This was CNBC’s live blog covering European markets.

European stock markets closed lower on Friday to round off a choppy session and hugely volatile week, as concerns about a trade war between the U.S. and China mounted further.

The pan-European Stoxx 600 index closed 0.1% lower, following its best session since March 2022. The U.K.’s FTSE 100 closed 0.64% higher while the FTSE 250 was flat after data showed the British economy grew significantly more than expected in February.

Germany’s Dax and France’s CAC 40 fell by 0.9% and 0.3%, respectively.

Building on strong Thursday gains, the euro added another 1.3% against the U.S. dollar to trade around $1.134, its highest level since February 2022.

Top posts

- ‘Liberation Day’ tariffs would be ‘roughly equivalent’ to damage from euro-zone crisis | view post

- Energy stocks fall after EIA cuts oil demand and price forecasts | view post

- Euro and British pound rally against the U.S. dollar | view post

- Luxury market recovery stalls on tariff uncertainty | view post

- BP expects lower first-quarter reported upstream production | view post

- UK economy grows by 0.5% in February, higher than expected | view post

In a sign of continued nervous sentiment, the industrials, technology and energy sectors remained lower, while sectors perceived to be safer — utilities and consumer durables — traded higher.

It has been a choppy week for European, and global, markets as investors have been reacting to the frequent developments in global trade policy that were set off by U.S. President Donald Trump’s latest tariff plans.

Trump’s so-called reciprocal tariffs came into effect earlier this week before being temporarily dropped to a blanket 10% for 90 days to allow for trade negotiations with most of the close to 90 countries and territories targeted. Tariffs on imports from China were raised to a rate of 145%, however, a level which economists say effectively cuts off trade between the world’s biggest economies.

On Friday, China responded by raising its levies on U.S. goods to 125% from 84%.

Stateside, U.S. stocks opened lower to close off one of the rockiest periods on record for Wall Street.

Europe stocks close slightly lower

European stocks closed slightly lower on Friday, with the regional Stoxx 600 index down 0.1%.

Industrials and oil and gas stocks led losses, down 1.25% and 1.2% respectively, while health-care and utilities were both higher by around 1%.

— Jenni Reid

Markets don’t like long periods of volatility, says strategist

Alex Morris, president and chief investment officer of F/m Investments, discusses tariffs and global markets.

U.S. stocks open lower Friday

U.S. stocks kicked off Friday’s session in the red.

The S&P 500 declined 0.5%. The Dow Jones Industrial Average dropped 0.2%, while the Nasdaq Composite fell 0.3%.

— Hakyung Kim

China retaliates with 125% tariffs on U.S. goods

The trade war escalated on Friday as China raised tariffs on goods from the United States to 125% from 84%.

The move came after the Trump administration confirmed its levy on Chinese imports now stands at a total of 145%.

“Even if the U.S. continues to impose higher tariffs, it will no longer make economic sense and will become a joke in the history of world economy,” the Chinese ministry said in a statement, according to a CNBC translation.

“With tariff rates at the current level, there is no longer a market for U.S. goods imported into China,” the statement said.

—Anniek Bao, Michelle Fox

America would be hit much harder than Europe in a trade war, top EU official says

EU Commissioner for Economy and Productivity, Valdis Dombrovskis pictured before the informal meeting of EU Ministers for Economic and Financial Affairs and Central Bank Governors (ECOFIN) in Warsaw, Poland, on April 11, 2025.

Valdis Dombrovskis, European Commissioner for Economy and Productivity on Friday laid out how substantially U.S. President Donald Trump’s tariffs regime could hamper the growth of the world’s largest economy.

“According to our latest model simulations on the U.S. tariff impact, U.S. GDP would be reduced by 0.8% to 1.4% until 2027,” he said. “The negative impact on the [European Union] would be less than for the U.S., about 0.2% of GDP.”

“If tariffs are perceived to be permanent or if there are further countermeasures the economic consequences would be more negative: up to 3.1% to 3.3% for the US, and 0.5% to 0.6% for the EU and 1.2% for world GDP, while global trade would decline by 7.7% in three years’ time,” Dombrovskis said.

Earlier this week, Trump announced a 90-day pause on his so-called reciprocal tariffs, which set a 20% import duty on EU goods shipped to the U.S. Those would have come in addition to Trump’s 25% levies on steel, aluminum, cars and car parts.

