The debate over value versus growth stocks has been running on for a long time and won’t be stopping soon. While that discussion is one for the ages, picking individual growth or value stocks will never go out of style.

In recent interviews I conducted, fund managers Quentin Velleley of Third Avenue and Daniel Barker and Eric Almeraz of Apis Capital each recently offered up two under-the-radar value stock picks. Velleley suggested Helical and StorageVault, while Barker and Almeraz pitched Osaka Titanium and E Ink Holdings.

Portrait of Third Avenue Value Fund portfolio manager Martin Whitman w. hand to forehead (Photo … [+]

Apis Capital is a boutique asset manager with about $550 million in assets under management that aims to take advantage of cross-border inefficiencies in global small- and mid-cap equities with market capitalizations below $5 billion.

Third Avenue’s International Real Estate Value Fund is a unique strategy that consists of a concentrated portfolio that contains the best non-U.S. listed real-estate investments.

Helical

Helical is a small-cap real estate investment trust traded on the London Stock Exchange. It focuses on property investment and development in Central London, with a long track record of developing and redeveloping London office properties into green, amenity-rich workplaces.

Helical targets income growth stemming from creative asset management and capital gains from development activity. With a history dating back to 1919, the company used to make and sell reinforcing steel for the construction industry. It then sold that steel reinforcement business at the end of 1986, and Helical became a pure-play property development and investment company.

In early 2020, it was clear that the global lockdowns would weigh heavily on office REITs globally. As a result, the Third Avenue team slashed their office exposure from 25% of total exposure to less than 10%. However, they’ve been following the office markets closely since then, seeking possible inflection points that could lead to attractive special-situation investments in discounted office REITs.

“However, work-from-home trends, elevated inflation following the Ukraine conflict, and rising interest rates gave us pause in most cases along the way,” Velleley said. “Late last year though, it became apparent that the London office market was bottoming, and rents were set to grow for prime quality buildings. Since then, office valuations now also appear to be at cyclical lows.”

He noted that Helical’s book value has tumbled from 572 GBp per share to 331 GBp per share, almost entirely due to higher cap rates resulting from higher interest rates. However, Velleley called attention to a report from real estate broker Cushman & Wakefield, which indicated that leasing inquiries in London prime offices had reached the highest level in 10 years.

“Tenants were searching for high-quality spaces that would enable them to attract talent or relocate into ‘green’ buildings so that they could meet stringent ESG standards,” he said. “Meanwhile, the overall London office vacancy rate is about 9%, but the prime vacancy rate is only 2%; there is early evidence that rents are starting to grow with this demand-supply backdrop.”

Velleley considers Helical a deep-value special situation. In other words, he said the company’s common shares trade at a sizable discount to his conservative estimate of net asset value. Nonetheless, Velleley sees several catalysts that could close that discount in the coming months or years.

Those catalysts include having a large amount of space to lease after a large tenant vacated its space, which could boost its revenue by nearly 70%. Additionally, Helical’s development pipeline amounts to about 450,000 square feet that could also raise its net asset value in the coming years.

Finally, changes to executive remuneration were recently approved, solely linking long-term incentives to shareholder returns.

Velleley’s current valuation for Helical is 340 GBp per share, not far off its tangible book value of 331 GBp per share. He used a cap rate of 6.5% to value the company’s office assets using stabilized net rent and held the development assets at book value while deducting net debt.

Velleley noted that some transactions in the London office market suggest that cap rate is reasonable as a 230-basis-point spread to the 10-year Gilt. He also expects asset values to be supported as interest rates start to come down and the outlook for rental growth improves even more.

Helical’s valuation should continue to rise in the coming two or three years as it leases the rest of its existing portfolio and finishes the projects it has in development. The company disclosed the potential for nearly £100 million in upside from development activities in the next three years, which Velleley said would add about 25% to the existing book value.

However, he set his “reasonable case” for net asset value at 340 GBp, implying 53% upside from the current share price. That valuation also implies no value for Helical’s specialized redevelopment skills.

StorageVault

StorageVault is the largest provider of self-storage in Canada, owning and operating over 240 locations with over 11.8 million rentable square feet spanning 678 acres. The company went public in late 2007 and put new management in place in 2015.

That management team controlled a sizable private portfolio of self-storage properties separately, but since their hiring, StorageVault has acquired many of those assets. As a result, the company now has major presences in most regions, operating some of the top self-storage brands like Sentinel Storage, Cubeit Portable Storage and Access Storage.

Velleley was drawn to StorageVault because self-storage is one of Third Avenue’s preferred types of real estate because of the attractive features they see associated with this type of property. For example, he said such assets typically provide steady cash flows once they’re leased, and their maintenance costs are relatively low compared to those of other property types.

Velleley also believes self-storage is one of the few property types with “legitimate” scale benefits because advertising and property access automation technologies are benefiting the larger players.

“Importantly, self-storage is structurally undersupplied outside the U.S., with markets 15 to 20 years behind the U.S. in terms of maturity,” he added. “Within that backdrop, we had followed StorageVault closely since 2015, but the shares tended to trade too expensively, given the market was factoring in the significant acquisition accretion. Furthermore, the balance sheet tended to be over-levered, which made us cautious.”

However, when the company slowed its acquisition activities and amid moderating COVID fundamentals, Velleley said the premium in the share price also moderated. Thus, Third Avenue was able to invest in the leading storage business in Canada “at an attractive discount to valuation.”

The thesis for StorageVault is simple. He believes the company trades at a discounted valuation and is well positioned to compound value at 10% or more over the coming years — until the public or private markets recognize the value.

