(Bloomberg) — The FTSE 100 Index closed at a record high for the first time in more than a year, as recent equity market volatility and geopolitical risks prompted investors to pile into the defensive sectors that characterize the UK benchmark.

Most Read from Bloomberg

The index — home of global bellwethers such as AstraZeneca Plc, Shell Plc and Unilever Plc — is catching up with global peers such as the S&P 500 Index which have been trading at record highs earlier this year. The FTSE 100 has also benefited from a recent drop in the pound amid mounting expectations for UK interest rate cuts.

“While the US markets are currently feeling the pressure under the weight of a heavily bloated tech sector built of expected AI gains, the FTSE 100 has quietly been gaining traction thanks to its heavy mining and energy weighting, which stand to benefit from recent oil, copper, and precious metals strength,” said Joshua Mahony, chief market analyst at Scope Markets.

The index closed 1.6% higher at 8,023.87 points, surpassing its previous record closing peak of 8,014.31 in February 2023. It’s still below an intraday high of 8,047.06.

The FTSE 100 is up about 4% year to date, with Shell Plc and BP Plc alone accounting for almost half of those gains, according to data compiled by Bloomberg. AstraZeneca Plc, HSBC Holdings Plc and jet-engine maker Rolls-Royce Holdings Plc are also among the main drivers. The benchmark tends to have a negative correlation with the pound.

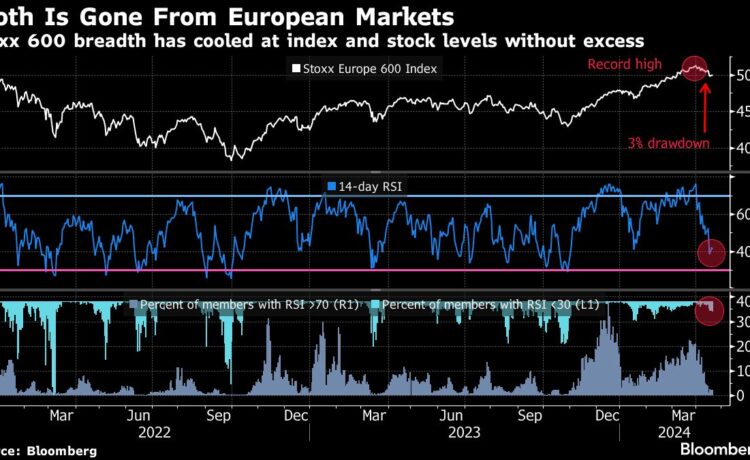

Broader investor appetite was also returning after a pullback in stocks last week on worries about higher-for-longer interest rates as well as geopolitical tensions in the Middle East. The Stoxx 600 gained 0.6% on Monday, with telecoms and personal care stocks leading the rebound.

Meanwhile, investors are bracing for the peak of earnings season, while monitoring comments from central banks to gauge the outlook for interest rates. At the European Central Bank, Governing Council member Francois Villeroy de Galhau said uncertainty around oil markets won’t prevent a first interest-rate cut in June.

“This is a week for assessing the fundamentals. Earnings reports will need to be immaculate to boost risk appetite, and any weakness may be punished by the market,” said Kathleen Brooks, research director at XTB.

Among single stocks, Portuguese oil company Galp Energia SGPS SA soared after it said a well test “potentially” indicates that Mopane could be an important commercial find in Namibia. UBS Group AG declined following a downgrade and as the Swiss National Bank raised the reserve requirement for domestic banks.

For more on equity markets:

-

Markets Can Absorb Geopolitic Risks, to a Point: Taking Stock

-

M&A Watch Europe: Hipgnosis, Blackstone, Eurazeo, Knorr-Bremse

-

US Stock Futures Rise

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

–With assistance from Michael Msika and Allegra Catelli.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.