Dombrovskis said Friday that the EU’s new GDP simulations did not account for a loss of investor and business confidence in the economy, which would exacerbate the slowdown.

“Europe did not start this confrontation, and Europe does not want this confrontation,” he told officials and reporters. “Tariffs go against the political and economic logic of deep and longstanding transatlantic trading partnership, valued at 1.6 trillion euros ($1.8 trillion) in 2023. This is the largest trade and investment partnership in the world.”

— Chloe Taylor

Novartis vows to invest $23 billion in U.S. as tariffs loom

Novartis said in August that it plans to spin off its generics unit Sandoz to sharpen its focus on its patented prescription medicines.

Shares of Novartis were up 2.09% at 11:21 a.m. London time, after Swiss pharmaceutical giant pledged to invest $23 billion to build and expand 10 facilities in the U.S. over the next five years amid fresh threats of industry-wide tariffs from U.S. President Donald Trump.

The plan will ensure all key Novartis medicines for U.S. patients — including its widely used Entresto heart failure medicine and Kisqali breast cancer therapy — will be made in the U.S., the company said in a statement out Thursday.

Novartis said the plans include six new manufacturing plants — one each in Florida and Texas and four in “soon-to-be-determined states” — and one new research and development site in San Diego, California.

The company said the move would create nearly 1,000 new jobs at Novartis and approximately 4,000 additional U.S. jobs.

CEO Vas Narasimhan, who has repeatedly outlined his ambitions to grow in the U.S. market, said that tariffs were a consideration, but not the driving factor behind the firm’s decision.

“As a Swiss-based company with a significant presence in the US, these investments will enable us to fully bring our supply chain and key technology platforms into the US to support our strong US growth outlook,” Narasimhan said.

“These investments also reflect the pro-innovation policy and regulatory environment in the US that supports our ability to find the next medical breakthroughs for patients.”

— Karen Gilchrist

‘Liberation Day’ tariffs would be ‘roughly equivalent’ to damage from euro-zone crisis, says Capital Economics

In a worst-case scenario where the U.S. is unable to strike a trade deal with many countries, the hit to the global gross domestic product could be as much as 1%, according to Capital Economics.

The London-based consultancy modeled the scenario assuming President Donald Trump’s 90-day pause on tariffs expires without significant trade deals, and that the U.S. reverts to its “Liberation Day” tariffs while maintaining roughly 145% cumulative tariffs on China.

“This would be roughly equivalent to the global damage resulting from the euro-zone crisis,” said Simon MacAdam, the firm’s deputy chief global economist, in a Thursday note to clients. The euro zone debt crisis involved Portugal, Ireland, Italy, Greece, and Spain inching close to sovereign default.

“If the US and China were to effectively cut off trade in most if not all areas, the fallout in financial markets could conceivably take on a life of its own with large negative feedback loops on the global economy,” MacAdam added.

— Ganesh Rao

Energy stocks fall after EIA cuts oil demand and price forecasts

European oil and gas stocks retreated Friday after the U.S. Energy Information Administration said it anticipated less oil demand and lower oil and gasoline prices “in an uncertain market.”

The Stoxx 600 Oil and Gas Price Index was 1.5% lower at 10 a.m. in London, with Shell down 0.6% and TotalEnergies down 1.6%.

An oil pumpjack in Nolan, Texas, on April 8, 2025.

In a Thursday update accounting for the latest tariff-related global volatility, the EIA said it expected global oil inventories to rise from the middle of 2025, just as market uncertainty could drag on economic growth.

The agency altered its forecasts to an average Brent crude oil price of less than $70 per barrel in 2025 and just over $60 per barrel in 2026, around 10% lower than its March outlook. It now sees global oil consumption increasing by 0.9 million barrels per day in 2025, down by 0.4 million barrels per day from the March forecast.

In a note published Thursday, analysts at UBS said energy markets were “facing the unusual situation of higher than expected oil supplies coming alongside a more fragile demand growth environment.”

“Low prices are likely to continue to weigh on sentiment and we reduce our assumption deck accordingly, driving an average 11% reduction to price targets,” they added.

Elsewhere, BP warned in an update that it expected “weak” gas trading earnings in the first quarter along with higher net debt. Shares were last 2% lower.

— Jenni Reid

European currencies rally

The euro was 1.2% higher against the U.S. dollar on Friday morning, trading at around $1.133.

