Figure 1: What Can Be Done to Help European IPOs?

Institutions say no to 24/7 trading, advocate for retail

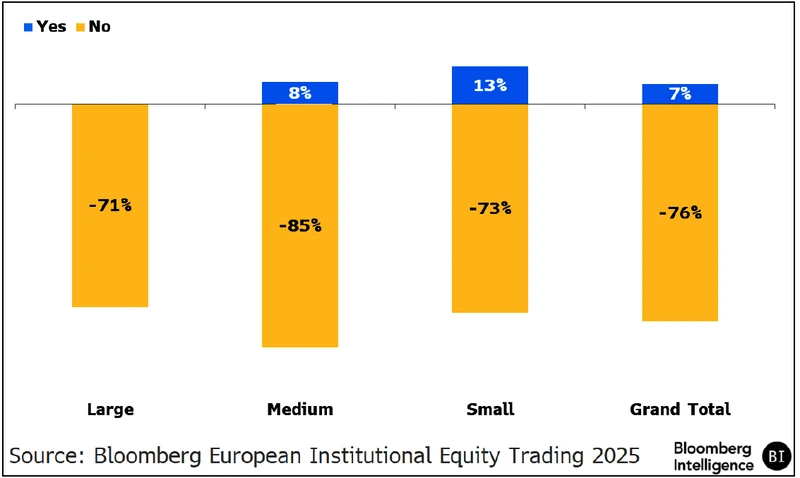

European institutional investors in our survey overwhelmingly oppose 24-hour-a-day, five-days-a-week (24/5) or 24/7 trading, with a number of US exchanges having put in application for 24-hour trading and the London Stock Exchange considering it. Many of the senior traders we spoke with aren’t in favor of a potential move, with a number of respondents voicing strong opinions

Figure 2: Views on 24/7 Trading in Europe

More than three-quarters of the traders we interview oppose any move toward 24/5 or 24/7 operations, with many concerned about diluted liquidity, with one noting that US premarket sessions remain largely inactive despite wider access. Many argued that Europe’s earlier debate on reducing hours should be revisited, suggesting shorter sessions might help concentrate liquidity and align more closely with US openings, fostering a more efficient and competitive market.

Greater retail participation is viewed as a way to expand the liquidity pool in European equity markets and support broader capital-markets growth. Almost two-thirds (64%) of senior buyside traders surveyed said they would like increased access to retail flow — 58% from large funds, 64% midsize and 69% from smaller funds. Just under a quarter (22%) already trade with retail but indicated they would like to increase that exposure, while only 8% said they would prefer not to engage with retail flow at all.

Retail flow is often considered less toxic than other types of equity flow, offering institutional traders an opportunity to interact with it in ways that could enhance overall liquidity provision.

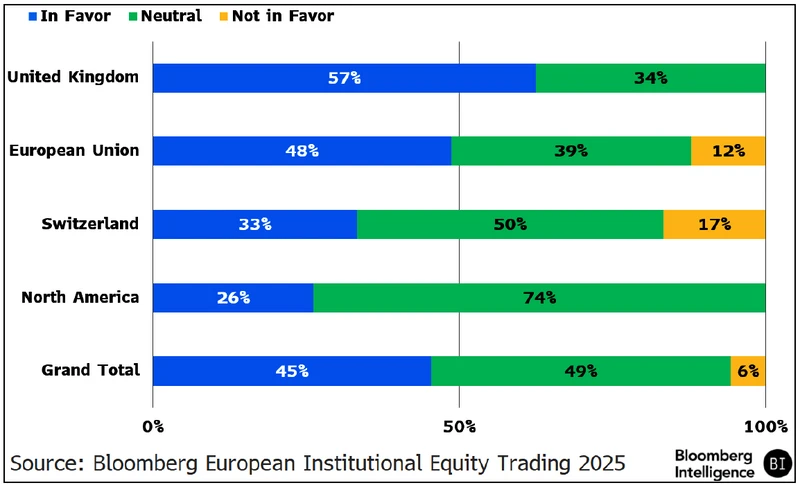

The survey showed 44% of large and 41% of medium buyside funds support on-venue trajectory crossing models — systems that match large orders internally to reduce market impact — in Europe, with just 4% of senior traders opposed across all funds. The UK and Switzerland already permit such models, but the EU has yet to decide, underscoring regulatory divergence. Respondents noted that a regulated, on-venue option could promote transparency and support market-structure innovation, similar to existing sellside capabilities.

Figure 3: Are You in Favor of On-Venue Trajectory Crossing?

