Among the key news on Hong Kong stocks, CK Infrastructure Holdings (HK:1038) gained over 6% as of writing after announcing plans for a potential secondary listing on the London Stock Exchange. With this move, the company aims to expand its shareholder base across different regions and expand the trading market for its shares. The company also stated that the listing would not involve any fundraising.

CK Infrastructure Holdings (CKI), owned by Hong Kong’s wealthiest individual, Li Ka-shing, is an investment company that manages diversified infrastructure businesses worldwide.

CKI’s Global Expansion

The London listing is seen as a key step to support the company’s overseas acquisitions, which are essential for its expansion plans. The company is a major investor in the UK and Australia, with investments covering gas, water, electricity, and renewable assets.

According to Denise Wong, an industry analyst at Bloomberg Intelligence, the UK listing could serve as a currency hedge for the company. It is also expected to raise its credibility in international markets for potential mergers and acquisitions.

London Set for Growth with New Listing Rules

Earlier this week, the UK’s Financial Conduct Authority (FCA) introduced new stock market rules set to take effect on July 29. As per the changes, non-UK-incorporated issuers with a recognized overseas listing will have the option to pursue a second listing in the city under a bespoke category.

CK Infrastructure could become the first company to capitalize on these new rules in the UK. Additionally, this could further attract more companies to London after a sluggish period for listings, marking a favourable development for the UK IPO market.

CK Infrastructure Share Price Target

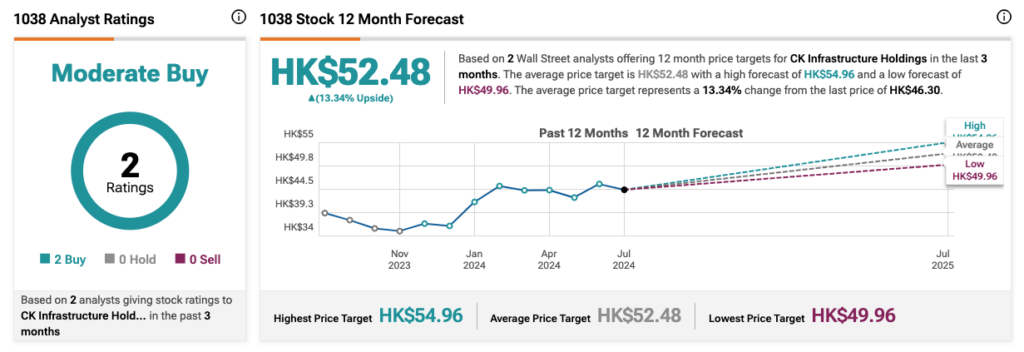

According to TipRanks consensus, 1038 stock has received a Moderate Buy rating, based on two Buy recommendations. The CK Infrastructure share price target is HK$52.48, which implies a 13.34% increase on the current price level.