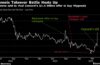

Osaka Titanium

Osaka Titanium manufactures and produces titanium sponge, which is critical for aerospace and defense applications. The company transforms raw titanium ore from rutile and ilmenite into titanium sponge and then sells it to customers that melt and alloy it and then use it for a variety of purposes.

Osaka is the second-largest producer of aerospace-grade titanium sponge globally behind Russia’s VSMPO. With more than 80 years of history and roots in steel manufacturing, Osaka Titanium has benefited from a variety of geopolitical and economic trends over the decades.

For example, newer generations of aircraft use more titanium than previous generations, dramatically increasing the need for titanium sponge. In the early 2000s, a global underinvestment in capacity for titanium sponge led to favorable supply-demand balance for makers. A sudden surge in aerospace demand accelerated around 2004 or 2005, when Boeing and Airbus’ deliveries soared 75% over five years.

The Apis Capital team had been involved in Osaka Titanium during that previous cycle, so they were already familiar with the stock when it came up again more recently.

“Osaka Titanium saw its share price increase by more than 15x from the trough in that cycle,” Barker said. “While not all cycles are identical, our experience from that period makes the potential for this one just as attractive.”

Although China is the world’s largest source of titanium sponge, none of it is qualified for aerospace and defense applications. Also benefiting Osaka is the fact that U.S.-based producers have all shuttered their facilities since the last cycle. Today, a handful of companies in Japan, Russia, Ukraine and Kazakhstan are all that are left.

When Russia invaded Ukraine, the West lost about one-third of its production capacity, leaving Osaka and one other Japanese company as the only two suppliers. Meanwhile, Airbus and Boeing are ramping production on near-record orders for new-generation aircraft containing two or three times the amount of titanium as previous generations.

“We believe the titanium sponge market could be set for another multi-year run like the last cycle,” Almeraz explained. “If Japanese titanium sponge export prices can increase just another 25% from where they are today (still 20% below previous cycle highs) and titanium ore prices continue to normalize, the company should be able to generate over ¥650 in EPS. A peak cycle multiple of 10x gets you to our target price of ¥6,500 for this stock.”

E Ink Holdings

E Ink holds a near-monopoly position in ePaper technology, a type of display that only uses energy when changing images on the screen. ePaper doesn’t actually emit light from the panel, which is why it is extremely energy efficient, easy on the eyes, and even visible in full sunlight.

The company manufactures and supplies its ePaper technology to panel manufacturers and system integrators, which then assemble display modules containing the technology and sell them into a variety of consumer, retail and other end markets.

E Ink is a combination of E Ink Corporation, a spinoff from the MIT Media Lab in 1997, and Prime View International, the first Thin Film Transistor LCD company in Taiwan. Prime View acquired E Ink Corporation in 2009 to integrate and expand the ePaper display supply chain, and the combined company was branded as E Ink.

During the COVID-19 pandemic, the markets granted lots of attention to any company perceived as a beneficiary of the time. E Ink emerged as an under-the-radar play on this thesis that continues even after the pandemic has abated.

“COVID-19 presented a unique challenge to the retail industry, driving a severe labor shortage,” Almeraz said. “In this context, Electronic Shelf Labels (ESLs, which represent 60% of E Ink revenue), emerged as a solution. These labels allow retail stores to remotely update prices and product information on the shelves, leading to higher efficiency.”

The Apis team observed Walmart’s announcement about rolling out ESLs in its U.S. stores and saw it as a significant catalyst for adoption to accelerate. In the U.S. ESL penetration remains at less than 5%, presenting plenty of opportunities for growth. In France and other more mature markets, the penetration rate is greater than 50%.

“We estimate the U.S. Walmart opportunity alone represents half of the global installed base, and E Ink has a significant runway for growth here, demonstrating its resilience and adaptability in the face of a global crisis,” said Barker.

E Ink’s technology is patent protected via intellectual property acquired through past acquisitions and in-house research and development. Almeraz added that the company has also been able to create new product categories based on its proprietary technology, building the ePaper supply chain through partnerships that he believes would take years to replicate.

“This is a quality growth stock with a healthy margin expansion driven by the business mix shifting towards the ESL business,” he said. “There is ample growth ahead for E Ink based on the existing businesses, and we see another 50% upside for the stock. What is more exciting is the optionality in the new product categories with larger total addressable markets, such as outdoor/ in-store advertising and fashion retail.”

Value and small-cap stock performance

While all four stocks can be classified as value stocks, Helical and StorageVault are both small caps with market capitalizations of £280 million (£1.27) and C$1.7 billion (C$1.37), respectively.

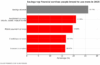

July actually brought some great news for value stocks and small caps that suggests things could finally be turning around after a drought period for both groups. According to Morningstar, some investors who thought they had missed out on the artificial-intelligence theme started to rotate into small-and mid-cap stocks and large-cap value stocks around July 11.

At the time, those corners of the market just looked too cheap to ignore, and the rotation paid off for those who participated. Some small-cap and value stocks were down to the cheapest levels relative to the S&P 500 and Nasdaq Composite in decades.

As a result, July brought some of the widest margins for outperformance in both groups in years, based on data from Dow Jones. The small-cap Russell 2000 outperformed the Nasdaq Composite by 11.19 percentage points in July. Versus the S&P 500, the Russell was set for its best outperformance since February 2000.

The Russell 1000 Value was set to outperform the Russell 1000 Growth by 7 percentage points, the widest margin since March 2001. Additionally, the S&P 500 Value Index was on track to beat the growth index by the widest margin since October 2022.

It will take time for value and small-cap names to catch up to mega-cap technology stocks, but July’s outperformance demonstrates that there are plenty of returns to be captured in these corners of the market.

Disclosure: No positions in any companies mentioned