 futures rose 0.1%

-

Hong Kong’s Hang Seng fell 0.1%

-

The Shanghai Composite fell 0.4%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0923

-

The Japanese yen fell 0.2% to 143.64 per dollar

-

The offshore yuan was little changed at 7.1636 per dollar

Cryptocurrencies

-

Bitcoin rose 0.7% to $43,225.2

-

Ether rose 0.8% to $2,245.39

Bonds

Commodities

-

West Texas Intermediate crude rose 1% to $73.43 a barrel

-

Spot gold rose 0.2% to $2,046.18 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.