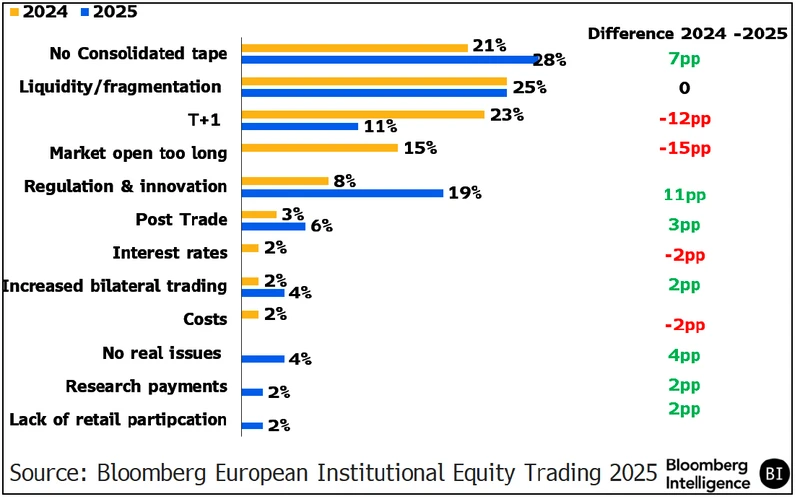

Figure 4: Top Market-Structure Issues

Proposed tape unlikely to replace market-data feeds

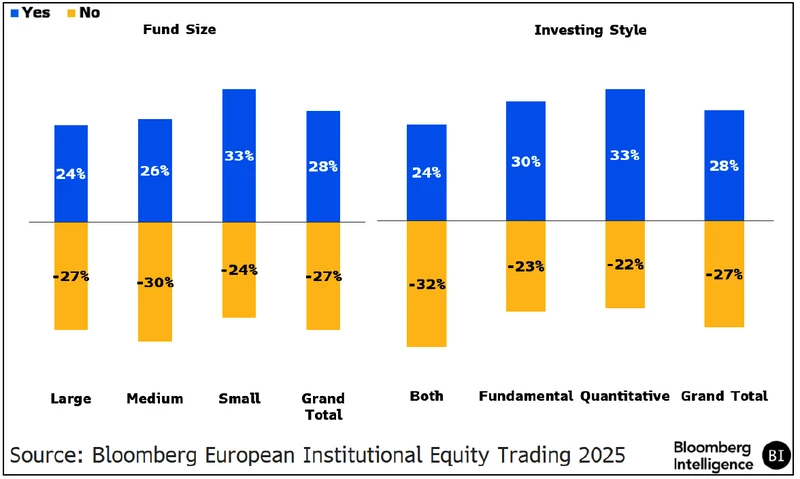

Just 28% of our study’s participants indicated interest in switching to a consolidated tape, with smaller institutions (33%) – which are potentially more concerned about the price – and quantitative funds leading. A consolidated tape in Europe could replace direct data feeds for market participants, allowing them to potentially reduce their market-data costs by swapping direct feeds for a CT. But this depends on multiple factors, including the tape’s type, cost, latency and robustness.

Figure 5: Could Proposed CT Let You Swap Data Feeds?

The BI study revealed strong buyside preference for a consolidated tape that includes both pre- and post-trade data, with support from 45% of large, 37% of medium and 67% of small institutions. By contrast, only 24% of funds favor the EU’s current proposal, which aims to implement a consolidated tape (CT) offering post-trade data and pre-trade Level 1 top-of-book quotes — best bid and offer prices across venues. The project is at the tender stage, with just one potential provider stepping forward so far.

The UK Financial Conduct Authority is prioritizing a consolidated tape for fixed income before considering equities, yet survey results show strong demand for a broader approach: 72% of respondents favor a pre- and post-trade equity tape in the UK, led by smaller institutions (79%), then large (71%) and medium-sized funds (67%). Support spans regions, with 80% of North American funds, 71% of UK, 69% of EU and 67% of Swiss saying any UK equity tape should include both pre- and post-trade data.

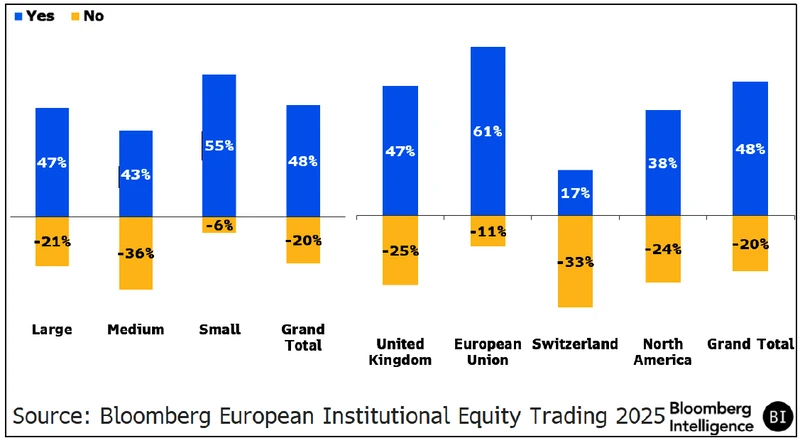

Just under half of survey respondents (48%) think the EU will implement a full pre-trade consolidated tape (Fig. 6). The EU has already agreed to launch an anonymous tape covering post-trade data and pre-trade Level 1 top-of-book quotes — the best bid and offer across venues. This marks a first step toward broader pre-trade coverage, with 61% of EU funds and 55% of smaller institutions expecting such a development.

