(Bloomberg) — European stocks trimmed gains late in the afternoon as Axios reported that Israeli Defense Minister Yoav Gallant said Israel had no choice but to retaliate against Iran.

Most Read from Bloomberg

The Stoxx Europe 600 index ended the day nearly changed, giving up gains of as much as 1% that was built on hopes that there won’t be further escalation in the Middle East. Consumer products stocks led gains with Adidas AG jumping after a double upgrade, while the energy sector was the biggest laggard.

“For as long as this stays now a once-and-for-all escalation, we should probably get away with some marginal market impact on oil prices, volatility and some safe haven assets,” said Tatjana Puhan, chief investment officer at Copernicus Wealth Management.

European nations and the US are calling for Israel not to react aggressively to Iran’s attack. French President Emmanuel Macron urged Israel to respond in “a calibrated manner” to avoid an escalation in the hostilities.

“Financial markets have been immune in recent years to the increase in international conflicts, starting with the war in Ukraine,” said Luis Buceta, chief investment officer at Creand Wealth Management.

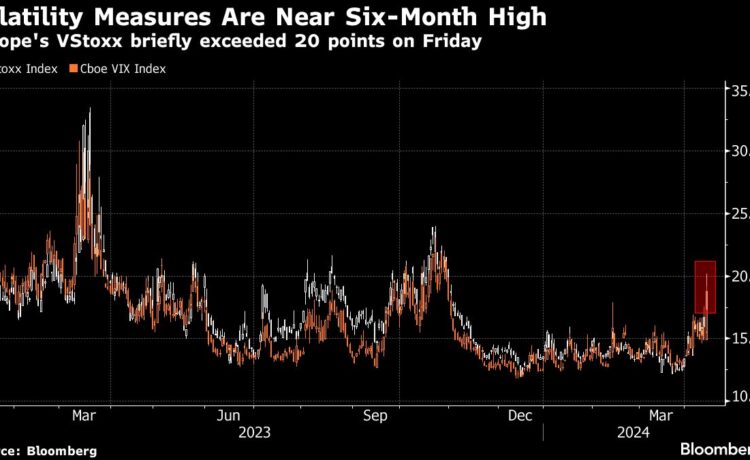

Following a brisk rally in the first quarter, gains in European stocks have slowed in April as expectations of interest rate cuts by the US Federal Reserve get pushed back amid sticky inflation. Now, the intensifying crisis in the Middle East could fuel market volatility, which already started to rise last week.

“For sure, current Middle East events might trigger some volatility and could be the excuse for a correction,” said Charles-Henry Monchau, chief investment officer at Banque SYZ in Geneva. However, Monchau doesn’t expect a major selloff following Iran’s attack, and thinks investors could use any pullback as a buying opportunity.

Pierre Gallice, head of overlay strategies at Ellipsis AM agrees, saying “given the current information, I don’t anticipate a market stall or any adjustments to forecasts.”

Defense companies including Saab AB, Thales SA and Leonardo SpA gained amid the heightened geopolitical tensions. Shipping stocks such as A.P. Moller-Maersk A/S and Hapag-Lloyd AG were mixed, with investors continuing to focus on a sector that has been particularly volatile this year following attacks by Iran-backed Houthi militants on Red Sea commercial traffic.

–With assistance from Michael Msika.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.