(Bloomberg) — European stocks slipped in the final trading session of June, with French shares tumbling to the lowest level in five months ahead of Sunday’s first round of legislative elections.

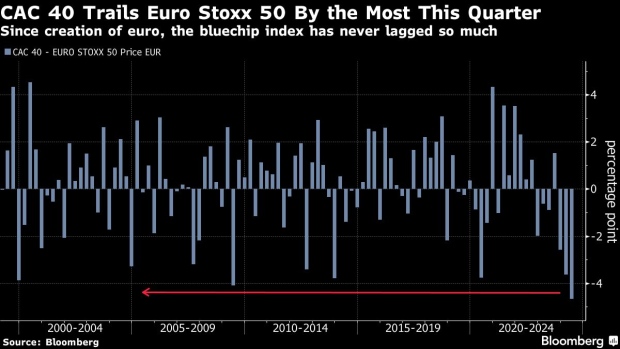

The Stoxx 600 index slid 0.2% by the close in London, with three French stocks leading the drop as traders ditched the country’s assets. The CAC 40’s quarterly showing marked the biggest underperformance against the Euro Stoxx 50 since the creation of the common currency in 1999.

The CAC 40 fell 0.7% and France’s 10-year bond yield rose to the highest since November. Redemptions from European equity funds climbed to $2.1 billion — the highest in 14 weeks — in the week through Wednesday, according to a Bank of America Corp. note citing EPFR Global data.

For BlackRock Inc.’s Wei Li, the high uncertainty surrounding France’s parliamentary elections means that stock markets are unlikely to have priced in the risks fully. “It’s a big statement to say the risks are fully priced in. We can’t say that right now,” she added.

French blue-chip stocks have diverged from German peers in recent weeks, in a clear sign of how investors have been cutting exposure to France.

Meanwhile, the UK is set for elections on July 4, with the opposition Labour Party expected to take power.

“Pondering the French and UK elections, combined with the US political situation, is a complex exercise,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management.

The Stoxx 600 index posted its fourth consecutive half-year gain, the longest such streak since an advance between 2012 and 2015. Technology, media and banks have been the best performing sectors in the latest six-month period.

On the macro front, French inflation slowed a little in June, data on Friday showed, reinforcing the European Central Bank’s decision to begin cutting record-high interest rates. In the US, the Federal Reserve’s preferred measure of underlying US inflation decelerated in May, bolstering the case for lower interest rates later this year.

For more on equity markets:

- French Market May Still Be Underpricing Vote Risk: Taking Stock

- M&A Watch Europe: Keywords Studios, EQT, Millicom, Nokia, Tyman

- Swiss Bourse Sees an End to Lull in Chinese Listings: ECM Watch

- US Stock Futures Unchanged

- Currys Dips: The London Rush (1)

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

–With assistance from Farah Elbahrawy and Thyagu Adinarayan.

©2024 Bloomberg L.P.