Figure 6: Will a Full Pre-Trade EU CTP Ever Happen?

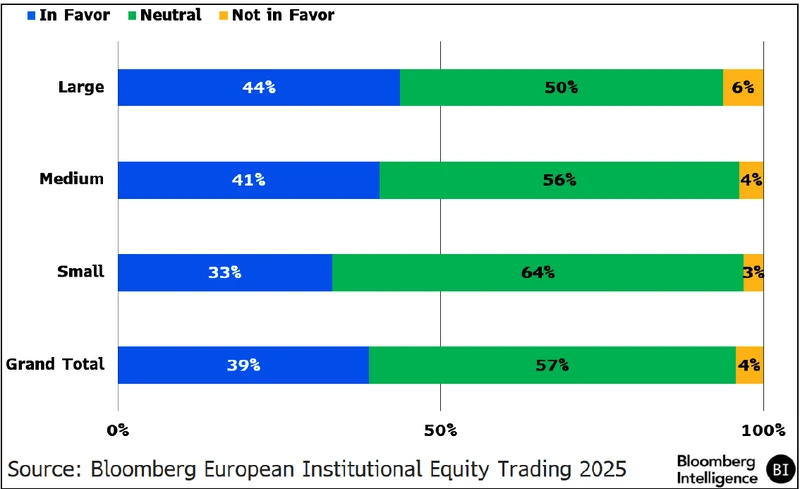

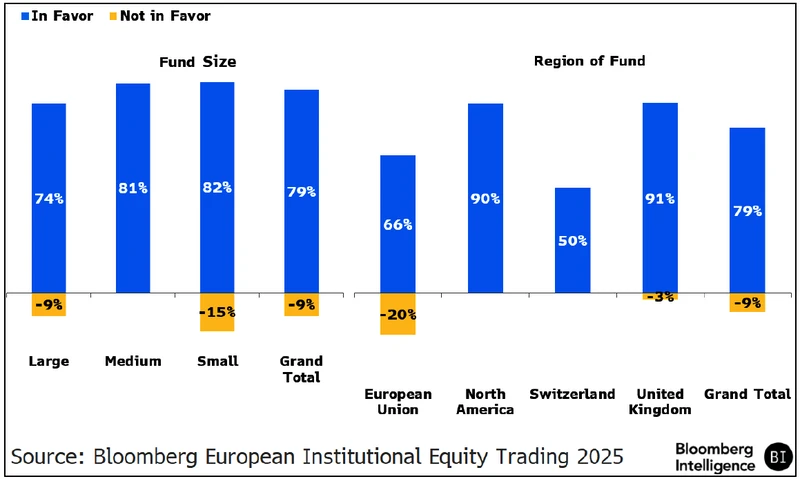

79% of institutional traders back Europe’s move to T+1

Support for Europe’s planned shift to next-day (T+1) trade settlement is strongest among funds based in the UK (91%) and North America (90%), with overall backing at 79%. The US has completed its own transition smoothly, boosting confidence in Europe and the UK ahead of the 2027 rollout. T+1 cuts counterparty risk by one business day but raises operational and FX costs.

Figure 7: Are You in Favor of Europe’s Move to T+1?

Europe’s shift to a T+1 settlement cycle is seen as a positive step for equities, yet the need to coordinate across multiple central securities depositories (CSDs) makes the transition more complex and costly than in the US. Market participants may need to prepare earlier given Europe’s intricate post-trade environment.

Traders broadly back Europe’s move to T+1, yet support drops sharply for faster cycles. Only 20% favor T+0 (same day) settlement and just 11% back real-time settlement. Such changes would likely heighten risks and costs without major technological and operational upgrades. Still, the rise of tokenization and crypto’s use of real-time settlement suggest the debate may resurface.

More than half of UK funds favor pan-Euro clearing

Europe’s fragmented clearing landscape adds costs, especially for smaller firms navigating multiple systems. Horizontal clearing — enabling trades to be processed seamlessly across jurisdictions without centralization — could cut inefficiencies and costs, and boost interoperability. Overall, 45% of traders support pan-European clearing, rising to 57% among UK institutions.