The British pound also rallied against the greenback, jumping 0.6% to $1.304 by 8:12 a.m. in London.

Earlier this week, U.S. President Donald Trump paused the rollout of country-specific tariffs that would have hit the European Union goods with levies of 20%, and British goods with 10% duties.

The EU said on Thursday that it would suspend its planned countermeasures to Trump’s tariffs for 90 days.

Sterling also jumped on Friday after better-than-expected figures on economic growth out of the country.

— Chloe Taylor

Luxury market recovery stalls on tariff uncertainty, Barclays says

U.S. tariff uncertainty has clouded the outlook for the luxury goods market and it’s long-awaited recovery, Barclays said Friday.

“I was expecting to see a recovery of the luxury market towards H2 2025,” Carole Madjo, Barclays’ head of European luxury goods research, told CNBC’s “Squawk Box Europe.“

“With all these new macro uncertainties, this [recover] will likely to a further stage.”

Madjo added that a possible tariff-induced global economic slowdown would likely further stymy consumer demand in the once lucrative Chinese market.

“We were expecting to see China being down 5% this year,” she said. “But we now, of course, see much more downside risk.”

— Karen Gilchrist

European stocks rise on Friday as tariff-triggered volatility persists

The pan-European Stoxx Europe 600 opened up 0.4%, with the U.K.’s FTSE 100 inching up by 0.5%, while Germany’s DAX and France’s CAC 40 were higher by 0.4% at 8.10 am London time.

All sectors of the stock market, except energy, were trading in positive territory. Stocks in the utilities sector traded higher by 1%, followed by consumer cyclicals and the mining sectors, which were up by 0.8%.

— Ganesh Rao

Oil giant BP expects lower first-quarter reported upstream production, higher net debt

A general view of the BP logo and petrol station forecourt sign in Southend, United Kingdom, on Jan. 22, 2024.

British oil major BP said it anticipates lower reported upstream production and higher net debt in the first quarter than in the final three months of 2024.

In a trading statement, the London-listed energy giant said reported upstream production is expected to be lower primarily because of the already announced divestments in Egypt and Trinidad and Tobago.

First-quarter net debt, which energy analysts have flagged as an area of concern for BP, is expected to be around $4 billion higher than in the fourth quarter.

The buildup of net debt “is driven primarily by a working capital build, which is largely expected to reverse, reflecting seasonal inventory effects, timing of payments including annual bonus payments and payments related to low carbon assets held for sale,” BP said.

BP is scheduled to report first-quarter earnings on April 29.

— Sam Meredith

UK economy expands by 0.5% in February, higher than expected

The U.K. economy grew by 0.5% month-on-month in February, official data showed on Friday.

Analysts had been expecting a monthly increase of 0.1%, according to LSEG data.

In January, the U.K. economy unexpectedly shrank by 0.1% on a monthly basis.

European markets head for muted open

European markets are on track to open slightly higher on Friday as the end of a volatile week approaches.

The U.K.’s FTSE 100 was last set to add 31 points to 7,955, while Germany’s DAX was on track to rise by 125 points to 20,727 and the French CAC 40 was set to gain 25 points to 7,172. Italy’s FTSE MIB was meanwhile on course to add 223 points to 33,668.

— Sophie Kiderlin

Gold price hits new record high, crossing $3,200 for the first time

Gold futures hit a fresh record high of $3,226 per ounce as festering trade tensions between the world’s two largest economies culminated in a rush towards the safe haven asset.

“Persistent tariffs and policy unpredictability continue to elevate the risk of stagflation, further increasing the demand for gold as the best safe-haven asset,” said Paul Wong, market strategist at Sprott Asset Management.

Wong added that he believes the current economic environment will continue to support rising gold prices.

—Lee Ying Shan

Stock futures edge higher Thursday evening

Shortly after 6 p.m. ET, S&P 500 futures traded 0.2% higher, while Nasdaq 100 futures gained 0.2%. Futures tied to the Dow Jones Industrial Average added 50 points, or about 0.1%.

— Pia Singh

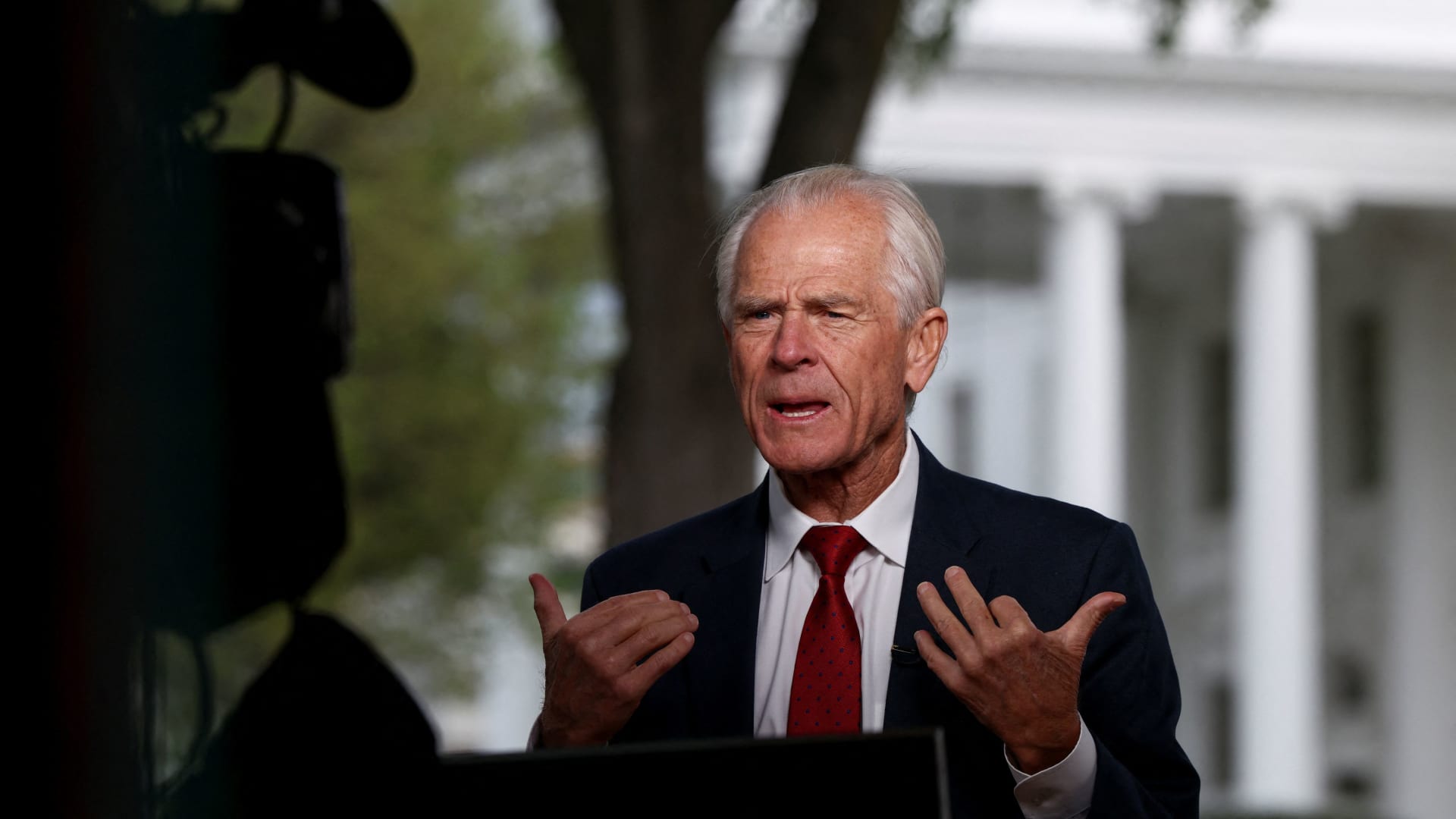

Navarro says stock plunge is ‘no big deal’

U.S. senior trade advisor Peter Navarro speaks during an interview with CNN at the White House, in Washington, April 10, 2025.

After stocks plunged, Trump’s top trade advisor Peter Navarro laughed off the suggestion that Trump’s freewheeling tariff policy switch-ups may have caused a lasting impact on the global financial system.

“I think CNBC’s gonna sue CNN for intruding on their financial analysis,” Navarro said in response during a CNN interview after markets closed.

“That to me is pure spin,” he said. “You had the highest rise in stock market history yesterday. Of course there’s gonna be a little pullback. The question is: What spin are you gonna put on it?”

“It’s just normal retracement after a big day. It’s no big deal,” Navarro said.

— Kevin Breuninger